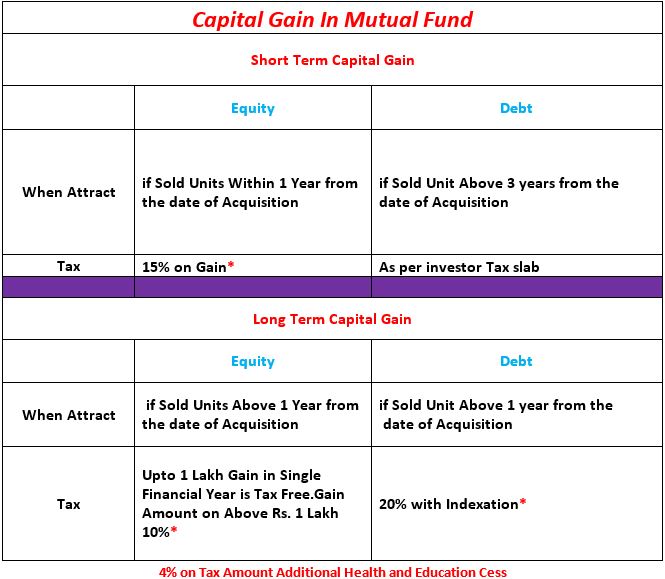

What Is Short Term Gain In Mutual Fund Gains from the sale of debt funds are considered short term capital gain on Mutual Funds if the sale takes place within 36 months or 3 years of acquiring it Examples of debt funds are

Short Term Capital Gains STCG on listed shares and equity oriented mutual funds are subject to a concessional rate of 15 till transfer made on or before 22nd July 2024 From 23rd July Short term capital gains STCGs are capital gains that are realised upon the sale of assets held for less than a certain period of time which is 12 months for equity funds and hybrid equity

What Is Short Term Gain In Mutual Fund

What Is Short Term Gain In Mutual Fund

https://edufund.in/wp-content/uploads/2022/11/SWP-in-mutual-fund-1024x512.jpg

Best Short Term Mutual Funds 2024 A Comprehensive Guide Blog By

https://www.tickertape.in/blog/wp-content/uploads/2023/03/9-March-2023-Best-Mutual-Funds-for-Short-Term-Investment-2023-32-1200x628-cropped.png

How To Do Mutual Fund Nomination Online CAMS KFintech

https://moneyexcel.com/wp-content/uploads/2023/03/mutual-fund-nomination-online.jpg

Short Term Capital Gains STCG Tax on Mutual Funds The tax applicable to STCG generated from a mutual fund investment is known as STCG tax However the definition of short term varies for mutual fund categories Short term capital Gain STCG tax on mutual funds is the tax levied on profits rendered from the sale of mutual fund units within a specified holding period This duration varies based on the type of mutual fund

The mutual fund s short term capital gain tax rate for equity funds is 15 Short term capital gains on non equity assets however are taxed at the investor s individual income tax rate A shareholder can offset recent capital Short Term Capital Gain Occurs when mutual fund units are sold within a year of purchase equity oriented mutual funds The short term capital gains tax rate is generally

More picture related to What Is Short Term Gain In Mutual Fund

Mutual Funds Exploring The Benefits Of Mutual Funds

https://blog.shoonya.com/wp-content/uploads/2023/08/Benefits-of-Investing-in-Mutual-Funds-1.jpg

