Who Pays P11d Tax Employer Or Employee The P11D form is filled out and filed by employers then sent to the tax office It is possible to be both an employer and an employee for example if you are a freelancer or contractor If you are an employee you should get a copy of your P11D for your records Who pays National Insurance and Income Tax on Benefits in Kind

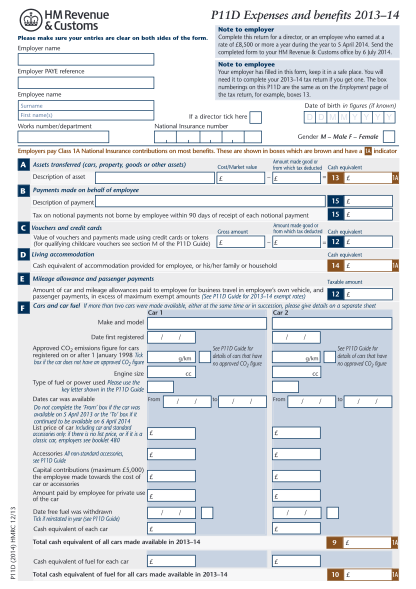

Who pays the tax and National Insurance on benefits The employee pays tax either through payroll deductions or self assessment The employer pays Class 1A National Insurance by July 19th postal or July 22nd electronic for 2022 23 Employers who provide benefits in kind to employees and directors normally need to report these to HMRC through either their payroll software or by using a P11D form so the correct amount of tax can be paid In this article we explain what P11D forms are who needs to use them and what to include

Who Pays P11d Tax Employer Or Employee

-1.png)

