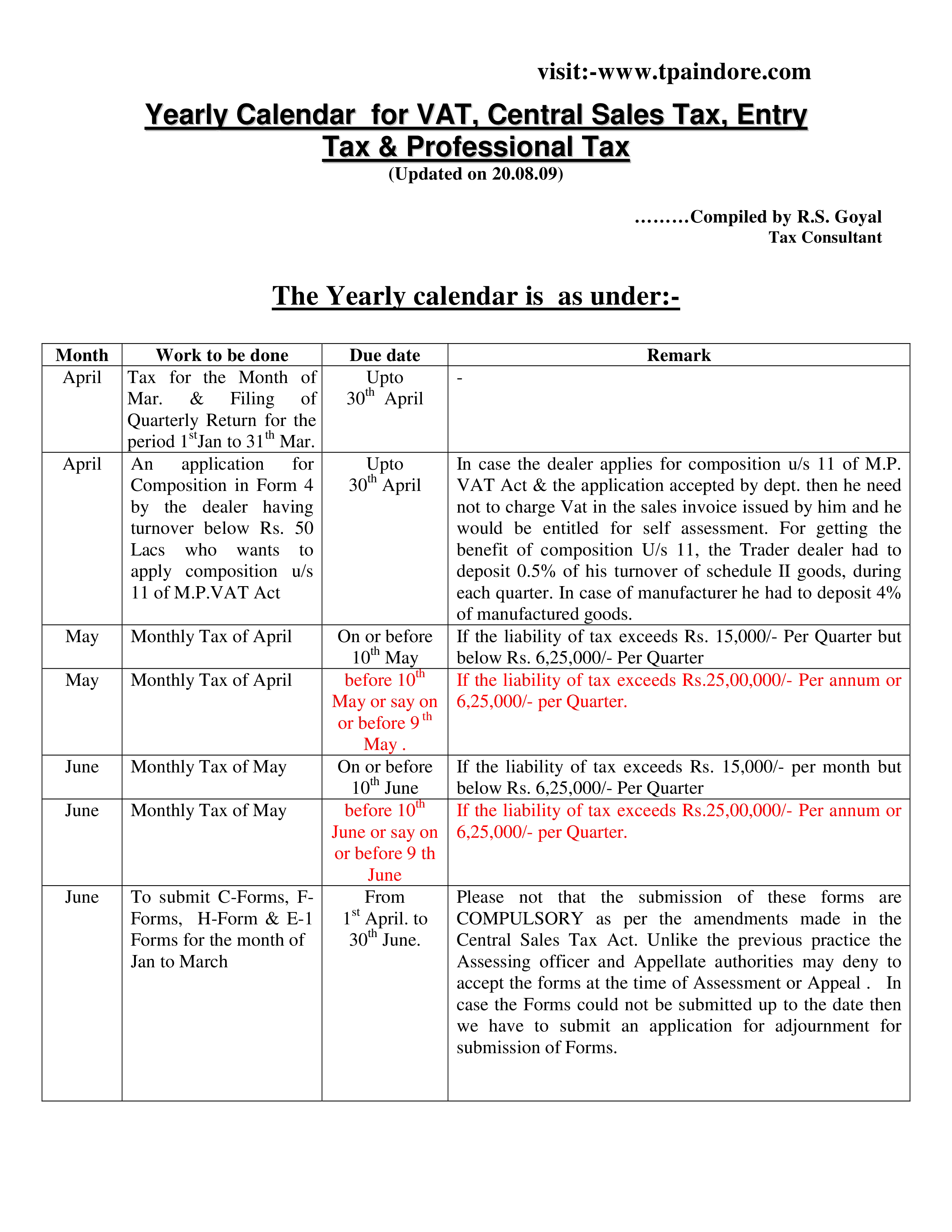

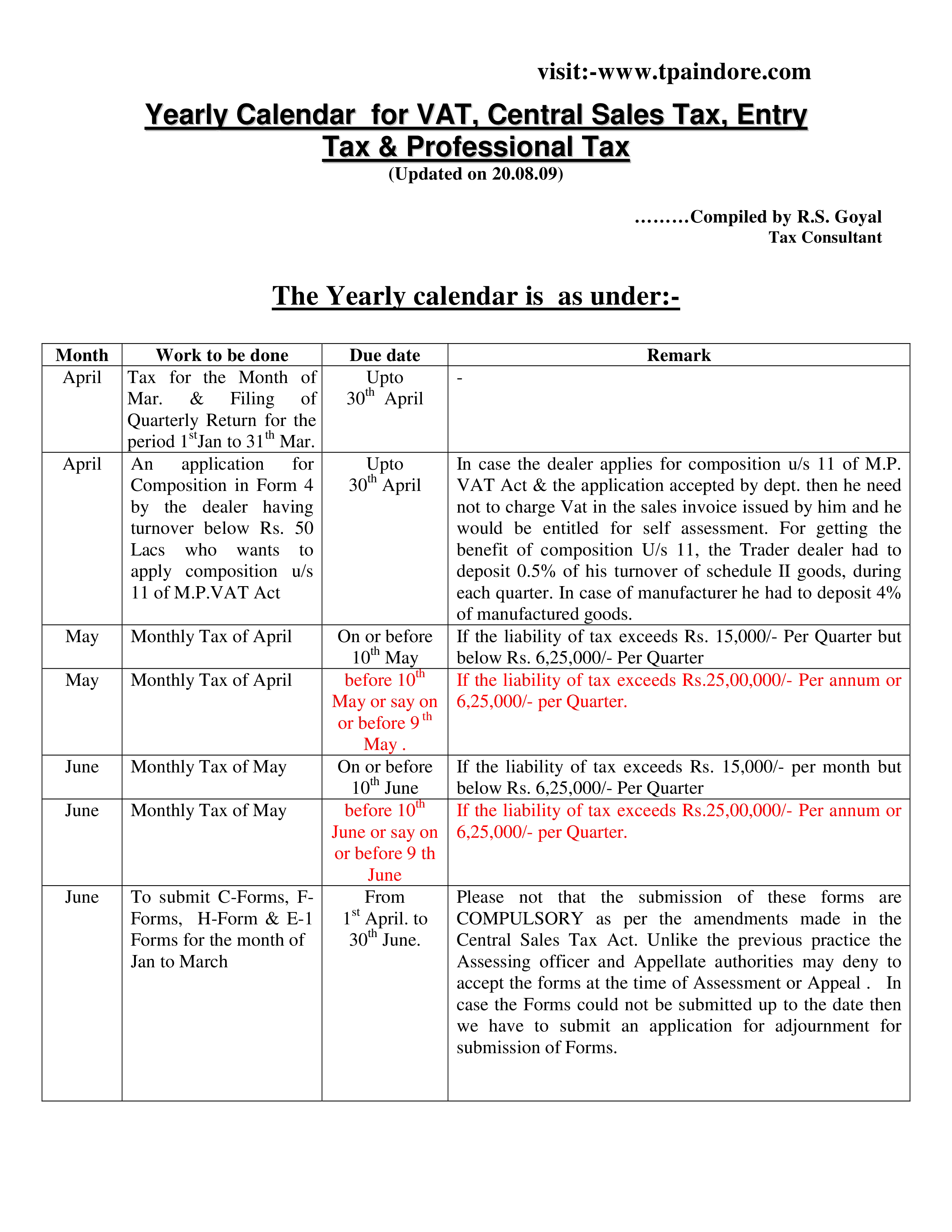

Sales Tax Rules 2006 Sales Tax Rules 2006 The SALES TAX RULES 2006 Updated By a team of ST FE Policy Wing FBR Islamabad Updated up to 31 10 2023 Latest amendments are in RED Any inadvertent

Sales Tax Rules 2006 1 The SALES TAX RULES 2006 Updated By FATE WING FEDERAL BOARD OF REVENUE ISLAMABAD Updated up to 30 10 2018 Last amendments made through S R O No 259 I 2018 S R O No 277 I 2018 S R O No 493 I 2016 S R O No 757 I 2016 S R O No 1031 I 2016 S R O No 227 I 2016 have been shown in RED Make the following rules namely THE SALES TAX RULES 2006 1 Short title application and commencement I These Rules may be called the Sales Tax Rules 2006 2 They shall be applicable to such persons or class of persons as are specified in the respective Chapters 3 They shall come into force on the first day of July 2006

Sales Tax Rules 2006

Sales Tax Rules 2006

https://i.ytimg.com/vi/KhA7XmOGffk/maxresdefault.jpg

The Sales Tax Rules 2006 List Of Chapters PDF Tax Refund Invoice

https://imgv2-1-f.scribdassets.com/img/document/420834614/original/eadc790adf/1703118455?v=1

AccountsIQ How Do I Partially Recover My Input Tax

https://static.helpjuice.com/helpjuice_production/uploads/upload/image/3606/direct/1518172604809-1518172604809.jpg

