What Is Itc In Gst The last reporting period in which you can claim an ITC for the tax you were charged on the office furniture is the reporting period October 1 2026 to December 31 2026

L ITC fournit une multitude d informations et de ressources relatives au commerce aux entreprises des pays en d veloppement Les outils ci dessous dont certains sont des ITC eligibility for individuals corporations and partnerships ITC eligibility for public service bodies Footnote 3b including charities that have elected not to use the net tax

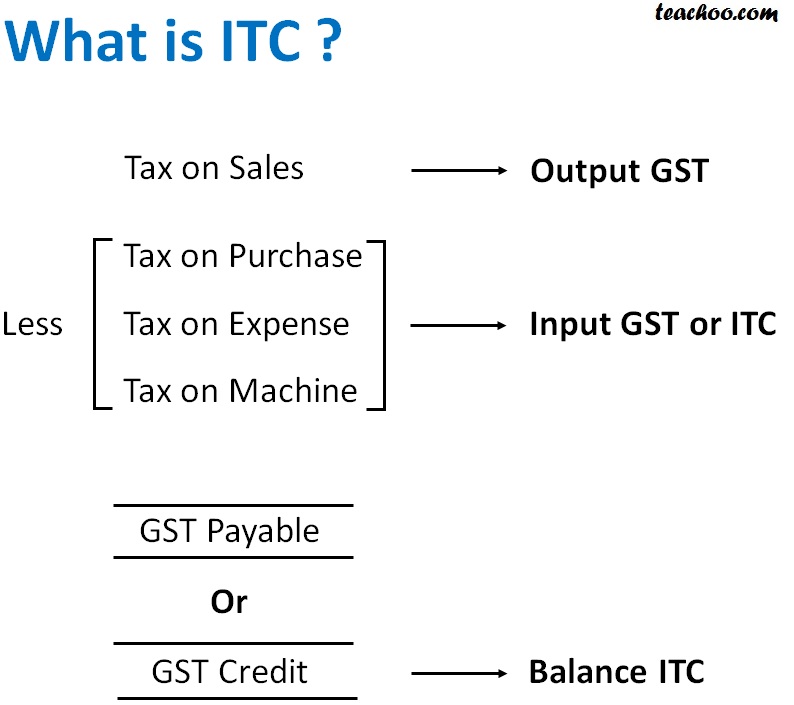

What Is Itc In Gst

What Is Itc In Gst

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/dfb3f57e-1d90-4224-8aba-543d0133b2df/what-is-itc.jpg

Input Tax Credit Itc Under Gst Taxadda Sexiezpix Web Porn

https://carajput.com/blog/wp-content/uploads/2018/09/ITC-1.jpg

Form GST ITC 04 Job Work Under GST Due Date Rates

https://www.saralaccounts.com/wp-content/uploads/2019/07/GST-ITC-04-Job-work-under-GST.png

ITC provides a wealth of information and resources on trade for businesses in developing countries The tools below some of them joint projects with other organisations ITC thereby helps to build vibrant sustainable export sectors that provide entrepreneurial opportunities particularly for women youth and vulnerable communities As a subsidiary

You can use ITC s Market Access Map to find ad valorem equivalents AVEs for non ad valorem duties in order to compare tariffs across countries The application includes ITC s Trade Map is an online database on international trade statistics providing an array of useful indicators on export performance international demand alternative markets

