Maximum Value Of Call Option The maximum value of a call option is equal to the value of the underlying asset This makes a lot of economic sense An option allows you to buy a given asset at a certain exercise price

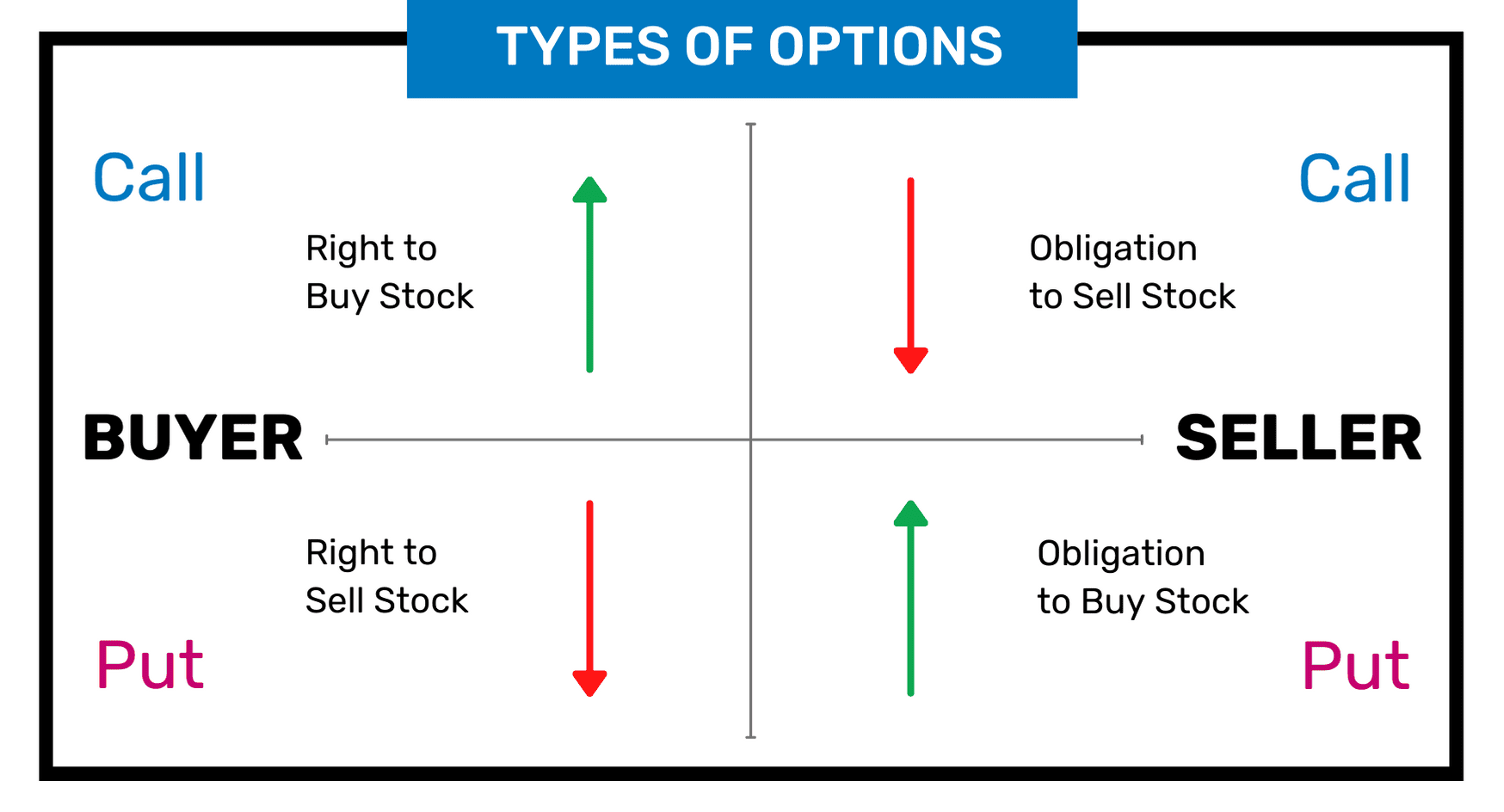

A call option provides the option buyer the right to buy the asset For the option to have value its price at any time must be lower than the underlying stock price at any time This is because if the option price were higher than the stock price it would be cheaper to just buy the asset directly in the spot market Boundary conditions are the maximum and minimum values used to indicate where the price of an option must lie Boundary conditions are used to estimate what an option may be priced at but the

