Income Tax Bands Uk 2022 23 The Canada Disability Benefit will provide direct financial support to people with disabilities who are between 18 and 64 years old The program is administered by Service

The income level cut offs do not include the OAS pension the first 5 000 of employment or self employment income and 50 of employment or self employment income How to determine your income When applying for the Guaranteed Income Supplement and the Allowance you or in the case of a couple you and your spouse or common law partner must

Income Tax Bands Uk 2022 23

Income Tax Bands Uk 2022 23

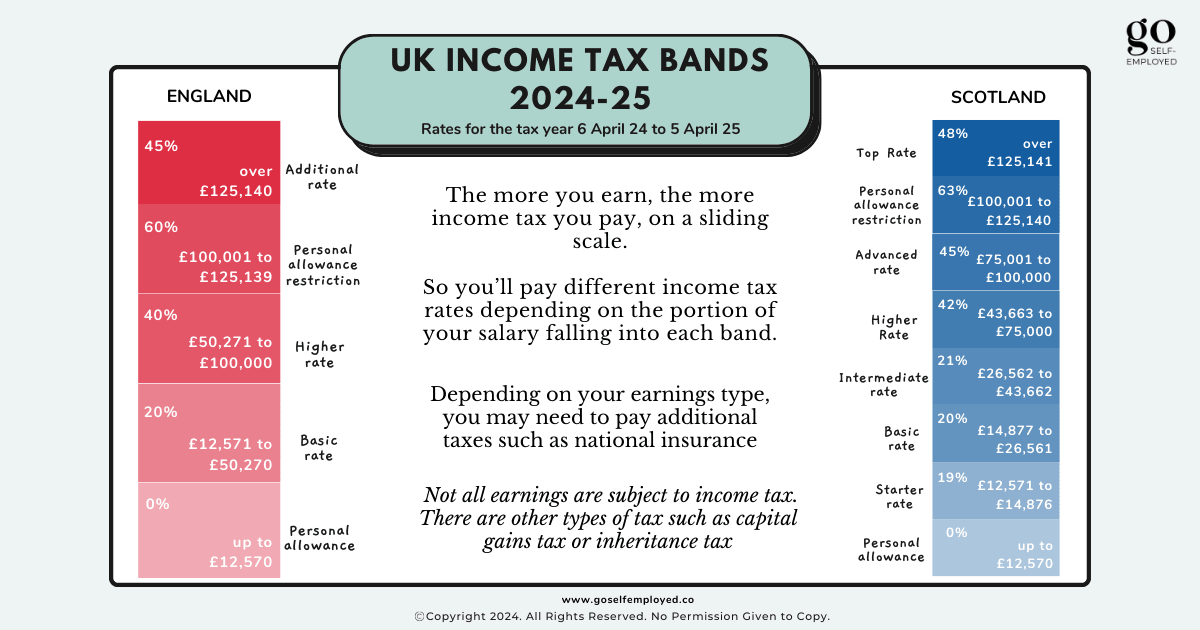

https://goselfemployed.co/wp-content/uploads/2024/04/uk-tax-bands-2024.png.webp

2025 Tax Rates Jamie K Therry

https://images.prismic.io/payfit/4a90d271-43c6-4dcf-834a-53fa79bb3a33_UK+tax+rates.png?auto=compress,format&rect=0,0,642,406&w=2429&h=1536

Tax Rate 2024 Table Uk Helsa Krystle

https://www.fkgb.co.uk/wp-content/uploads/2023/02/image-1.png

The personal income levels used to calculate your Manitoba tax have changed The basic personal amount has changed The maximum annual amount of eligible expenses for fertility If your net world income exceeds the threshold amount 86 912 for 2023 you have to repay part or your entire OAS pension Part or your entire OAS pension is reduced as a monthly recovery

Enter net income or loss after income tax and extraordinary items at amount A page 1 of Schedule 1 Add the taxable items and the non allowable expenses listed on lines 101 to 199 If you are reporting only Canadian source income from taxable scholarships fellowships bursaries research grants capital gains from disposing of taxable Canadian property or from

More picture related to Income Tax Bands Uk 2022 23

2024 Tax Rates And Brackets Uk Adela Austine

https://freeagent-res.cloudinary.com/image/upload/c_limit,w_1200/dpr_auto,f_auto/website-images/netlify/rates_income-tax-rates-and-bands_2022-23.png

