Are Contributions To Whole Life Insurance Tax Deductible When you sign up to be a Local Guide you can contribute content to Google Maps and get points if it s published Learn how to contribute high quality reviews and photos To increase your

Generally if you pay administration fees or you make contributions to your employee s savings or pension plan the benefit is taxable If you withhold contributions to any savings or pension Beginning January 1 2024 you must begin to calculate the second additional CPP contributions CPP2 on earnings above the annual maximum pensionable earnings You may be looking

Are Contributions To Whole Life Insurance Tax Deductible

Are Contributions To Whole Life Insurance Tax Deductible

https://i.ytimg.com/vi/M0MGv6xPmvc/maxresdefault.jpg

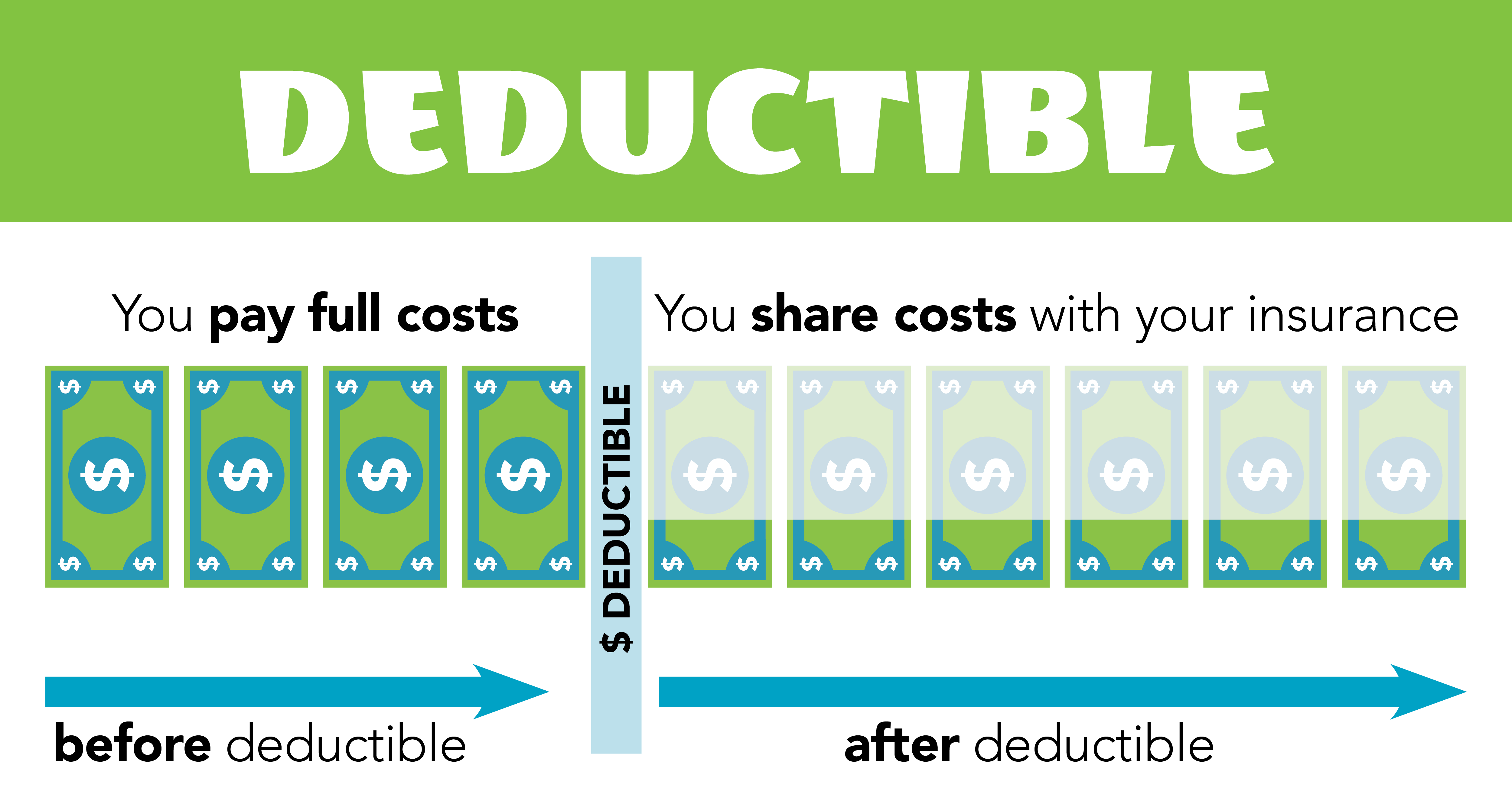

Deductible Maryland Health Connection

https://www.marylandhealthconnection.gov/wp-content/uploads/2016/06/MHC_Deductible_Chart.png

