Daybreak 2 Release Date English There is no 12 tax rate for long term capital gain For 2020 and 2021 the tax brackets for long term capital gain are 0 15 and 20 depending on filing status and

Yes Capital gains are found on Line 13 1040 2019 Line 6 and are included in your AGI Capital Gains may be long term or short term one year or less Short term capital Long Term Capital Gains and AGI I sold some stocks in 2024 after holding for more than 1 year and had long term capital gains LTCG of 86k Does this get added to my

Daybreak 2 Release Date English

Daybreak 2 Release Date English

https://i.ytimg.com/vi/VGH9oMexgh8/maxresdefault.jpg

The Legend Of Heroes Trails Through Daybreak Announcement Trailer

https://i.ytimg.com/vi/HzbJsCpSZEE/maxresdefault.jpg

The Legend Of Heroes Kuro No Kiseki 3840x2160

http://static.minitokyo.net/downloads/24/02/765124.jpg

The long term capital gain does increase your AGI and the increase in AGI affects other things in your tax return besides the tax on the long term gain The increase in AGI has side effects Your capital gain is part of your total income AGI but your capital gain is taxed separately and depends upon your taxable income which includes the deduction of your

It depends on your filing status While capital gains may be taxed at a different rate including 0 they are still included in your adjusted gross income or AGI and thus can Modified Adjusted Gross Income MAGI is your Gross Income GI adjusted for deductions AGI and then modified by adding certain deductions back in to calculate MAGI

More picture related to Daybreak 2 Release Date English

Film Pembuka The Legend Of Heroes Kuro No Kiseki II Crimson Sin

https://anime.atsit.in/id/wp-content/uploads/2022/09/film-pembuka-the-legend-of-heroes-kuro-no-kiseki-ii-crimson-sin-diungkapkan-5.jpg

The Legend Of Heroes Trails Through Daybreak Wallpapers Wallpaper Cave

https://wallpapercave.com/wp/wp14144790.jpg

Image Gallery For The Legend Of Heroes Trails Through Daybreak

https://pics.filmaffinity.com/The_Legend_of_Heroes_Trails_through_Daybreak-581239876-large.jpg

1040 line 7 says Capital gain or loss schedule D required and it does say the capital gain amount And that number is included in the sum of total income on lines 9 and 11 Capital gains from the sale of your primary home under 250 000 can be excluded and don t affect subsidies The exclusion is 500 000 for a family

[desc-10] [desc-11]

Inside Out 2 Cast Release Date Trailer Premieres Events

https://facinema.com/wp-content/uploads/2024/03/Inside-Out-2-2024-Movie-Poster-jpg.webp

