Persons Exempted From Income Tax In India In order to prevent multiple repetitive comments this is a friendly request to u SaintMana to reply to this comment with the prompt they used so other users can

It contains the term the people once and the term persons twice I think the common interpretation is that the opening use of the term people is actually understood as Read and Share our Missing Person Reports to help bring home Missing Canadians Spamming with insensitive or off topic remarks on a Missing Person may result in being banned And yes

Persons Exempted From Income Tax In India

Persons Exempted From Income Tax In India

https://www.livelaw.in/h-upload/2022/07/19/426471-agnipath-scheme.jpg

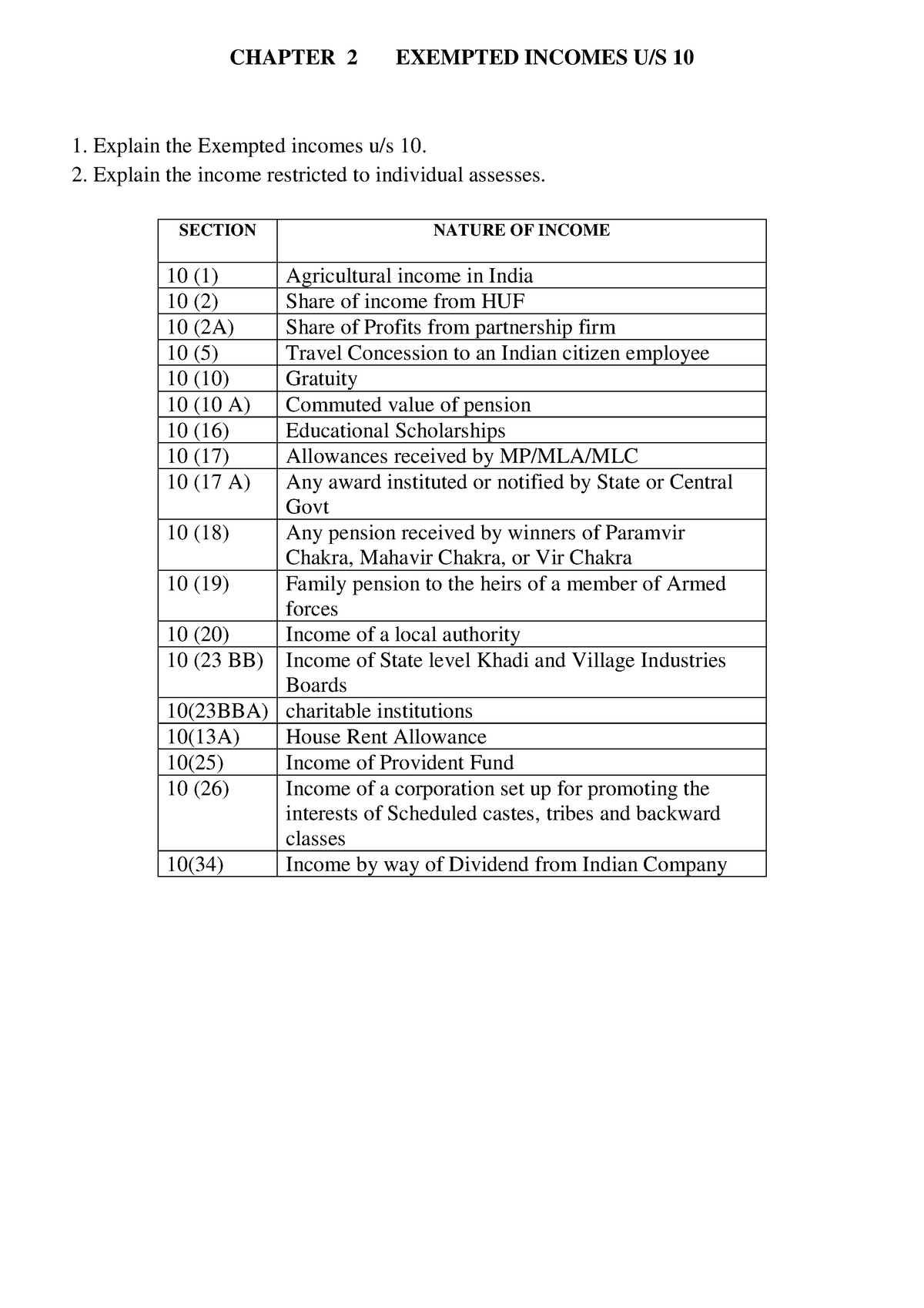

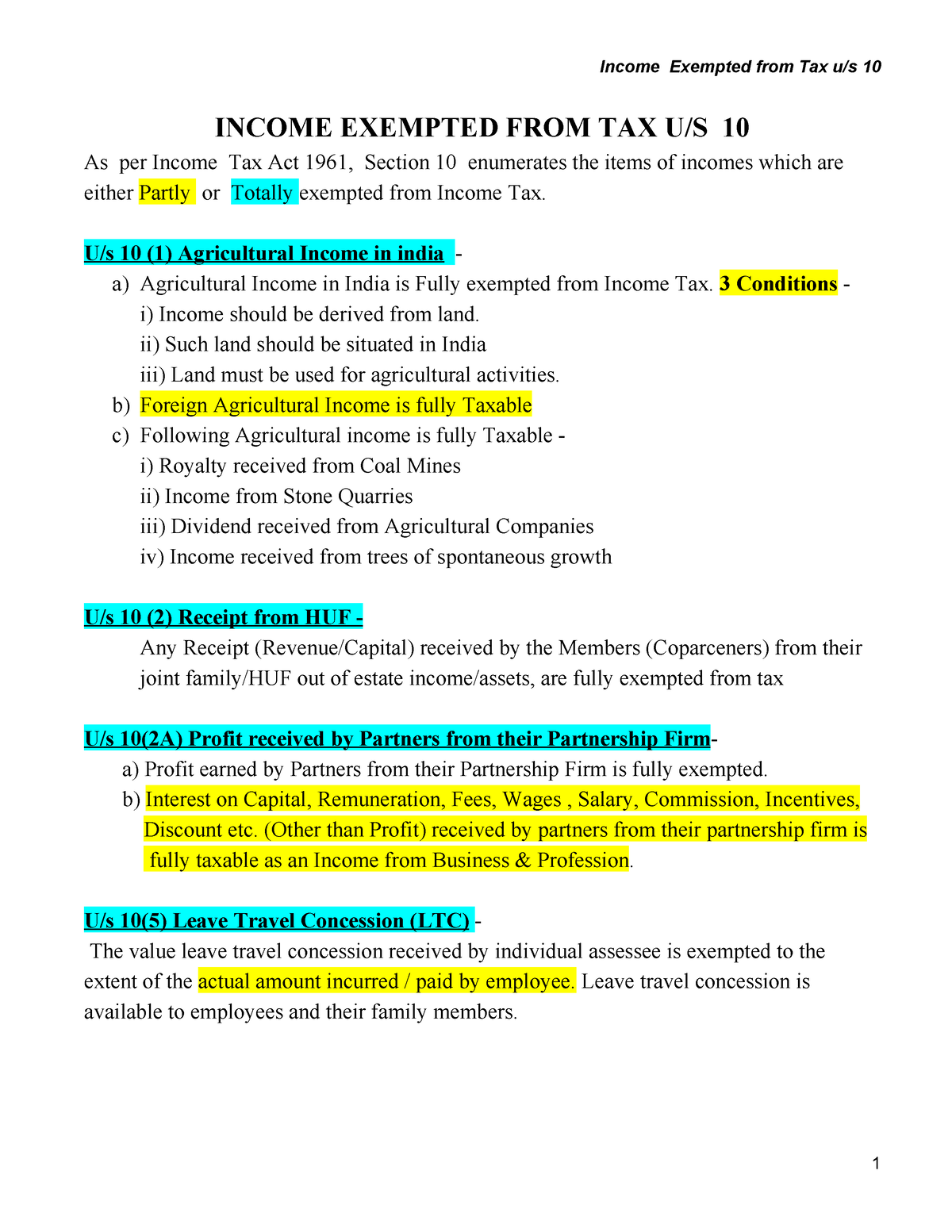

Income Exempted U s 10 Lecture Notes INCOME EXEMPTED FROM TAX U S

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/1e6ed41ab1579da043d5061a9e55bffc/thumb_1200_1553.png

Exempt Income Income Exempt From Tax As Per Section 10

https://www.wintwealth.com/blog/wp-content/uploads/2022/11/Exempt-Income.jpg

Why use persons instead of people Yesterday there was a sign a maximum occupancy sign I think and my son asked me why it said persons instead of people I was Hi citizens So I thought I ll do some investigation missions every now and then to do something different from xeno bounty hunting and 890 bording mission Are these broken

Hello everyone I stayed in a hotel recently and met a friend while staying there It took her 2 hours to get to me and another 2 to get back home I didn t think of this at the time Is there no way to really quickly view someone elses calender without adding their calender to my list of calenders I am sure that I had this ability before in older non 365

More picture related to Persons Exempted From Income Tax In India

Income Tax Notes CHAPTER 2 EXEMPTED INCOMES U S 10 Explain The

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/a4057e638566fb66e1d0c7e92e1eabbc/thumb_1200_1698.png

