Is Income Tax High In China Today you can start filing your 2024 income tax return online For most individuals the deadline to file is April 30 2025 and any amounts owed must also be paid by

Income is reported and tax is calculated on an annual basis To reflect a one percentage point cut in the lowest tax rate coming into effect halfway through the year the full The Canada Disability Benefit is a monthly payment for working age persons with disabilities who have low income

Is Income Tax High In China

Is Income Tax High In China

https://russellinvestments.com/-/media/images/us/blogs/images/kuharicjuly19_3.jpg

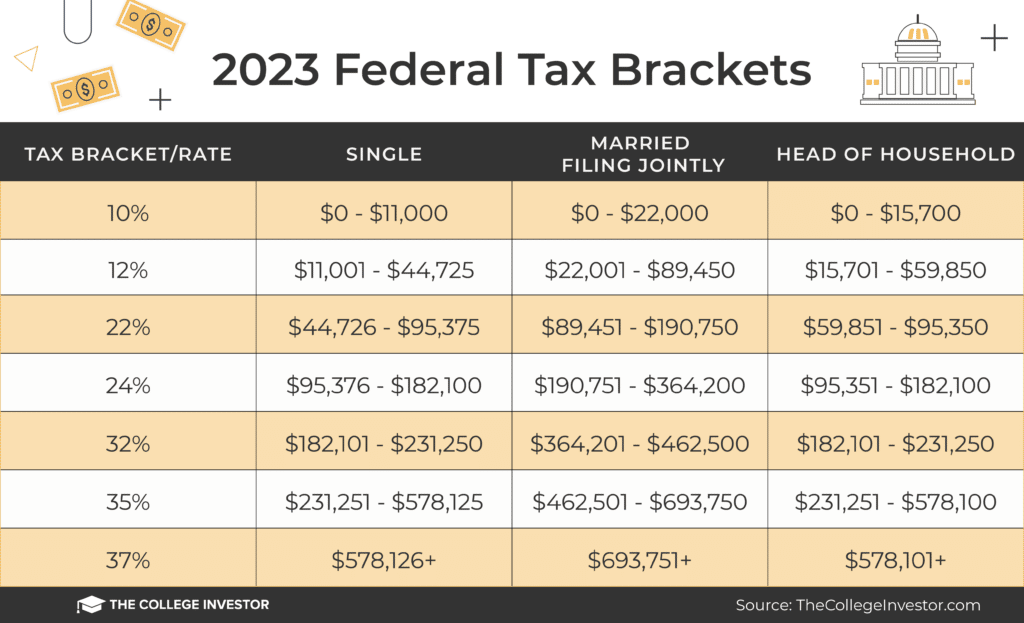

Income Tax For Fy 2023 24 Image To U

https://images.axios.com/FeF3kXyZuSjEVWj-265DifJa2hw=/0x0:1280x720/1366x768/2022/10/19/1666195709283.png

Income Tax Thresholds 2025 26 Trish Micheline

https://www.thechichesteraccountants.com/wp-content/uploads/2023/01/tax-2-2-1024x633.png

Review all types of income you need to report on your income tax and benefit return Chart 2 2025 Federal claim codes Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions If your employees want you to adjust their tax

Income tax calculator Updated for 2024 25 tax year how much tax will you pay on your salary in South Africa find out with the SARS income tax calculator updated for 2024 25 tax year Personal income tax Reporting income Find out what you need to report as income and how to enter these amounts on your tax return

More picture related to Is Income Tax High In China

2025 Tax Brackets Australia Calculator Lilian D Broughton

https://taxedright.com/wp-content/uploads/2023/10/2024-Tax-Brackets.png

Income Tax

https://navi.com/blog/wp-content/uploads/2023/03/Income-Tax-Assessment.jpg

Income Tax Rules For 2023 24 Image To U

https://thecollegeinvestor.com/wp-content/uploads/2022/10/TCI_-_2023_Federal_Tax_Brackets_1600x974-1024x623.png