Who Pays P11d Tax Employer Or Employee

https://blog.darwinbox.com/hubfs/MicrosoftTeams-image (31)-1.png

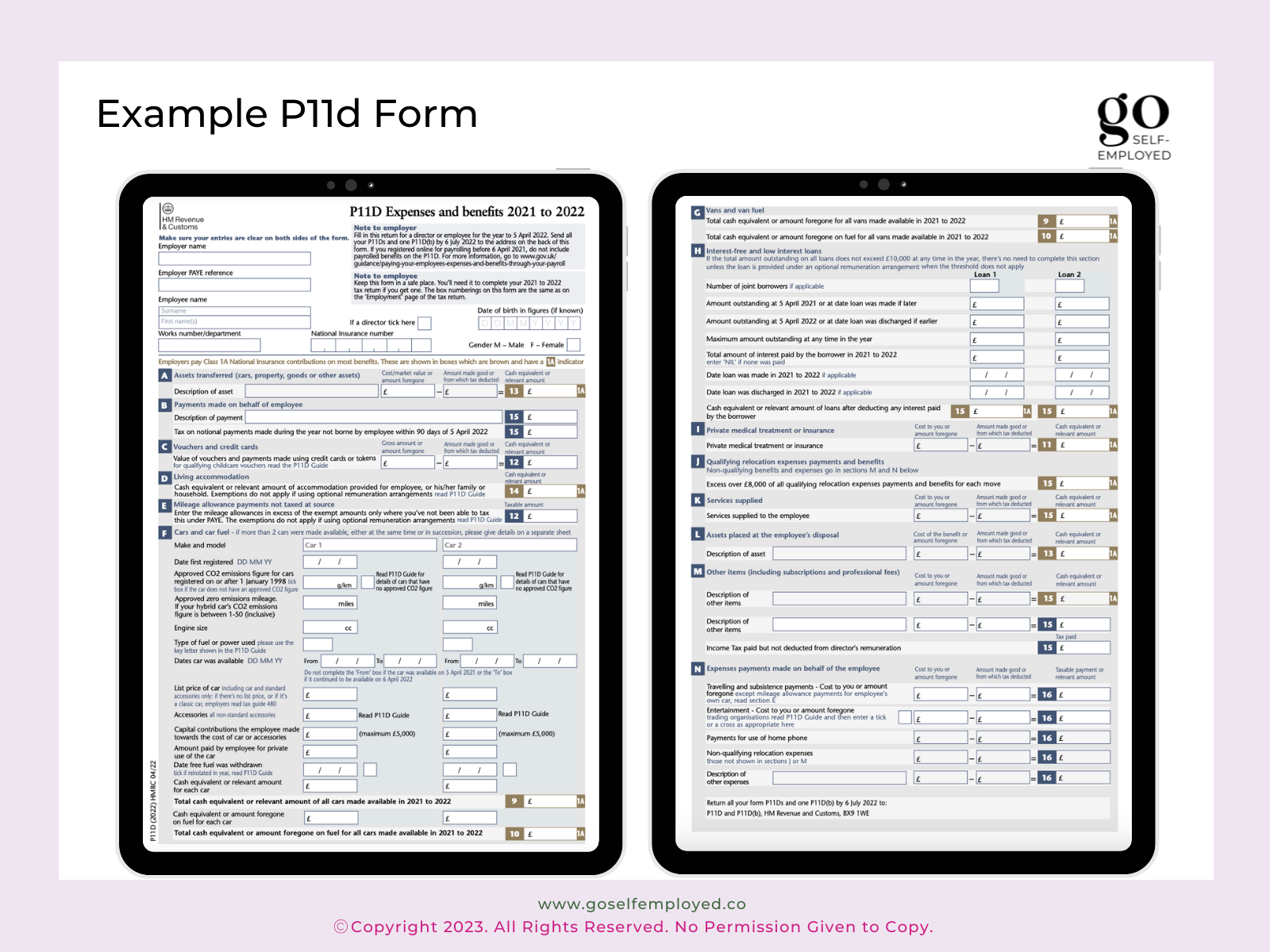

What Is A P11d Form

https://goselfemployed.co/wp-content/uploads/2021/06/example-p11d.png

Employee And Employer Top 9 Differences Explained

https://media.publit.io/file/w_759,h_427,c_fit,q_80/chrmpWebsite/employee-and-employer.png

Employers pay Class 1A National Insurance Contributions on benefits provided to employees which is currently 13 8 You as an employer have to prepare P11Ds for your employees for non payrolled benefits see above Assuming taxes and NI are correctly paid to HMRC the question is can the company chose to write off the debt the employee technically owes the company Or must it be reclaimed Or does the

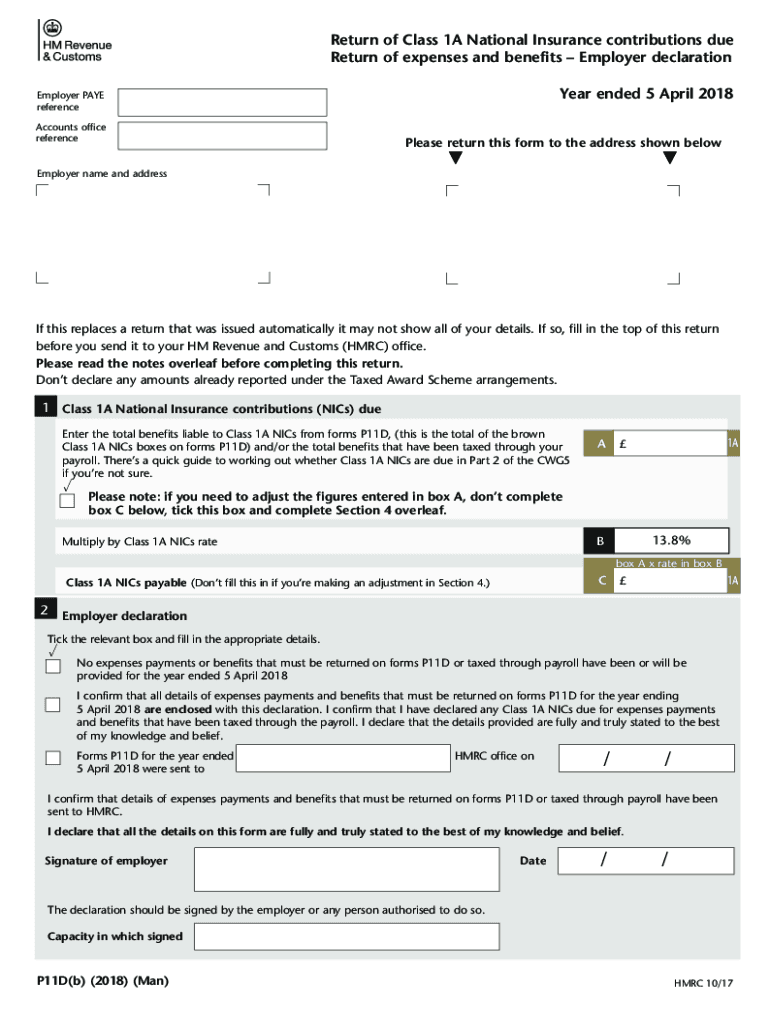

Similar to P11Ds the employee is responsible for paying the Income Tax but this is collected in real time via the employer s payroll The employer will pay Class 1A NIC and will need to prepare and submit a P11D b in order for HMRC to collect this Q What is a P11d form and why do I have to complete one A A P11d is a declaration to HMRC of benefits paid by a company on behalf of one of their employees The cash equivalent of the benefit is calculated and added to

More picture related to Who Pays P11d Tax Employer Or Employee

Employers Quotes BrainyQuote

https://www.brainyquote.com/photos_tr/en/h/henryford/122318/henryford1.jpg

P11d Deadline Alexander Sloan

https://www.alexandersloan.co.uk/wp-content/uploads/2020/10/content-_0043_DSC_5239-1024x683.jpg

