Income Tax Is Calculated On Ctc Or Gross Income is reported and tax is calculated on an annual basis To reflect a one percentage point cut in the lowest tax rate coming into effect halfway through the year the full

Today you can start filing your 2024 income tax return online For most individuals the deadline to file is April 30 2025 and any amounts owed must also be paid by It s never been easier to do your taxes online In fact online filing gets you access to the benefits credits and refunds you may be eligible for even faster Last year approximately 93 of

Income Tax Is Calculated On Ctc Or Gross

Income Tax Is Calculated On Ctc Or Gross

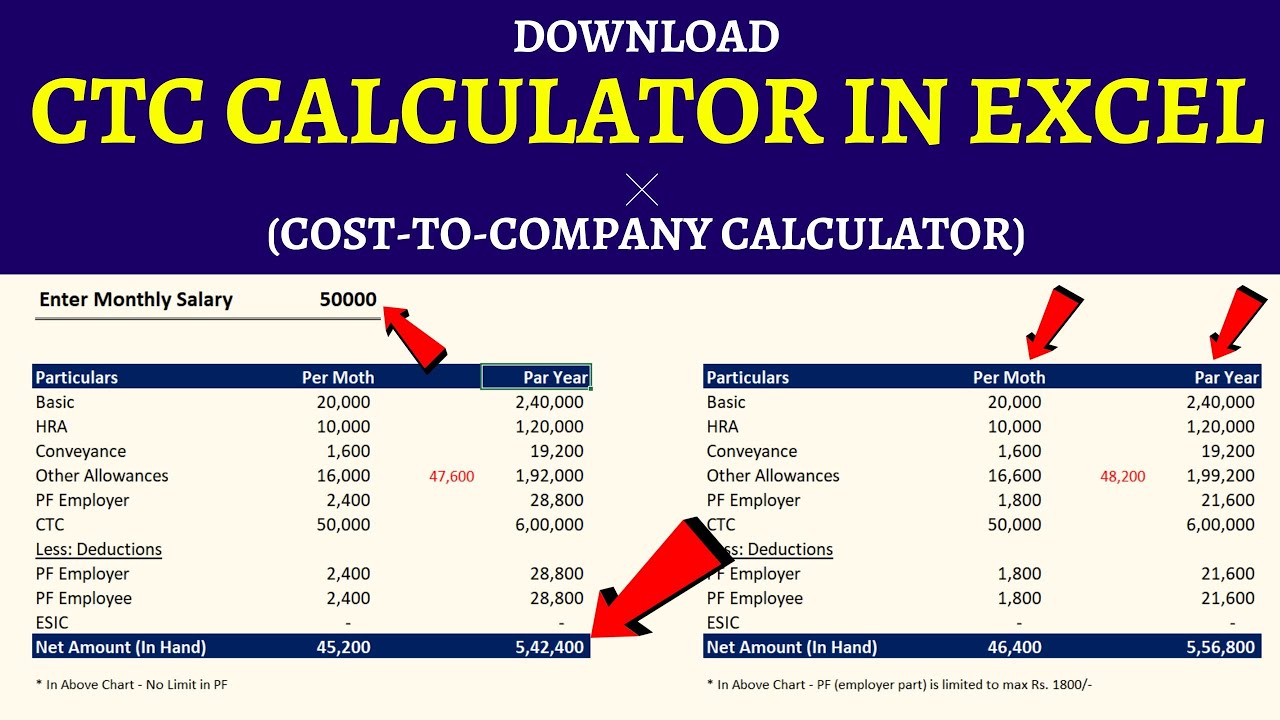

https://i.ytimg.com/vi/Ig5izabu_bU/maxresdefault.jpg

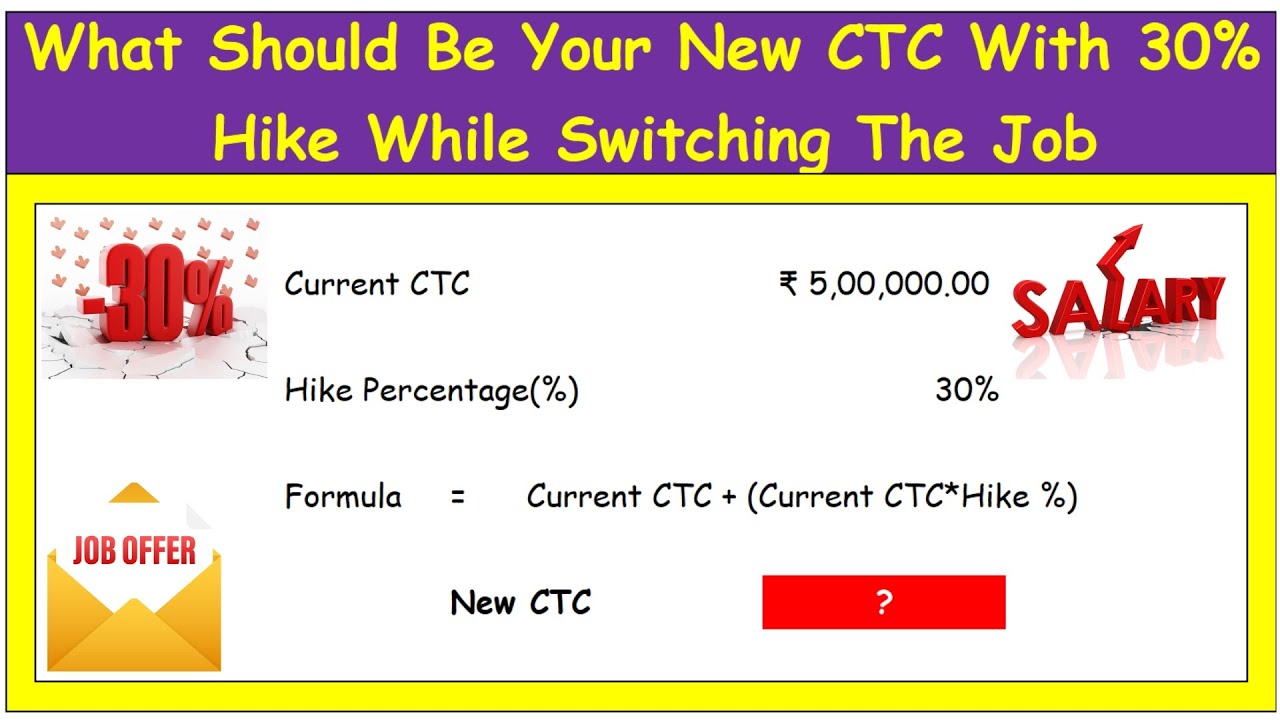

What Should Be Your New CTC With 30 Hike While Switching The Job New

https://i.ytimg.com/vi/x72rlkWpeGg/maxresdefault.jpg

30 LPA In Hand Salary Reality Of 30 LPA Tax Calculation For 30

https://i.ytimg.com/vi/EbEOXcrNFwc/maxresdefault.jpg

How income affects your benefit amount The Canada Disability Benefit is an income tested benefit which means the benefit amount will start to decrease after your adjusted family net Personal income tax Reporting income Find out what you need to report as income and how to enter these amounts on your tax return

Review all types of income you need to report on your income tax and benefit return The Government of Canada sets the federal income tax rates for individuals Each province and territory determines their own income tax rates Provincial or territorial income

