P Value Meaning P B ratio Stock Price Book Value per share Book value 2 000 1 500 500 note that this is the same as owners equity Book value per share 500 100 5 P B ratio 6 5 1 2 A P B ratio of less than 1 0 can indicate that a stock is undervalued while a ratio of greater than 1 0 may indicate that a stock is overvalued

The profit and loss statement summarizes all revenues and expenses a company has generated in a given timeframe This summary provides a net income or bottom line for a reporting period The P L reporting period can be any length of time but the most common are monthly quarterly and annually A P L statement is also known as income statement It s important to note that price elasticity of demand uses absolute value meaning that it essentially ignores the negative symbol Since we already know the direction demand will shift we re more concerned about the value of the number since it explains whether demand is elastic or inelastic and how responsive it is to changes in price

P Value Meaning

P Value Meaning

https://i.ytimg.com/vi/xdZSWsKk5P0/maxresdefault.jpg

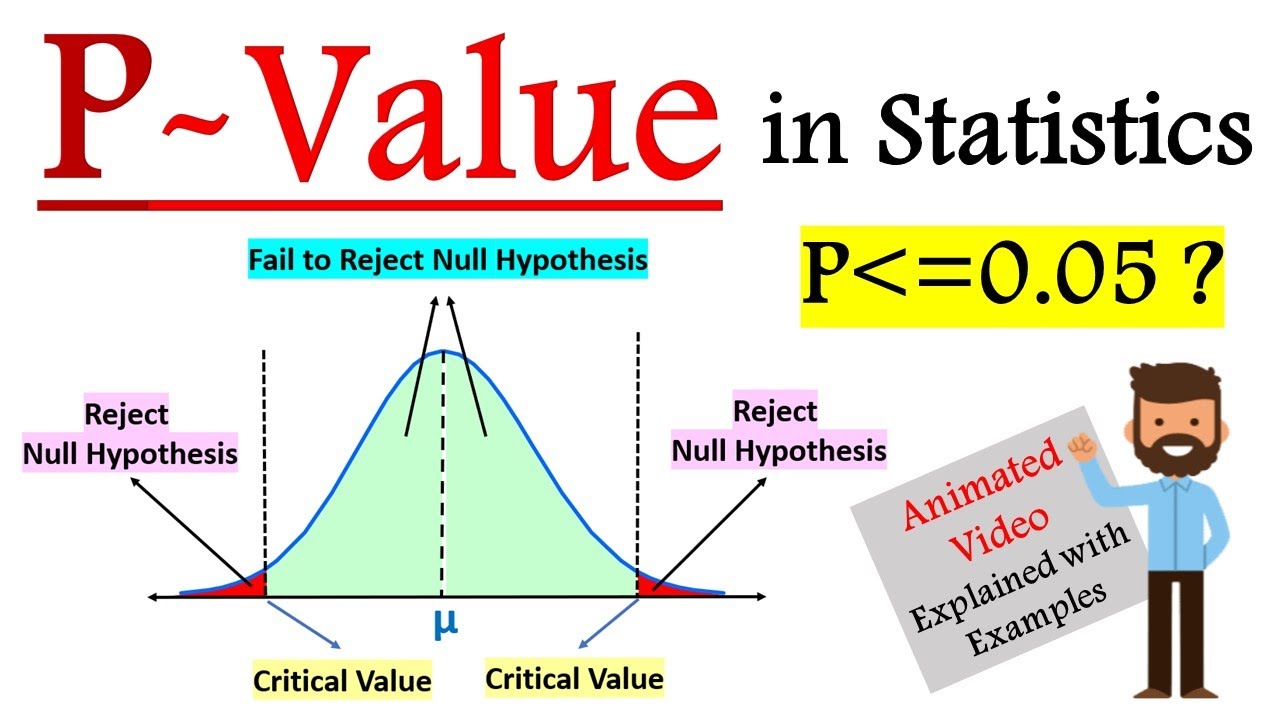

What Is P Value Part 1 Basics Of P Value Range Of P Value Along

https://i.ytimg.com/vi/eOp_VMcFM-o/maxresdefault.jpg

How To Do On A Rejection Word Graph

https://www.simplypsychology.org/wp-content/uploads/p-value.jpeg

Book value and salvage value are two terms that refer to the value of an asset on a balance sheet with respect to depreciation However there is one major difference between book value and salvage value Book value or carrying value reports the value of an asset on a balance sheet which is adjusted for depreciation The future value formula changes slightly depending on which calculation is carried out Future Value with Simple Interest Future value with simple interest uses the following formula Future Value Present Value 1 Interest Rate x Number of Years Let s say Bob invests 1 000 for five years with an interest rate of 10

