Deduction U S 80u Is Allowed To Changes to the income tax rules now deny income tax deductions related to non compliant short term rentals after 2023

Learn more Increase or reduce income tax deducted at source What to do if your employee requested to reduce the income tax deducted If your employee received a letter of Today the Department of Finance Canada announced the automobile income tax deduction limits and expense benefit rates that will apply in 2025

Deduction U S 80u Is Allowed To

Deduction U S 80u Is Allowed To

https://i.ytimg.com/vi/ntlVqu96DbA/maxresdefault.jpg

Module 05 Deduction Under Section 80C TO 80U Theory Studocu

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/281727b78d2cf4b9a82526ef57813f70/thumb_1200_1553.png

HOW TO CLAIM DEDUCTION U S 80U 80DD HOW TO FILE FORM 10IA HOW TO

https://i.ytimg.com/vi/zMLLaOz5jqs/maxresdefault.jpg

Voluntary income tax deductions You can start change or stop a federal or provincial voluntary tax deduction at any time in MSCA Select Profile on your OAS dashboard then select Learn about Canada Pension Plan CPP the Employment Insurance EI and the income tax deductions how to calculate the deductions on the amounts you pay includes how to

This page is for employers and provides links to the current and previous years of T4032 Payroll Deductions Tables including the Federal Provincial and Territorial Income Tax Deductions Section C EI premiums table Section D Federal tax deduction table Additional information about payroll deductions Deducting tax from income not subject to CPP

