When Profession Tax Is Not Applicable Unlike the name Professional Tax is not a tax which is applicable on professionals only it is tax which is applicable on all kinds of professions trades and employment and based on the income Applicability It is

Professional tax has to be paid to the State government by every individual earning over a specific monetary limit in certain states in India It is only when someone earns an What Happens if You do not Pay Professional Tax How is Professional Tax Calculated on Salary In Which States is a Professional Tax Not Applicable Where Should

When Profession Tax Is Not Applicable

![]()

When Profession Tax Is Not Applicable

https://cdn1.vectorstock.com/i/1000x1000/77/50/white-not-applicable-icon-isolated-on-vector-31067750.jpg

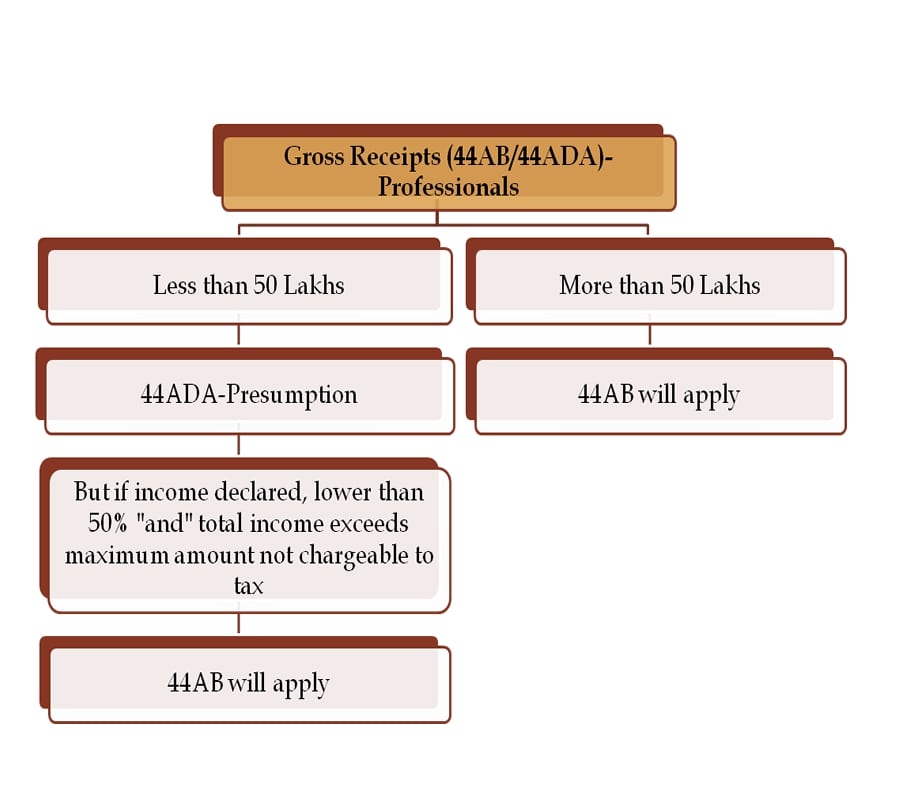

What Is Tax Audit Limit For The AY 2022 23 CA Rajput Jain

https://carajput.com/blog/wp-content/uploads/2022/08/tax-audit.jpg

Tax Evidence In Developing Countries International Growth Centre

https://www.theigc.org/sites/default/files/styles/og_image/public/2023-03/Thumbnail_Video 01.jpg?h=d1cb525d&itok=3-S7efkQ

In which states is a professional tax not applicable Not all Indian states levy professional tax The states and union territories where professional tax is not applicable are However professional tax is applicable only if the income crosses a certain limit just like Income Tax This post discusses professional tax in detail what it is professional tax slabs exemption and the difference between

Once professional tax legislation becomes applicable not registering for professional tax may levies penalty and the amount depends on the respective state s legislation Failing to make The professional tax is imposed basis a slab amount on the gross income of the professionals required to pay professional tax Note that the tax paid in the form of

