Hmrc Scale Rates This keeps things consistent and transparent as HMRC s rates are publicly available and updated regularly Alternatively some companies opt for the Bank of England

The reason for using the scale rates is to try to reduce the admin burden on both the employee and employer NB I am reluctant to do the work for calculating a rate for HMRC Benchmark Scale Rates for Day Subsistence 5 for one meal 5 hours away 10 for two meals 10 hours away etc My client frequently travels on business and is

Hmrc Scale Rates

Hmrc Scale Rates

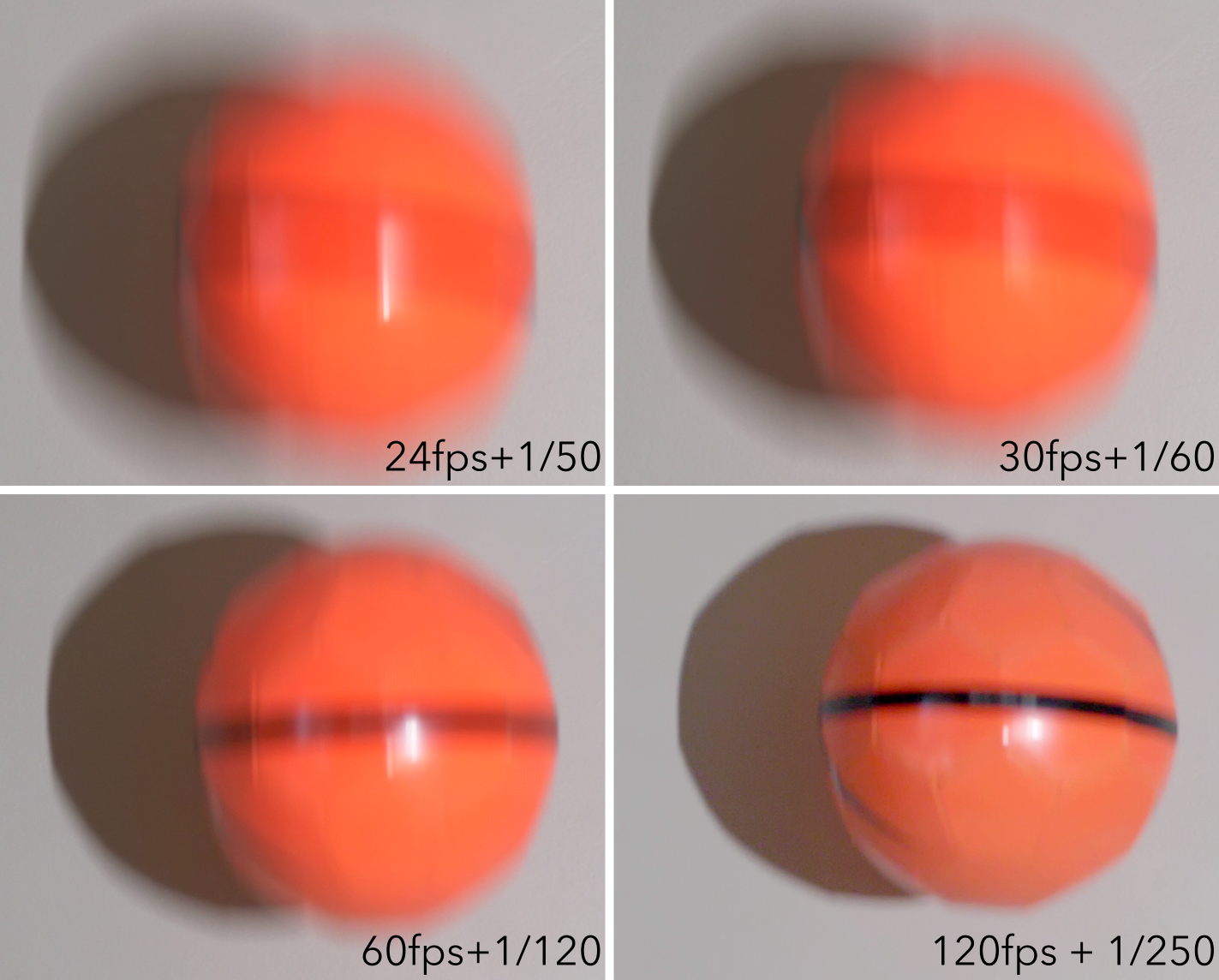

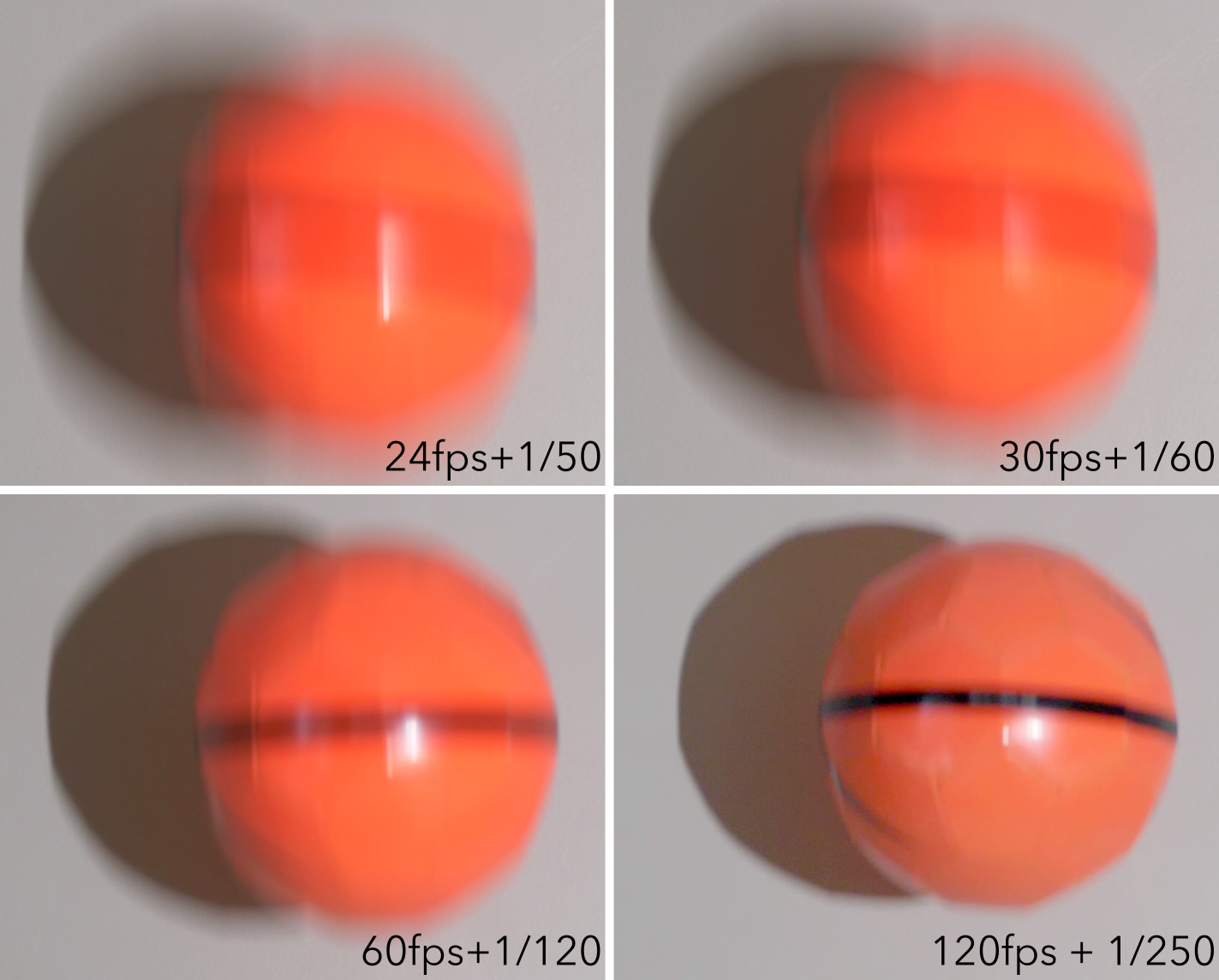

https://photographylife.com/wp-content/uploads/2022/03/Four_Framerates_compared_motion_blur.png

