Are Donations Tax Deductible Partnership client has donated 2 5K to their local greek church in UK is there any tax relief on charitable donations if not made under Gift Aid

Additionally it is actively and successfully seeking assistance in funding the free work So the costs losses incurred in engaging in this tax deductible activity are being defrayed by donations ie not being wholly incurred by the business I do not see where the tax free element comes in given the operation is trading for profit overall However any charitable donations which are not allowed as a trading deduction will normally be deductible as a qualifying charitable donation QCD under CTA 2010 Pt 6 Thanks 0 Replying to alejandra

Are Donations Tax Deductible

Are Donations Tax Deductible

https://i.ytimg.com/vi/ofMWcRTpvy0/maxresdefault.jpg

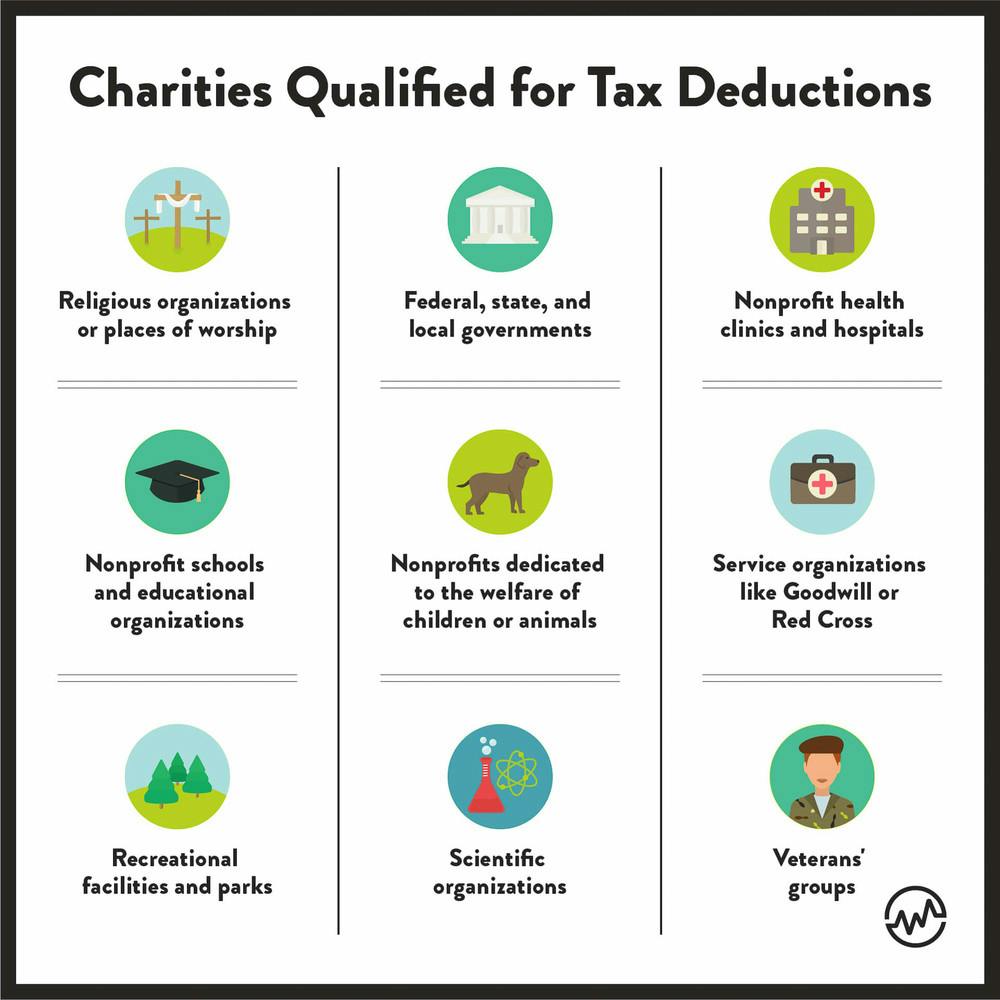

Charitable Tax Deductions How To Save On Your Taxes Presented By

https://i.ytimg.com/vi/4rHTFqkcv3w/maxresdefault.jpg

Benefits charitable giving donations

https://www.historickansascity.org/wp-content/uploads/2019/12/benefits-charitable-giving-donations-scaled.jpg