More picture related to Income Tax Is Calculated On Ctc Or Gross

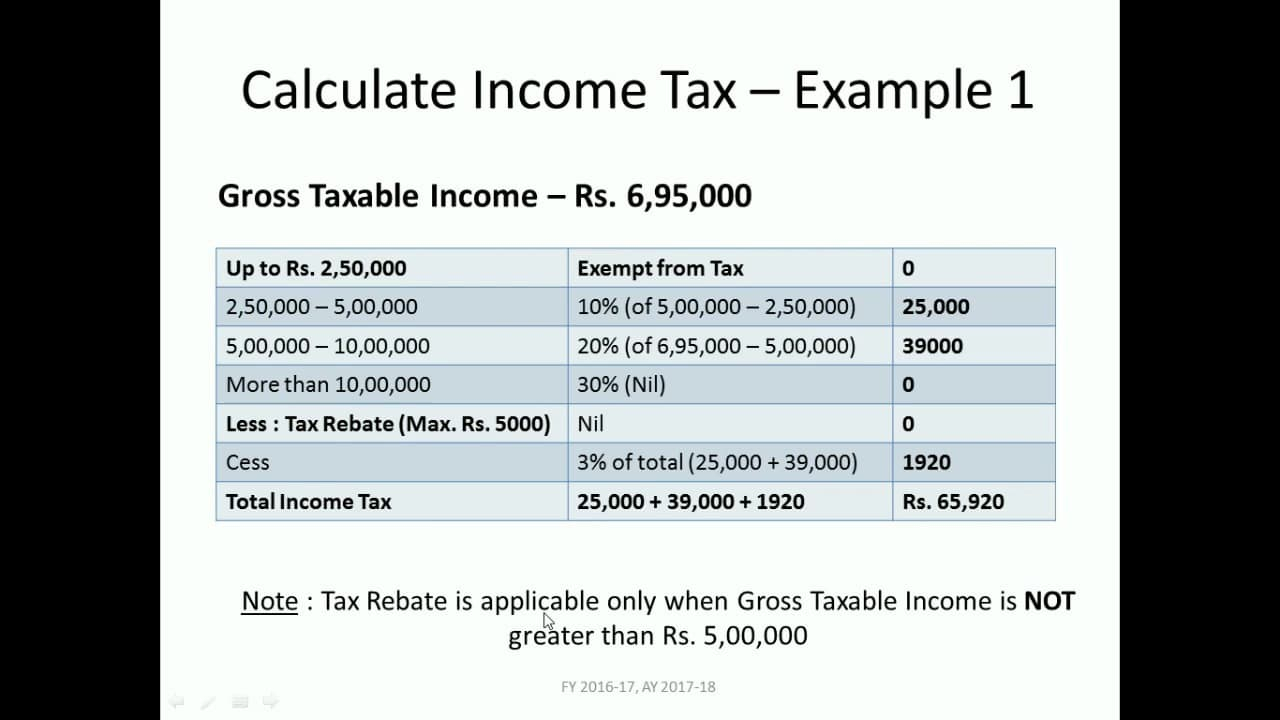

How To Calculate Income Tax On Salary With Payslip Example Income Tax

https://i.ytimg.com/vi/USW68EaURfg/maxresdefault.jpg

35 LPA In Hand Salary Reality Of 35 LPA Tax Calculation For 35

https://i.ytimg.com/vi/oehZislUjXo/maxresdefault.jpg

Understanding Of CTC Basic Salary Gross Salary Salary In Hand And

https://i.ytimg.com/vi/FMbDn2jaZJU/maxresdefault.jpg

Income requirements for the sponsorIncome requirements for the sponsor To be a sponsor you must have enough money to support all of the people you ll be financially responsible for Personal income tax Who should file a tax return how to get ready and file taxes payment and filing due dates reporting income and claiming deductions and how to make payments or

[desc-10] [desc-11]

