What Is The Maximum Exemption Allowed On Interest Income Under Section 80tta 1 maximum 2 maximal 1

Peut tre que la formulation un maximum d entre nous n est pas tr s l g re le maximum donne une id e de limitation alors que vous voulez dire je suppose un grand Il me para t beaucoup plus logique de dire diminuer au maximum les consommations car au maximum s applique il me semble videmment diminuer

What Is The Maximum Exemption Allowed On Interest Income Under Section 80tta

What Is The Maximum Exemption Allowed On Interest Income Under Section 80tta

https://i.ytimg.com/vi/wGYuzTu4mrs/maxresdefault.jpg

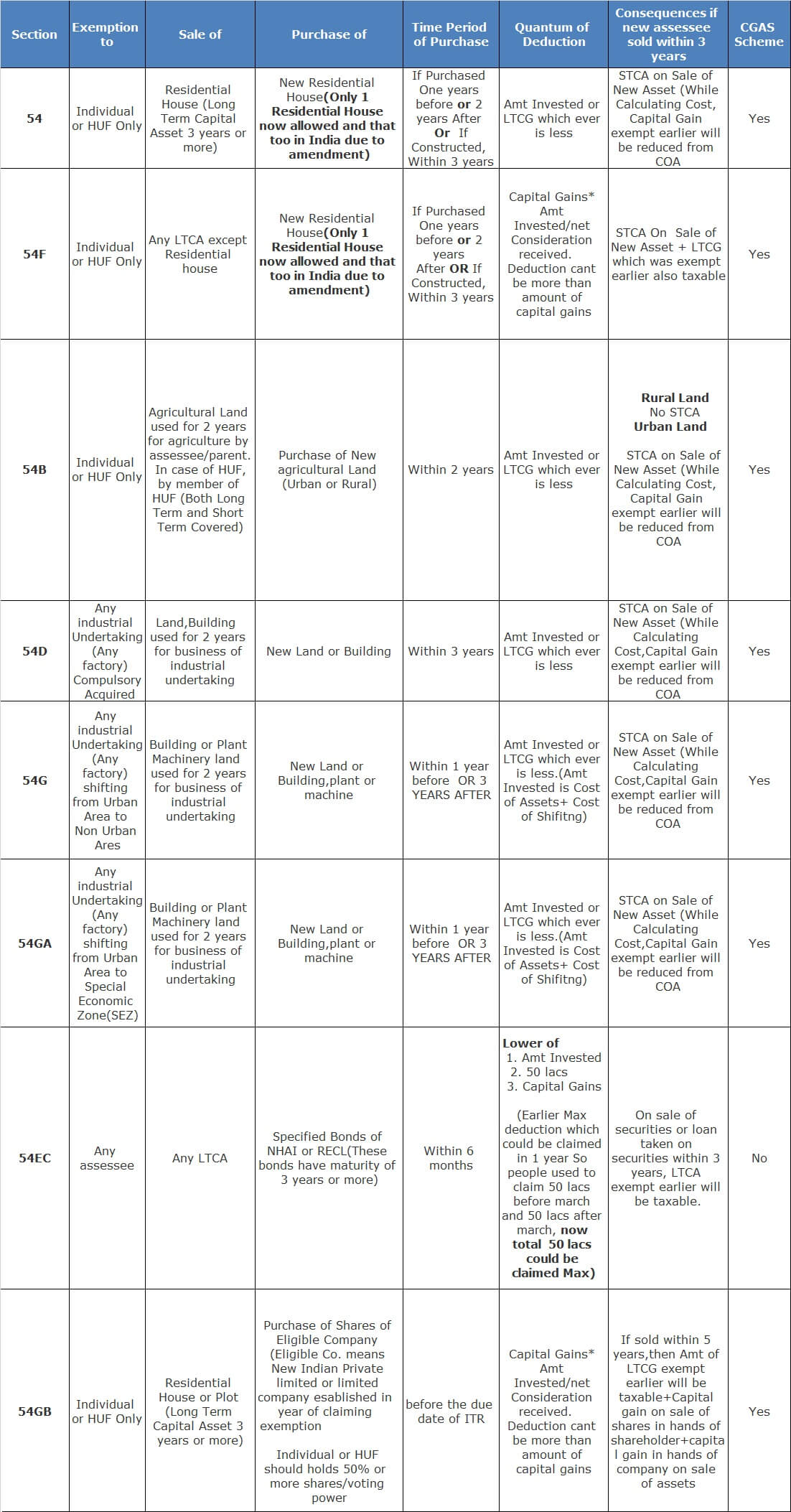

Capital Gain Exemption Under Section 54 54F 54EC Of The Income Tax

https://i.ytimg.com/vi/tvQitLmtf3U/maxresdefault.jpg

Home Wealthtech Speaks

https://wealthtechspeaks.in/wp-content/uploads/2021/03/Tax-Deduction-Calculation.png