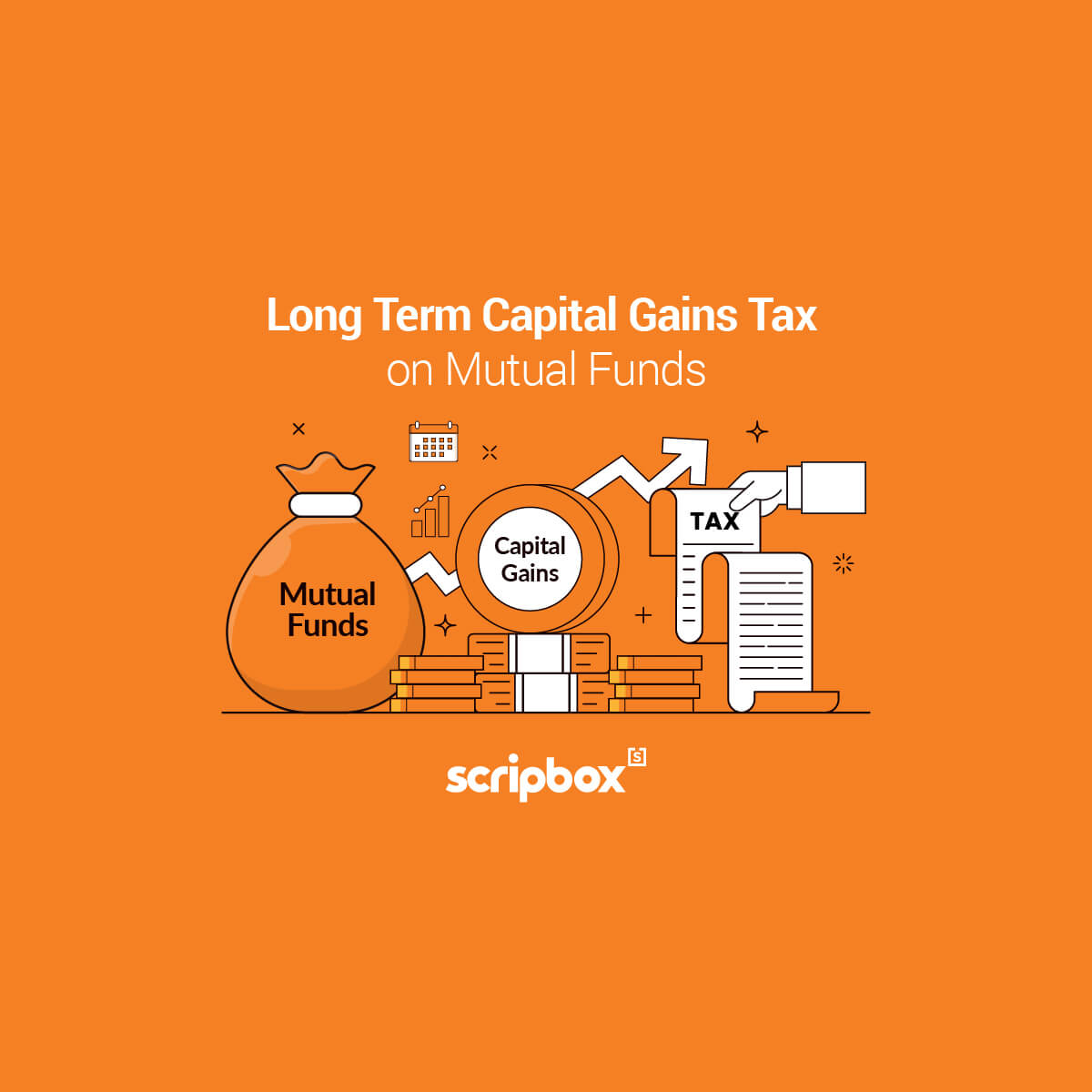

How Mutual Fund SIP Units Are Taxed worked Example

https://freefincal.com/wp-content/uploads/2022/10/Schedule-of-SIP-transactions-used-for-explaining-mutual-fund-taxation.jpg

Best Mutual Funds For Children In 2024 Blog By Tickertape

https://www.tickertape.in/blog/wp-content/uploads/2023/03/14-Mar-2023-Best-Mutual-Fund-Plans-for-Your-Children-in-2023-37.png

Any gains as a result of that sale are considered short term capital gains when a mutual fund sells shares it has owned for one year or less They ll be distributed to shareholders as short term capital gains Taxation of Equity Oriented Mutual Funds In the case of Equity Funds if you hold the fund units for up to 1 year before redeeming your gains will be classified as Short Term Capital Gains STCG The STCG Tax rate of

Short term capital gains on mutual funds MFs are earned by the investors who sold their MF investments and those investments were held for a period of less than or equal Selling the tree before it matures means selling the equity mutual fund mutual fund before holding it for 12 months or even less Short term capital gains are the profits from

