Who Pays Transfer Tax In Jamaica Transfer Tax is borne by the Vendor In cases where the portion of a property gift or sale is being transferred Transfer Tax is chargeable on the market value of the property being

The Transfer Tax Act Statute Details Preamble An act to impose tax upon transfers of interests in land and securities and to provide for matters connected therewith or incidental thereto Transfer Tax is a mandatory payment to the Commissioner of Stamp Duty calculated at a rate of 2 of the sale price or the appraised value Appraised value is the estimated current market

Who Pays Transfer Tax In Jamaica

Who Pays Transfer Tax In Jamaica

https://i.ytimg.com/vi/ipUHTUhZTB0/maxresdefault.jpg

More Clarification On Who Pays Transfer Fees YouTube

https://i.ytimg.com/vi/nP4J2zboado/maxresdefault.jpg

Make It Home Q A Property Taxes In Jamaica Wihcon

https://wihcon.com/wp-content/uploads/2019/12/Capture-min-1024x573.png

2 No tax shall be payable in respect of the transfer of property by any personal representative to a person as legatee in the course of administration of the deceased s Vendor s attorney pays assessed transfer tax five per cent and stamp duty four per cent and registration fee one per cent These amounts are usually paid from the deposit

As with the stamp duty the transfer tax is paid to the Tax Administration of Jamaica and is assessed at two per cent of the value of the property Prior to the reform transfer tax was formerly assessed at five per Land Transfers require payment of government taxes and fees before they can be given effect Transfer Tax of 2 and Stamp Duty of J 2 500 as well as Registration Fee of 0 05 of the

More picture related to Who Pays Transfer Tax In Jamaica

A Breakdown Of Transfer Tax In Real Estate UpNest

https://www.upnest.com/1/post/files/2021/08/shutterstock_1060115645-1.jpg

Jamaica Tax By Phuong Do Thi

https://is5-ssl.mzstatic.com/image/thumb/PurpleSource115/v4/8f/20/4c/8f204cfe-1542-cd01-a95d-cbe94a2ac568/39f74ebb-38f8-4b52-9b6b-387a1fd0e37e_Simulator_Screen_Shot_-_iPhone_8_Plus_-_2021-09-04_at_00.20.39.png/750x750bb.jpeg

Who Pays Transfer Tax In Illinois YouTube

https://i.ytimg.com/vi/wb74bKI9ReU/maxresdefault.jpg

Payment of Transfer Tax Pursuant to Section 33 of the Transfer Tax Act a certificate issued by the Stamp Commissioner verifying payment of transfer tax should be produced The transfer A transfer tax of 2 is applicable on the consideration payable or market value in certain instances on the transfer of land buildings securities and shares provided that a refund is available where the transfer tax

The vendor alone pays Transfer Tax 2 of sale price The Real Estate Agent s Commission usually 5 of the sale price If any Each party pays his own Attorney at Law For tax purposes in relation to each of the transfers does not exceed ten thousand dollars and further transfers if any of any such land according to subsection 3 of section 6 on

Does Illinois Have A Capital Gains Tax Illinois CPA

https://www.ps.cpa/wp-content/uploads/2023/03/pexels-karolina-grabowska-4386370.jpg

Jamaica Tax Understanding The Basics Of The Tax System YouTube

https://i.ytimg.com/vi/17_mSldhf18/maxresdefault.jpg

https://www.jamaicatax.gov.jm › stamp_duty_and_transfer_tax

Transfer Tax is borne by the Vendor In cases where the portion of a property gift or sale is being transferred Transfer Tax is chargeable on the market value of the property being

https://laws.moj.gov.jm › library › statute › the-transfer-tax-act

The Transfer Tax Act Statute Details Preamble An act to impose tax upon transfers of interests in land and securities and to provide for matters connected therewith or incidental thereto