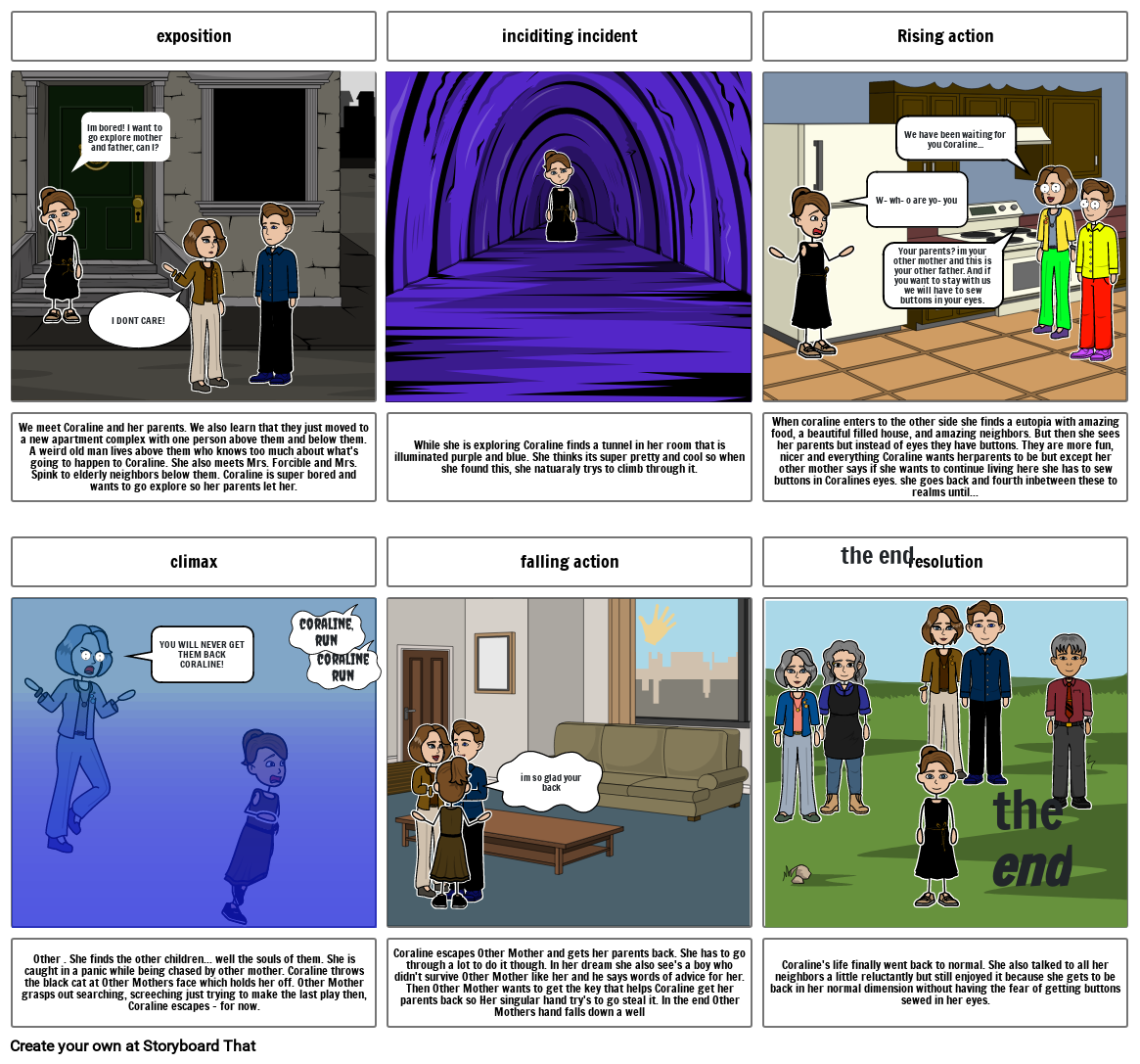

Coraline August 2024 Tory Ainslee

https://sbt.blob.core.windows.net/storyboards/nussbaumh29/coraline-harper-2nd.png

https://ttlc.intuit.com › ... › discussion › long-term-capital-gain-and-agi

There is no 12 tax rate for long term capital gain For 2020 and 2021 the tax brackets for long term capital gain are 0 15 and 20 depending on filing status and

https://ttlc.intuit.com › community › investments-and-rental-properties › d…

Yes Capital gains are found on Line 13 1040 2019 Line 6 and are included in your AGI Capital Gains may be long term or short term one year or less Short term capital