All personal income tax packages On this page you will find current year and previous year personal income tax packages for the current year and all prior available years As an employee you complete this form if you have a new employer or payer and will receive salary wages or any other remuneration or if you wish to increase the amount of

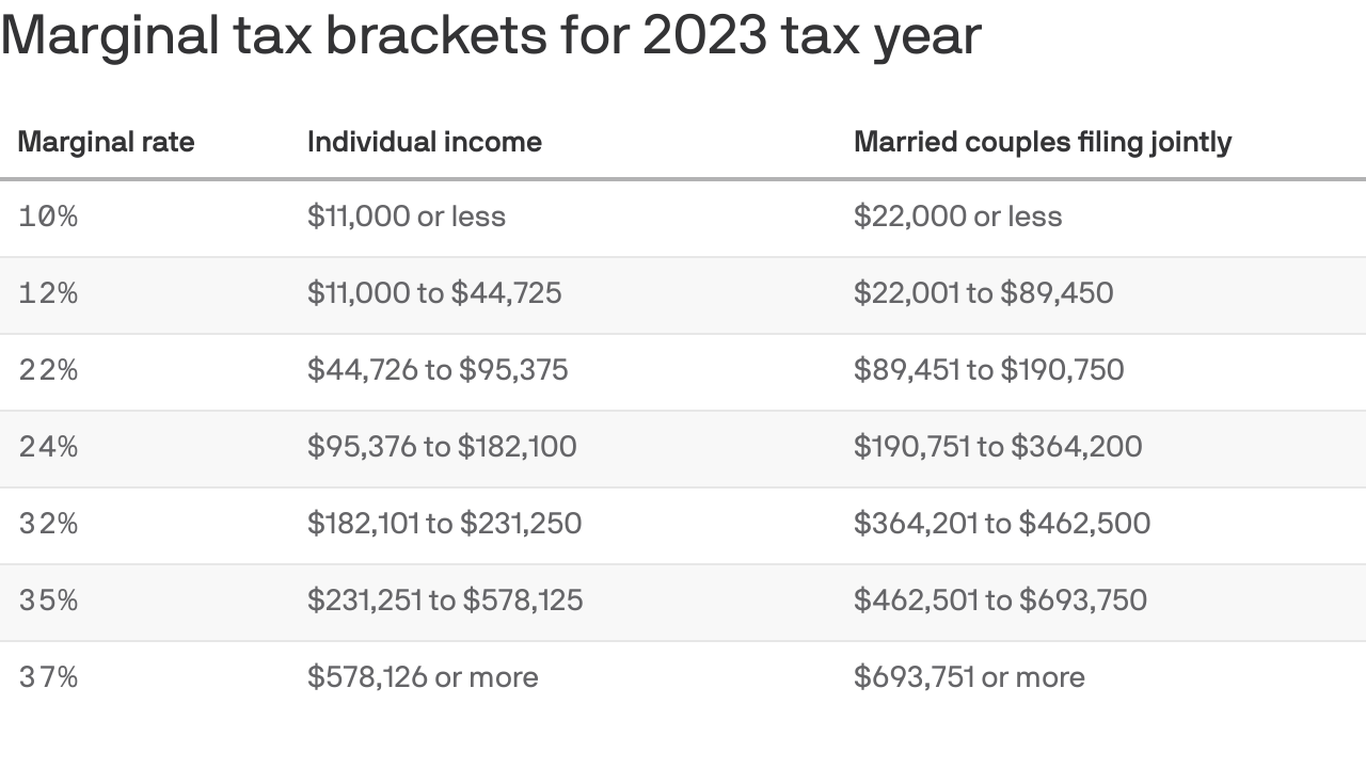

[desc-10] [desc-11]

Fed Estimated Tax Payments 2025 Calculator Edward L Elliott

https://taxwithholdingestimator.com/wp-content/uploads/2021/08/income-tax-calculator-format-for-financial-year-2020-21-13.jpg

