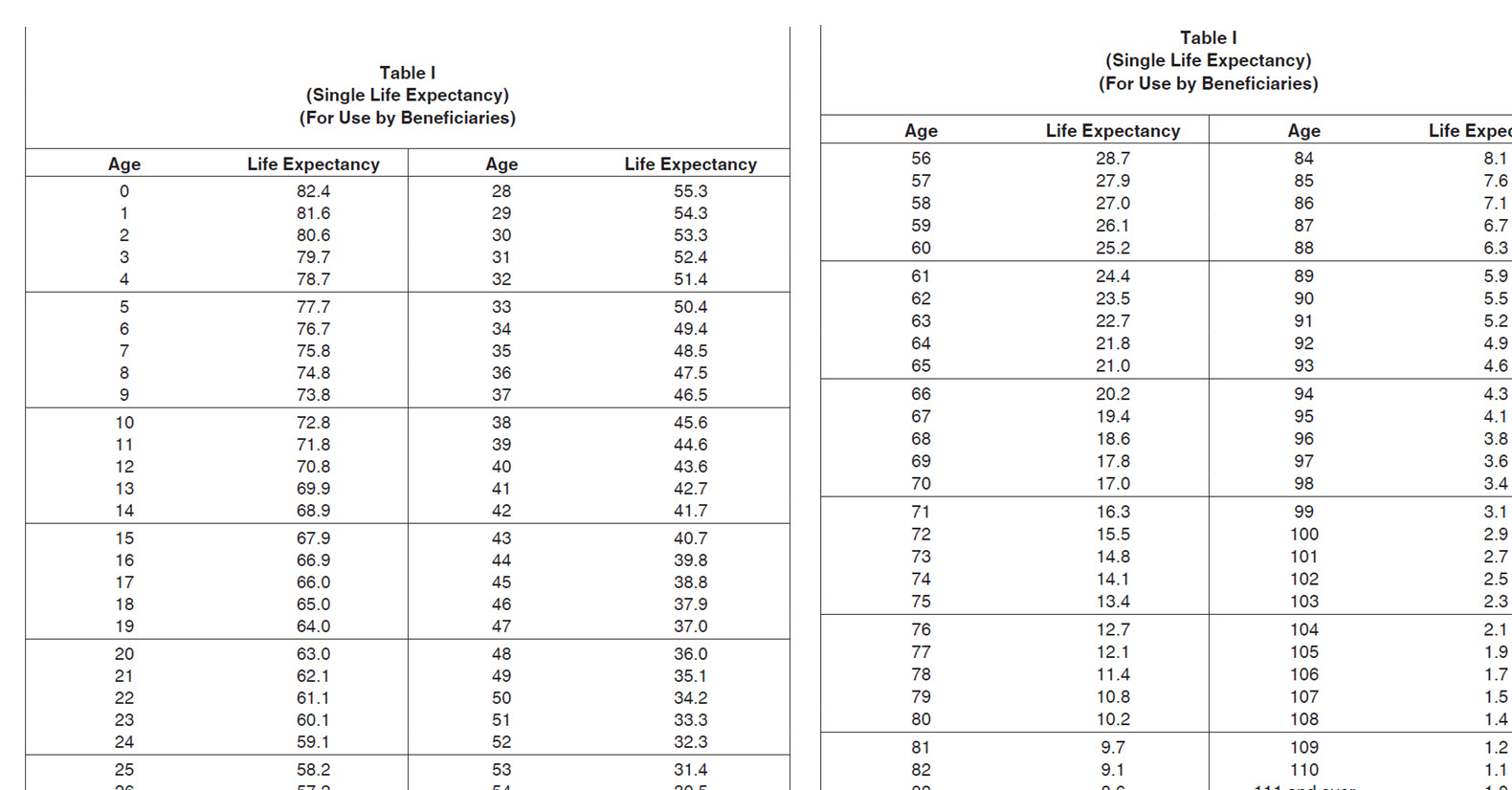

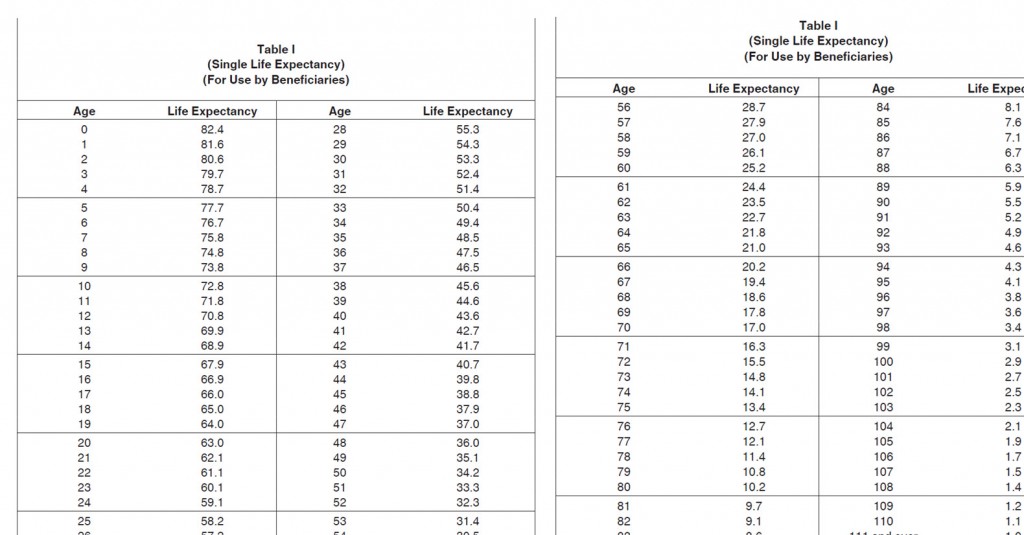

10 Year Rule Rmd Table Information on this page may be affected by coronavirus relief for retirement plans and IRAs Table 1 Single Life Expectancy Appendix B Publication 590 B Learn the required minimum

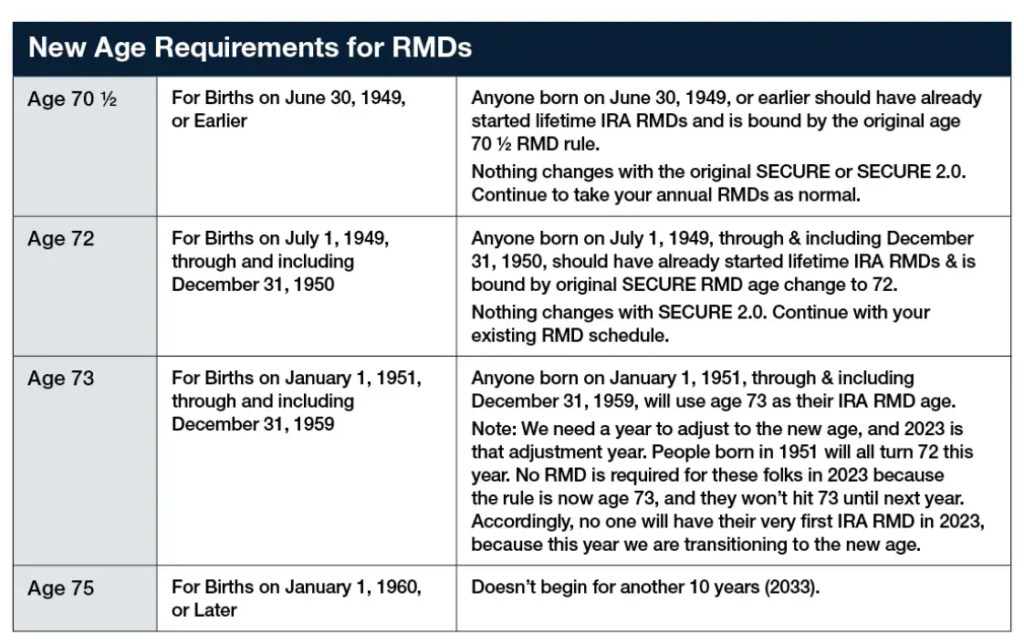

2020 Pub L 116 94 133 Stat 2534 2019 to add 401 a 9 H to the Code Generally pursuant to 401 a 9 H i if an employee in a defined contribution plan has a designated This 10 year rule applies to a successor beneficiary who inherits a retirement account after 2019 from an eligible designated beneficiary taking distributions over their applicable life

10 Year Rule Rmd Table

10 Year Rule Rmd Table

https://required-minimum-distribution.com/wp-content/uploads/2014/11/rmd-table.jpg

Rmd Factors For 2025 Over 50 Yvette P Mason

https://blogs-images.forbes.com/mattcarey/files/2018/09/blueprint-income-rmds-wide.png