More picture related to Deduction U S 80u Is Allowed To

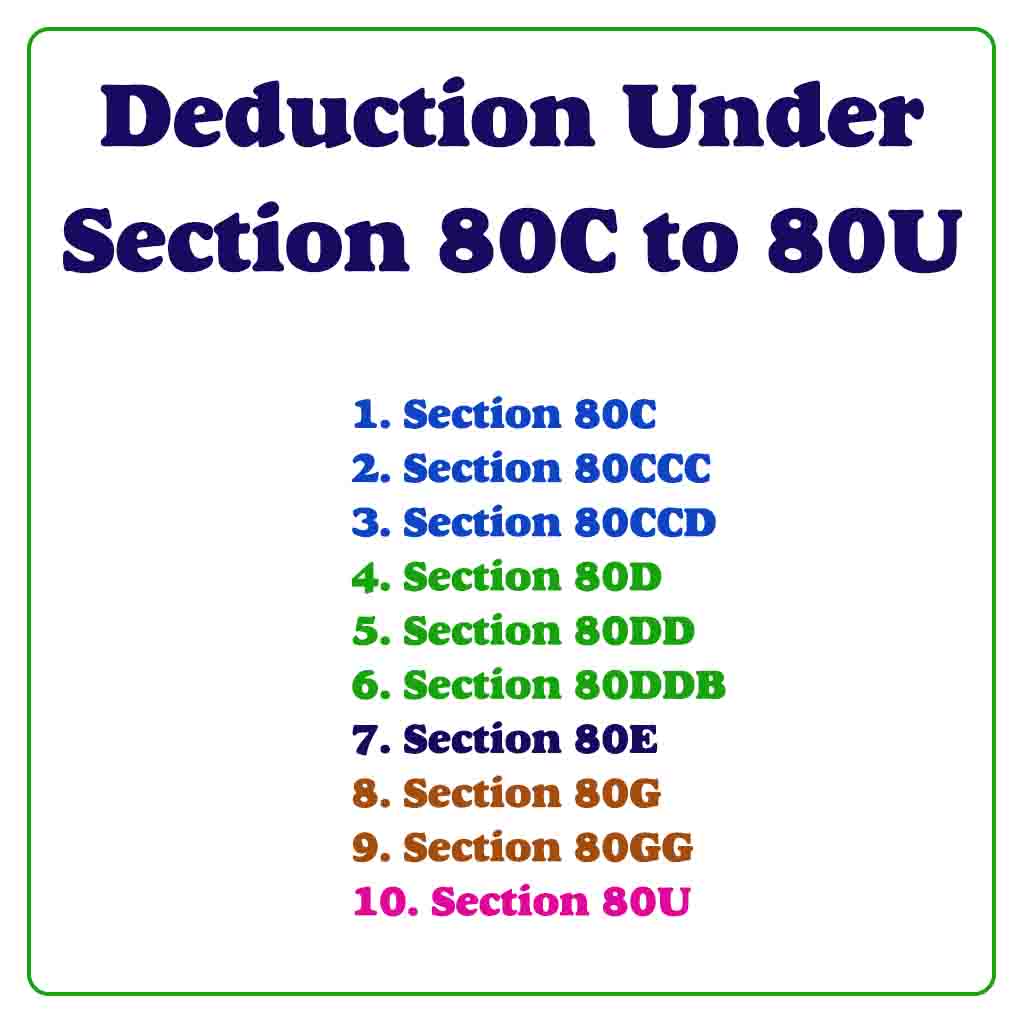

Deduction Under Section 80C

https://taxguru.in/wp-content/uploads/2020/08/Tax-Deduction.jpg

Deductions U S 80C Under Schedule VI Of Income Tax IFCCL

https://www.caindelhiindia.com/blog/wp-content/uploads/2021/07/80c.jpg

All About Deduction U s 80JJAA CA INTER Income Tax CA Rohan Gupta

https://i.ytimg.com/vi/T_--IlMjTc4/maxresdefault.jpg

D couvrez quelles sont les d ductions cr dits et d penses que vous pouvez demander pour r duire le montant d imp t que vous devez payer About the deduction of income tax Income tax rates and income thresholds About the GST HST on benefits GST HST rates on benefits Determine if a benefit is taxable Determine the tax

[desc-10] [desc-11]

Deduction U s 80 EEB CA INTER Income Tax CA Rohan Gupta YouTube

https://i.ytimg.com/vi/RdfWJyD5ph0/maxresdefault.jpg

Deductions To Be Made In Computing Total Income Sections 80A To 80U

https://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/GTI/Tax-Deductions/Deduction Allowed under Chapter VIA.jpg

https://www.canada.ca › ... › changes-rules-eligible-deductions-short-ter…

Changes to the income tax rules now deny income tax deductions related to non compliant short term rentals after 2023

https://www.canada.ca › ... › topics › payroll › payroll-deductions-contrib…

Learn more Increase or reduce income tax deducted at source What to do if your employee requested to reduce the income tax deducted If your employee received a letter of