Why Does a Price to Cash Flow Ratio P CF Matter The price to cash flow ratio offers investors a somewhat more useful look at a company s value than the P E ratio because the price to cash flow ratio uses a denominator that excludes the effects of depreciation and the accounting differences related to depreciation Par Value Example Let s assume Company XYZ issues 1 000 000 in bonds to the public It may do so by issuing 1 000 bonds each with a 1 000 par value When each bond matures the borrower will pay back the par value of 1 000 to the lender

More picture related to P Value Meaning

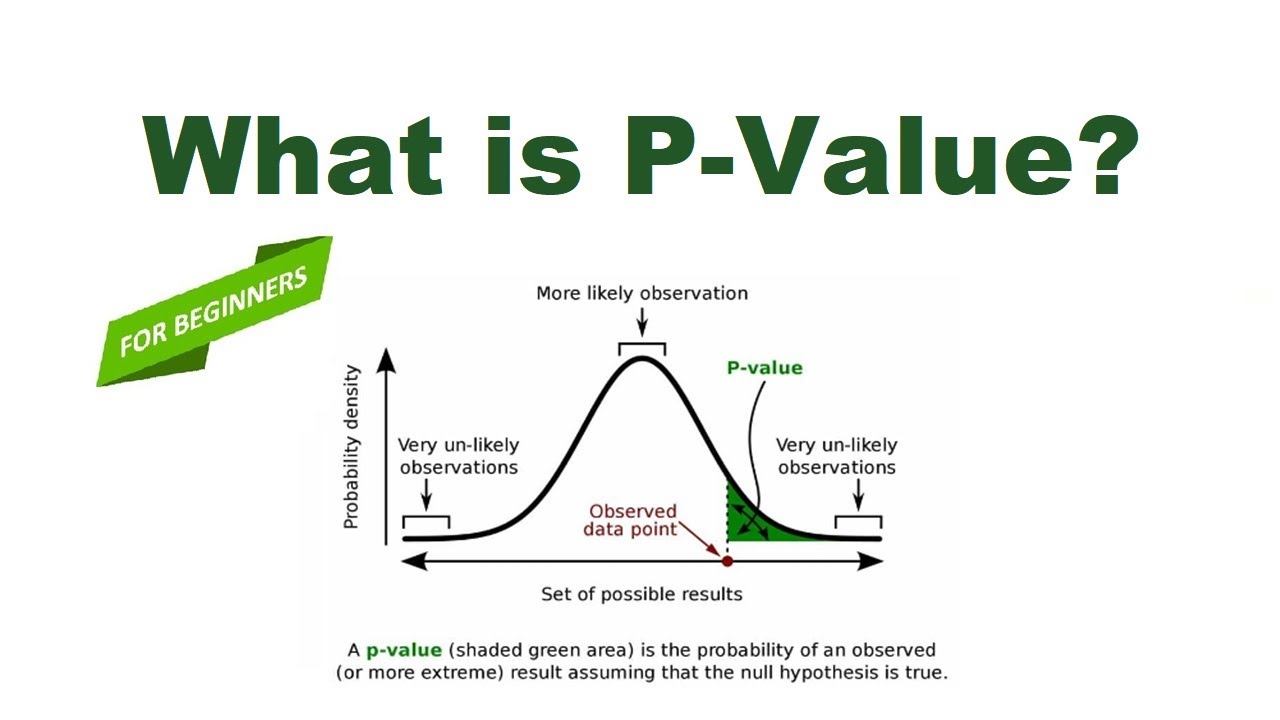

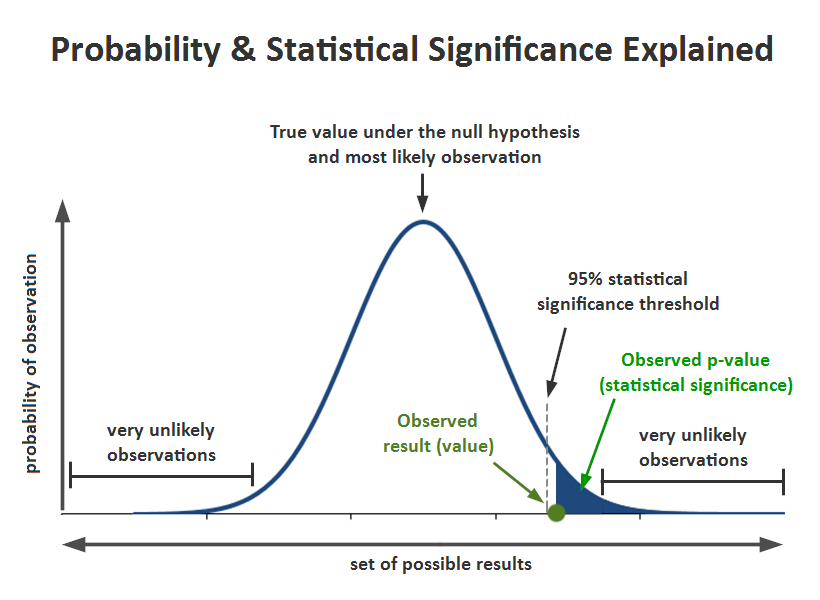

Statistical Significance And P Value Explained In Simple Terms

https://www.marketcalls.in/wp-content/uploads/2023/03/Statistical-Significance-and-p-value-0.05.png

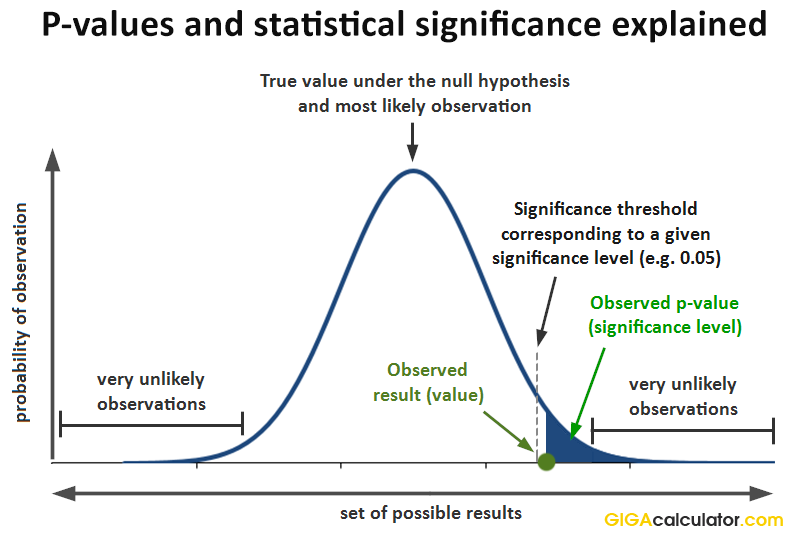

The P Value Definition And Interpretation Of P values In Statistics

https://www.gigacalculator.com/articles/wp-content/uploads/2020/12/p-value-significance-level-explained.png

Demystifying P Values Statistical Significance Explained Analythical

https://images.squarespace-cdn.com/content/v1/64c4f5cffc1a5952f996c322/9bf085ec-4546-476c-b132-02705ed9adff/p-value.png?format=1500w

The P S ratio varies dramatically by industry For example retail companies typically display a much higher P S ratio than companies highly involved in research and development Therefore when comparing P S ratios make sure the firms are within the same industry The P S ratio is useful because sales figures are considered to be relatively The formula for the price to tangible book value is Price to Tangible Book Value Share Price Tangible Book Value per Share For example let s assume that Company XYZ has 10 000 000 shares outstanding which are trading at 3 per share The company also recorded 15 000 000 of tangible book value last year

[desc-10] [desc-11]

:max_bytes(150000):strip_icc()/Term-Definitions_p-value-fb1299e998e4477694f6623551d4cfc7.png)