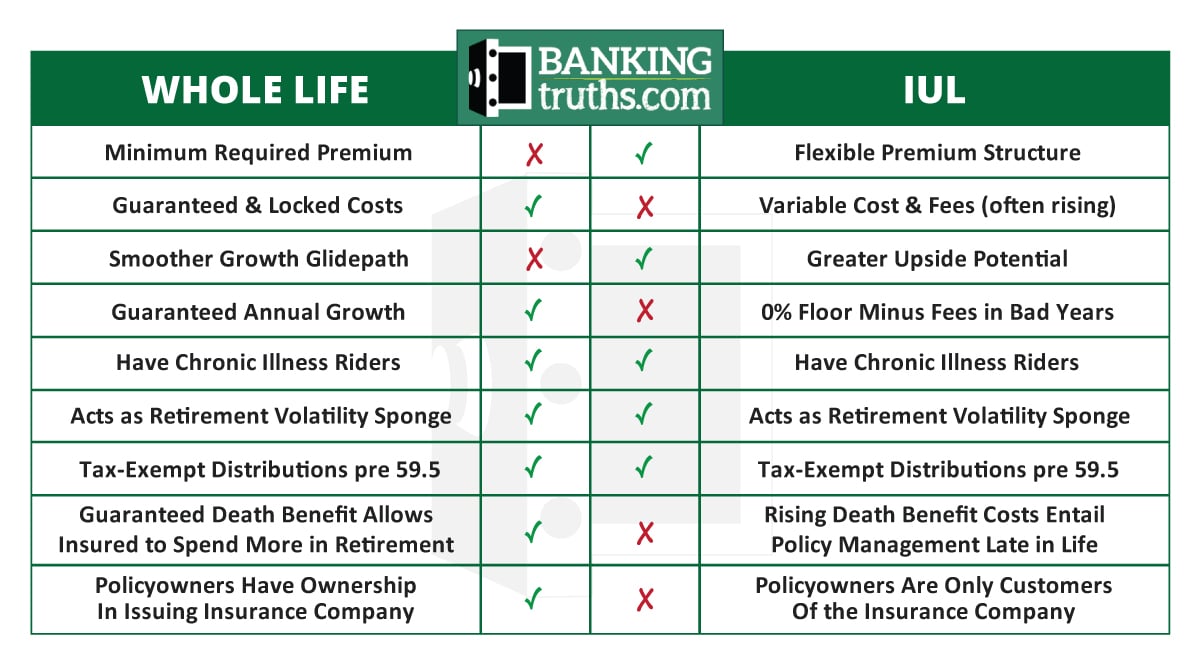

Is Universal Life Insurance A Good Retirement Strategy Outlet

https://bankingtruths.com/wp-content/uploads/2023/09/whole-life-vs-indexed-universal-life-comparison-chart.jpg

View your CPP statement of contributions If you have contributed to the CPP you can view or request your official statement of contributions be mailed by selecting View my contributions Grants and contributions ESDC mainly uses 2 ways to issue funding Grants and Contributions which are also referred to as transfer payments 1 Grants Grants are payments made to an

Calculate payroll deductions and contributions Get ready to make deductions About the deduction of CPP contributions CPP contribution rates maximums and exemptions Second additional Your employer pension plan basics defined contributions and benefits Group RRSPs PRPPs and voluntary retirement savings plans