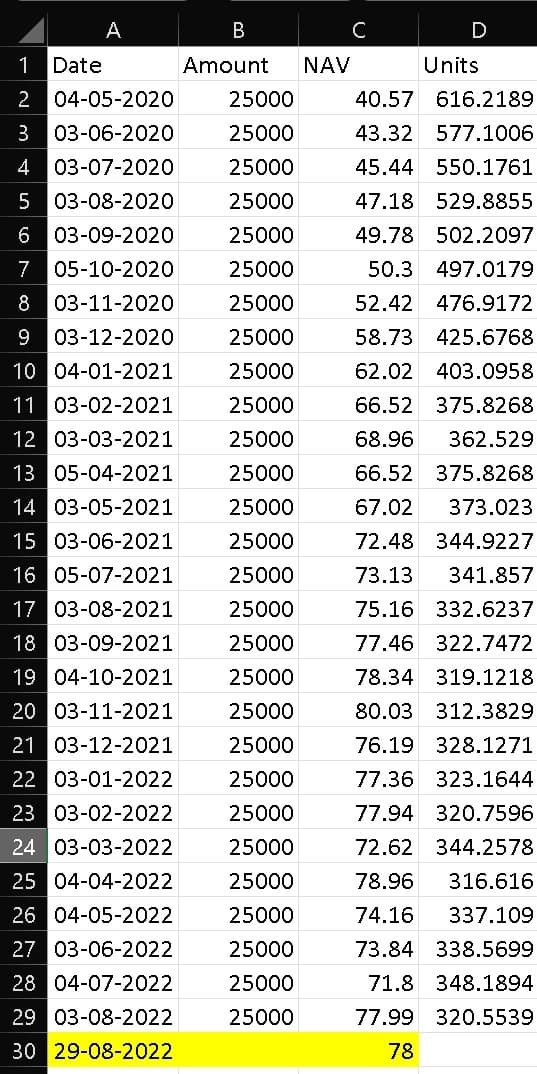

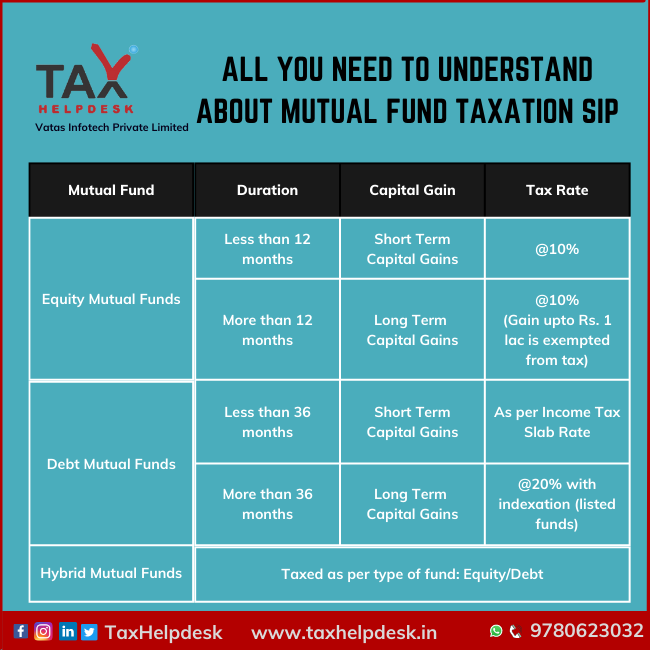

Mutual Fund Taxation SIP

https://www.taxhelpdesk.in/wp-content/uploads/2022/05/All-you-need-to-understand-about-mutual-fund-taxation-SIP.png

Long Term Capital Gain Tax On Mutual Funds

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2022/10/long-term-capital-gain-on-mutual-fund-image.jpg

https://groww.in › short-term-capital-gain-on-mutual-funds

Gains from the sale of debt funds are considered short term capital gain on Mutual Funds if the sale takes place within 36 months or 3 years of acquiring it Examples of debt funds are

https://cleartax.in › short-term-capital-gains-stcg-tax

Short Term Capital Gains STCG on listed shares and equity oriented mutual funds are subject to a concessional rate of 15 till transfer made on or before 22nd July 2024 From 23rd July

Investing In Mutual Funds For Short Term Vs Long Term Goals Dates

Mutual Fund Taxation SIP

.png?width=4800&name=Benefits_and_Risks_of_Growth_Stock_Mutual_Funds (1).png)

Growth Mutual Fund What It Is How To Invest In One

What Is A Mutual Fund How Does It Work Mutual Funds For Beginners

Growth Vs IDCW Mutual Fund Which Is A Better Plan

Standard Deviation In Mutual Fund MyFinopedia

Standard Deviation In Mutual Fund MyFinopedia

Should I Buy Long Or Short Term Bonds Charles Schwab

Mutual Funds Advantages And Disadvantages Myfinopedia

Tax On Capital Gain In Mutual Fund With Examples Universal Invests

What Is Short Term Gain In Mutual Fund - The mutual fund s short term capital gain tax rate for equity funds is 15 Short term capital gains on non equity assets however are taxed at the investor s individual income tax rate A shareholder can offset recent capital