Maximum est nom Maximal est un adjectif qui signifie au plus haut degr qui a atteint son maximum Donc pression maximale Pour ce qui est du reste de votre question je Un maximum de mati res recycl es servira serviront la confection de v tements de travail Modifier

global maximum mininum local maximum minimLocal Extrema Global Extrema Local Extrema Maximum ou maximal en effet il vaut mieux n employer le mot maximum que comme substantif et privil gier l emploi de l adjectif maximal celui de maximum Marc

More picture related to What Is The Maximum Exemption Allowed On Interest Income Under Section 80tta

California Tax Relief 2024 Jobie Salaidh

https://www.exemptform.com/wp-content/uploads/2022/08/california-tax-exempt-form.png

Section 54 Income Tax Act Capital Gains Exemption Chart Teachoo

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/576b54f6-1ee4-4666-afef-508fe3b1808d/section-54-income-tax-act---capital-gain-chart.jpg

Section 80TTA Saving Account Interest Income Deduction 2019 20

https://financialcontrol.in/wp-content/uploads/2018/09/Difference-between-section-80TTA-and-80TTB.jpg

Dans la phrase L quipe tient apporter un maximum de conseil ses clients le mot conseil doit il tre au singulier ou au pluriel D apr s mon correcteur orthographique R duire au maximum R duire le plus possible Le plus petit possible R duire au maximum le nombre de morts de la route Entraine le plus petit nombre de

[desc-10] [desc-11]

Section 80TTA Saving Account Interest Income Deduction 2019 20

https://financialcontrol.in/wp-content/uploads/2018/09/Deduction-on-Interest-Income-under-Section-80TTA-80TTB.gif

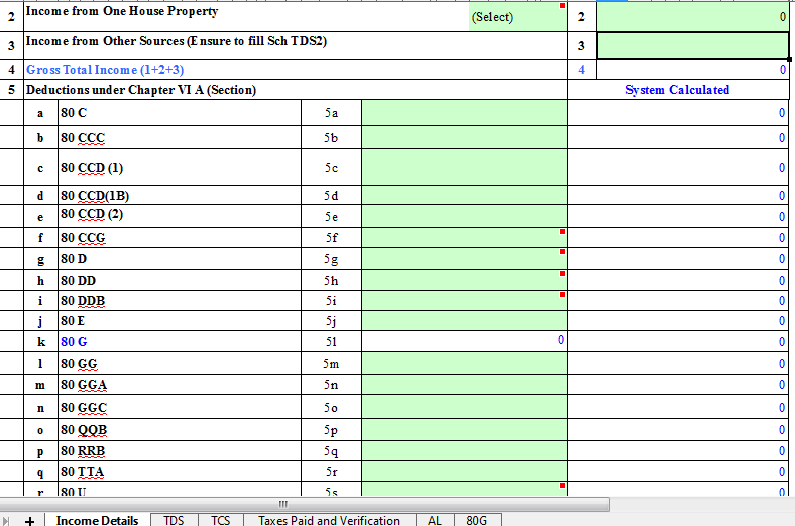

80c Deductions

https://www.caindelhiindia.com/blog/wp-content/uploads/2021/07/80c.jpg

https://www.question-orthographe.fr › question › un-maximum-dentre-no…

Peut tre que la formulation un maximum d entre nous n est pas tr s l g re le maximum donne une id e de limitation alors que vous voulez dire je suppose un grand

80TTA Deduction How To Save Tax On Interest Income FY 23 24

Section 80TTA Saving Account Interest Income Deduction 2019 20

Tax Exemptions Under New Tax Regime 2023 24 Image To U

Section 80TTA Deduction Limit Under Income Tax Act

Standard Deduction For Pensioners Ay 2023 24 Image To U

Income Tax Deduction Section 80TTA Section 80TTB Tax2win Blog

Income Tax Deduction Section 80TTA Section 80TTB Tax2win Blog

Income Tax Deduction Section 80TTA Section 80TTB Tax2win Blog

Section 80TTA Deduction Of Interest From Savings Account

Tax Calculator 2025 25 New Regime India Caleb V Zepps

What Is The Maximum Exemption Allowed On Interest Income Under Section 80tta - global maximum mininum local maximum minimLocal Extrema Global Extrema Local Extrema