Rmd Table For 2025 Natalie Carter

https://image3.slideserve.com/6765293/calculating-ira-minimum-required-distributions-l.jpg

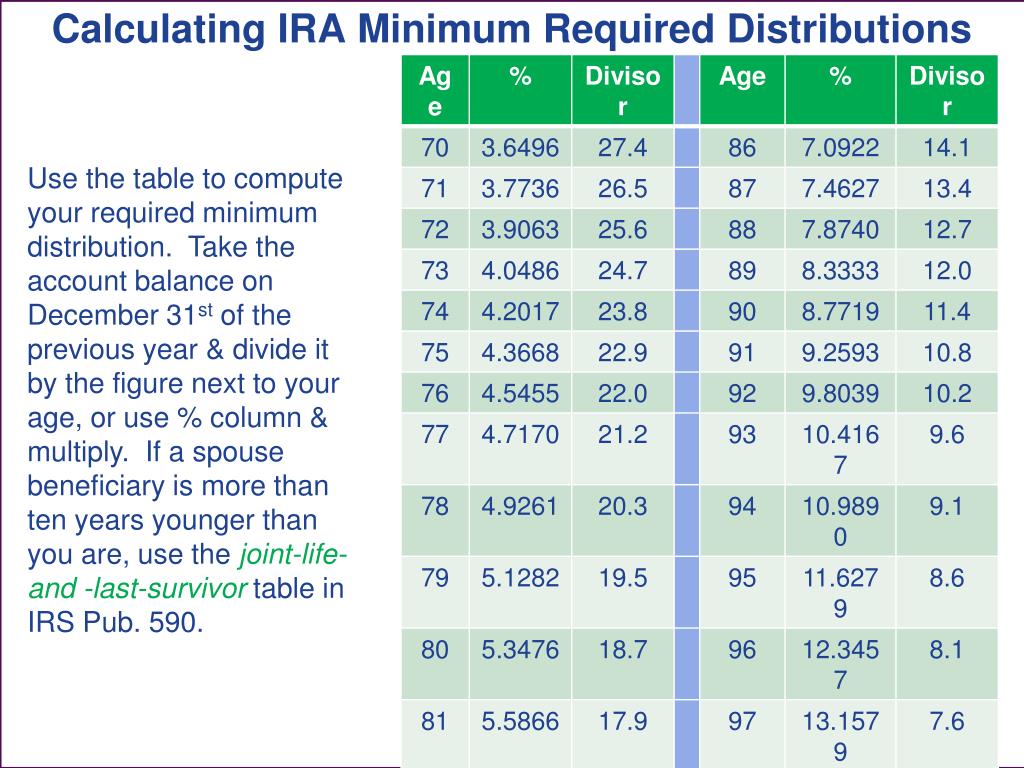

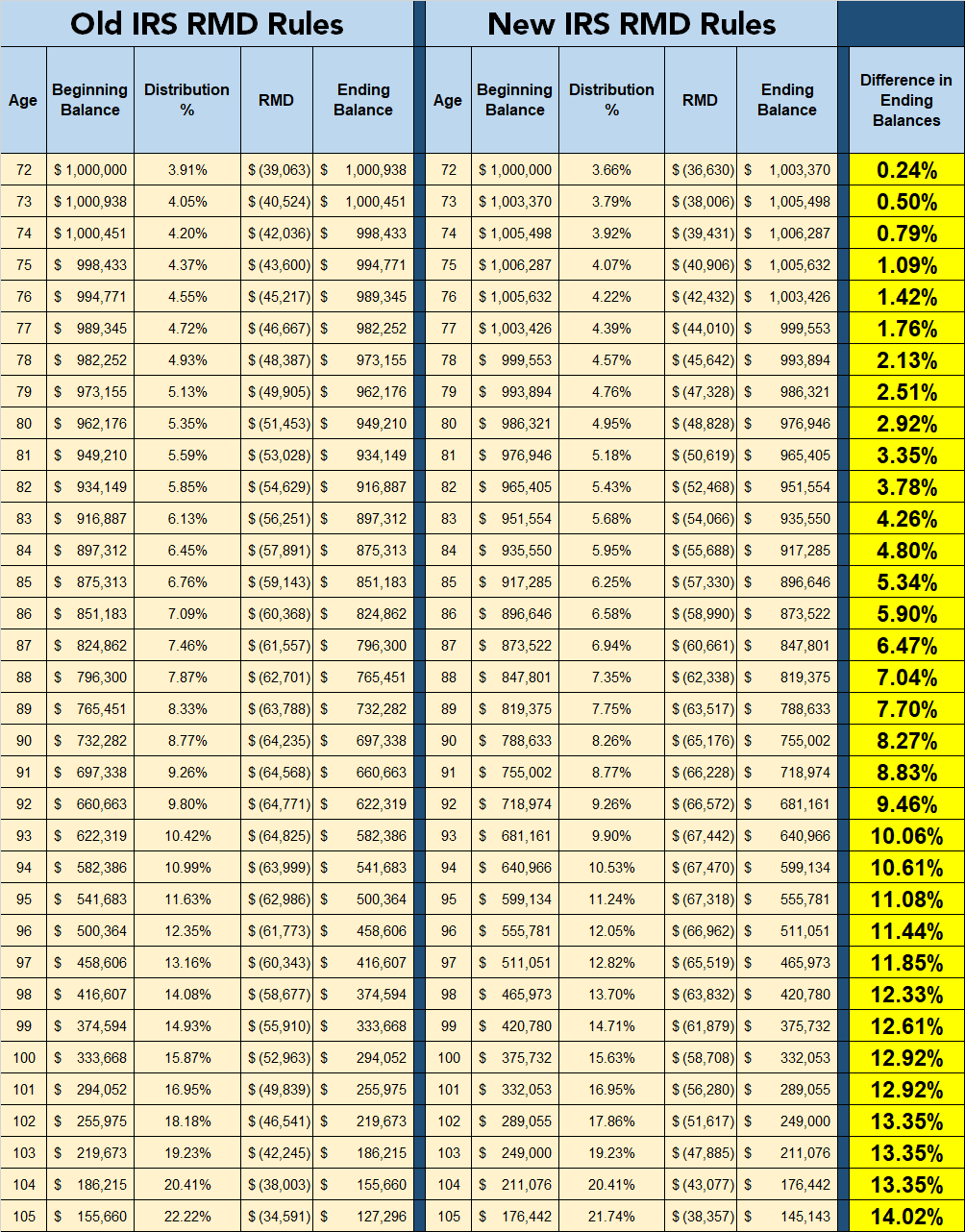

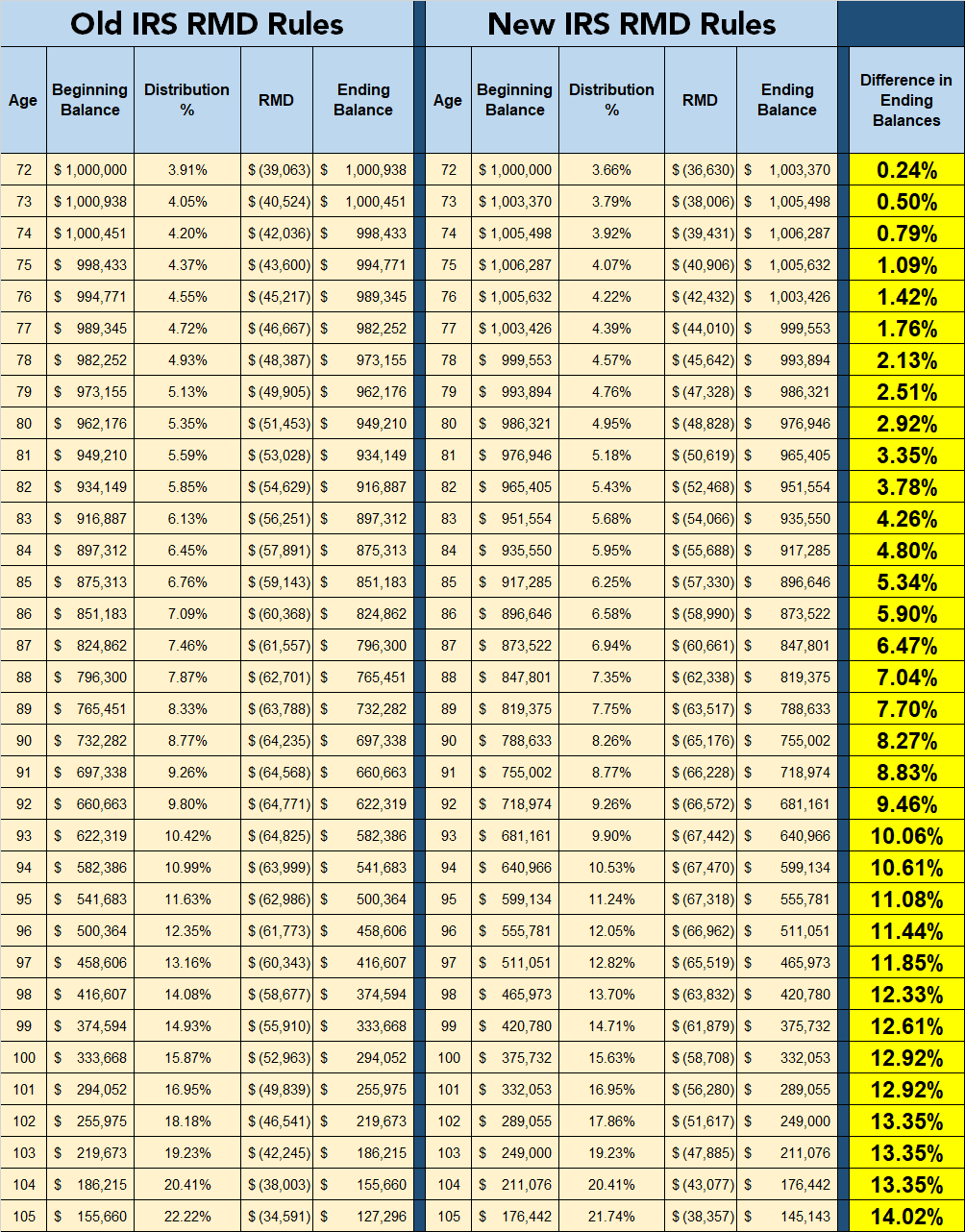

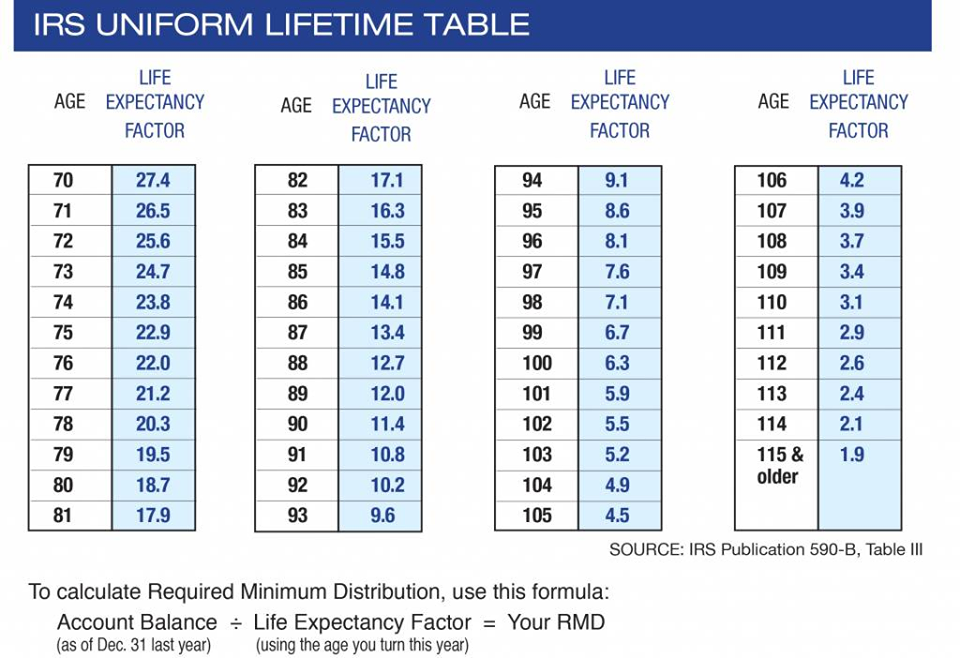

The new 10 year rule applies regardless of whether the participant dies before on or after the required beginning date The required beginning date is the date an account owner must take Uniform Lifetime Table The life expectancy used to calculate RMDs for participants This table assumes the participant s beneficiary is 10 years younger than the participant regardless

Untangling the IRS s new Final Regulations issued on July 18 2024 including post death distribution rules for non eligible designated beneficiaries RMDs for those subject to the 10 Year Rule and more In the recently issued final rules the IRS confirmed that most beneficiaries must take annual RMDs throughout the 10 years with the account fully depleted by the end of the tenth year

