How To Avoid Paying Taxes On Gambling Winnings Learn how to avoid paying taxes on gambling winnings and reduce your taxable gambling profit to a minimum with our practical guide

Gambling winnings are fully taxable and you must report the income on your tax return Gambling income includes but isn t limited to winnings from lotteries raffles horse Here are some strategies for avoiding or minimizing taxes on prize winnings Donating a portion of the prize winnings to charity Donating a portion of the prize winnings to a qualified charitable organization can lower your taxable

How To Avoid Paying Taxes On Gambling Winnings

How To Avoid Paying Taxes On Gambling Winnings

https://thecasinowizard.com/uploads/2019/11/Online-Casino-Chips-Table-Money-1200-800.jpg

Detailed Guide On Tax Rate For Gambling Winnings And Casino Earnings

https://taxrise.com/wp-content/uploads/2023/04/iStock-1436969898-scaled.jpg

What You Should Know About Taxes On Gambling Winnings Tax Resolution

https://ecgtaxpros.com/media/what-you-should-know-about-taxes-on-gambling-winnings-scaled.jpeg

Avoid Paying Taxes on Money You Never Kept Let s say you won 10 000 at a casino and the casino issued a Form 1099 G gambling If you lost 8 000 throughout the year but didn t keep The IRS considers all money won from gambling or gaming taxable income to have a fair market value like any item you win Simply put you can t avoid paying taxes on