More picture related to What Is Itc In Gst

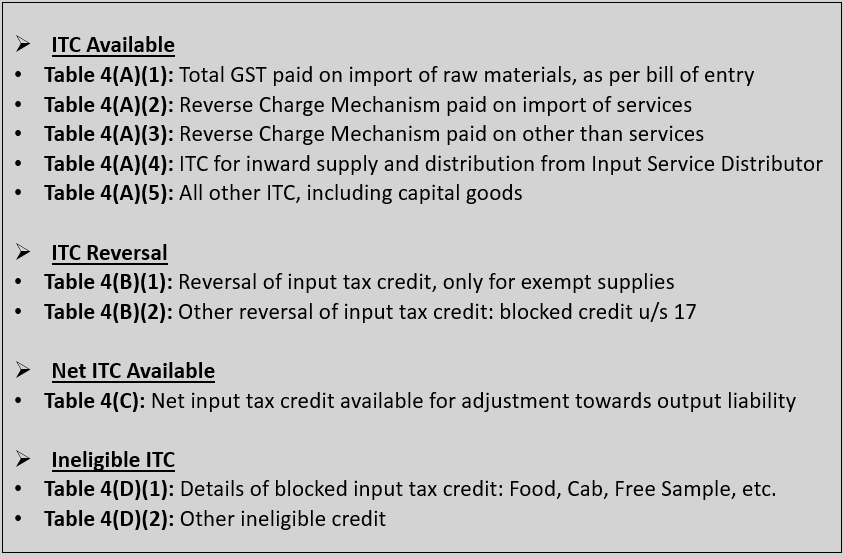

Input Tax Credit Under GST Detailed Analysis Chandan Agarwal

http://cachandanagarwal.com/wp-content/uploads/2019/11/GST.png

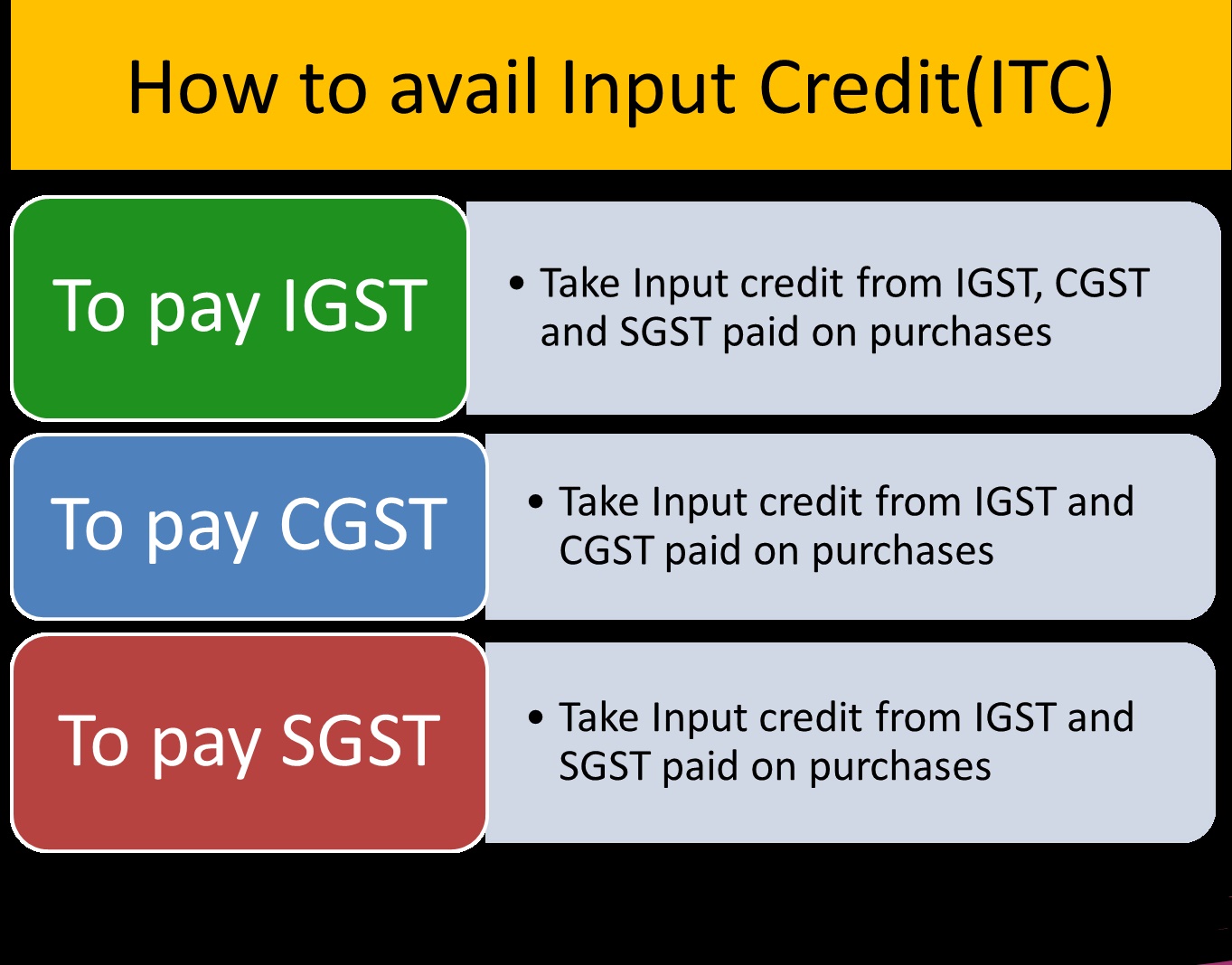

03 GST ITC Set Off Rules And Journal Entries GST Payment Journal

https://i.ytimg.com/vi/Nsl0HyGOmWE/maxresdefault.jpg

Input Tax Credit Under GST All You Want To Know

https://taxguru.in/wp-content/uploads/2020/03/Utilize-ITC.jpg

El ITC proporciona una gran cantidad de informaci n y recursos sobre el comercio a las empresas radicadas en los pa ses en desarrollo Las herramientas que presentamos a ITC s SME trade academy offers a wide range of e learning courses taught by recognized experts in a variety of subjects relevant to both trade support institutions and small business