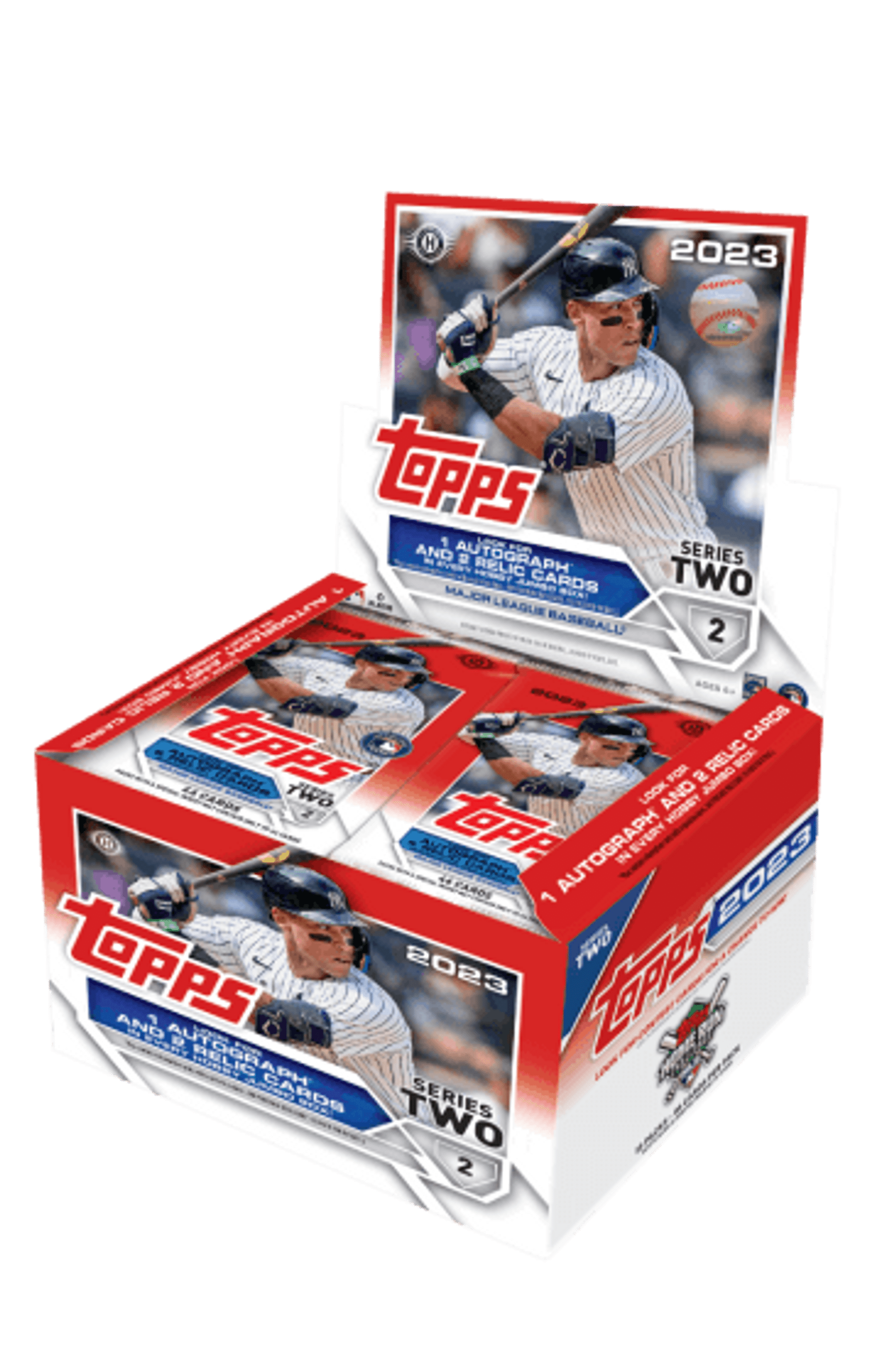

Topps 2024 Series 2 Checklist Codie Catharine

Inside Out 2 Cast Release Date Trailer Premieres Events

Emnlp 2024 Meta Review 2024 Carri Cristin

Inside Out Release Date 2024 Elysee Gavrielle

Dora 2024 Season 2 Release Date Glyn Phoebe

Jujutsu Kaisen Trailer 2024 Aurlie Trenna

Jujutsu Kaisen Trailer 2024 Aurlie Trenna

Daybreak Season 2 Is It Renewed Or Canceled

Topps 2024 Series 2 Release Fredi Jo Anne

Trails Through Daybreak English Voice Actors Revealed Siliconera

Daybreak 2 Release Date English - Modified Adjusted Gross Income MAGI is your Gross Income GI adjusted for deductions AGI and then modified by adding certain deductions back in to calculate MAGI