Write The Rules Of Section 80tta Section 80TTA Learn about the deduction limit under the Income Tax Act eligibility criteria and how to claim tax benefits on interest income

What is Section 80TTA Section 80TTA of the Income Tax Act 1961 allows taxpayers to claim a deduction of up to Rs 10 000 on interest In the income tax act Section 80TTA is termed as Deduction in respect of interest on deposits in a Savings Account Deduction under this section can be claimed against

Write The Rules Of Section 80tta

Write The Rules Of Section 80tta

https://vakilsearch.com/blog/wp-content/uploads/2022/05/shutterstock_1096017494.jpg

Section 80TTA 80TTB Of The Income Tax Act cs ca cma YouTube

https://i.ytimg.com/vi/A6WE_VnPPkE/oar2.jpg?sqp=-oaymwEkCJUDENAFSFqQAgHyq4qpAxMIARUAAAAAJQAAyEI9AICiQ3gB&rs=AOn4CLBzdwSHimUcGRQOLF-ZqP4JV-LEPA

Section 80TTA 80TTB Of The Income Tax Act cs ca cma YouTube

https://i.ytimg.com/vi/A6WE_VnPPkE/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYJCBXKH8wDw==&rs=AOn4CLApmG-nLEAOth9kemNHr4qD5ancow

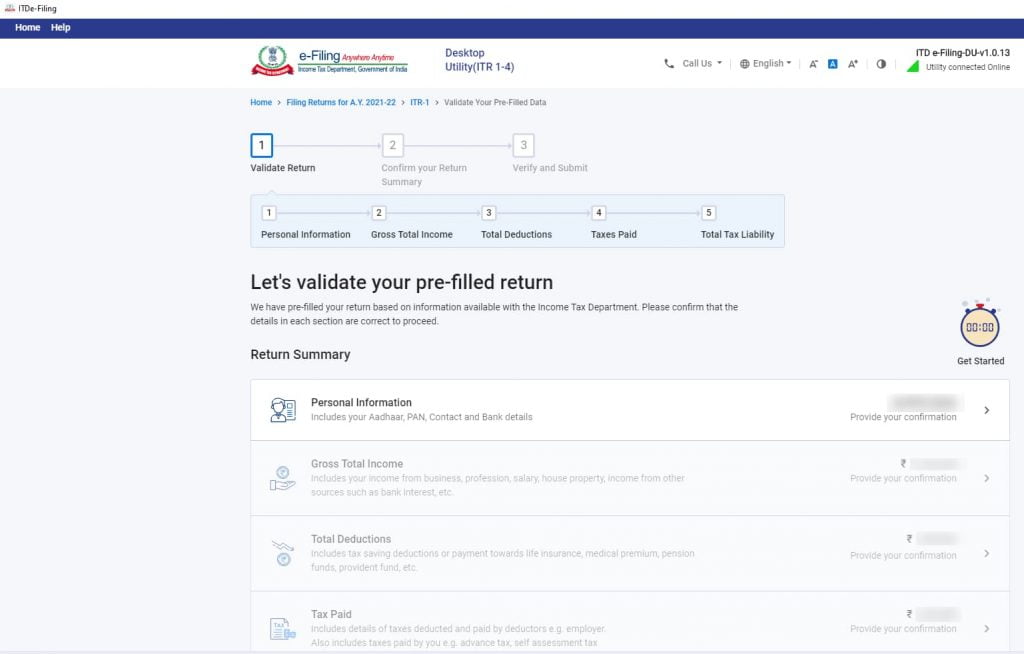

Conclusion In brief Section 80TTA is a simple yet effective provision of the Income Tax Act The deduction of up to 10 000 on the interest earned on savings accounts has come as a relief to the vast majority of taxpayers If you Section 80TTA can be claimed while filing income tax return Check out how much deductions are allowed and who can claim this benefit

Section 80tta allows a deduction to an individual or a Hindu Undivided Family in respect of interest income earned on savings account held with the banks or co operative Get a complete analysis of Section 80TTA of the Income Tax Act 1961 learn when trusts and companies are ineligible for the deduction of up to Rs 10 000 Understand how these deductions apply to individuals HUFs

More picture related to Write The Rules Of Section 80tta

Tax Free Interest For Everyone Section 80TTA 80ATTB Saving Interest

https://i.ytimg.com/vi/1_8RyPN4nsg/maxresdefault.jpg

Section 80TTA Of Income Tax Act Deduction For Interest On Savings

https://margcompusoft.com/m/wp-content/uploads/2023/03/7-10-1024x576.jpg

Section 80TTA Of Income Tax Act 1961

https://www.cabkgoyal.com/wp-content/uploads/2023/06/Section-80TTA-of-Income-Tax-Act-1961.png

Section 80TTA of the Income Tax Act allows you to claim deductions on savings accounts deposits that are held in a post office bank or cooperative society Exemption Guide to section 80tta of income tax act Read what interest income comes under 80tta for AY 2020 21 minimum and max deduction allowed example of section 80tta and more

Section 80TTA of the Income Tax Act allows individuals and Hindu Undivided Families HUFs to claim deductions on interest income earned from savings accounts Section 80TTA of the Income Tax Act from 1961 presents an opportunity one can deduct up to Rs 10 000 on interest income earned specifically from a savings bank

Analysis Of Section 80TTA Of The Income Tax Act 1961

https://taxguru.in/wp-content/uploads/2023/01/Analysis-of-Section-80TTA-of-the-Income-Tax-Act-1961.jpg

Section 80TTA Savings Account Interest Deduction FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2023/10/section-80tta-1024x576.webp

https://tax2win.in › guide

Section 80TTA Learn about the deduction limit under the Income Tax Act eligibility criteria and how to claim tax benefits on interest income

https://www.indiafilings.com › learn

What is Section 80TTA Section 80TTA of the Income Tax Act 1961 allows taxpayers to claim a deduction of up to Rs 10 000 on interest

HackerRank The Story Of A Tree Problem Solution TheCScience

Analysis Of Section 80TTA Of The Income Tax Act 1961

Section 80TTA Income Tax Act Claim Deduction On Interest Income

Understanding The Rules Of The 2024 European Championships Group Stage

Deduction Under Section 80TTA Of The Income Tax Act 1961 Palgou India

Reveille Trailer Tests The Rules Of War Like Never Before In This Award

Reveille Trailer Tests The Rules Of War Like Never Before In This Award

Section 80TTA How You Can Claim Tax Deduction

What Is Section 80TTA Meaning Eligibility And Deduction Under Sec 80TTA

Trump Adviser On New Campaign Push Think Trump On Steroids The

Write The Rules Of Section 80tta - Section 80TTA allows claiming deductions on interest earned on savings account deposits Learn about the 80TTA deduction limit deductions allowed and not allowed and more on Groww