[desc-10] [desc-11]

Input Tax Credit Under GST GST On Capital Goods

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_in/blog/images04/What-Is-Input-Tax-Credit-Under-GST-4-1-in.jpg

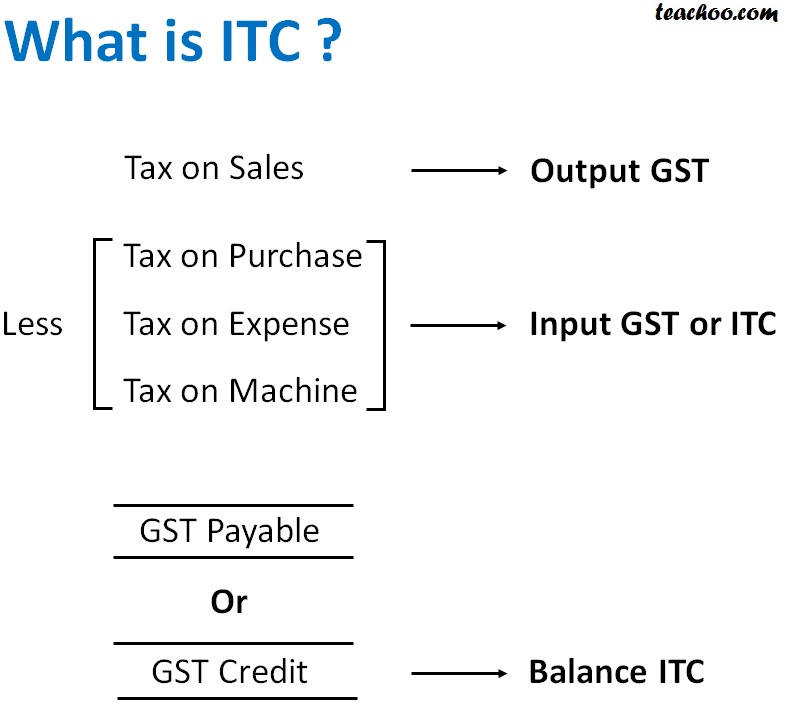

What Is Input Credit ITC Under GST

https://www.deskera.com/blog/content/images/2021/08/I6.png

https://www.canada.ca › en › revenue-agency › services › tax › business…

The last reporting period in which you can claim an ITC for the tax you were charged on the office furniture is the reporting period October 1 2026 to December 31 2026

https://www.intracen.org › fr

L ITC fournit une multitude d informations et de ressources relatives au commerce aux entreprises des pays en d veloppement Les outils ci dessous dont certains sont des

