What Is The Maximum Income For Pension Credit Pension Credit tops up your weekly income to 218 15 if you re single your joint weekly income to 332 95 if you have a partner

To qualify for Pension Credit you must Live in the UK England Scotland Wales or Northern Ireland Have reached State Pension age Have a weekly income below 218 15 if How much Pension Credit could I get Pension Credit comes in 2 parts You might be eligible for one or both parts What is Guarantee Credit Guarantee Credit tops up your weekly income to

What Is The Maximum Income For Pension Credit

What Is The Maximum Income For Pension Credit

https://i.ytimg.com/vi/ZX4NLahNq74/maxresdefault.jpg

How To Get Pension Credit In The UK YouTube

https://i.ytimg.com/vi/NFDSuw4lKvw/maxresdefault.jpg

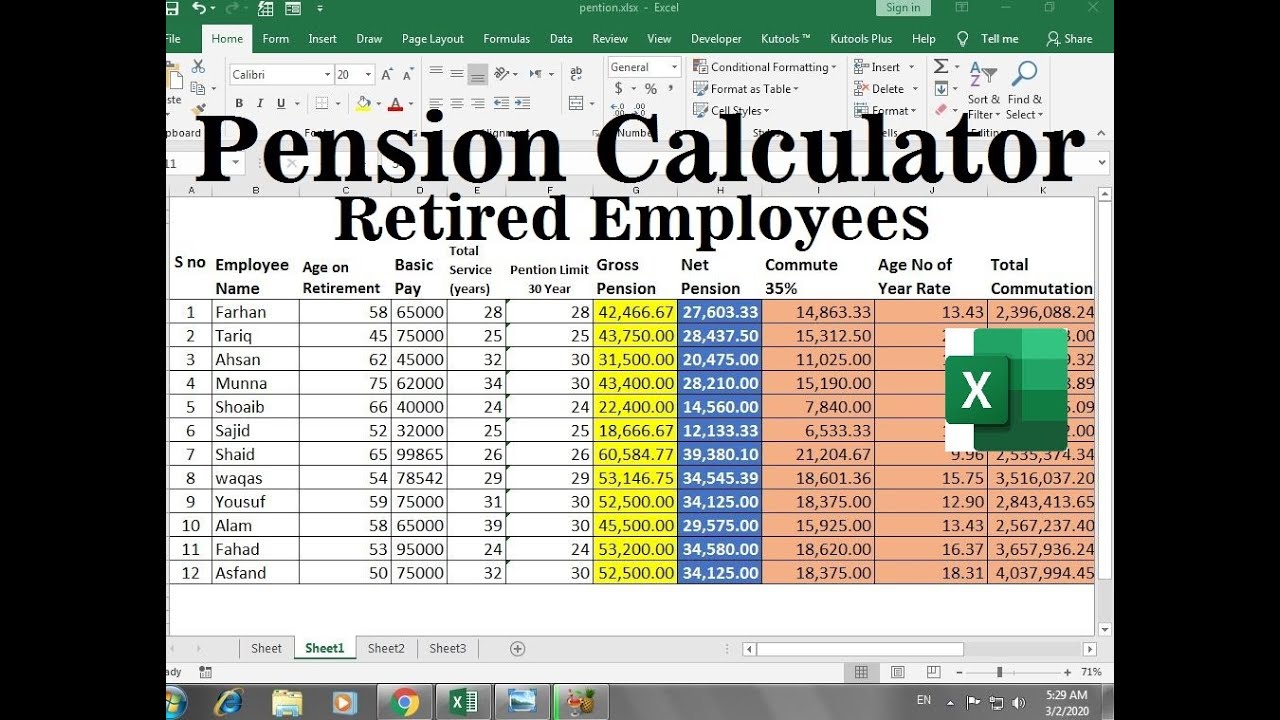

Pension And Commutation Calculator In Excel For Retired Employees YouTube

https://i.ytimg.com/vi/M4Uk17FwOsE/maxresdefault.jpg

For every 1 by which your income exceeds the savings credit threshold 189 80 a week if you re single and 301 22 a week if you re in a couple your savings credit is reduced by 40p All of your income is added To get Pension Credit as a single person your income must not be more than 173 75 a week To get Pension Credit as a couple your total income must not be over 265 20 a week You can