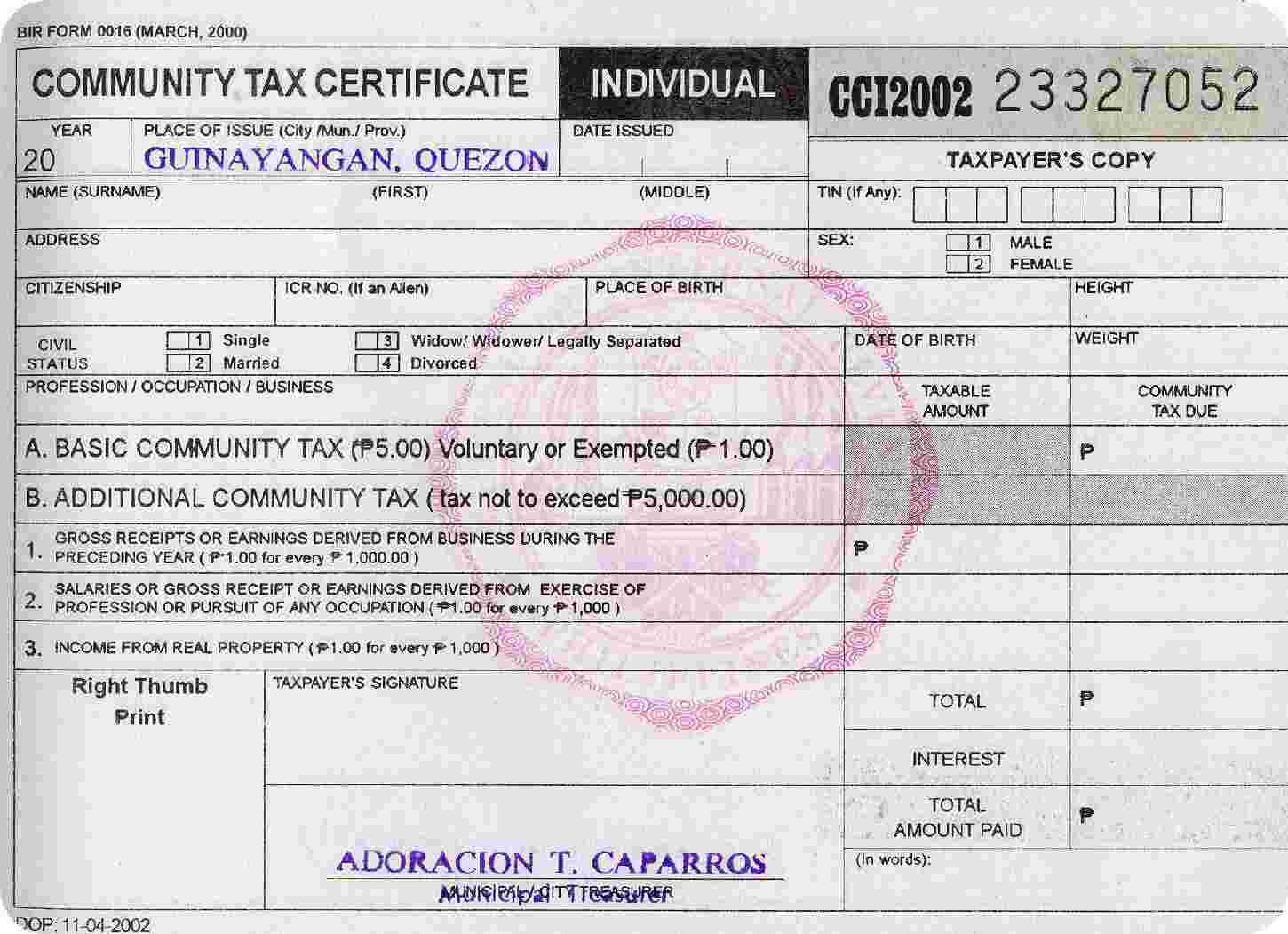

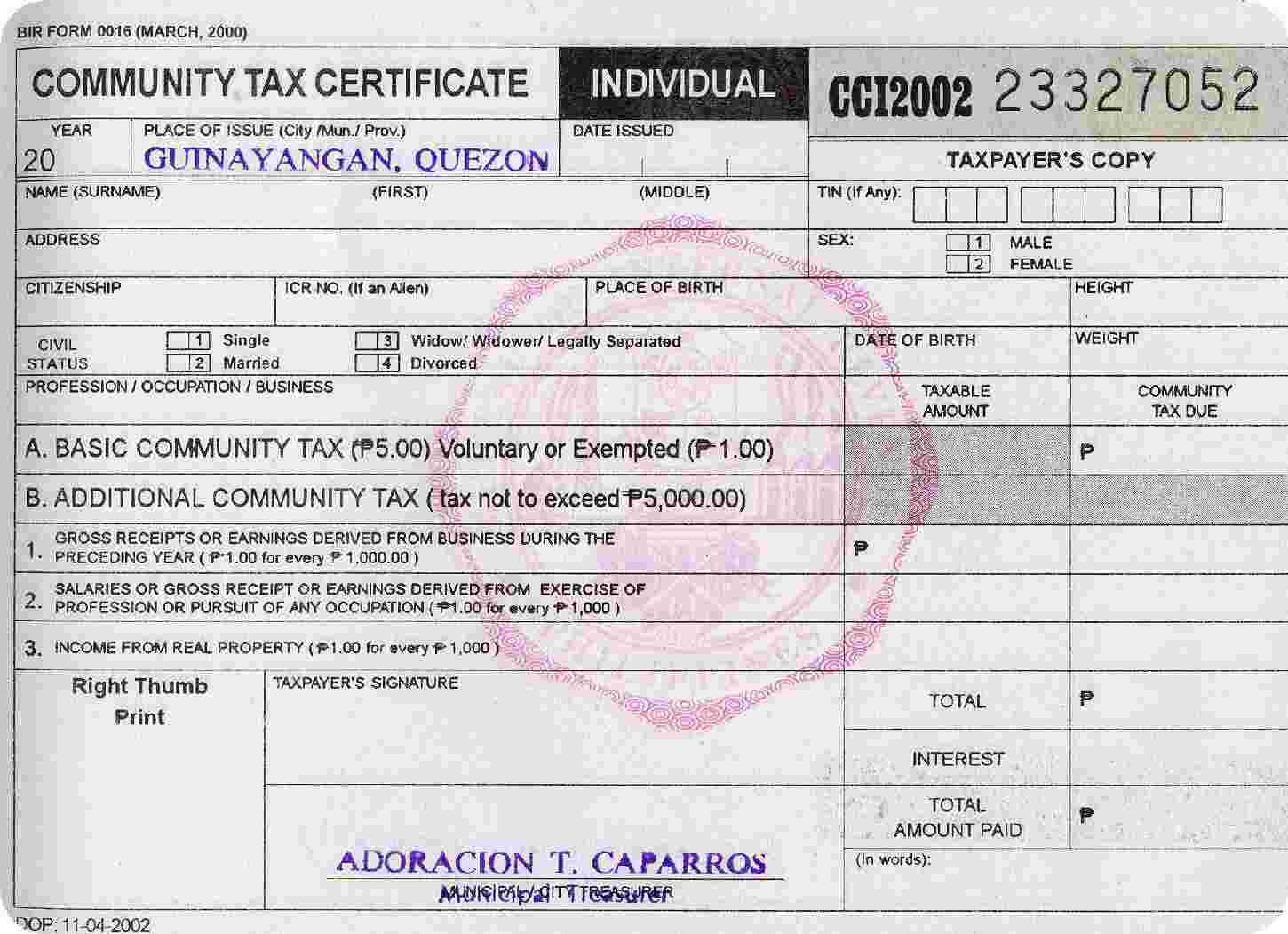

Local Government Unit Site

http://www.guinayangan.com/ctc1a.jpg

Salary Floor Meaning Viewfloor co

https://c.keka.com/media/2021/04/Gross-Salary-Direct-Benefits-Indirect-Benefits-Saving-Contributions-or-deductions-2-1024x576.png

https://www.canada.ca › en › department-finance › news › delivering-a-…

Income is reported and tax is calculated on an annual basis To reflect a one percentage point cut in the lowest tax rate coming into effect halfway through the year the full

https://www.canada.ca › en › revenue-agency › news › tax-season-start…

Today you can start filing your 2024 income tax return online For most individuals the deadline to file is April 30 2025 and any amounts owed must also be paid by