More picture related to 10 Year Rule Rmd Table

Rmd Divisor Table 2025 Pdf John B Mills

https://michaelryanmoney.com/wp-content/uploads/2022/07/www.michaelryanmoney.com_.jpg

Rmd Age For 2025 Adrien Hunt

https://bestpathforward.com/wp-content/uploads/2023/06/RMD-chart-1024x644.png

2024 Rmd Age Table

https://bestpathforward.com/wp-content/uploads/2023/06/RMD-chart.png

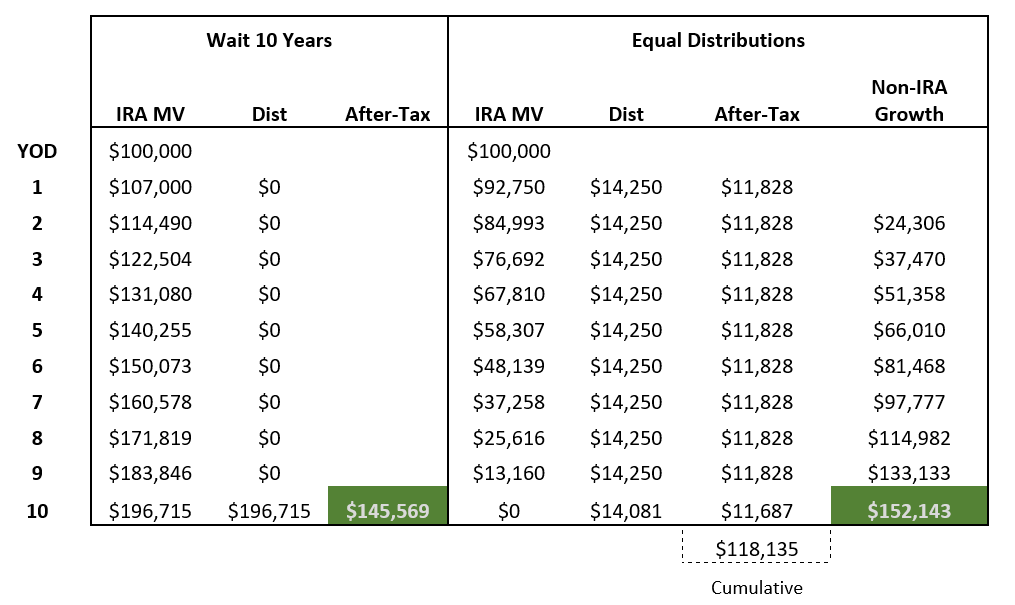

A Required Minimum Distribution RMD is an IRS mandated withdrawal from certain types of tax protected accounts including Traditional IRAs 401 k s 403 b s and Key Points Starting in 2025 most non spouse beneficiaries have a 10 year window to fully distribute an Inherited IRA s assets The IRS also clarified rules regarding taking a