The income limit for Pension Credit varies based on individual circumstances such as whether you live alone or with a partner As of 2023 the standard income limit for a single person is 182 60 per week while for Some income and capital is taken into account but some is disregarded There is no upper capital limit You can work and receive PC but most of your earnings are taken into account as

More picture related to What Is The Maximum Income For Pension Credit

Gratuity And Pension Calculation Formula Excel Spreadsheet YouTube

https://i.ytimg.com/vi/vh6SxwbdHds/maxresdefault.jpg

What Is The Maximum Income For Low Income Housing CountyOffice

https://i.ytimg.com/vi/mMsML0ofGrk/maxresdefault.jpg

How To Apply For Pension Credit 2024 YouTube

https://i.ytimg.com/vi/4hBNQbTh2-g/maxresdefault.jpg

You ll usually qualify for Pension Credit if your weekly income is less than 333 if you re a couple You may still be eligible if your income is higher especially if you have a disability look after children care for someone or have certain housing To qualify you must have a minimum income in 2024 25 of 189 80 a week if you re single and 301 22 a week if you re a couple For every 1 by which your income exceeds this savings credit threshold your savings credit

To qualify you or your partner need to have reached the State Pension age You can check when you qualify by calling Age NI s Advice and Advocacy Service or the Northern Ireland Pension If you are eligible for Pension Credit you can top up your weekly income through Guarantee Credit to 218 15 per week for single people and 332 95 for couples Savings

What Is The Maximum Amount For A Money Order YouTube

https://i.ytimg.com/vi/wurL1rk8nVw/maxresdefault.jpg

Do You Qualify HPD

https://www1.nyc.gov/assets/hpd/images/content/pages/affordable-housing-income-eligibility-2021.jpg

https://www.gov.uk › pension-credit › what-youll-get

Pension Credit tops up your weekly income to 218 15 if you re single your joint weekly income to 332 95 if you have a partner

https://www.moneysavingexpert.com › savings › pension-credit

To qualify for Pension Credit you must Live in the UK England Scotland Wales or Northern Ireland Have reached State Pension age Have a weekly income below 218 15 if

