Foreign Exchange In Income Tax Act The meaning of FOREIGN is situated outside a place or country especially situated outside one s own country How to use foreign in a sentence Synonym Discussion of Foreign

In politics and journalism foreign is used to describe people jobs and activities relating to countries that are not the country of the person or government concerned Foreign definition of relating to or derived from another country or nation not native See examples of FOREIGN used in a sentence

Foreign Exchange In Income Tax Act

Foreign Exchange In Income Tax Act

https://navi.com/blog/wp-content/uploads/2022/04/Section-281-1.webp

Section 13 OF THE INCOME TAX ACT

https://www.legalmantra.net/admin/assets/upload_image/blog/INCOME_TAX2.jpg

All Of These Factors Determine The Foreign Exchange Rate Fluctuations

https://i.pinimg.com/originals/8c/bc/67/8cbc671f39e2873bbd2f7b073ad25353.jpg

These adjectives mean of from or characteristic of another place or part of the world a foreign accent alien customs exotic birds moved to a strange city Foreign definition located outside one s own country or place Check meanings examples usage tips pronunciation domains and related words Discover expressions like foreign language

Foreign refers to something or someone that originates from is characteristic of or is connected to a country or culture other than one s own It can also refer to something unfamiliar or unknown Belonging to or proceeding from other persons or things a statement supported by foreign testimony not belonging to the place or body where found foreign matter in a chemical mixture

More picture related to Foreign Exchange In Income Tax Act

Changes In Income Tax Act Proposed In Finance Bill 2020 AKGVG

https://www.akgvg.com/blog/wp-content/uploads/2020/02/Changes-in-Income-tax-Act-proposed-in-Finance-Bill-2020-scaled.jpg

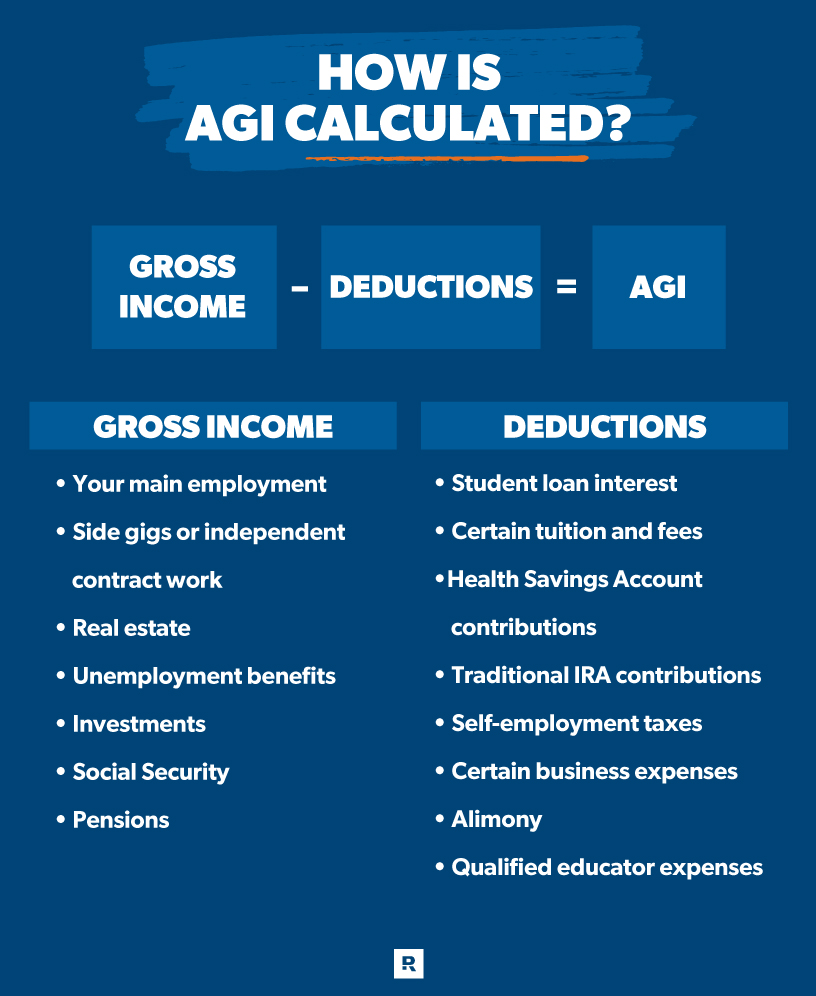

What Is Adjusted Gross Income AGI Does My Snapshot On Tax Act Have The

https://cdn.ramseysolutions.net/media/blog/taxes/personal-taxes/how-is-agi-calculated.jpg

How To Reply The Notice Issued Under Section 133 6 Of The Income Tax

https://onlinesolves.com/wp-content/uploads/2023/12/main-logo.png

Belonging to characteristic of or coming from another country not from one s own country as in foreign accent foreign currency foreign food foreign government foreign investor foreign Foreign meaning definition what is foreign from or relating to a country that is no Learn more

[desc-10] [desc-11]

Foreign Exchange Loss Is Allowable As Deduction U s 37 Of The Income

https://www.taxscan.in/wp-content/uploads/2016/08/Foreign-Exchange.jpg

What To Do When You Receive A Notice Under Section 142 1 Of The Income

https://taxconcept.net/wp-content/uploads/2023/07/High-Value-Transactions-Alert-Income-Tax-Notice-May-Come.webp

https://www.merriam-webster.com › dictionary › foreign

The meaning of FOREIGN is situated outside a place or country especially situated outside one s own country How to use foreign in a sentence Synonym Discussion of Foreign

https://www.collinsdictionary.com › dictionary › english › foreign

In politics and journalism foreign is used to describe people jobs and activities relating to countries that are not the country of the person or government concerned

What Is A Foreign Exchange Rate Definition Examples TheStreet

Foreign Exchange Loss Is Allowable As Deduction U s 37 Of The Income

Section 281 Of Income Tax Act Explanation

Mastering Income Tax Returns Real Life Use Cases

Income Tax FY 2022 23 AY 2023 24 Income Tax Act IT FY 2022 23 New And

Foreign Exchange Management Act Law Firm In Ahmedabad

Foreign Exchange Management Act Law Firm In Ahmedabad

Listed Here Are The Federal Tax Brackets For 2023 Vs 2022 FinaPress

Income Tax Increase And Inflation Economics Essay

Individual Income Tax Rates 2023 In Singapore Image To U

Foreign Exchange In Income Tax Act - [desc-12]