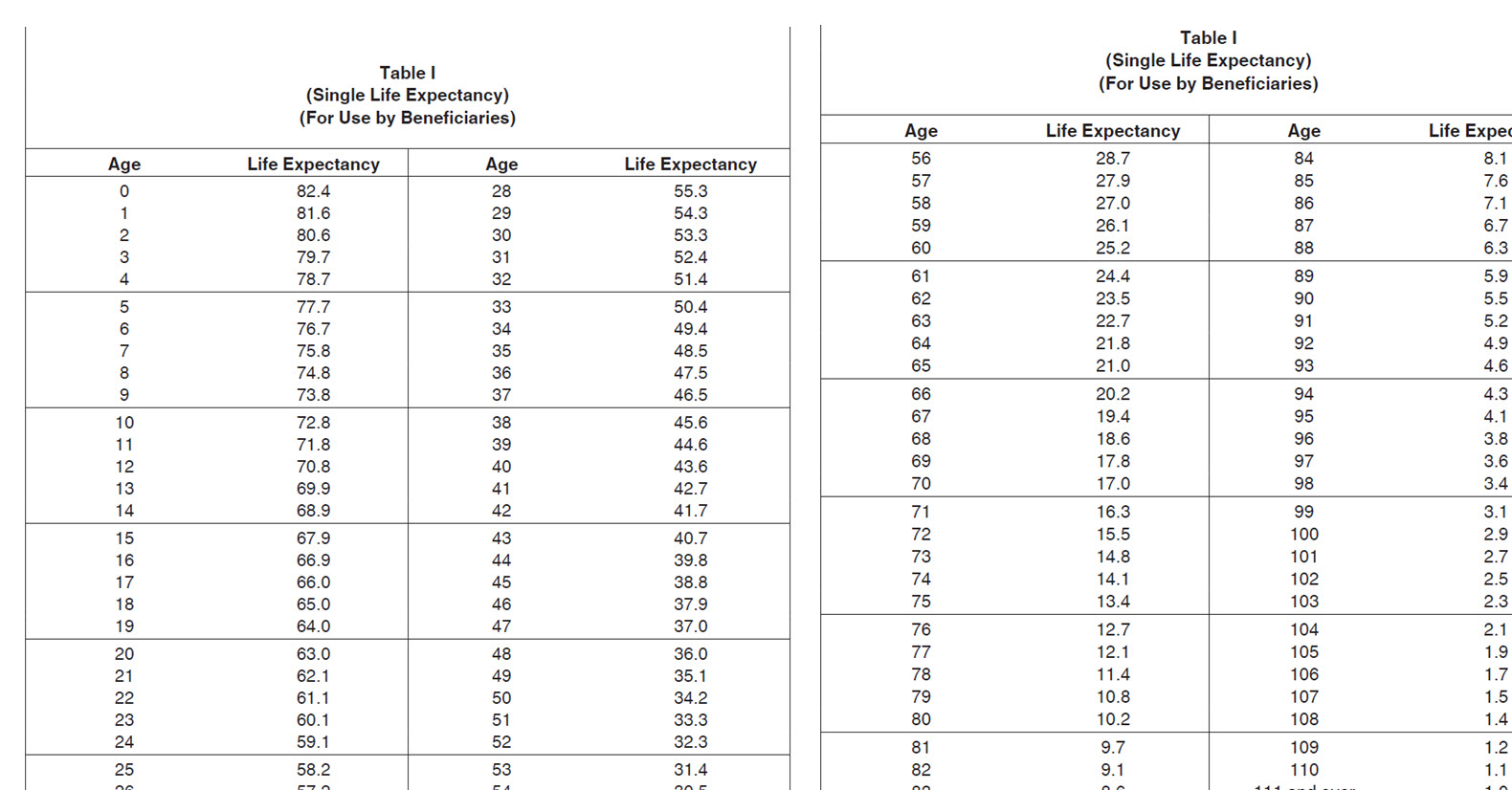

The IRS has new RMD tables effective January 1 2022 See how much you are required to withdraw from your IRAs The life expectancy of a 61 year old under the current IRS Single Life Table is 26 2 Subtracting 1 0 for each subsequent year gets us to a 22 2 year life expectancy for Karen s

Rmd Changes For 2024 Becka Coralyn

https://levelfa.com/wp-content/uploads/2020/12/RMD-Rule-Changes.png

Rmd Age For 2025 Sara J Hettinger

https://michaelryanmoney.com/wp-content/uploads/2022/07/RMD-New-Uniform-Lifetime-Tables-2022-750x579.jpg

https://www.irs.gov › retirement-plans › required...

Information on this page may be affected by coronavirus relief for retirement plans and IRAs Table 1 Single Life Expectancy Appendix B Publication 590 B Learn the required minimum

https://www.irs.gov › pub › irs-drop

2020 Pub L 116 94 133 Stat 2534 2019 to add 401 a 9 H to the Code Generally pursuant to 401 a 9 H i if an employee in a defined contribution plan has a designated

Current Life Expectancy 2025 Usa Roger S Sims

Rmd Changes For 2024 Becka Coralyn

Rmd Calculator 2025 Aarp Medicare Karen W Epps

Required Minimum Distribution Table 2025 Jax Faith

Understanding The SECURE Act Managing The 10 Year Rule Financial

Rmd Life Expectancy Table 2024 Pdf Sela Kylynn

Rmd Life Expectancy Table 2024 Pdf Sela Kylynn

Rmd Calculator 2025 Table Pdf 2025 Marla Lauren

Rmd Calculator 2025 Table Pdf 2025 Easton Nasir

Rmd Calculator 2025 Table Pdf 2025 Easton Nasir

10 Year Rule Rmd Table - The 10 year rule will kick in requiring any remaining funds in the inherited IRA to be wholly distributed within ten years During her ages of ten through 18 an RMD must be