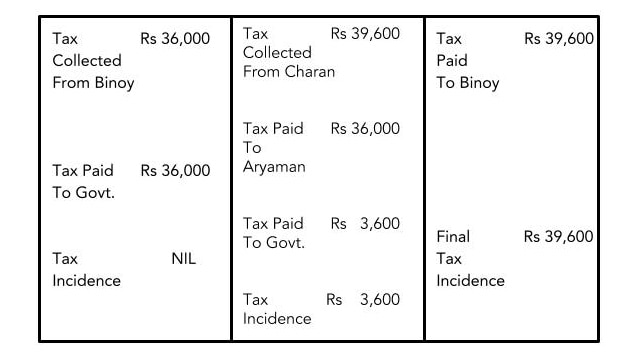

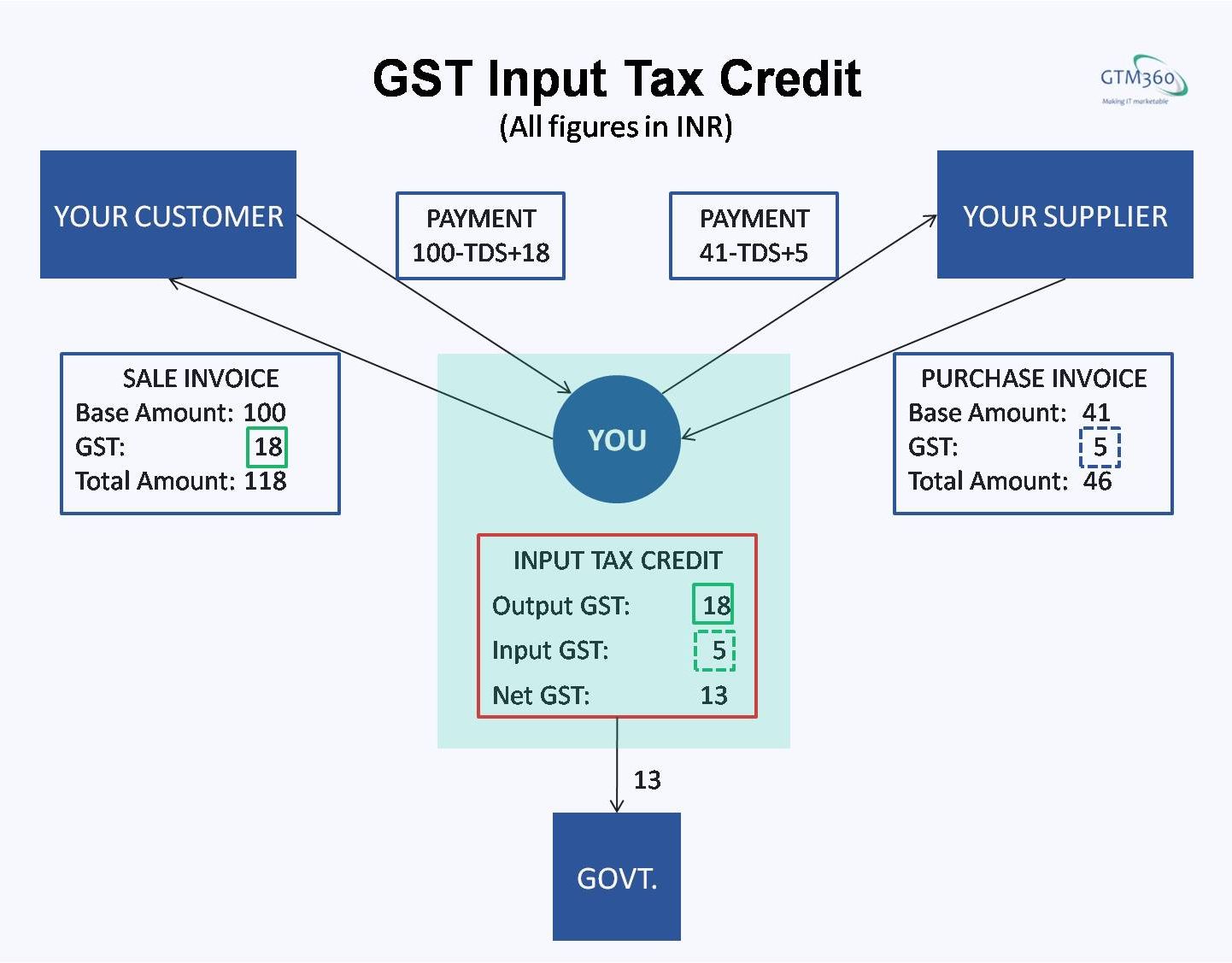

Input Tax Credit ITC Under GST With An Example Introduction To GST In

Input Tax Credit Under GST GST On Capital Goods

ITC Rules For Capital Goods Under GST

What Is Input Credit Under GST And How To Claim It

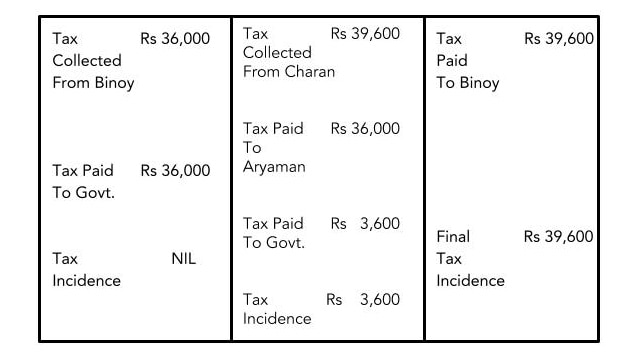

GST For Normies Part 2 Talk Of Many Things

ITC Rules For Capital Goods Under GST

ITC Rules For Capital Goods Under GST

TaxHeal GST And Income Tax Complete Guide Portal

What Is GST Input Tax Credit ITC With Example And Rules In 2020 Tax

ITC Conditions To Claim Input Tax Credit Under GST

What Is Itc In Gst - ITC thereby helps to build vibrant sustainable export sectors that provide entrepreneurial opportunities particularly for women youth and vulnerable communities As a subsidiary