Hmrc Rates And Thresholds 2023 2024 Image To U

https://images.contentstack.io/v3/assets/blt3de4d56151f717f2/blt052283fe5234fa4f/6179a949412fb409f16bfc24/Autumn_budget_table_3.png

Tax Bands 2025 Uk Carol Paige

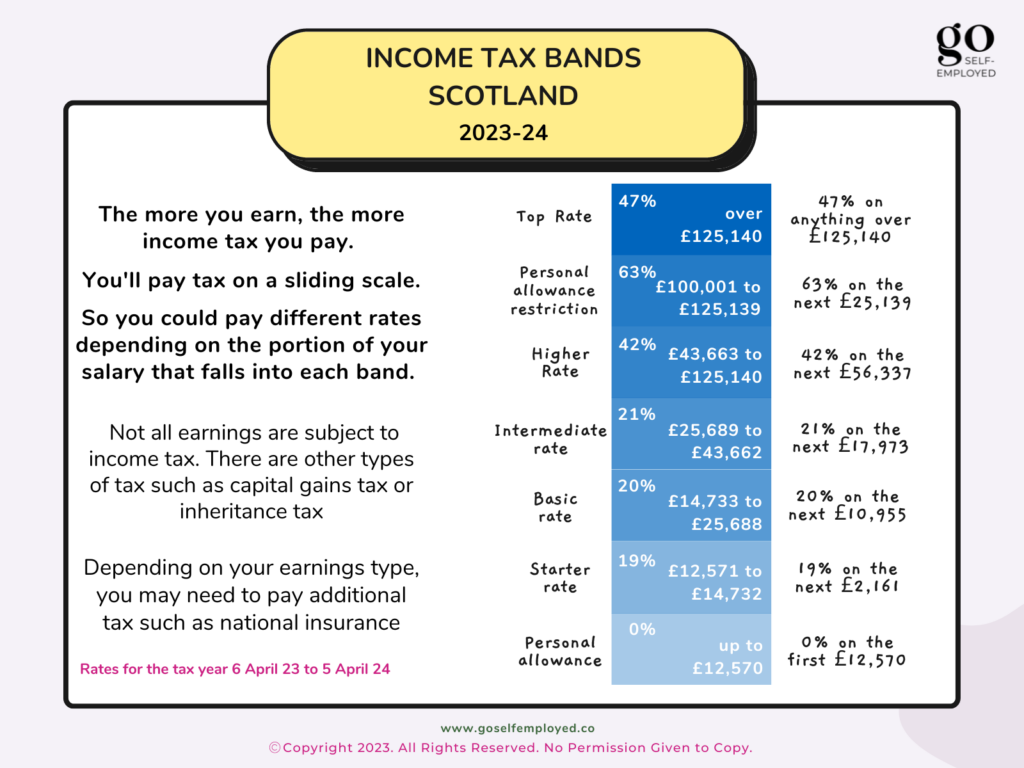

https://goselfemployed.co/wp-content/uploads/2023/04/scottish-income-tax-bands-23-1024x768.png

Filing an income tax and benefit return can help you access benefit and credit payments like the GST HST credit up to 533 for an eligible individual the Canada child If you have a modest income and a simple tax situation the Community Volunteer Income Tax Program CVITP or Income Tax Assistance Volunteer Program for residents of Quebec can

[desc-10] [desc-11]

Hmrc Spring Budget 2024 Calculator Dreddy Clemmie

https://images.contentstack.io/v3/assets/blt3de4d56151f717f2/blt30482d40649c84c3/6179a93afdb9af22b36e3ec3/Autumn_budget_table_1.png

