Are Employee Paid Health Benefits Taxable La r gle dit que Les noms f minins se terminant par t ou ti ne prennent pas de e Donc on dit une qualit une sant etc Mais pour

Qual la differenza tra employee e employer Sentiti libero di rispondere con un esempio Il proprietario della domanda ne sar al corrente Solo l utente che ha fatto questa domanda pu I m confused about the use of prepositons in work for at with in a company Can all the prepositions be used here Does it make any difference to use for at or with

Are Employee Paid Health Benefits Taxable

Are Employee Paid Health Benefits Taxable

https://avenuesofpa.org/__static/e426b5b726c9dc67ead10e29187aee81/transport2022.jpg

Social Security Benefits Worksheet Walkthrough IRS Form 1040

https://worksheets.clipart-library.com/images2/taxable-social-security-benefits-worksheet/taxable-social-security-benefits-worksheet-6.jpg

Benefits Stock Illustrations 31 896 Benefits Stock Illustrations

https://thumbs.dreamstime.com/b/employee-benefits-personal-leave-insurance-life-retirement-plan-child-care-paid-vacation-sick-health-diagram-color-flat-190273487.jpg

Hi If I would like to express an idea that an employee is continued to be employed since a date and is still continued to be employed in a foreseeable future is it suitable to use La r gle dit que Les noms f minins se terminant par t ou ti ne prennent pas de e Donc on dit une qualit une sant etc Mais pour tous les autres noms qui ne se termine

Permanent job a job with no predetermined end date and protections against being fired without warning full time job a job where the employee works at least a minimum number of hours Bonjour tous J ai des doutes sur l orthographe administratif ou administrative apr s employ e Les deux sont il possibles Si non lequel des deux

More picture related to Are Employee Paid Health Benefits Taxable

What Makes Employee Benefit Packages Great Thorpe Benefits

https://thorpebenefits.com/wp-content/uploads/2017/07/iStock-638669608.jpg

Nurses On Strike At NJ Hospital Lose Employee paid Health Benefits

https://assets1.cbsnewsstatic.com/hub/i/r/2023/09/01/adf8ded0-1d4e-4699-94dc-d89bdcd9f904/thumbnail/1200x630/8514cbc0d422f8dc9173b1c1bbf45856/10a971a6f7cfa985b01c4965d57e2ac0.jpg?v=6616762727d81e1cb010134e0c556e29

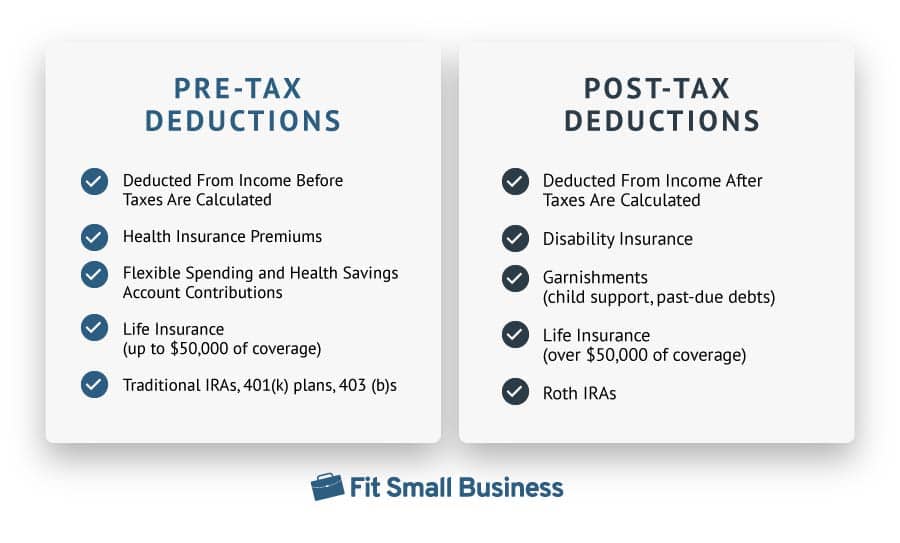

Pre tax Post tax Deductions An Ultimate Guide

https://fitsmallbusiness.com/wp-content/uploads/2022/11/Infographic_Pre-Tax_Deductions_vs_Post-Tax_Deductions.jpg

Hi Would you pls comment on which of these seems to be correct and most appropriate 1 A timely exchange of information between company employees is an GigI agree with Tashi It is most frequently used in the performing arts musicians usually get gigs It can also be used more broadly to describe being engaged to perform any specific task

[desc-10] [desc-11]

Microsoft Employee Benefits 2024 Gayel Joelynn

https://www.aihr.com/wp-content/uploads/types-of-employee-benefits-social.png

Taxable Social Security Worksheet 2025 Miran Christine

https://worksheets.clipart-library.com/images2/taxable-social-security-benefits-worksheet/taxable-social-security-benefits-worksheet-23.png

https://www.question-orthographe.fr › question › une-employe-ou-une-u…

La r gle dit que Les noms f minins se terminant par t ou ti ne prennent pas de e Donc on dit une qualit une sant etc Mais pour

https://it.hinative.com › questions

Qual la differenza tra employee e employer Sentiti libero di rispondere con un esempio Il proprietario della domanda ne sar al corrente Solo l utente che ha fatto questa domanda pu