Maximum Value Of Call Option

Maximum Value Of Call Option

https://i.ytimg.com/vi/FSa-pU7LSlw/maxresdefault.jpg

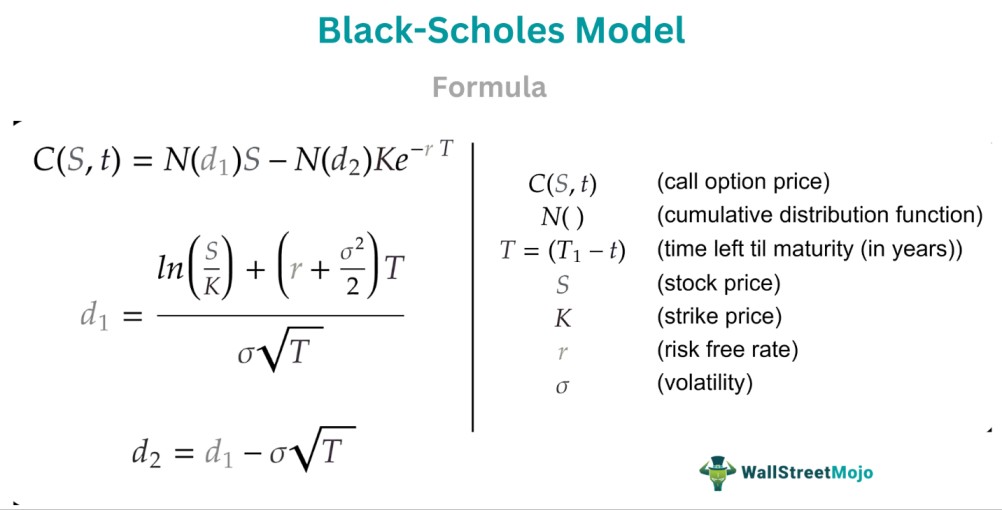

How To Calculate The Price Of A Call Option Using The BSOPM Formula

https://i.ytimg.com/vi/sBVjO8V9mDk/maxresdefault.jpg

:max_bytes(150000):strip_icc()/call-option-4199998-ddd54a71fc9a479f9dda9e5b9943d9c4.jpg)

BLUSONES ELEGANTES De MODA 2022 BLUSAS LARGAS Y BLUSONES 40 OFF

https://www.investopedia.com/thmb/_ALQ6oHjdmDOViKhI64v2qtZ0Cs=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/call-option-4199998-ddd54a71fc9a479f9dda9e5b9943d9c4.jpg

I m reading Sinclair s Option Pricing and am confused by the proof for the maximum value of a call It makes sense logically that a call can t be worth more than the underlying and so c Learn how to calculate the value and profit of call and put options at expiration Understand key factors affecting option pricing and returns

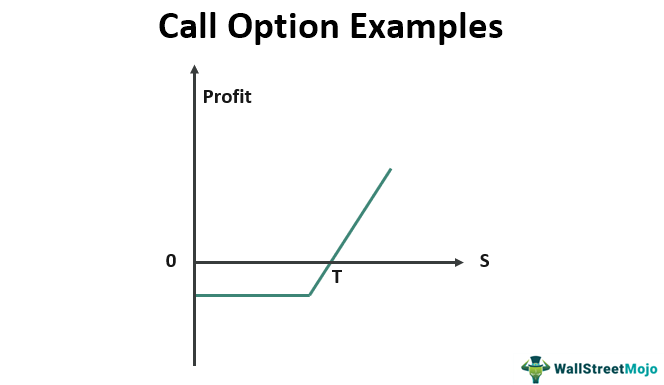

The payoff of a call option is Max S X 0 That is to say if the current prevailing price of the asset is 15 and the strike price is 10 the value of the call option is 10 A Minimum Values of Options 1 Minimum Value of Call A call option is an instrument with limited liability If the call holder sees that it is advantageous to exercise it the call will be exercised If exercising it will decrease the call holder s wealth the holder will not exercise it