I m struggling to find clear guidance on whether or not a donation needs to be to a charity which is UK registered in order for it to be deductible for corporation tax purposes A client has made voluntary cash donations to a charity registered overseas with no consideration received Any advice on this is much appreciated Many thanks Where donations are from joint bank accounts care should be taken to determine the identity of the donor Joint donations should be accompanied by joint Gift Aid declarations so should be considered carefully before the donation is made if the donors pay tax at different rates Healthy scepticism

3 Donations for projects Due to the nature of the cause recent events have meant there has been a surge of unexpected donations via a Just Giving page that is now 5 times over the initial goal No trading has been done to gain these donations and all the money will be used for future projects within the organisation In which case I would suspect neither expenses is deductible I was just wondering what the potential tax benefits could be of a CIC compared to giving money to charity from my company I would like to give money to charity or at least good causes through my company but the only donations that are deductible are small donations to local charities

More picture related to Are Donations Tax Deductible

Announcing Raisely s New Donation Receipting Features

https://raisely-images.imgix.net/www/uploads/receipt-example-png-e001fa.png

Charitable Contributions And How To Handle The Tax Deductions

https://growthmastery.net/wp-content/uploads/2017/11/form-1040.jpg

Charitable Contribution Deduction 2025 Etty Shanna

https://images.prismic.io/wealthfit-staging/6c4dff5e8f000e8b664bb80e4577267e647b8ba9_01-maximize-charitable-deductions.jpg?auto=compress

It is possible to make regular donations to a charity via PAYE The donations are made out of gross income before tax is collected For example a donation of 5 a month costs an employee 4 from their take home pay where they pay 20 tax or 3 if they pay 40 tax Treating the grant as taxable as it s released to P L in accordance with GAAP has the effect of matching the grant with the expenditure which gives an equitable tax effect Similarly with your correct treatment of the capital grant I think WhichTyler s link covers the donations which are likely to be considered a trading receipt

[desc-10] [desc-11]