More picture related to When Profession Tax Is Not Applicable

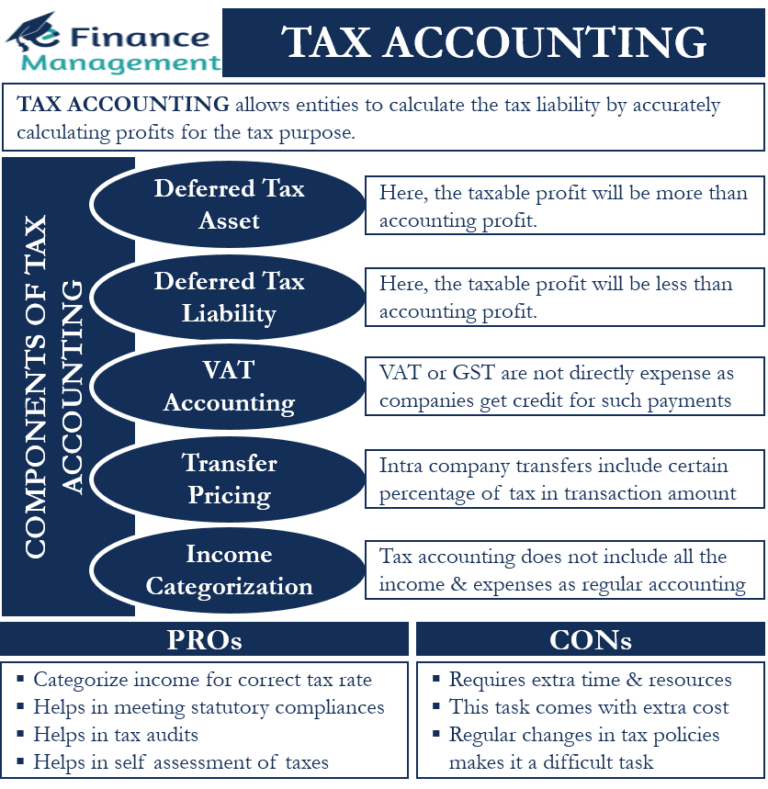

Tax Accounting Meaning Pros Components And More EFM

https://efinancemanagement.com/wp-content/uploads/2022/02/Tax-Accounting-768x789.png

Medical Device Tax Driving Companies Out Of U S Fox Business Video

https://a57.foxnews.com/a57.foxnews.com/media.foxbusiness.com/thumbnails/010313/640/360/1024/512/010313_closing_moore.jpg?ve=1&tl=1

What Is Income Tax Relief And How Does It Work Finzo

https://www.thefinzocompany.com/wp-content/uploads/2023/01/shutterstock_2145682813-1.jpg

Hence professional tax is not applicable to employees working in a Union Territory Who is exempted from payment of profession tax There are a few categories of persons exempted from this tax Senior citizens The Professional tax or P tax is a direct tax that the State Government imposes on individuals who earn either by practising a profession employment trade or calling or running a freelancing business The State Government deducts

Professional tax is a state government tax imposed on anyone who makes money from any profession trade or job Not every state imposes this tax The only conditions that In a nutshell professional tax will be applicable if either the branch office where the employee is working or the office paying salary is registered as per the state laws If the head

Capital Gains Tax Explained The Kalculators

https://thekalculators.com.au/wp-content/uploads/2022/05/capital-gains-tax-explained.jpg

Not Applicable Meaning Doc Template PdfFiller

https://www.pdffiller.com/preview/547/655/547655567/large.png

https://taxguru.in › ... › professional-tax.html

Unlike the name Professional Tax is not a tax which is applicable on professionals only it is tax which is applicable on all kinds of professions trades and employment and based on the income Applicability It is

https://economictimes.indiatimes.com › wealth › tax › ...

