Expenses Meaning In Tamil You deduct most of your allowable employment expenses on line 22900 of your income tax and benefit return To find out how to get a tax package online or to request a printed copy go to

This Folio Chapter provides tax professionals and individuals with a technical overview of the Canada Revenue Agency s application of the federal income tax rules related to claiming the Scroll down to read the publication T4130 Employers Guide Taxable Benefits and Allowances Unless otherwise stated all legislative references are to the Income Tax Act or where

Expenses Meaning In Tamil

Expenses Meaning In Tamil

https://www.multibhashi.com/wp-content/uploads/2018/01/transaction.jpg

Expenses Meaning In Tamil Expenses Multibhashi

https://www.multibhashi.com/wp-content/uploads/2018/03/tamil-banner.jpg

Vertical png

https://www.inditexcareers.com/imgs/vertical.png

Work space in the home expenses If you meet the eligibility criteria you can claim a portion of certain expenses related to the use of a work space in your home Commission The excessive interest and financing expenses limitation EIFEL rules limit the deduction of excessive interest and financing expenses by affected corporations and trusts The following

Expenses section of form T2125To determine whether the income you earned from a short term rental is from a property or business consider the number and types of services you provide You can claim eligible medical expenses on line 33099 or line 33199 of your tax return Step 5 Federal tax Line 33099 Medical expenses for self spouse or common law partner and

More picture related to Expenses Meaning In Tamil

Wind And Solar Generated A Record Amount Of Global Power In 2022

https://image.cnbcfm.com/api/v1/image/107222994-1681198621846-gettyimages-1242239375-Coastal_Tidal_Flat_Energy_Industry_In_China.jpeg?v=1681276931&w=1920&h=1080

107367490 1706766431716 gettyimages 1561361010 AMD Investing 400

https://image.cnbcfm.com/api/v1/image/107367490-1706766431716-gettyimages-1561361010-AMD_Investing_400_Million_in_India.jpeg?v=1706852956&w=1920&h=1080

Children In 1966 Predict What The Year 2000 Will Be Like Free Beer

https://www.freebeerandhotwings.com/wp-content/uploads/2023/02/Children-In-1966-Predict-What-The-Year-2000-Will-Be-Like.jpg

Out of Pocket Expenses GST HST Info Sheet GI 197 December 2021 This info sheet explains how the GST HST applies when out of pocket expenses are incurred by a supplier such as a T2SCH130 Excessive Interest and Financing Expenses Limitation 2023 and later tax years

[desc-10] [desc-11]

What Letters Would You Use To Write The Number 53 In Roman Numerals

https://www.freebeerandhotwings.com/wp-content/uploads/2023/01/What-Letters-Would-You-Use-To-Write-The-Number-53-In-Roman-Numerals-scaled.jpg

Nuclear Power Plants 15 Feb 2023

http://drishtiias.com/images/uploads/1676456027_Operational Nuclear Power Plants in India-01.png

https://www.canada.ca › ... › forms-publications › publications › employm…

You deduct most of your allowable employment expenses on line 22900 of your income tax and benefit return To find out how to get a tax package online or to request a printed copy go to

https://www.canada.ca › en › revenue-agency › services › tax › technica…

This Folio Chapter provides tax professionals and individuals with a technical overview of the Canada Revenue Agency s application of the federal income tax rules related to claiming the

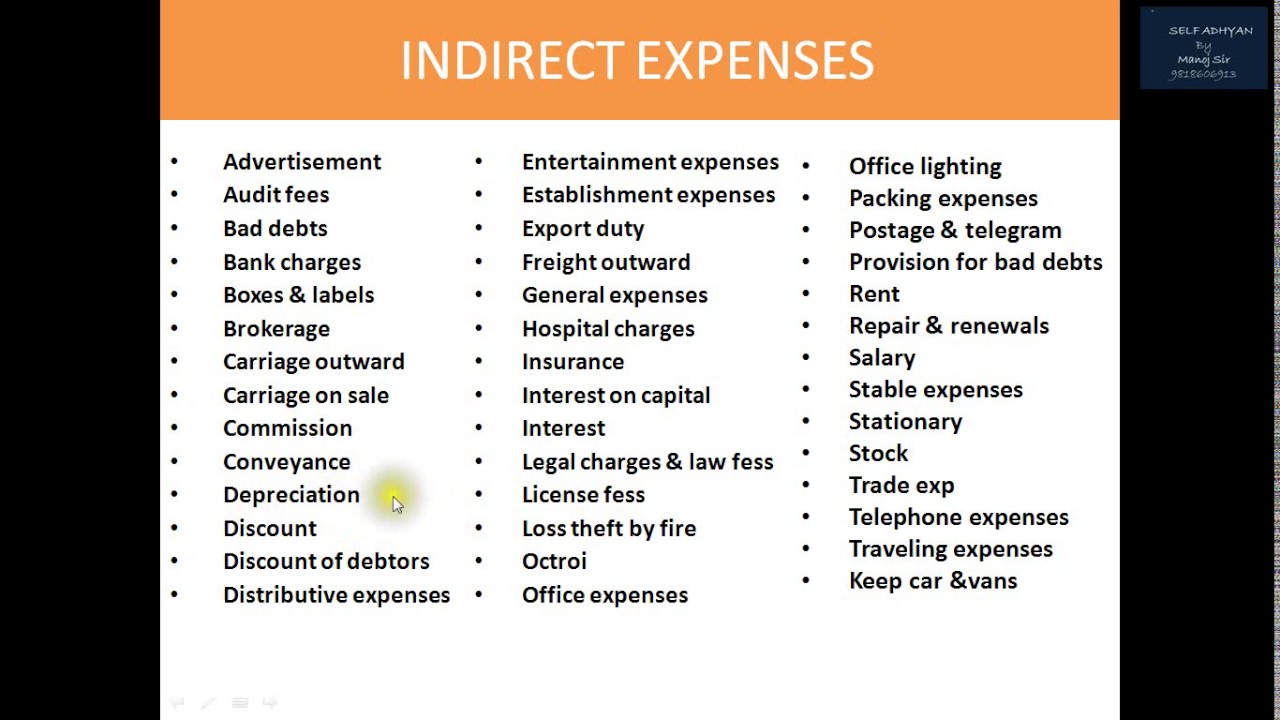

INDIRECT EXPENSES DETAILS TALLY LEDGER GROUP DESCRIPTION YouTube

What Letters Would You Use To Write The Number 53 In Roman Numerals

Mangroves In India 27 Sep 2022

Direct Indirect Expense WHAT IS DIRECT INDIRECT

Direct Indirect Expense WHAT IS DIRECT INDIRECT

Types Of Taxes GST Direct Tax Indirect Tax In Tamil For TNPSC SSC

Types Of Taxes GST Direct Tax Indirect Tax In Tamil For TNPSC SSC

Login DEBS

Income Expenses Logbook KDP TEMPLETE

Small Suras Tamil Android

Expenses Meaning In Tamil - The excessive interest and financing expenses limitation EIFEL rules limit the deduction of excessive interest and financing expenses by affected corporations and trusts The following