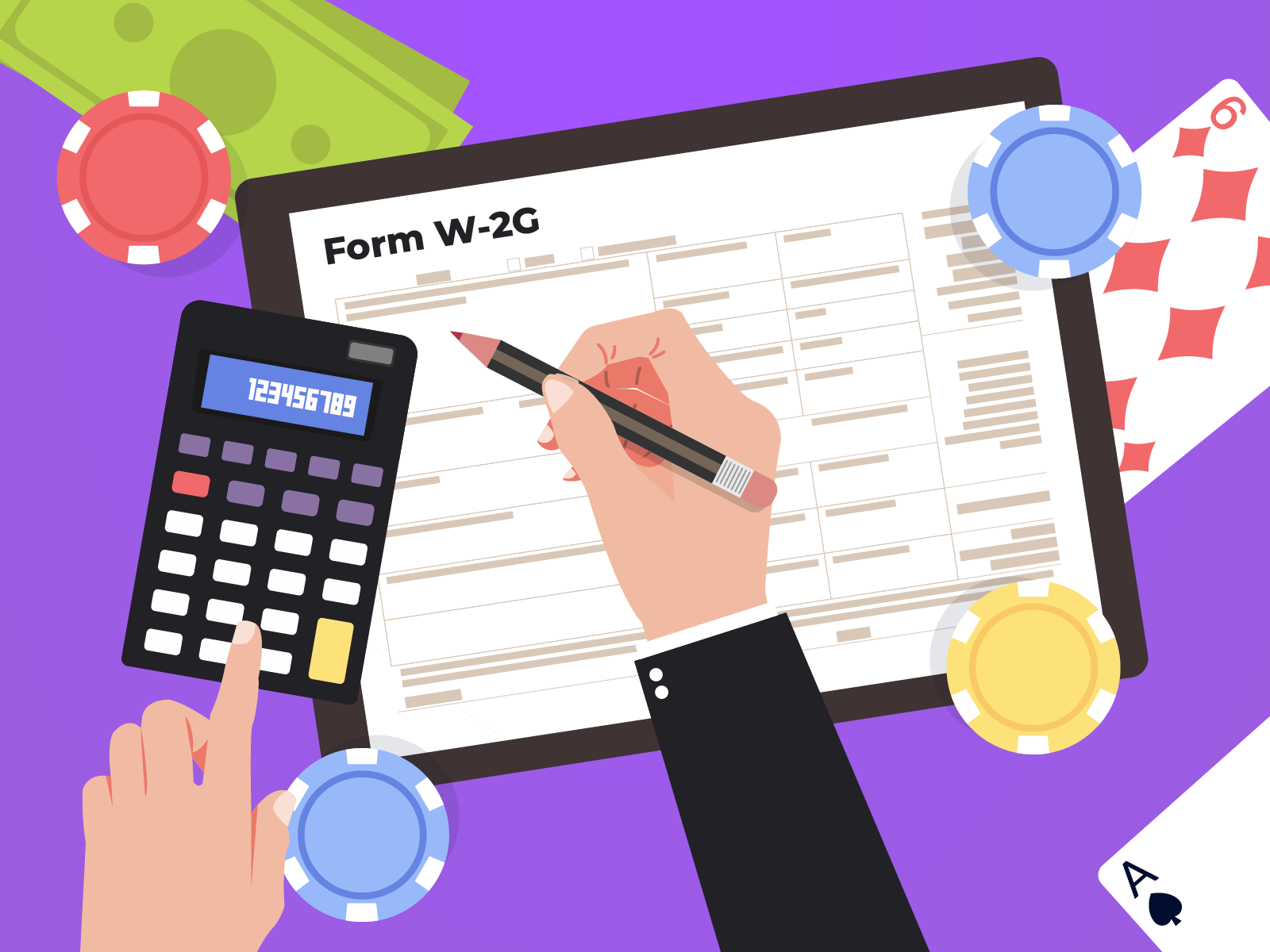

This article explores what you need to report the amounts to claim withholdings how to offset winnings with losses penalties for failure to report and strategies to simplify your tax obligations What Casino Winnings How to Report Winnings on Your Tax Return Enter gambling income on line 8b of Schedule 1 Then on the main 1040 form report federal taxes withheld on line 25a along with

More picture related to How To Avoid Paying Taxes On Gambling Winnings

How To Avoid Paying Tax Like The Rich YouTube

https://i.ytimg.com/vi/qmi6q3i_0qE/maxresdefault.jpg

How To Report Gambling Winnings Losses On Form 1040 For 2022 YouTube

https://i.ytimg.com/vi/qji3ZSmvIH8/maxresdefault.jpg

Tax On Online Gambling Winnings Guide With Calculator

https://www.offshoresportsbooks.com/wp-content/uploads/Tax-on-Online-Gambling-Winnings-Guide-1.png

The Internal Revenue Service IRS requires that all gambling winnings including those from casinos lotteries and sports betting be reported as taxable income However there are a few To deduct your losses you must be able to provide receipts tickets statements or other records that show the amount of both your winnings and losses For more information on record

BetMichigan has an online calculator to figure out taxes on gambling winnings Click on MI Gambling Tax Hold onto your paperwork In general tax professionals Any money you win while gambling or wagering is considered taxable income by the IRS as is the fair market value of any item you win This means there there is no way to

How Much Gambling Winnings Are Taxable

https://claudemoraes.net/wp-content/uploads/2021/05/How-Much-Gambling-Winnings-Are-Taxable.png

This Tool Will 100 Lower Your Taxes In Retirement Pension Income Tax

https://i.ytimg.com/vi/_b0j5e2L8PU/maxresdefault.jpg

https://thecasinowizard.com › news › how-t…

Learn how to avoid paying taxes on gambling winnings and reduce your taxable gambling profit to a minimum with our practical guide

https://www.irs.gov › taxtopics

Gambling winnings are fully taxable and you must report the income on your tax return Gambling income includes but isn t limited to winnings from lotteries raffles horse

Virginia Gambling Winnings Tax Calculator 2023

How Much Gambling Winnings Are Taxable

Tax On Gambling Winnings When Do You Have To Pay And How Much

Your Guide To Property Taxes Hippo

Tax On Casino Winnings How Much Do You Have To Win To Pay Tax

What Are The Taxes On Gambling Winnings Lear Pannepacker LLP

What Are The Taxes On Gambling Winnings Lear Pannepacker LLP

How To Avoid Paying Taxes Legally Ethically In 2023

Do You Have To Pay Tax On Gambling Winnings Nz

Form 1040 Gambling Winnings And Losses YouTube

How To Avoid Paying Taxes On Gambling Winnings - To avoid problems with casino winnings and taxes it s essential to keep accurate records of all gambling activities including wins and losses You should also consider seeking