More picture related to Maximum Value Of Call Option

Put Call Parity Definition Formula How It Works And 60 OFF

https://lh6.googleusercontent.com/ttGvAnzyq3SGApRoFOcjuQFmLUYRYpK5mjXZtjLFGopZO2sXrBh5sxmNWNxKdJmHvSKW5bI5k1VB3iufhR9AJ6pzosMz23vcYS-GODQkzJMocmgEE3gA9pyNp-sdeGeZtUl0J-BTBMjNG9Xor9Bsj6s

What Is Vega Understanding The Option Greeks

https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/641e2f9975f17fc5adc5669e_Black-Scholes Model.png

Options Trading

https://tradebrains.in/wp-content/uploads/2020/04/options-trading-call-and-put-1.jpg

An option s value consists of its intrinsic value and its time value The intrinsic value of a call option is the maximum of 0 and the spot price at time t minus the exercise price For a put option the intrinsic value is the maximum of 0 and the exercise price minus the spot price at time t A call option also has a maximum value C S 0 T X S O The call is a conduit through which an investor can obtain the stock The most one can expect to gain from the call is the stock s value less the exercise price

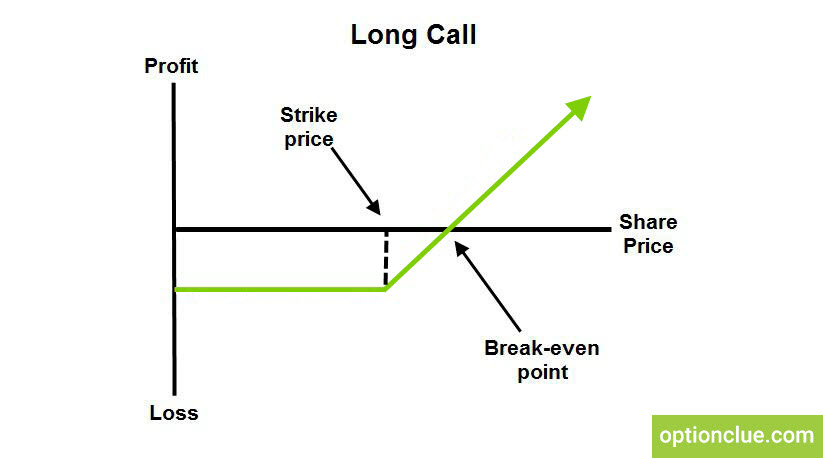

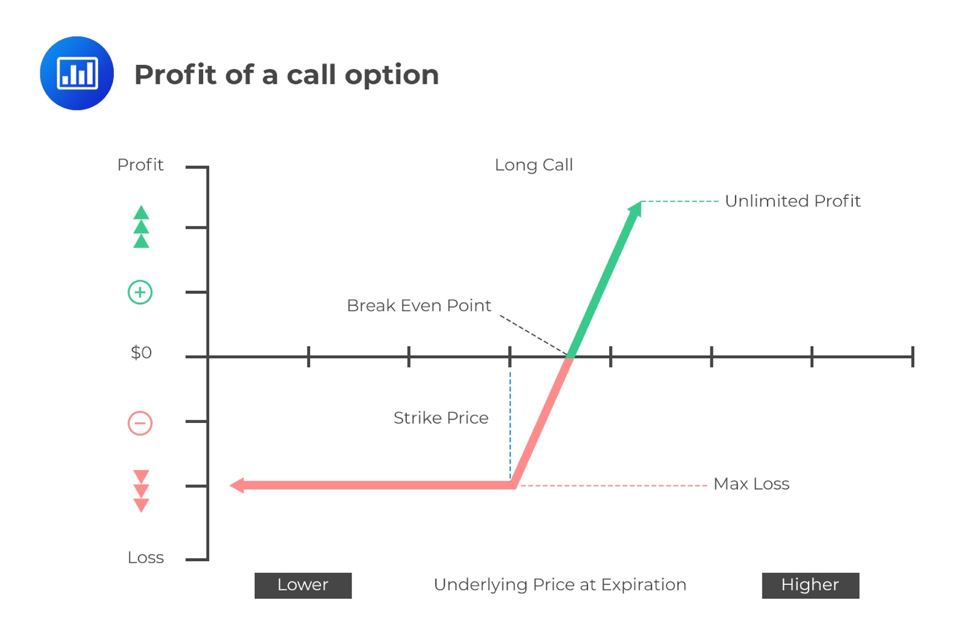

If the spot price is above the strike the holder of a call will exercise it at maturity The payoff not profit at maturity can be modeled using the following call option formula and plotted in a chart Excel formula for a Call MAX 0 Share Price Strike Price We ll use two popular methods to assess the value of both call and put options the Black Scholes closed form formula and a stochastic model After calculating the option values using each approach we ll compare the results to see if