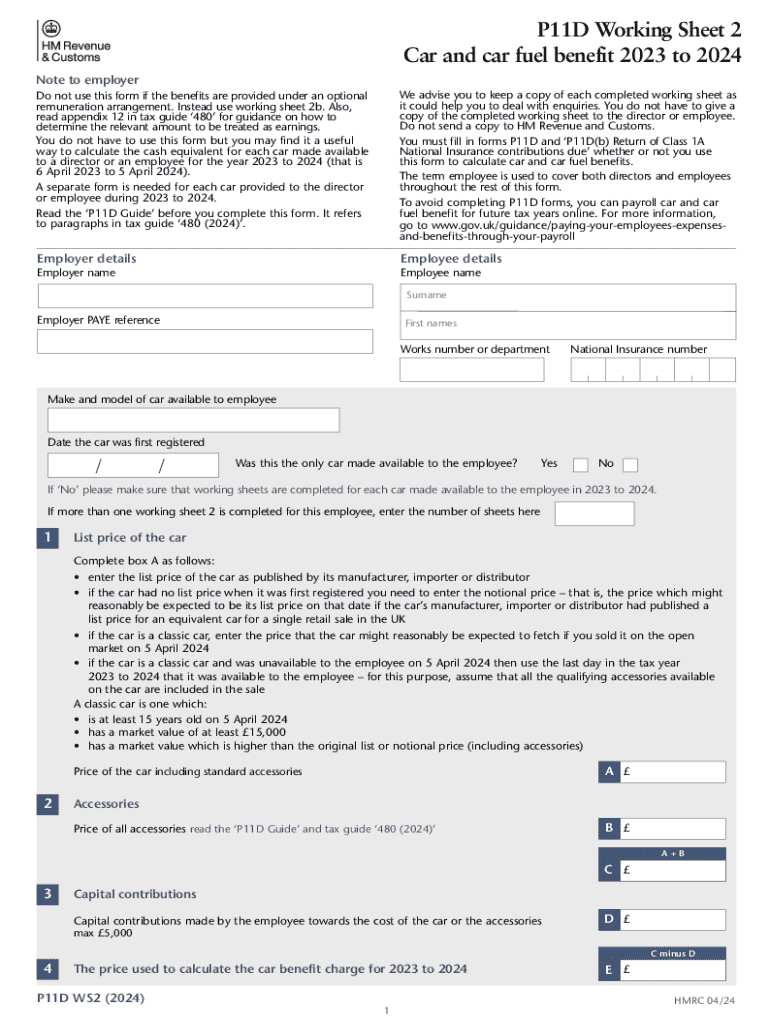

Company Car Tax In The UK How The P11D Process Actually Works For

https://i.ytimg.com/vi/PzF7Jclzl2s/maxresdefault.jpg

Completing a P11D for a director and employees who are in receipt of company benefits or expenses is a necessity and there are serious consequences for failing to comply including penalties based on a percentage of lost revenue WHAT HAPPENS IF As an employer you have several options for reporting these benefits Either by submitting them annually on a P11D including them in your monthly payroll or opting for a Pay as You Earn PAYE Settlement Agreement PSA for trivial expenses

[desc-10] [desc-11]

Conquer The P11D Form No Worries Accounting

https://www.no-worries.co.uk/wp-content/uploads/2023/01/sample_p11d_b.png

Benefits In Kind P11d Or PAYE Settlement Agreement Morgans

https://www.morgansca.co.uk/wp-content/uploads/2023/08/DS-Tax-News-pic2-0823.jpg

-1.png?w=186)

https://www.income-tax.co.uk

The P11D form is filled out and filed by employers then sent to the tax office It is possible to be both an employer and an employee for example if you are a freelancer or contractor If you are an employee you should get a copy of your P11D for your records Who pays National Insurance and Income Tax on Benefits in Kind

https://taxlab.co.uk

Who pays the tax and National Insurance on benefits The employee pays tax either through payroll deductions or self assessment The employer pays Class 1A National Insurance by July 19th postal or July 22nd electronic for 2022 23

P11D Explained Your Essential Guide To Employee Benefits Reporting UK

Conquer The P11D Form No Worries Accounting

P11d B Employer Declaration Complete With Ease AirSlate SignNow

P11D Working Sheet 2 Car And Car Fuel Benefit To Fill Out And Sign

Employer Branding Vs Employee Branding

DO YOU NEED TO FILE FORMS P11D OR AN EMPLOYMENT RELATED SECURITIES RET

DO YOU NEED TO FILE FORMS P11D OR AN EMPLOYMENT RELATED SECURITIES RET

101 Home Office Deduction Worksheet Page 4 Free To Edit Download

FreshPay On Twitter Join The FreshPay Team To Guide You Through The

Employer And Employee

Who Pays P11d Tax Employer Or Employee - [desc-14]