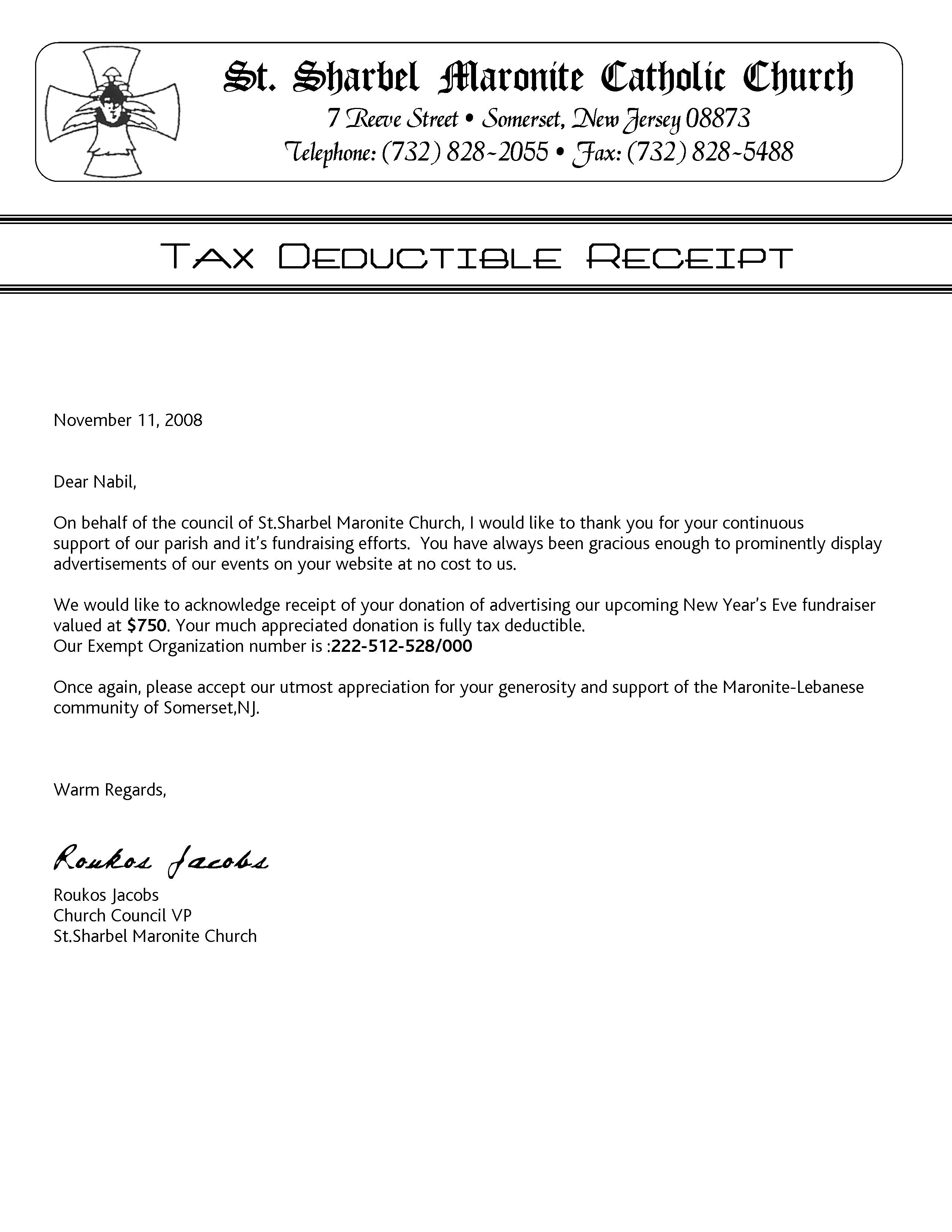

Donation Letter For Taxes Sample And Examples Word

https://i0.wp.com/templatediy.com/wp-content/uploads/2022/10/Donation-Letter-for-Taxes.jpg?fit=1414%2C2000&ssl=1

Church Contribution Letter Charlotte Clergy Coalition

http://charlotteclergycoalition.com/wp-content/uploads/2018/09/church-contribution-letter-sample-church-donation-letters-160605.jpg

https://www.accountingweb.co.uk › any-answers › charitable-donation-b…

Partnership client has donated 2 5K to their local greek church in UK is there any tax relief on charitable donations if not made under Gift Aid

https://www.accountingweb.co.uk › any-answers › donations-is-it-income

Additionally it is actively and successfully seeking assistance in funding the free work So the costs losses incurred in engaging in this tax deductible activity are being defrayed by donations ie not being wholly incurred by the business I do not see where the tax free element comes in given the operation is trading for profit overall

Business Charitable Deductions 2025 Ray D Mattson

Donation Letter For Taxes Sample And Examples Word

Tax Deductible Donation Form SEE Foundation

Charitable Tax Deduction

Donation Letter for Taxes Best Letter Template

2024 Taxes Charitable Deduction Olive Ashleigh

2024 Taxes Charitable Deduction Olive Ashleigh

Understanding Tax Deductible Donations A Complete Guide Fatu Pondo

The Donation Receipt For Donations Is Shown In This Document Which

Charitable Donations What Are Tax Deductible Donations Bold

Are Donations Tax Deductible - I m struggling to find clear guidance on whether or not a donation needs to be to a charity which is UK registered in order for it to be deductible for corporation tax purposes A client has made voluntary cash donations to a charity registered overseas with no consideration received Any advice on this is much appreciated Many thanks