More picture related to Are Contributions To Whole Life Insurance Tax Deductible

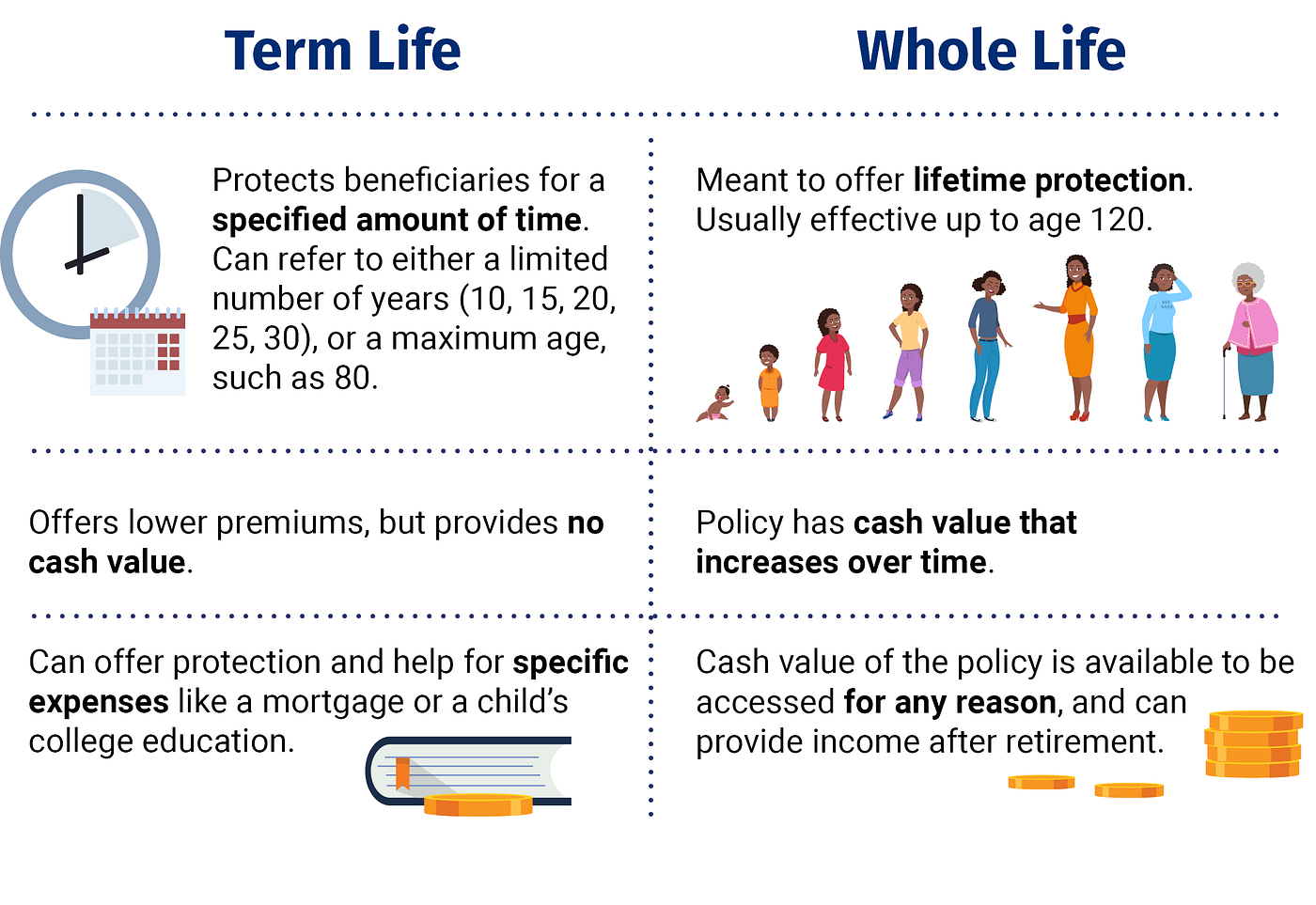

Is Whole Life Insurance A Good Value Outlet Dakora co

https://images.ctfassets.net/3uw9cov4u60w/1bAayQCl5erbC55ISpaOnl/20f0ef2b8039caa7fe05d7f553b49fac/Image_2.png