Tax Bracket Calculator 2025 Sydel Celesta

https://topdollarinvestor.com/wp-content/uploads/2022/11/2022-Federal-Income-Tax-Brackets-1.png

https://www.canada.ca › en › revenue-agency › news › tax-season-start…

Today you can start filing your 2024 income tax return online For most individuals the deadline to file is April 30 2025 and any amounts owed must also be paid by

https://www.canada.ca › en › department-finance › news › delivering-a-…

Income is reported and tax is calculated on an annual basis To reflect a one percentage point cut in the lowest tax rate coming into effect halfway through the year the full

Individual Income Tax Rates 2024 Singapore Image To U

Fed Estimated Tax Payments 2025 Calculator Edward L Elliott

Individual Tax Rates 2025 Nz Kareem Avery

Tax Day 2025 Refund Form Lila Mariyah

Tax 2025 Brackets 2025 Kira Heloise

Income Tax Brackets 2025 In Canada Jay C Petit

Income Tax Brackets 2025 In Canada Jay C Petit

New York State Supplemental Tax Rate 2025 Dyani Star

Medicare Tiers For 2025 Ernest B Johnson

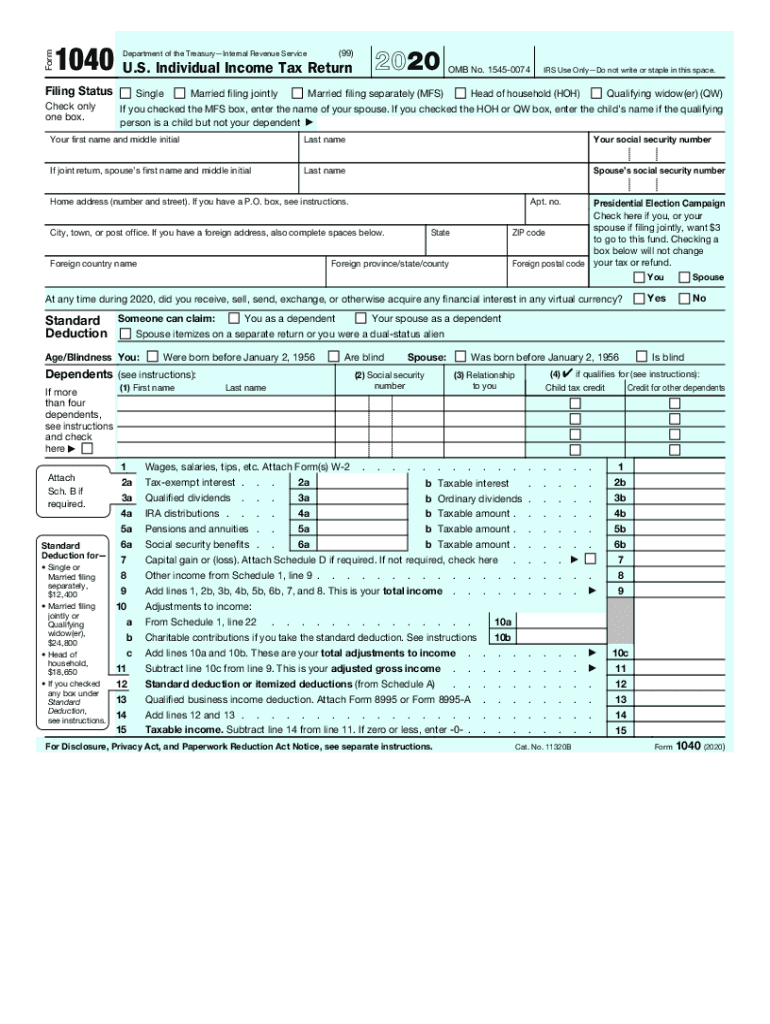

Tax Worksheet For 2021

Is Income Tax High In China - Chart 2 2025 Federal claim codes Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions If your employees want you to adjust their tax