Blog

https://i.ibb.co/0mVRwgZ/logo.png

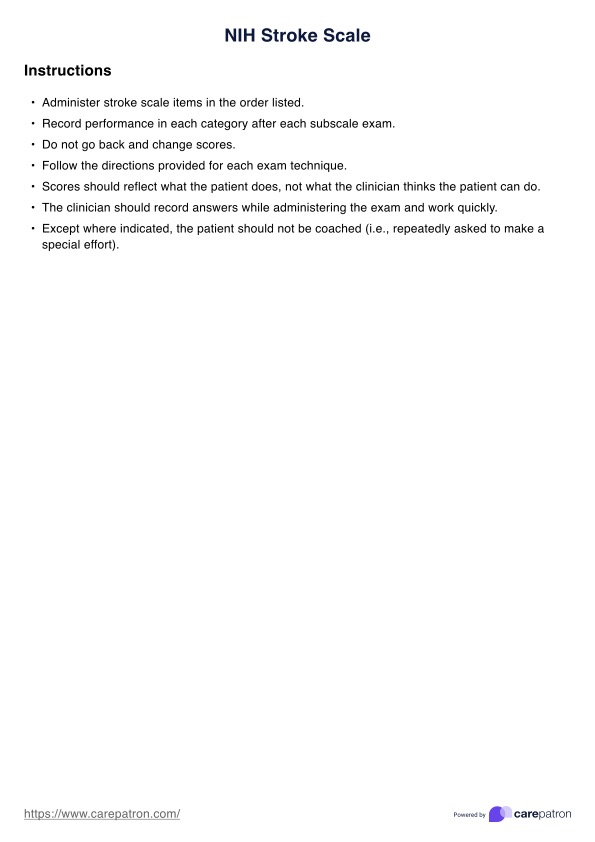

Nih Stroke Scale Score Card Infoupdate

https://www.carepatron.com/files/nih-stroke-scale.jpg

I ve done some further reading and I now gather that the scale rates may only be used if you apply for dispensation with HMRC via form P11DX Otherwise it s simply a case of Company car fuel rates are reviewed every three months and can change based on actual fuel rates You can only rely on the previous rates for up to one month before

1 Your contractor should adhere within the HMRC scale rates now that he is no longer trading under an Umbrella Company There are umbrella companies out there with a As this involves extra cost for travelling and subsistence than if I worked and ate at home would HMRC allow me to claim the subsistence scale rates or actual travel and meal

More picture related to Hmrc Scale Rates

Need A New Or Updated Head Shot I Offer Individual And Group Rates

https://64.media.tumblr.com/80efb71a438ab82835424a723578b672/tumblr_pm7gflGJgZ1qgprjoo1_1280.jpg

Tax In Practice

https://configiouk.blob.core.windows.net/media/em_InstituteCharteredAccountants/Attachments/speaker_photos/Sharon Cooke.jpg

Tax Rate Table Cabinets Matttroy

https://images.contentstack.io/v3/assets/blt3de4d56151f717f2/blt052283fe5234fa4f/6179a949412fb409f16bfc24/Autumn_budget_table_3.png

Although HMRC suggests that subsistence and cleaning would normally be the sort of expense covered by a scale rate AccountingWEB co uk s tax editor Nichola Ross If the driver is in a position to claim a mid day meal allowance whilst on the road then this would be covered by the benchmark rates There are also prescribed rates of

[desc-10] [desc-11]

Ratio Worksheets Ratios And Rates Worksheets Worksheets Library

https://worksheets.clipart-library.com/images2/rate-and-ratio-worksheet/rate-and-ratio-worksheet-4.jpg