Calcular El P Value En Excel Printable Templates Free

https://www.investopedia.com/thmb/57SSrjkubwPc6yvPr3vUnxvau5I=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Term-Definitions_p-value-fb1299e998e4477694f6623551d4cfc7.png

Hello Asad Excellent Write Up And Thanks For Taking The Time To Write

https://miro.medium.com/v2/resize:fit:1358/1*g9jXPPIWHeMlfsoyNztp3A.gif

https://investinganswers.com/dictionary/p/price-book-ratio-pb

P B ratio Stock Price Book Value per share Book value 2 000 1 500 500 note that this is the same as owners equity Book value per share 500 100 5 P B ratio 6 5 1 2 A P B ratio of less than 1 0 can indicate that a stock is undervalued while a ratio of greater than 1 0 may indicate that a stock is overvalued

https://investinganswers.com/dictionary/p/profit-loss-pl-statement

The profit and loss statement summarizes all revenues and expenses a company has generated in a given timeframe This summary provides a net income or bottom line for a reporting period The P L reporting period can be any length of time but the most common are monthly quarterly and annually A P L statement is also known as income statement

PPT Understanding P values And Confidence Intervals PowerPoint

:max_bytes(150000):strip_icc()/Term-Definitions_p-value-fb1299e998e4477694f6623551d4cfc7.png)