Ira Limits 2025 Income Tax Tayla S Champion De Crespigny

https://meldfinancial.com/wp-content/uploads/IRA-Contribution-Limits-in-2023-846x630.jpg

Permanent Life Insurance

https://images.squarespace-cdn.com/content/v1/5f5bc60959cec6440c4d5dbc/1613755141801-JI2959WTAPOCV43DSK6E/_TIP+-+Whole+vs.+Term+Insurance.png

Maximum Benefit Amounts and Related Figures Canada Pension Plan 2025 and Old Age Security January to March 2025 The Payroll Deductions Online Calculator PDOC calculates Canada Pension Plan CPP Employment Insurance EI and tax deductions based on the information you provide

[desc-10] [desc-11]

Permanent Life Insurance

https://miro.medium.com/v2/resize:fit:1400/1*xltPEjP8f2-FzBu_tqTMKg.png

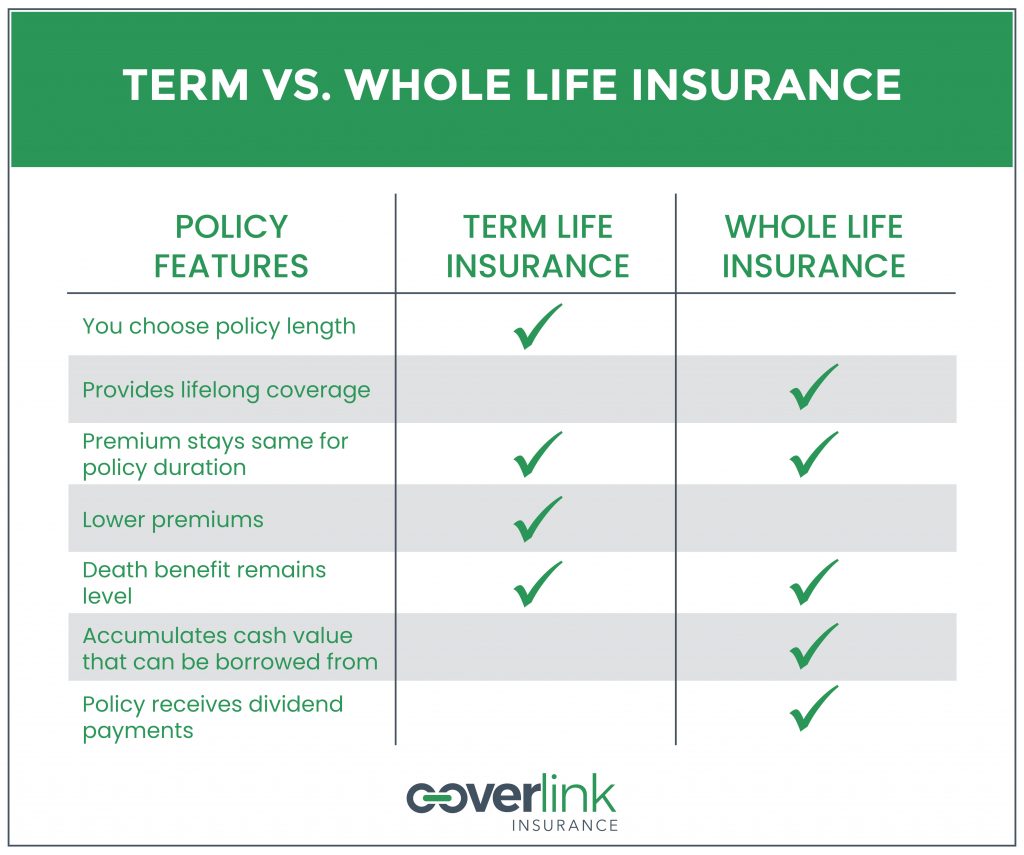

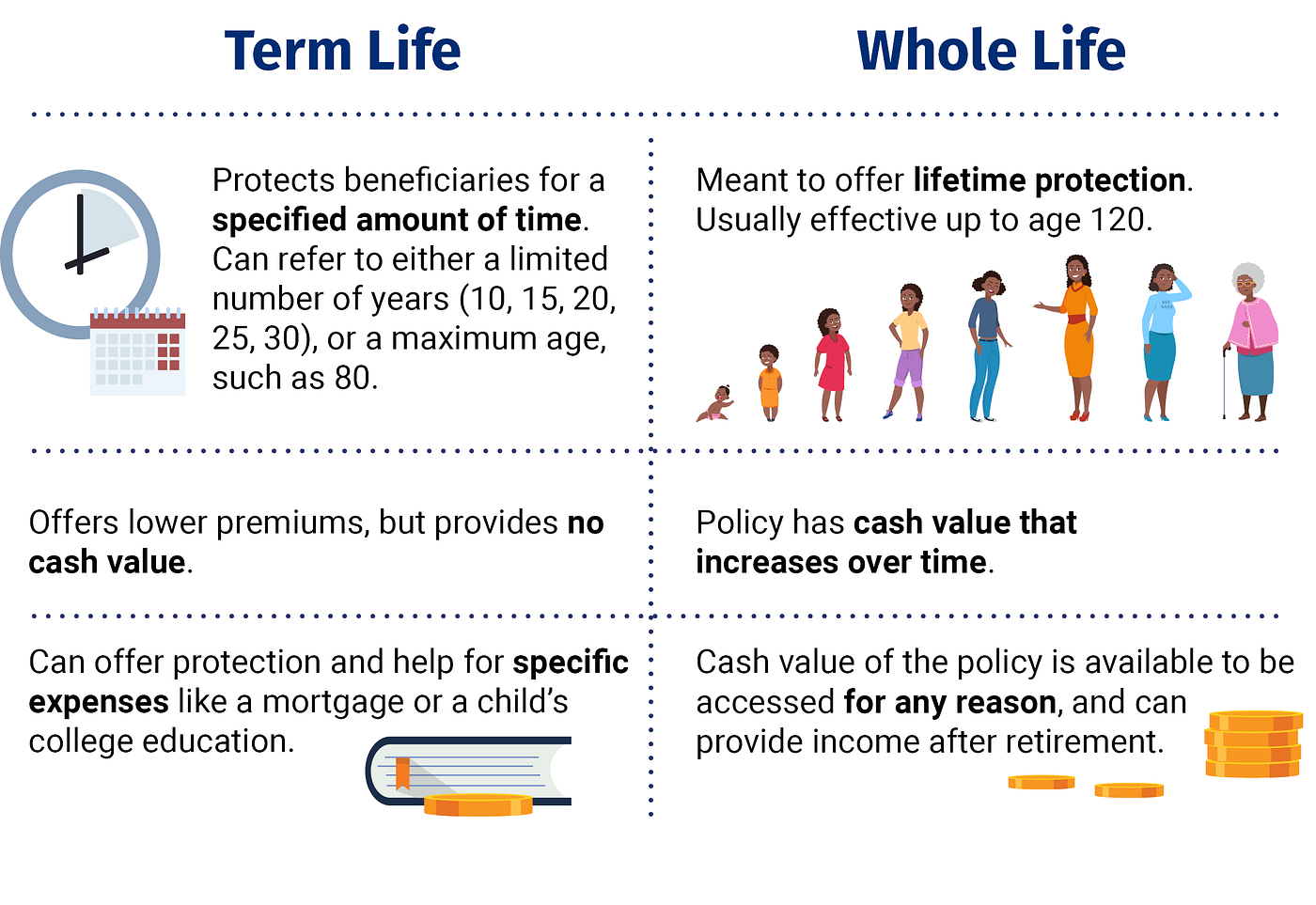

Whole Life Insurance

https://coverlink.com/wp-content/uploads/2020/09/Term-vs-Whole-LIfe-1024x855.jpg

https://support.google.com › maps › answer

When you sign up to be a Local Guide you can contribute content to Google Maps and get points if it s published Learn how to contribute high quality reviews and photos To increase your

https://www.canada.ca › en › revenue-agency › services › tax › business…

Generally if you pay administration fees or you make contributions to your employee s savings or pension plan the benefit is taxable If you withhold contributions to any savings or pension