AskTheTaxWhiz VAT Exemptions Discounts For PWDs

https://www.rappler.com/tachyon/r3-assets/325083AF39F840F3A9A24C54E847049B/img/3690181D57F84186A3BD6F92AE0720FA/20190920-tax-whiz-1.jpg

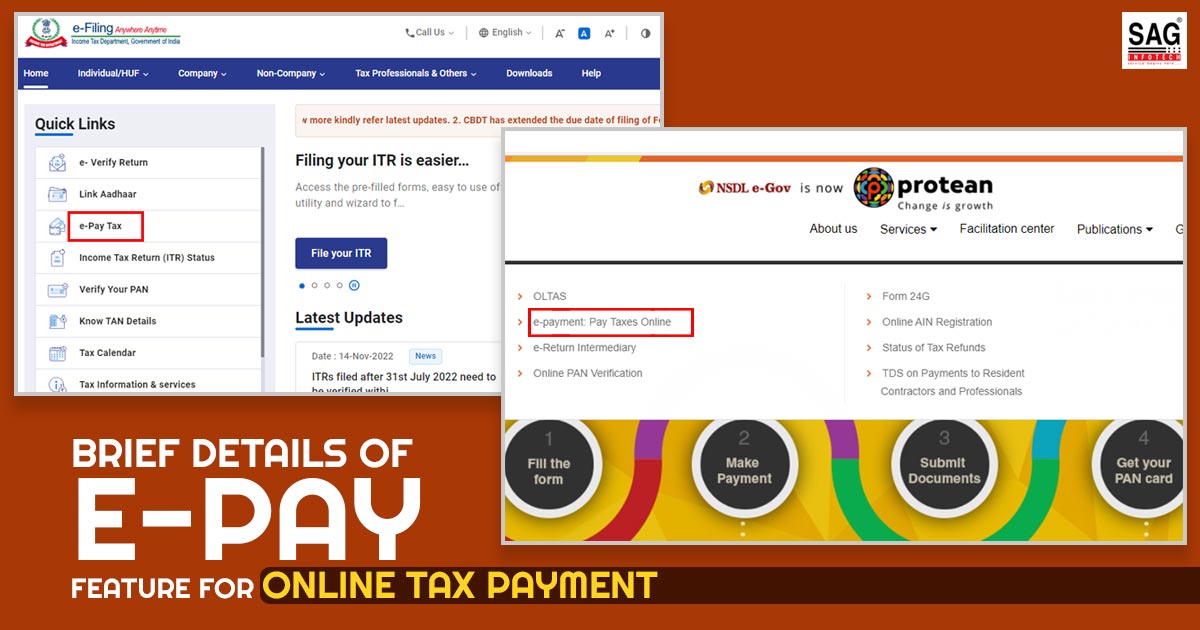

All About E pay Tax Feature With Online Payment Procedure

https://blog.saginfotech.com/wp-content/uploads/2022/11/brief-etails-of-e-pay-feature-for-online-tax-payment.jpg

201 votes 27 comments I loved Andrej s talk about in his Busy person s intro to Large Language Models video so I decided to create a reading Delete entire chat for both persons Is it possible to delete a chat for both persons I assume manually deleting every message and pressing Delete for everyone would do the

[desc-10] [desc-11]

CBDT Notified The Persons Exempted From The Provisions Related To

https://www.nyca.in/wp-content/uploads/2023/05/Angel-tax-25th-may-1536x865.jpg

CBDT Notified The Persons Exempted From The Provisions Related To

https://www.nyca.in/wp-content/uploads/2023/05/Angel-tax-25th-may-1024x577.jpg

https://www.reddit.com › ChatGPT › comments › can_multiple_users_us…

In order to prevent multiple repetitive comments this is a friendly request to u SaintMana to reply to this comment with the prompt they used so other users can

https://www.reddit.com › ... › what_does_the_term_people_and_persons…

It contains the term the people once and the term persons twice I think the common interpretation is that the opening use of the term people is actually understood as

CBDT Notified The Persons Exempted From The Provisions Related To

CBDT Notified The Persons Exempted From The Provisions Related To

CBDT Notified The Persons Exempted From The Provisions Related To

Gift Tax 2024 Exemptions In India Janel Lezlie

Who Qualifies For Tax Exemption A Comprehensive Guide

What Is The Tax Bracket For 2024 India Vevay Donelle

What Is The Tax Bracket For 2024 India Vevay Donelle

14 Magna Carta For Senior Citizens PWDs PART 14 Magna Carta For

Income Tax Slab Fy 2023 24 India Image To U

281 Certificate Income Tax Act

Persons Exempted From Income Tax In India - Is there no way to really quickly view someone elses calender without adding their calender to my list of calenders I am sure that I had this ability before in older non 365