Calcular El P Value En Excel Printable Templates Free

Continued T test P values Indicate Statistical Significance P

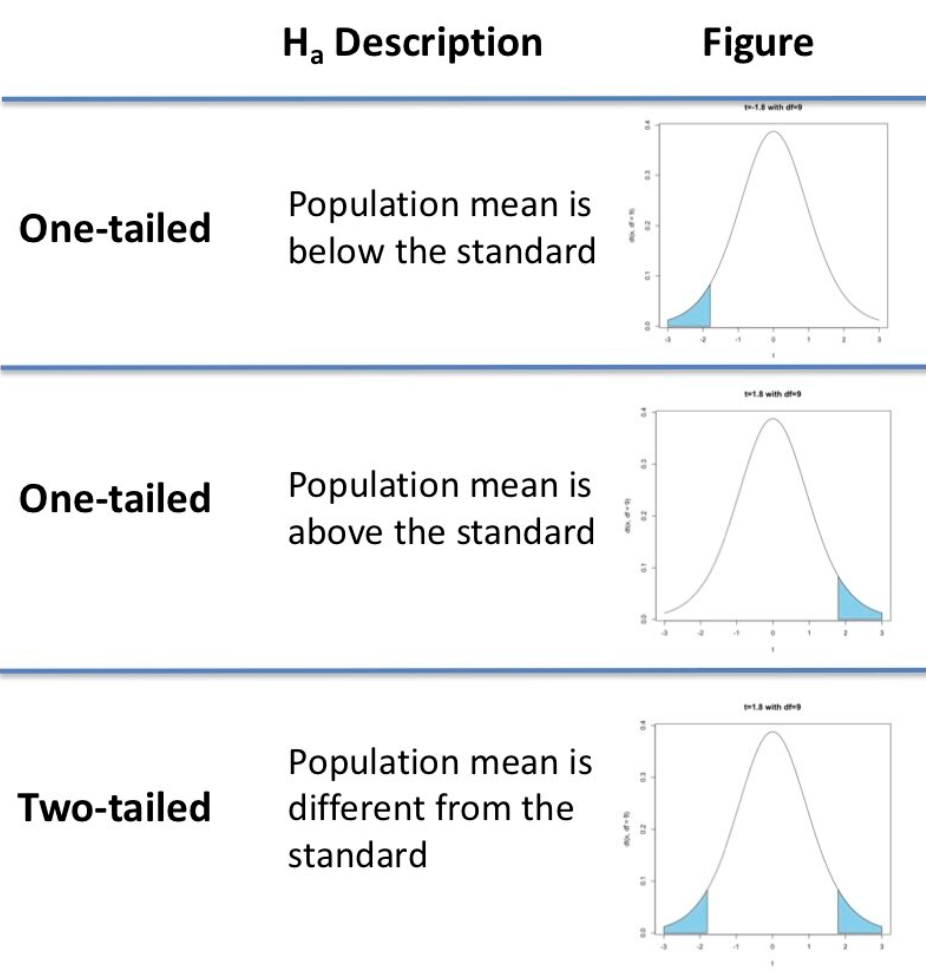

Understanding The Types Of P Value Tests One Sided Vs Two Sided

PPT Chapter 15 PowerPoint Presentation Free Download ID 3195383

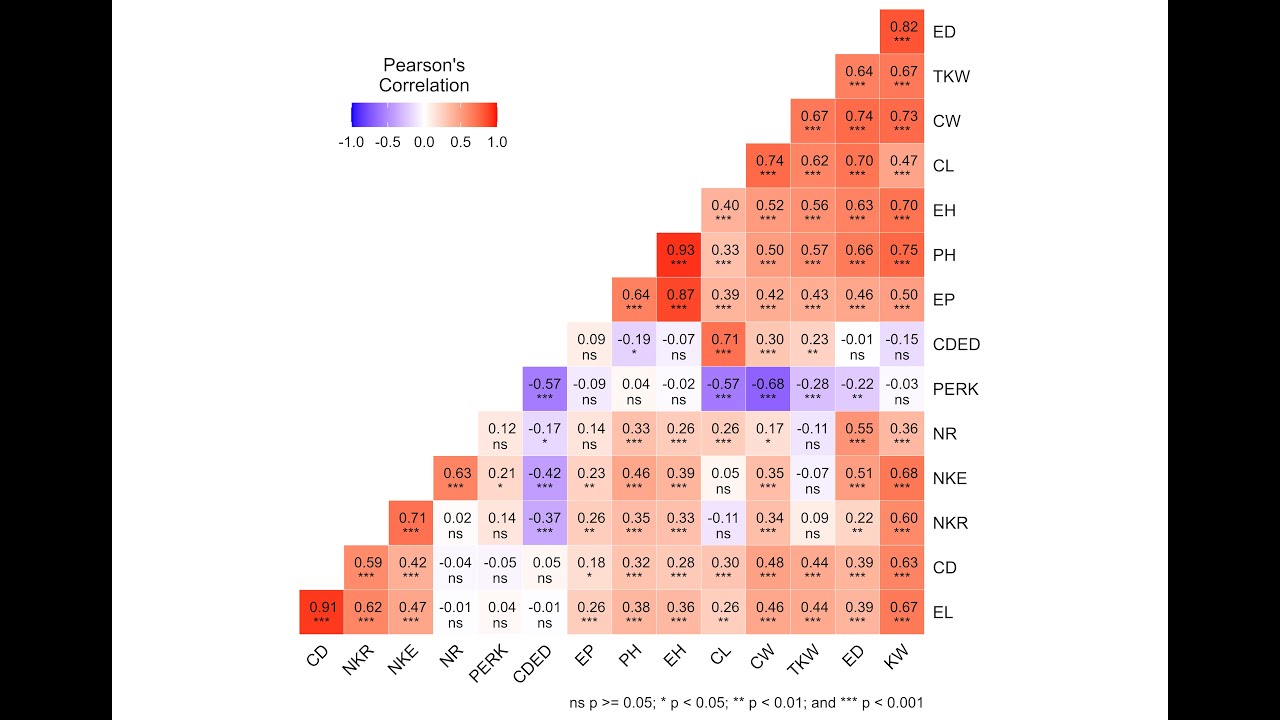

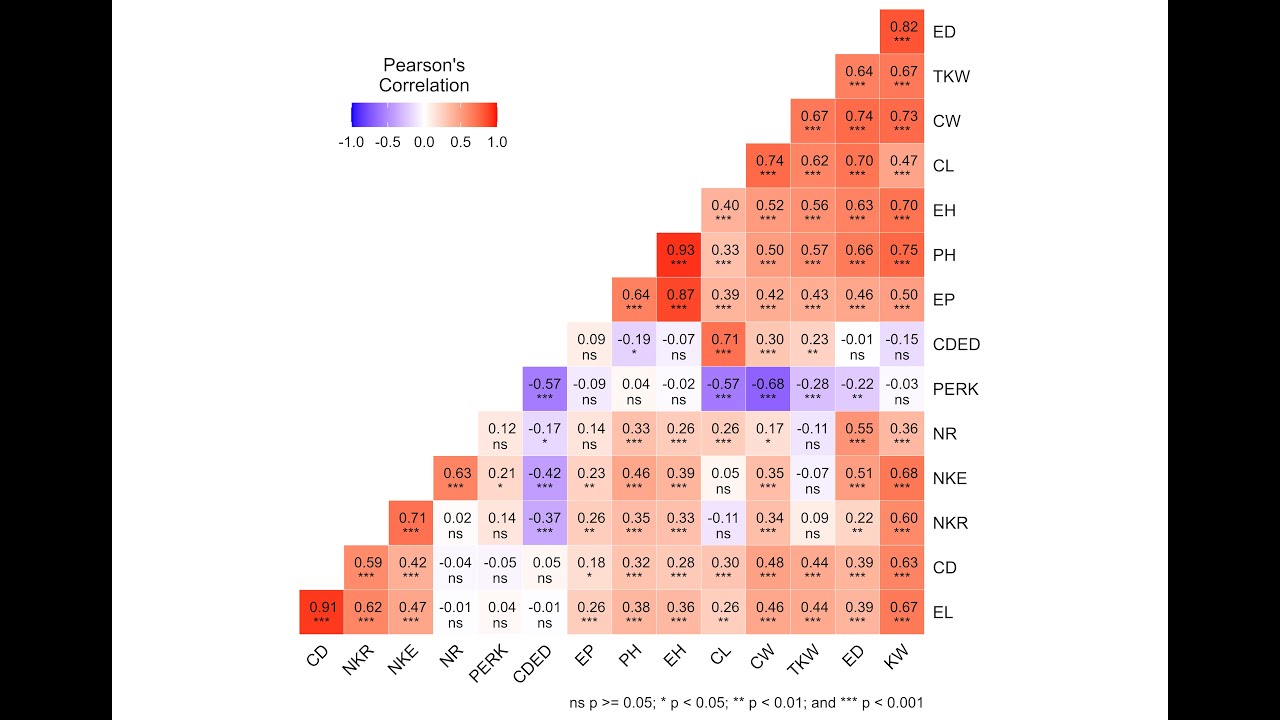