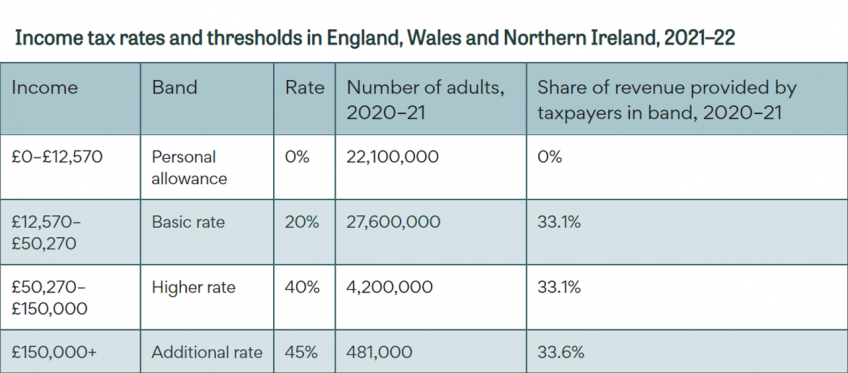

LIHKG

https://ifs.org.uk/sites/default/files/styles/wysiwyg_full_width_desktop/public/2021-06/Income tax rates and thresholds in England, Wales and Northern Ireland, 2021–22_0.png?itok=sAe2JxBC

https://www.canada.ca › en › services › benefits › disability › canada-dis…

The Canada Disability Benefit will provide direct financial support to people with disabilities who are between 18 and 64 years old The program is administered by Service

https://www.canada.ca › en › employment-social-development › program…

The income level cut offs do not include the OAS pension the first 5 000 of employment or self employment income and 50 of employment or self employment income