What Is Cost To Company CTC Meaning Definition Keka HR

Local Government Unit Site

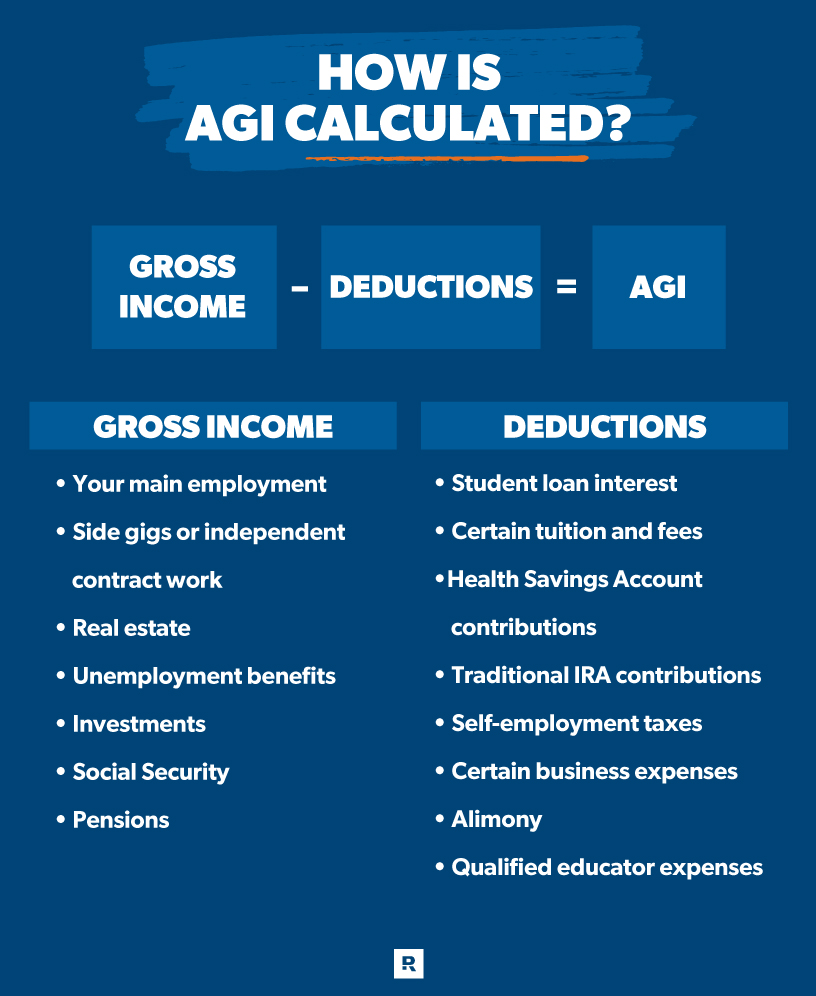

What Is Adjusted Gross Income AGI Does My Snapshot On Tax Act Have The

Calculate Your Tax Tax Withholding Estimator 2021

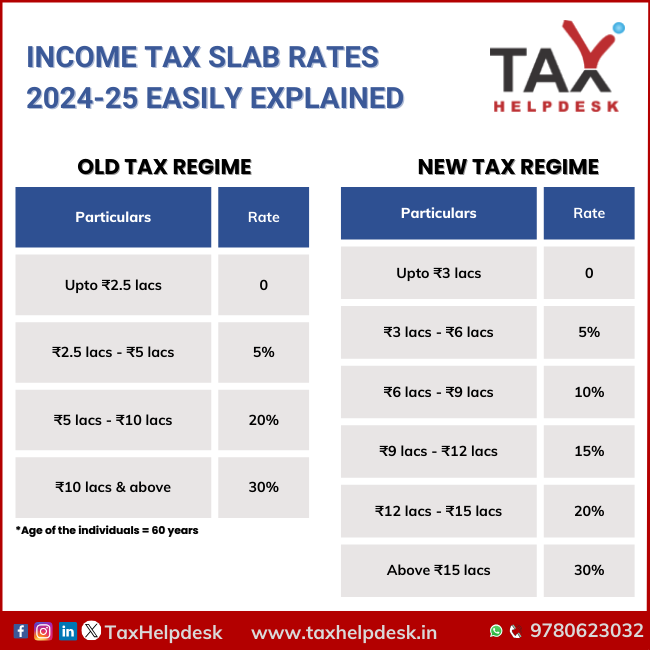

Ftc 2024 25 Tax Jeni Arleyne

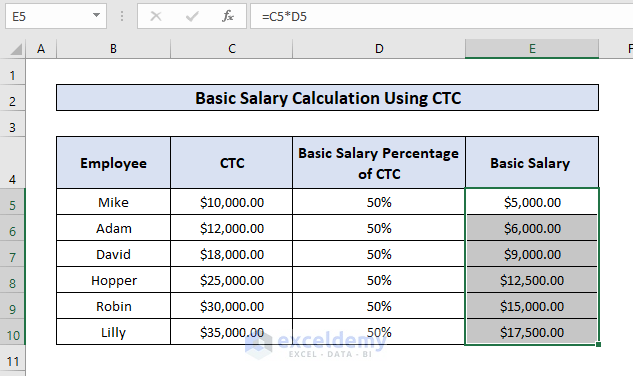

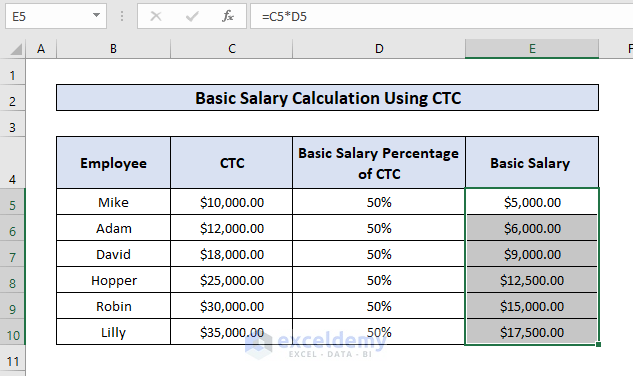

How To Calculate Basic Salary In Excel 3 Methods ExcelDemy

How To Calculate Basic Salary In Excel 3 Methods ExcelDemy

2025 Tax Calculator Canada Angela D Roney

Tax Refund Chart 2025 Usa Trine M Knudsen

CTC Calculator In Excel Download Cost to company Calculator

Income Tax Is Calculated On Ctc Or Gross - How income affects your benefit amount The Canada Disability Benefit is an income tested benefit which means the benefit amount will start to decrease after your adjusted family net