Oklahoma State Emplo Janey Lilian

Microsoft Employee Benefits 2024 Gayel Joelynn

Types Of Employee Benefits

Employee Health Benefits Clipart

Why Employee Insurance Are Important Taylor Benefits

Maximum Social Security Wages 2025 Renee R Lambert

Maximum Social Security Wages 2025 Renee R Lambert

Mgm Employee Benefits 2024 Dena Morena

Wrong Payment Correction Request Letter To Bank Vrogue co

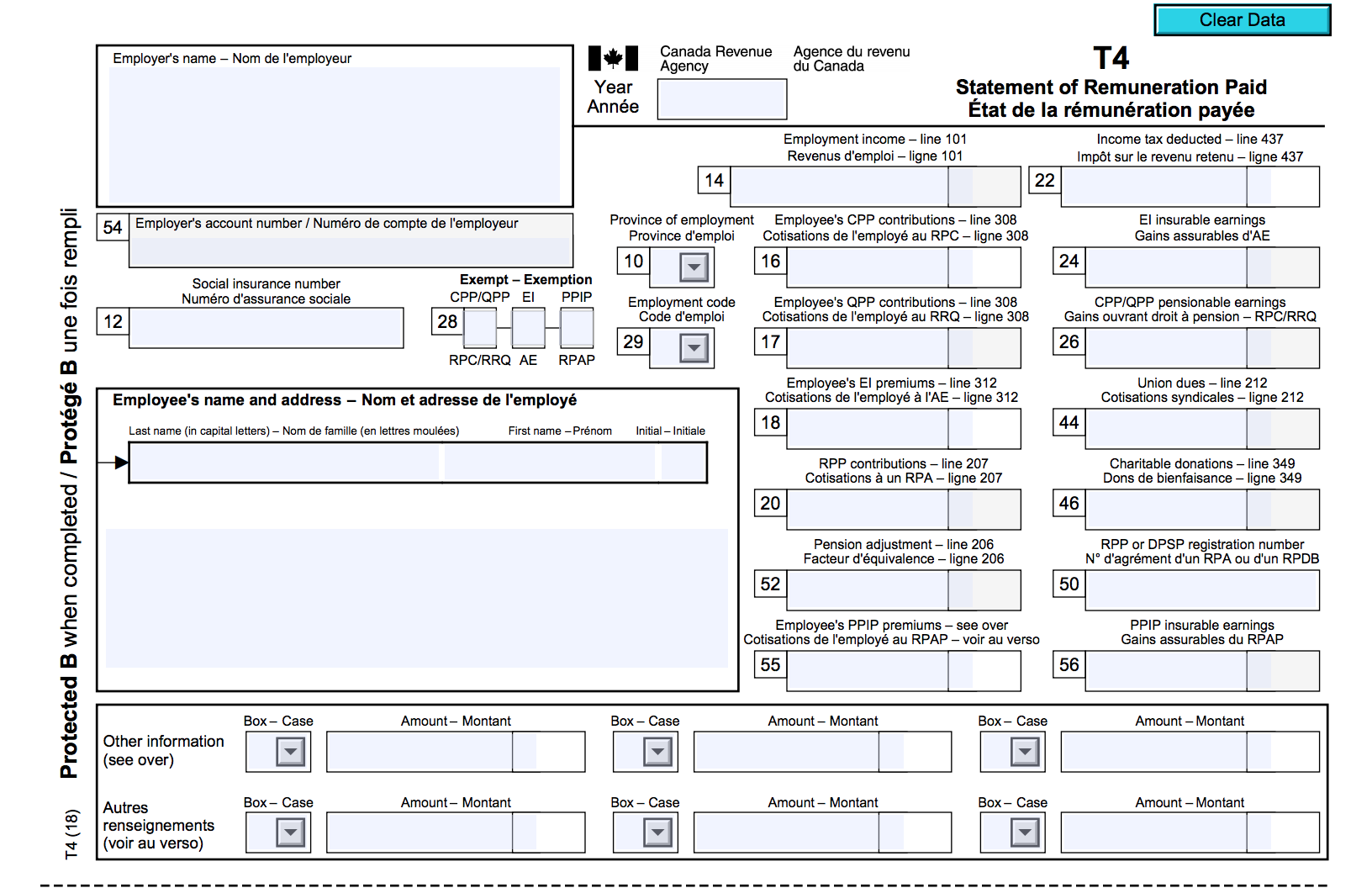

The Canadian Employer s Guide To The T4 Bench Accounting

Are Employee Paid Health Benefits Taxable - [desc-14]