Uk Tax Bands 2024 24 Sofie Eleanore

Hmrc Spring Budget 2024 Calculator Dreddy Clemmie

Setting New Taxpayer Records

Uk Corporation Tax Rates 2025 D Cruz Rivas

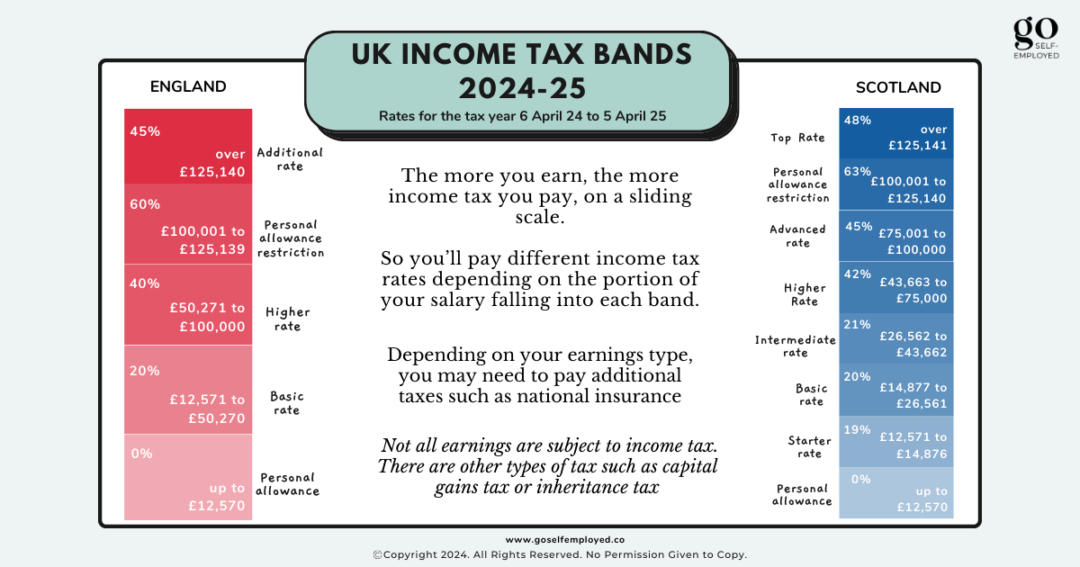

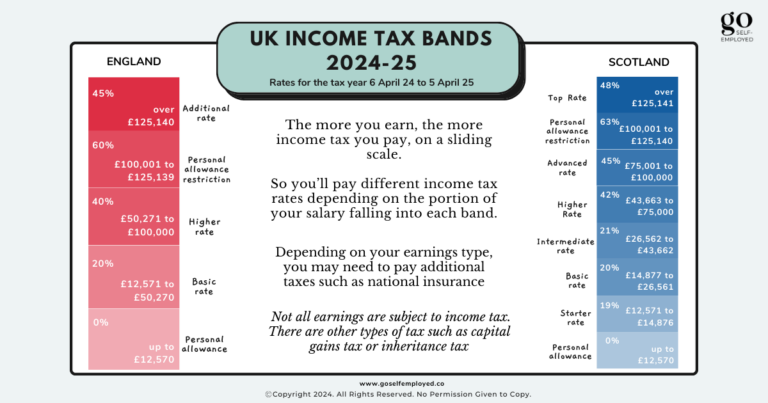

Understanding UK Tax Brackets Income Tax Bands 2024

2023

2023

Understanding UK Tax Brackets Income Tax Bands 2024