Whole Life Insurance

Permanent Life Insurance

Charitable Tax Deduction

Hdhp Minimum Deductible 2024 Halie Nadeen

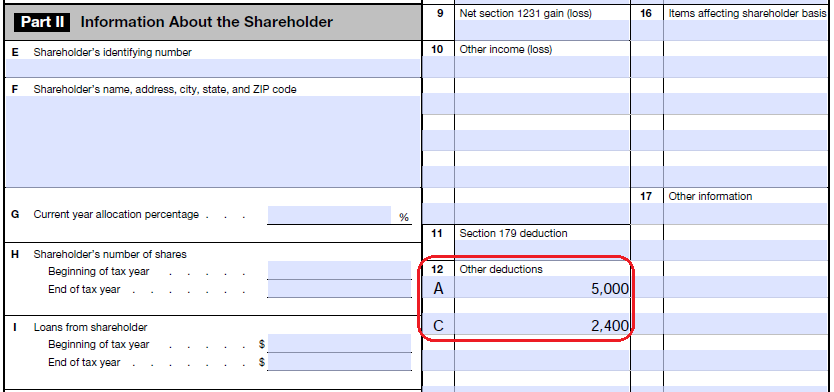

Cash And Noncash Contributions On A K 1 Bukers Taxanalysis

Understanding Your Deductible Plan Youtube Vrogue co

Understanding Your Deductible Plan Youtube Vrogue co

UK Employer s National Insurance Explained

Average Life Insurance Rates January 2024

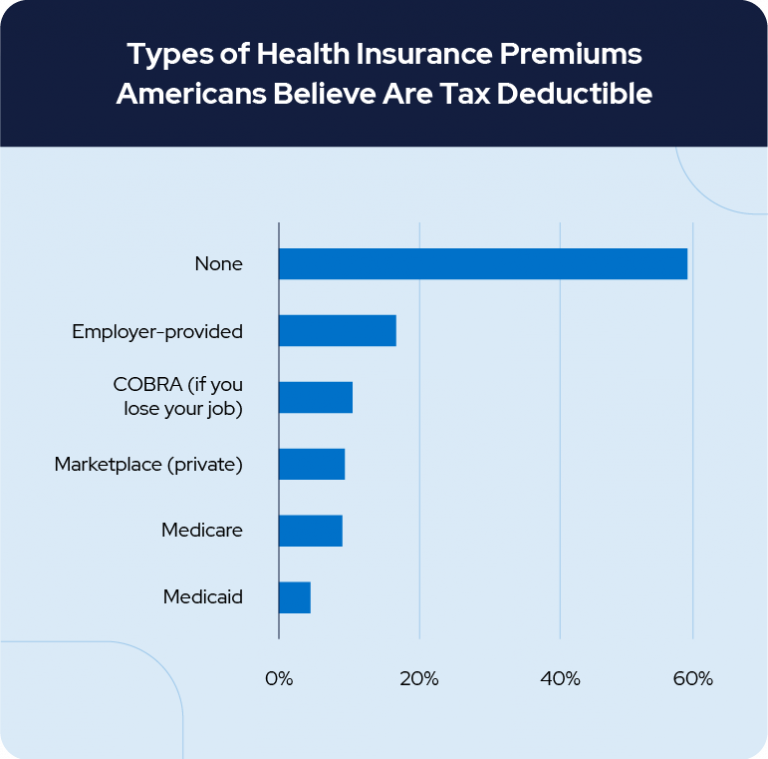

91 Of Americans Don t Know Medicare Premiums Are Tax Deductible

Are Contributions To Whole Life Insurance Tax Deductible - View your CPP statement of contributions If you have contributed to the CPP you can view or request your official statement of contributions be mailed by selecting View my contributions