Enlisted Basic Pay Rates Enlisted Basic Pay Rates Mosroadmap

https://mosroadmap.com/logo.png

https://www.accountingweb.co.uk › any-answers › scale-rate-payments-f…

This keeps things consistent and transparent as HMRC s rates are publicly available and updated regularly Alternatively some companies opt for the Bank of England

https://www.accountingweb.co.uk › any-answers › hmrc-scale-rate-expe…

The reason for using the scale rates is to try to reduce the admin burden on both the employee and employer NB I am reluctant to do the work for calculating a rate for

Scale Clipart Balance Weight Balancing Scale Clip Art Free Clip

Ratio Worksheets Ratios And Rates Worksheets Worksheets Library

Iccv 2024 Dates Colly Rozina

Hmrc Pay Scales 2023 Image To U

2025 2025 Salary Schedule Violeta Cordeiro

Private Equity Valuations

Private Equity Valuations

Hmrc Pay Scales 2023 Pdf Image To U

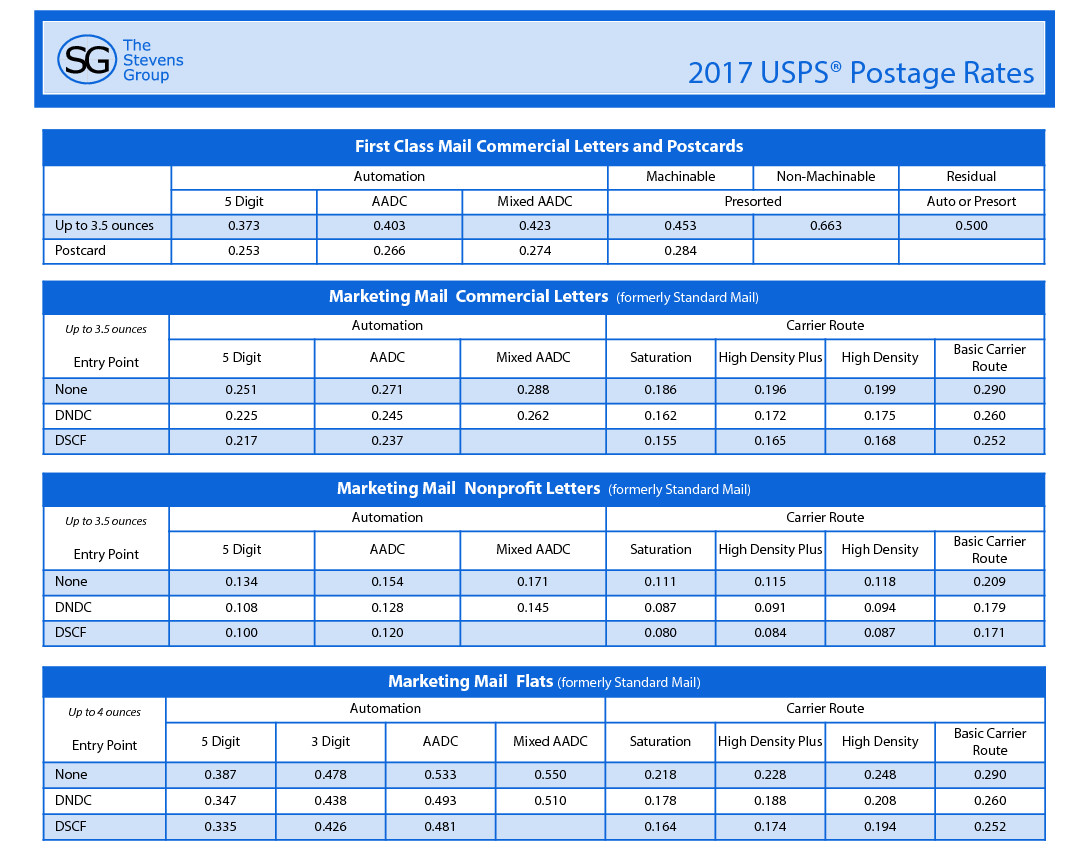

Usps Media Mail Rates 2025 Chart Christian J Mendis

Usps Rates 2025 Per Ounce Zahra Tatum

Hmrc Scale Rates - 1 Your contractor should adhere within the HMRC scale rates now that he is no longer trading under an Umbrella Company There are umbrella companies out there with a