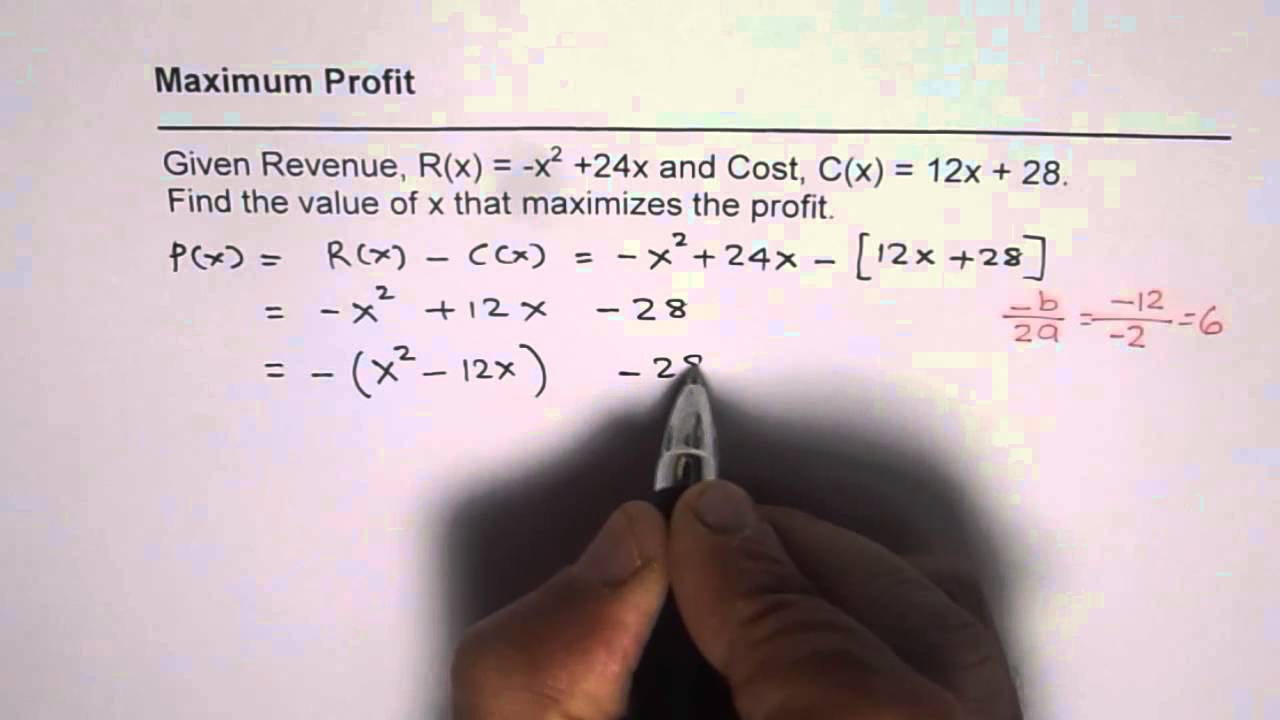

Determine Maximum Profit From Revenue And Cost Function YouTube

What Is The Maximum Amount For A Money Order YouTube

Pension Credit GwynethJacek

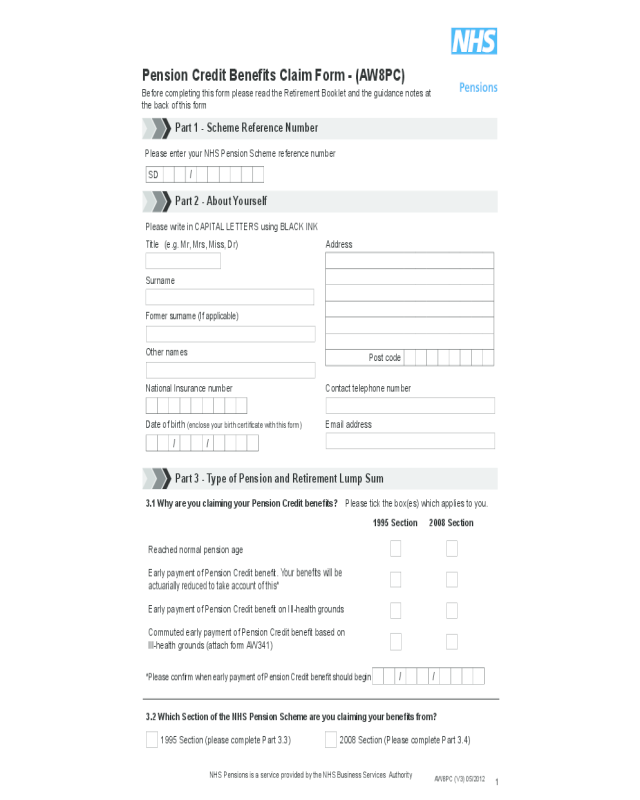

2024 Pension Credit Claim Form Fillable Printable PDF Forms Handypdf

Pension Credit DennaFranki

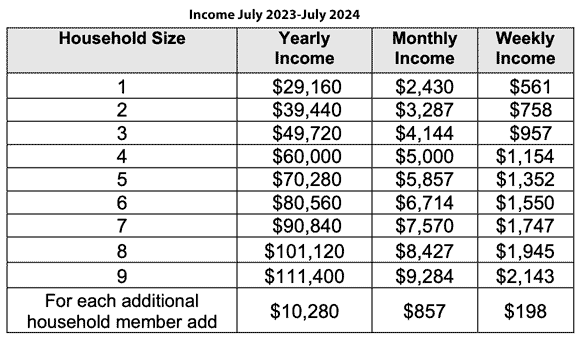

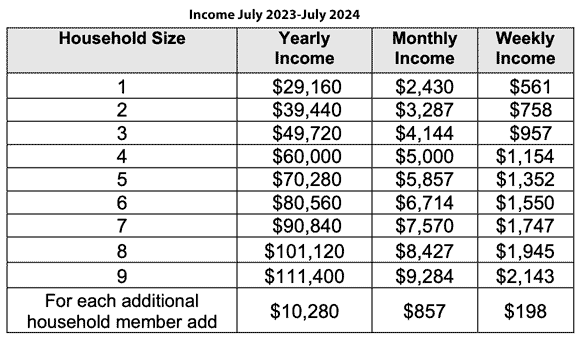

Income Guidelines July 2023 2024

Income Guidelines July 2023 2024

:max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg)

Income Tax

Pension Credit Week Of Action

Pension Verification PDF Government Government Information

What Is The Maximum Income For Pension Credit - The maximum savings credit you can get per week is 17 01 for a single person and 19 04 for a couple To qualify you must have a minimum income in 2024 25 of 189 80