Professional tax has to be paid to the State government by every individual earning over a specific monetary limit in certain states in India It is only when someone earns an

501 c 3 Nonprofits And Sales Tax What To Know

Capital Gains Tax Explained The Kalculators

Profession Tax Registration Invest In India Virtual CFO Virtual

Republicans With Viktor Orb n Against Global Minimum Tax

Professional Tax Return Filing Professional Tax Return Filing Online

What Is RTA Excise Tax

What Is RTA Excise Tax

The Sales Tax Is Not Automatically Being Added To My Client Invoice

Maximize Your Savings A Guide To Individual Tax Planning FinAccountant

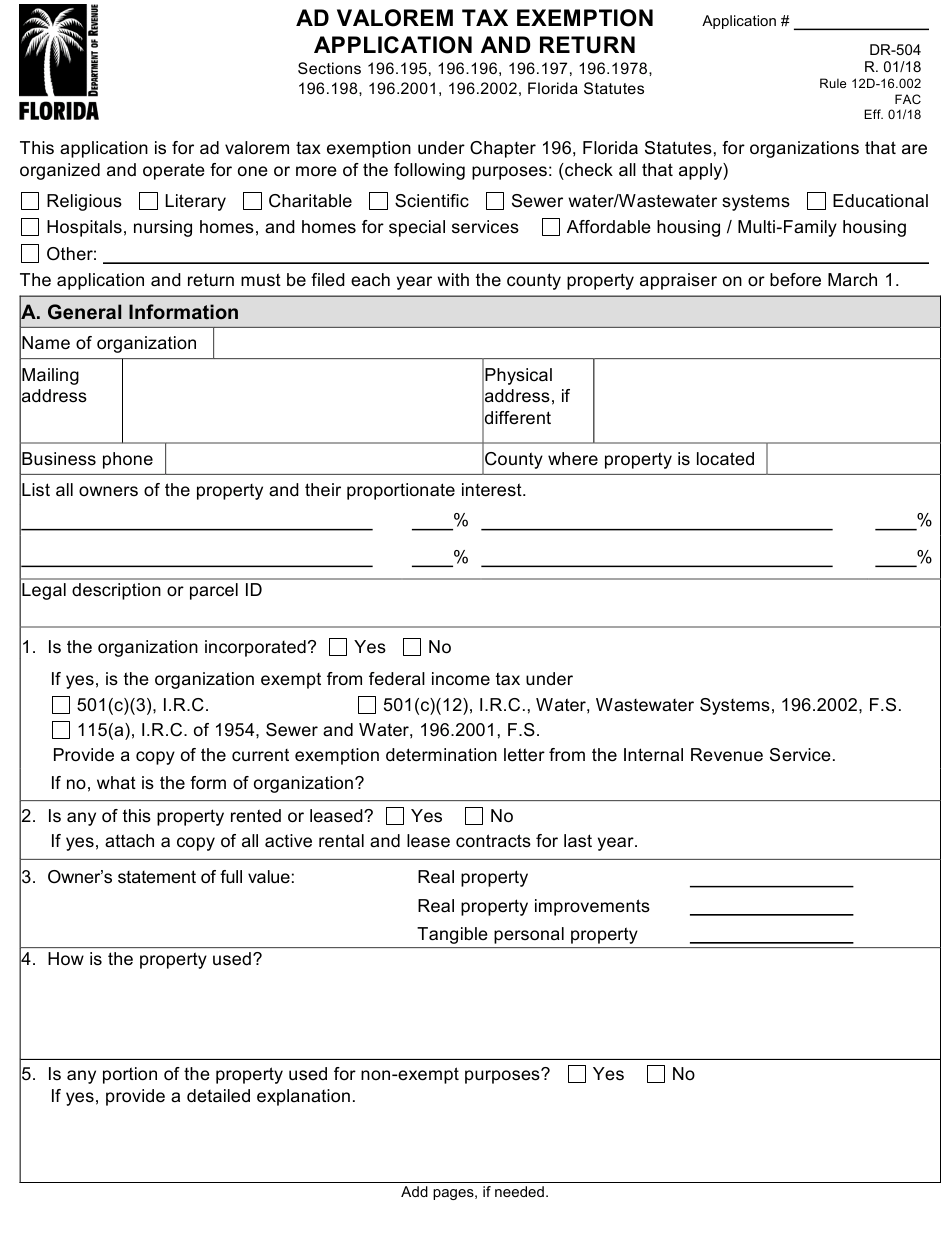

Florida Sales Tax Exemption Application Form ExemptForm

When Profession Tax Is Not Applicable - However professional tax is applicable only if the income crosses a certain limit just like Income Tax This post discusses professional tax in detail what it is professional tax slabs exemption and the difference between