European Option Definition Examples Pricing Formula With Calculations

https://www.wallstreetmojo.com/wp-content/uploads/2019/07/European-Option.jpg

WIP Enrollment Options Trading Program Beyond Insights

https://www.beyondinsights.net/wp-content/uploads/Call-vs-Put-Options.png

https://www.scranton.edu › faculty › hussain › teaching

The maximum value of a call option is equal to the value of the underlying asset This makes a lot of economic sense An option allows you to buy a given asset at a certain exercise price

https://financetrain.com › minimum-and-maximum-value...

A call option provides the option buyer the right to buy the asset For the option to have value its price at any time must be lower than the underlying stock price at any time This is because if the option price were higher than the stock price it would be cheaper to just buy the asset directly in the spot market

Call Options Explained Cheddar Flow

European Option Definition Examples Pricing Formula With Calculations

Voxt

Put Call Parity Definition Calculation How To Use

GitHub Arnavnair220 Basic Monte Carlo Options Uses Monte Carlo

Long Call Strategy Call Option Graph Optionclue

Long Call Strategy Call Option Graph Optionclue

Call Option Profit Formula AmaynaSulav

Call Option Examples What Are They Examples

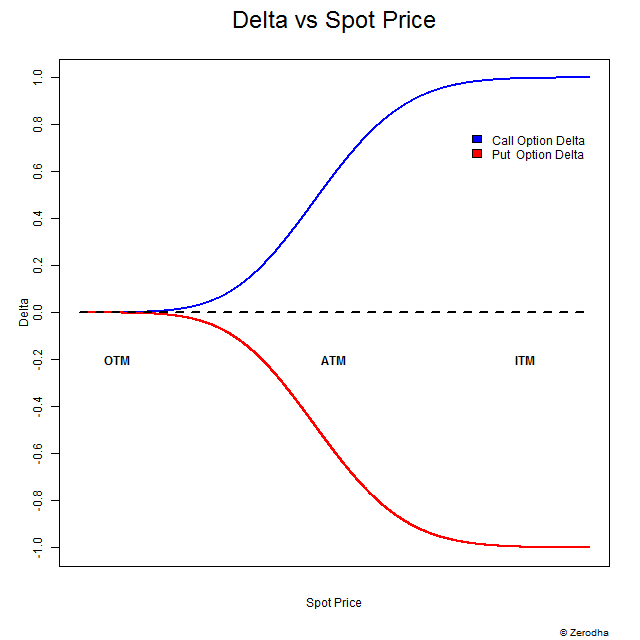

Delta Part 2 Varsity By Zerodha

Maximum Value Of Call Option - Learn how to calculate the value and profit of call and put options at expiration Understand key factors affecting option pricing and returns