20000 Dollars To Cedis Today As part of a bold new package to transform HMRC into a quicker fairer and more modern body the minister is expected to announce plans to increase the Income Tax Self

If your side job counts as self employment the amount you are taxed on will vary based on any allowable expenses you have claimed for HMRC has a second job tax The government has announced an upcoming change to tax reporting requirements for people with side hustles and small self employed incomes Within this parliament or by the end of

20000 Dollars To Cedis Today

20000 Dollars To Cedis Today

https://i.ytimg.com/vi/DHVHvIRQw_M/maxresdefault.jpg

Ghana Currency Cedis Today Euro Pound US Dollar Rate In Ghana

https://i.ytimg.com/vi/YFL49zrLGcA/maxresdefault.jpg

Ghana Currency Exchange Rate Today US Dollar Euro In Ghana Cedis 1

https://i.ytimg.com/vi/gMfiFFMI4Rg/maxresdefault.jpg

HMRC s new rule isn t a direct tax break but changes how you report side hustle income The reporting threshold for trading income like selling online or gig work has risen from 1 000 to This change means that anyone earning up to 3 000 annually in gross income from trading income or side activities will no longer be required to file a Self Assessment tax

Thanks to the trading allowance you can earn up to 1 000 a year from self employed or casual work before needing to declare it This allowance applies to your total This means If your side hustle earns less than 1 000 per year you don t need to report it to HMRC If your side hustle earns between 1 000 and 3 000 you may still need to

More picture related to 20000 Dollars To Cedis Today

Dollar Rate Today Ghana USD TO CEDI Exchange Rate In Ghana Today USD TO

https://i.ytimg.com/vi/F5FHoEamElU/maxresdefault.jpg

Bank Of Ghana Introduces New Cedi Notes Coin Check All The Security

https://i.ytimg.com/vi/TyvpkEge9rA/maxresdefault.jpg

Ghana CEDIS And NAIRA Notes Different Between The Two They Share

https://i.ytimg.com/vi/lTq7ngzfS3g/maxresdefault.jpg

Even with the new threshold many self employed individuals and side hustlers will still need to file an Income Tax Self Assessment If you earn over 3 000 from self employment are a partner In the UK you re allowed to earn up to 1 000 tax free in income not profit every tax year before registering as self employed This tax break is known as the trading income

[desc-10] [desc-11]

Today 100 Dollar In Ghana Cedis Exchange Rate How Much 100 US To

https://i.ytimg.com/vi/ZkVhpOZ-Z2s/maxresdefault.jpg

Forex 1000 Dollar In Ghana Cedis 500 Dollar How Much Ghana Currency

https://i.ytimg.com/vi/tnxMZfKk_oE/maxresdefault.jpg

https://www.gov.uk › government › news

As part of a bold new package to transform HMRC into a quicker fairer and more modern body the minister is expected to announce plans to increase the Income Tax Self

https://www.thetimes.com › money-mentor › income-budgeting › tax › si…

If your side job counts as self employment the amount you are taxed on will vary based on any allowable expenses you have claimed for HMRC has a second job tax

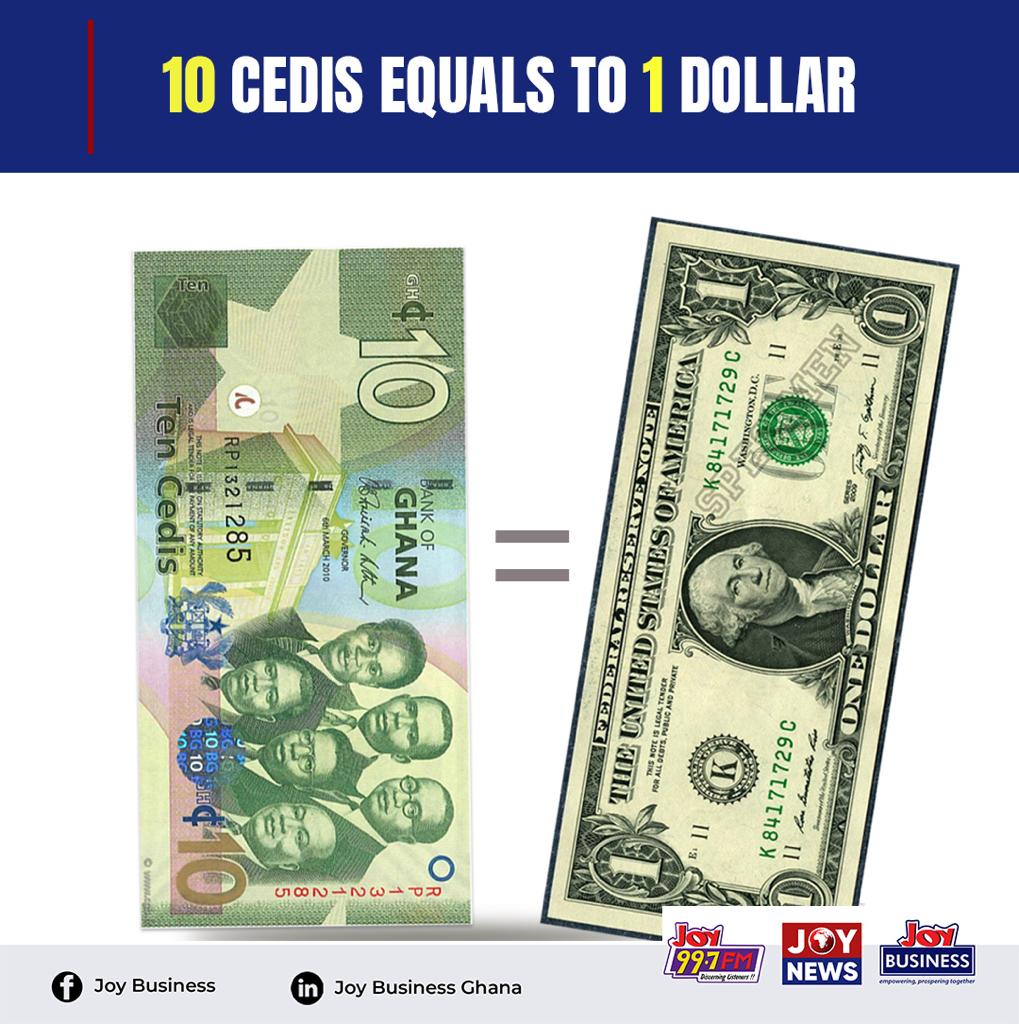

Joy 99 7 FM On Twitter 10 Cedis Equals 1 Dollar JoyBusiness

Today 100 Dollar In Ghana Cedis Exchange Rate How Much 100 US To

Divaporch VKR WizKids Fc On Twitter RT Kingofstoicism

Live Pound Sterling To Ghanaian Cedis Exchange Rate 1 GBP GHS Today

1695 Bank Of Ghana 5000 Cedis 4 10000 Cedis 2 20000 Cedis 3

50 Cedis Ghana 1957 date Numista

50 Cedis Ghana 1957 date Numista

20 000 Cedis Ghana 1957 date Numista

1 Dollar To Ghana Cedis 2024 Astra Candace

Dollar To Cedi Predictions 2024 Elvira Celestina

20000 Dollars To Cedis Today - This means If your side hustle earns less than 1 000 per year you don t need to report it to HMRC If your side hustle earns between 1 000 and 3 000 you may still need to