Understanding UK Tax Brackets Income Tax Bands 2024

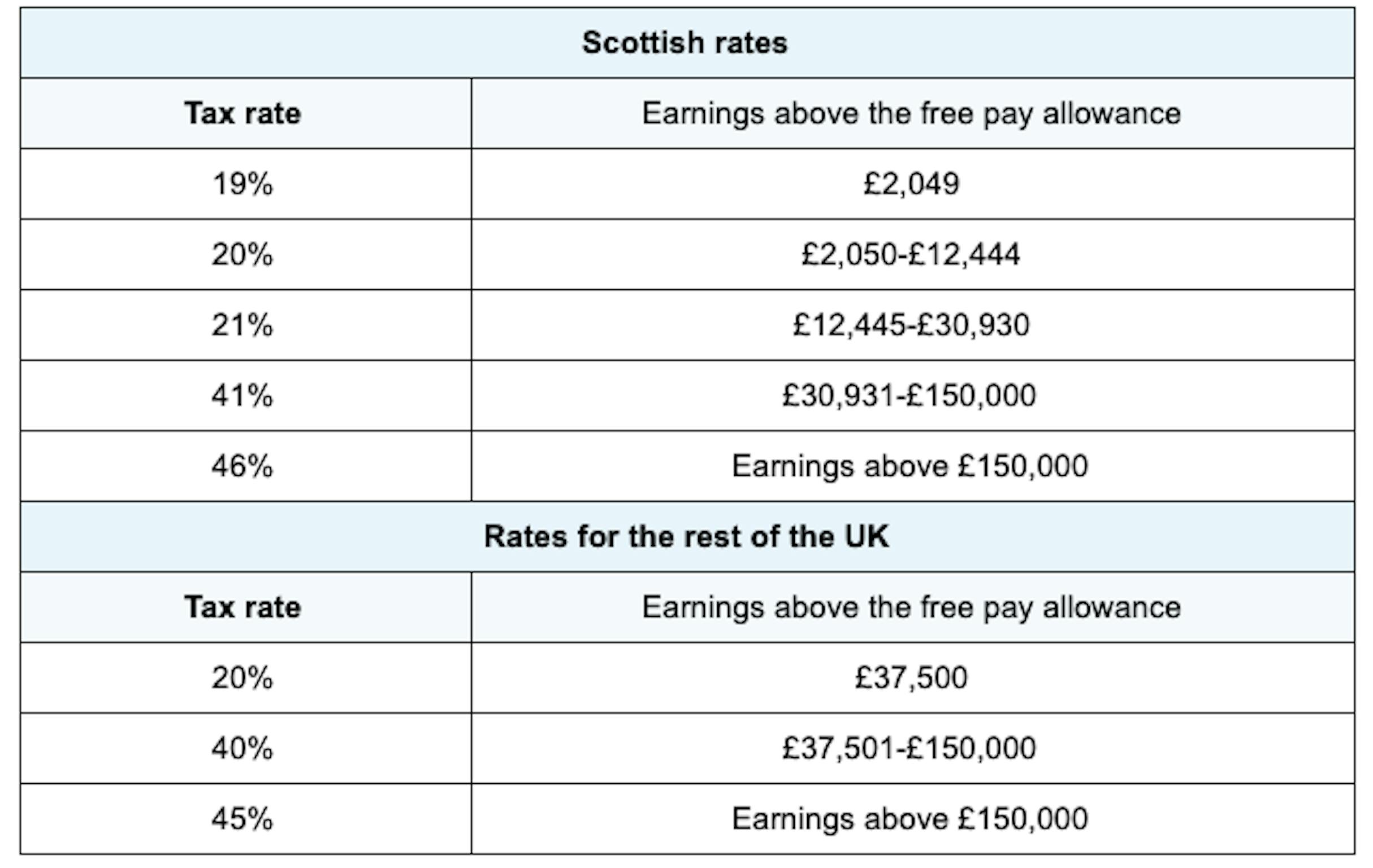

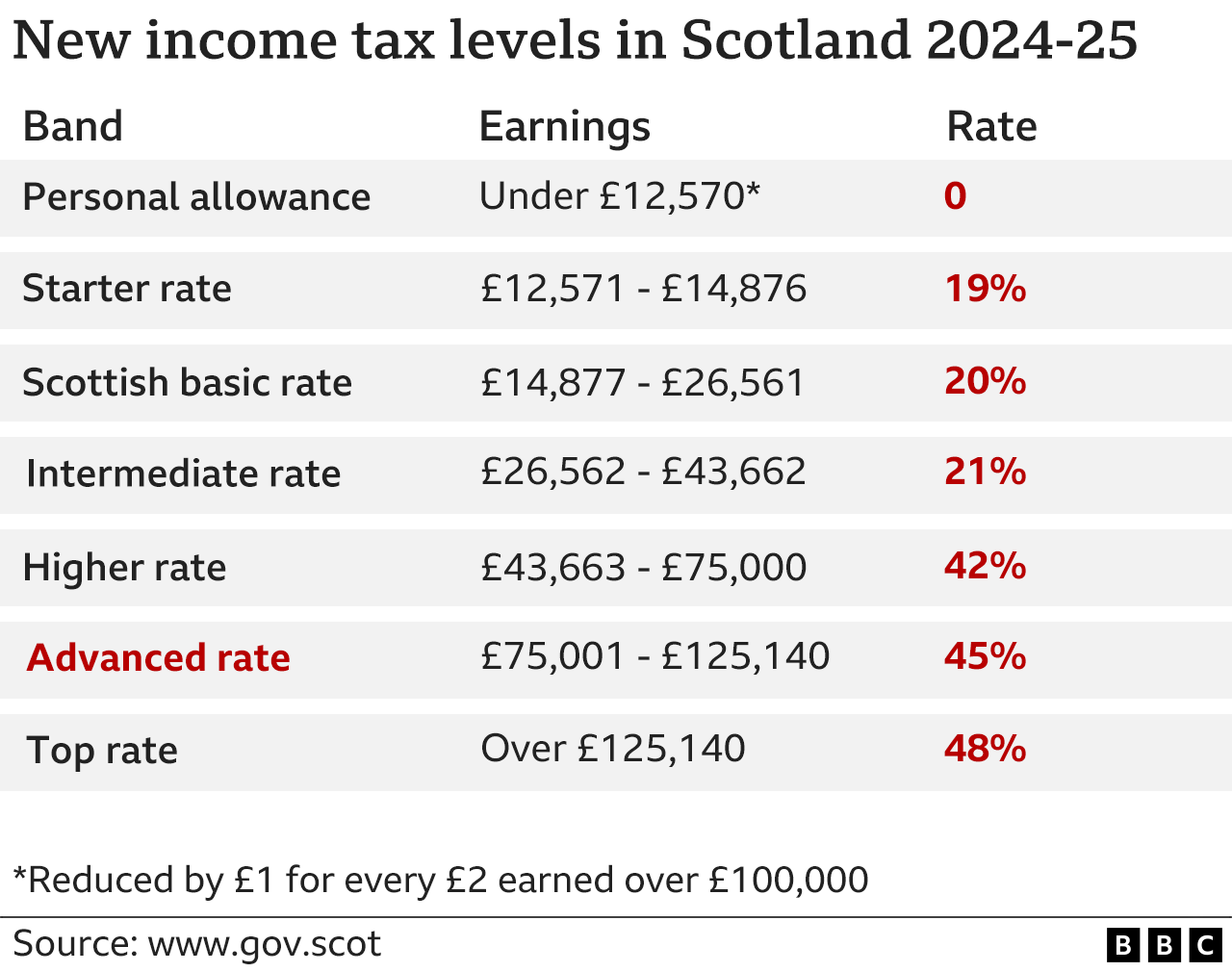

Scottish Budget How Will The Changes Affect You BBC News

Income Tax Bands Uk 2022 23 - If your net world income exceeds the threshold amount 86 912 for 2023 you have to repay part or your entire OAS pension Part or your entire OAS pension is reduced as a monthly recovery