Guide To Transfer Tax How To Calculate Transfer Tax 2024 MasterClass

Does Illinois Have A Capital Gains Tax Illinois CPA

The Basics Of Taxation In Jamaica Accountant Jamaica

What Is Income Tax Tax Administration Jamaica TAJ

PROPERTY TAXES IN JAMAICA WHAT YOU NEED TO KNOW Law Office Of Tracey

How To Check Your Property Tax Online In Jamaica How To Jamaica

How To Check Your Property Tax Online In Jamaica How To Jamaica

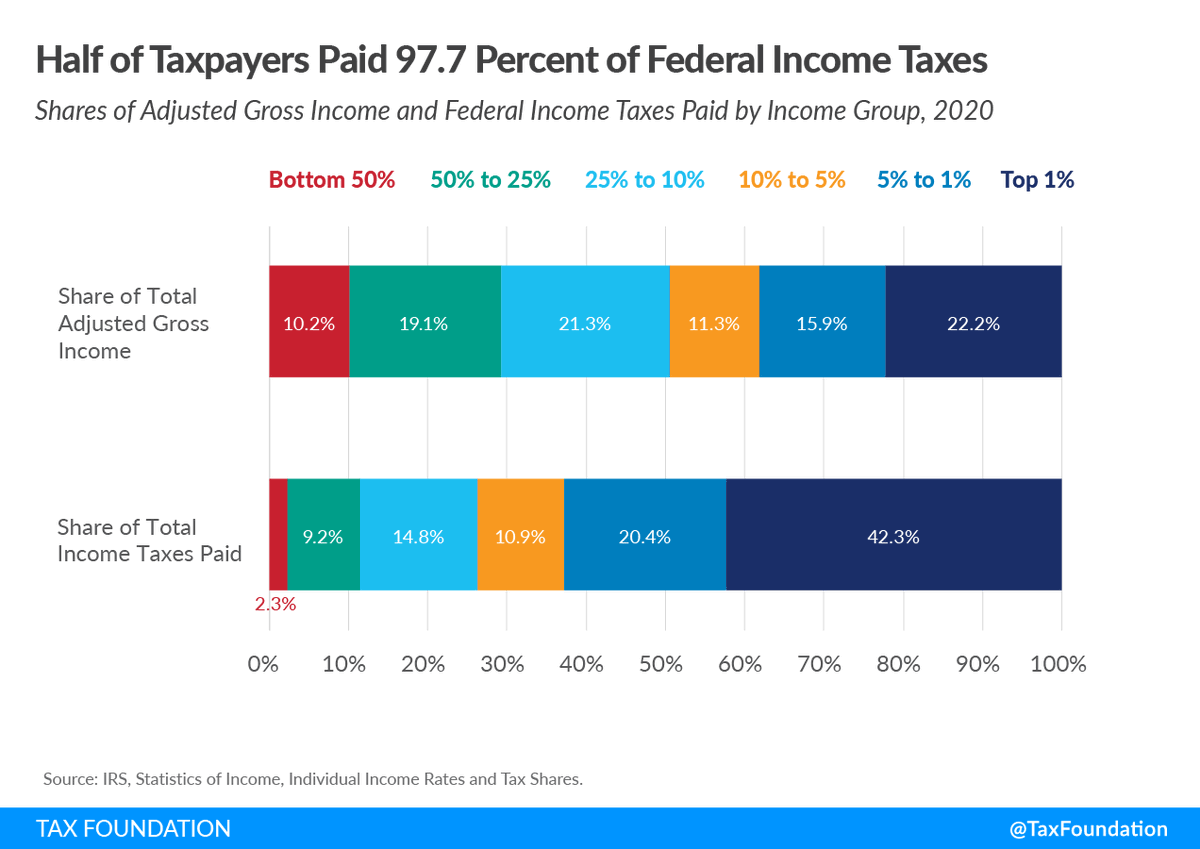

Tax Foundation On Twitter Who Pays Federal Income Taxes Explore The

Understanding Employer Education Tax In Jamaica A Comprehensive Guide

How To Obtain A General Consumption Tax Number GCT In Jamaica

Who Pays Transfer Tax In Jamaica - Here s a comprehensive overview of real estate transfers in Jamaica covering various scenarios General Notes Transfer Tax A percentage of the property s market value This tax must be