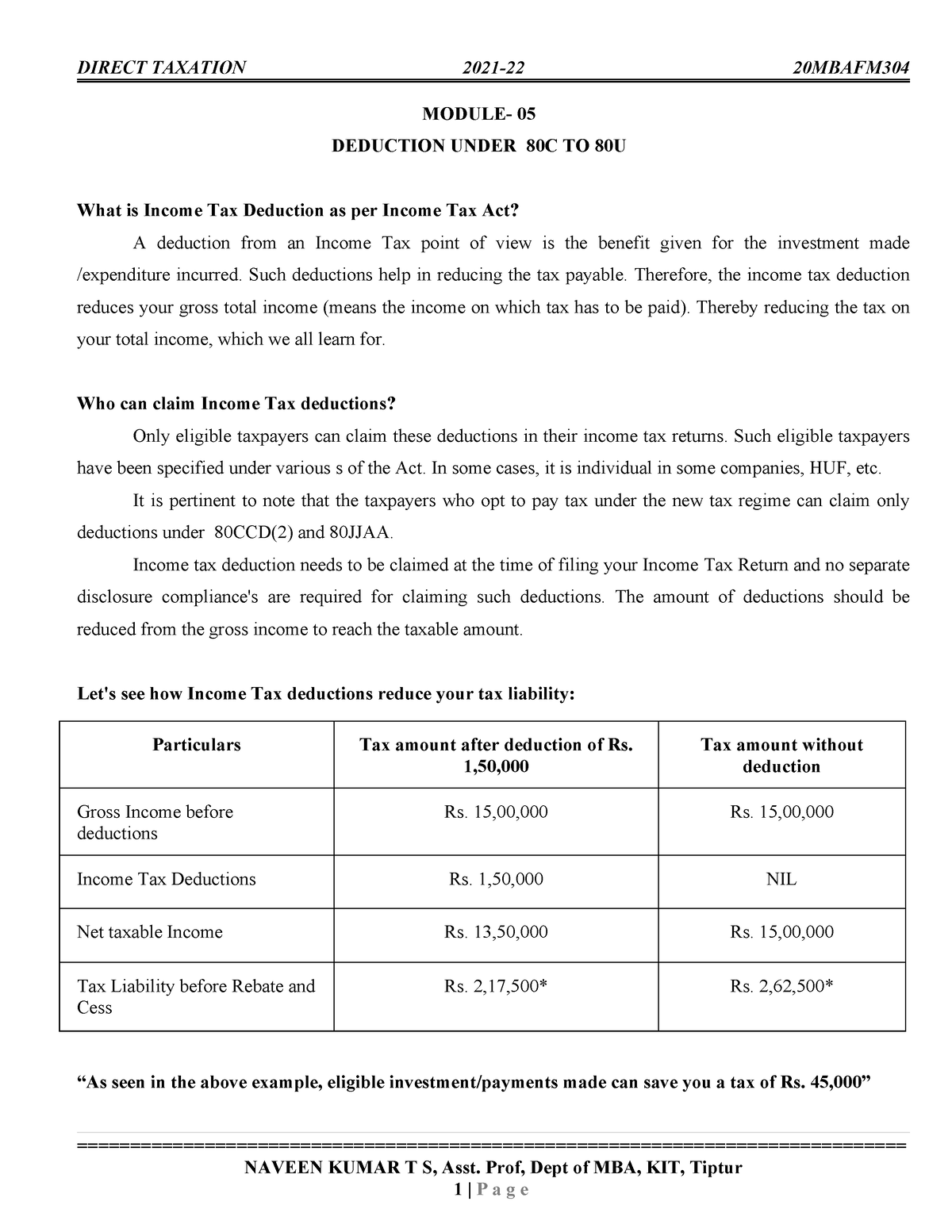

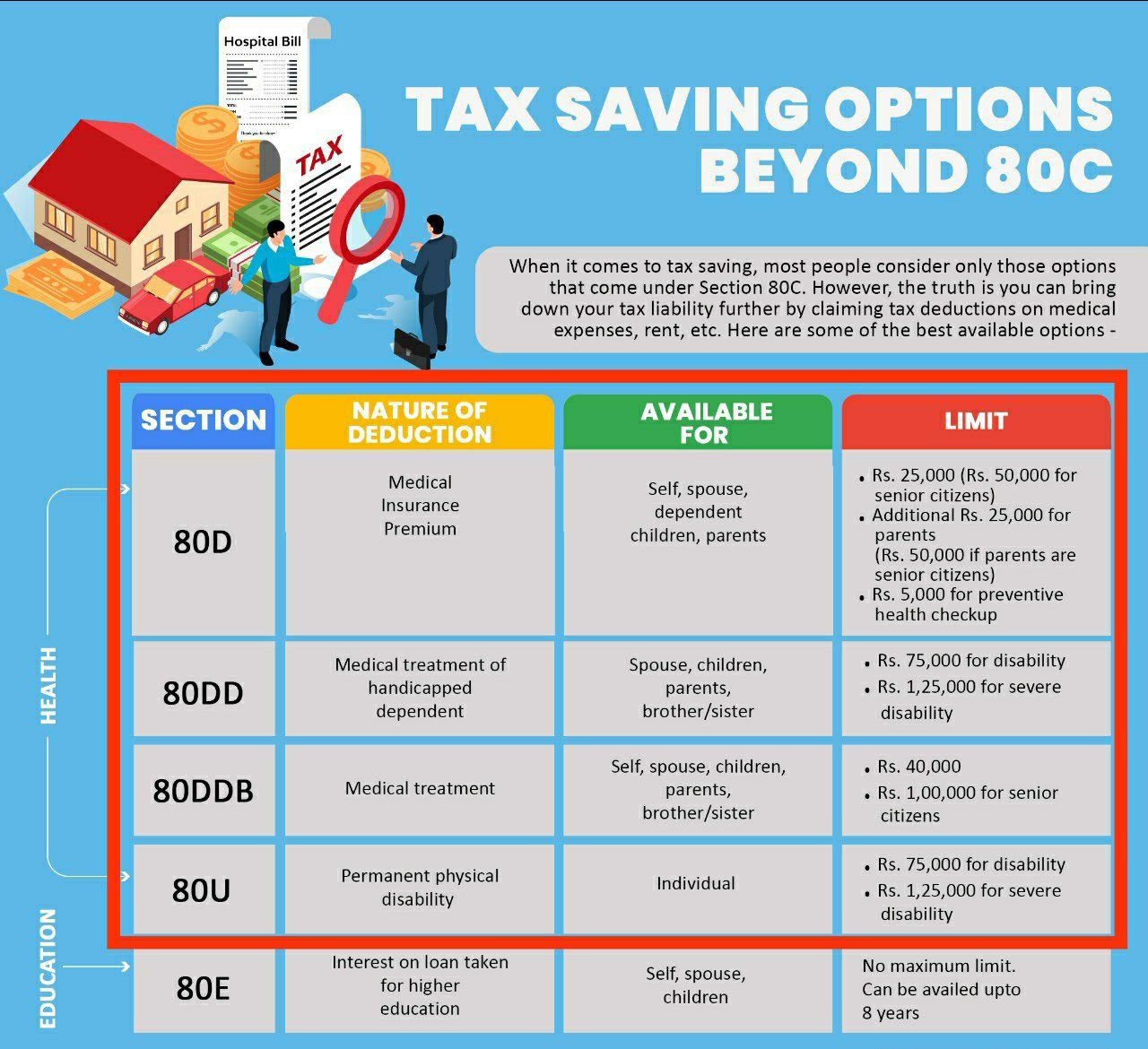

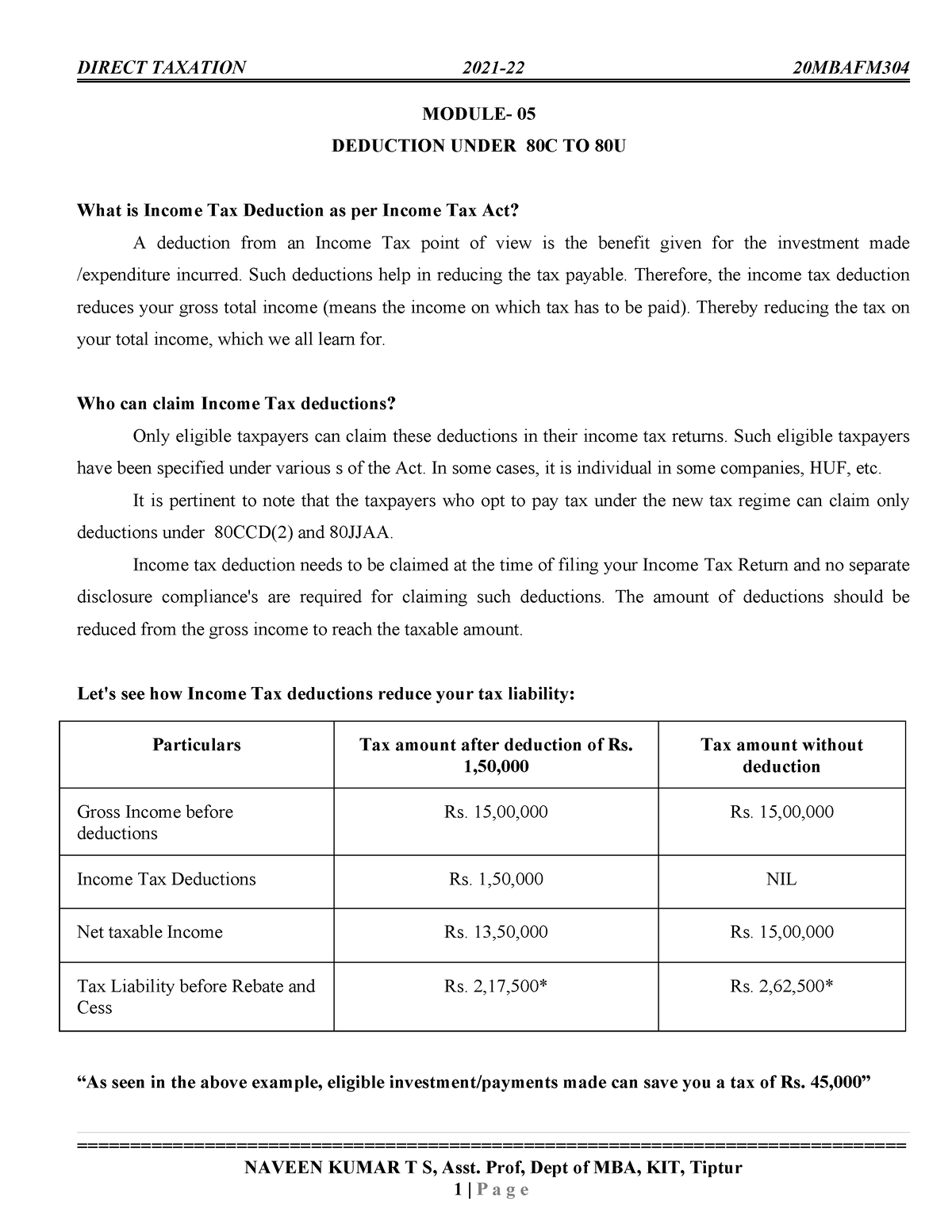

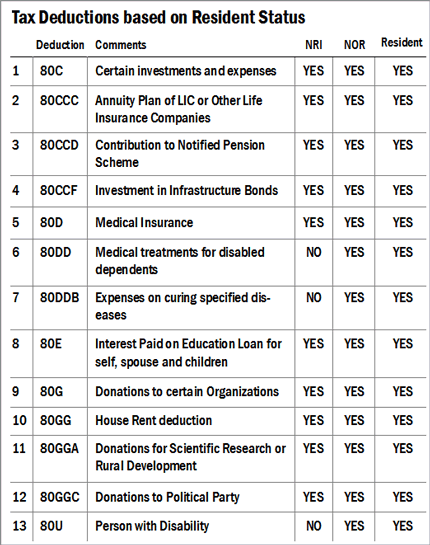

Deductions Deduction U s 80C Deduction U s 80D Deduction U s 80U

Deduction U s 80 EEB CA INTER Income Tax CA Rohan Gupta YouTube

Deduction Under Section 80C To 80U InFinTech

Step 4b Deductions Worksheets

Deduction U S 80E Interest On Education Loan By Munimji Training And

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Income Tax Deduction Under Section 80U For Disabled Persons I e Autism

Section 80U Deduction In Case Of Disability

Controversy In Respect Of Deduction U s 43B h YouTube

Deduction U S 80u Is Allowed To - [desc-14]