How To Create A Correlation Matrix In R R Blogger Buickcafe

How To Create A Correlation Matrix In R R Blogger Buickcafe

Statistical Significance In A B Testing A Complete Guide Analytics

How Alpha And Beta Spell Improved A B Testing

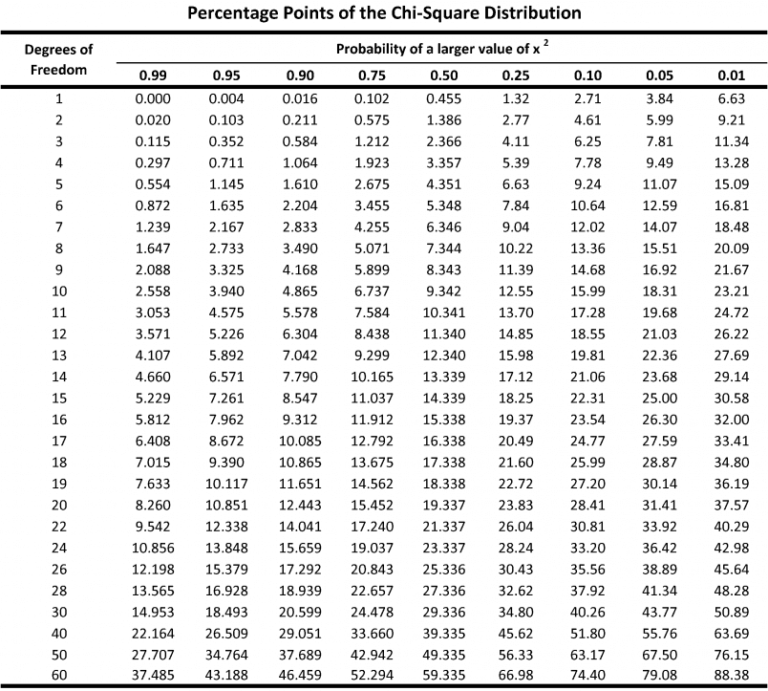

P Value Definition Formula Table Calculator Significance

P Value Meaning - [desc-14]