SALES TAX RULES 2006 Updated By Mr Hamid Hussain Joint Director Sales Tax Federal Excise Wing Federal Board of Revenue Islamabad Phone No 051 9205360 May not be use as a reference in courts Special Procedure for Adjustment of Sales Tax Due on Fertilizers Rules 2015 View 3 Sales Tax on Locally Manufactured Tractors Rules 2020 View 4 Sales Tax Rules 2006 Amended upto 26 Sept 2024 View 5 Inland Revenue Uniform Rules 2021 View 6 Special Procedure for Collection and Payment of Sales Tax Electric Power Supply by DISCOs

These rules are applicable for input tax paid for both taxable as well as exempt supply as per following formula Residual input tax credit Value of taxable supplies x Residual on taxable supplies Value of taxable input tax input tax exempt supplies Monthly apportionment as per formula is provisional which is subject t0 final adjustment This document outlines the chapters contained in The Sales Tax Rules 2006 There are 15 total chapters that cover various aspects of sales tax regulations such as registration filing of returns credit debit notes refunds audits zero rating of supplies and dispute resolution

More picture related to Sales Tax Rules 2006

Sales Tax Rules 2006 Amendment Supply Of Used Vehicles All Pak

https://i0.wp.com/allpaknotifications.com/wp-content/uploads/2020/10/Sales-Tax-Rules-for-Vehicles.jpeg?fit=734%2C884&ssl=1

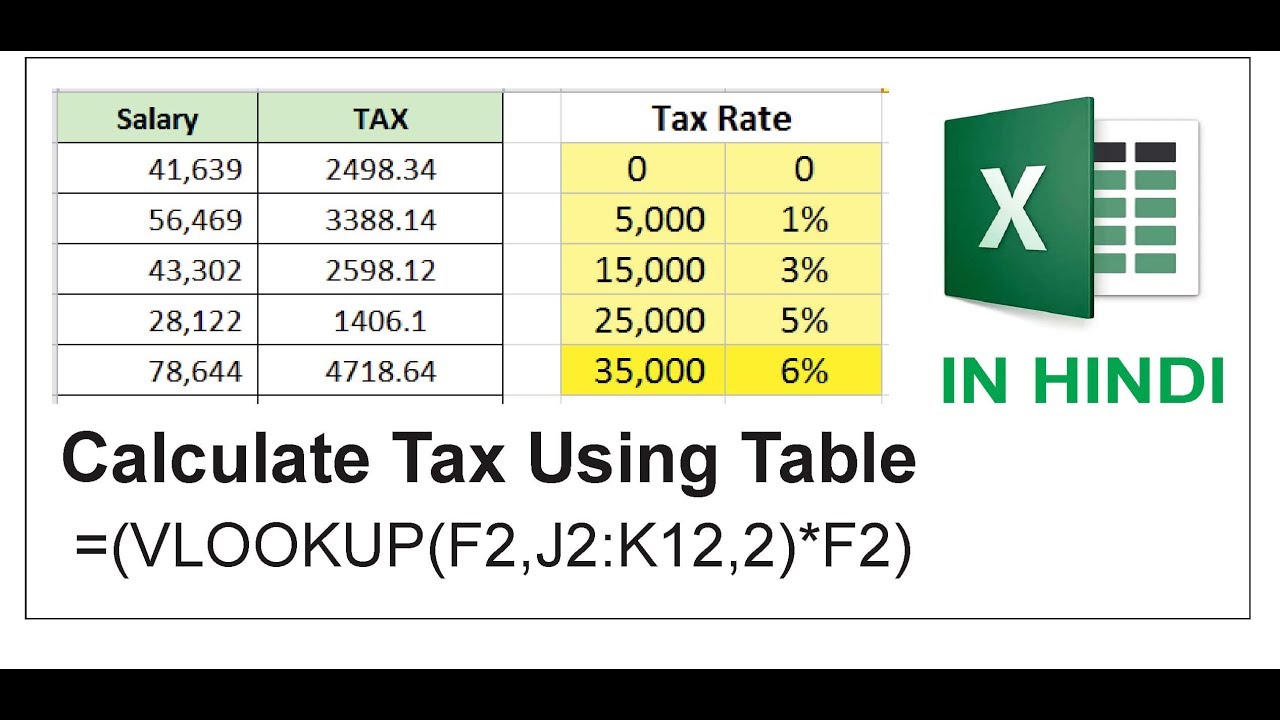

Calculate Sales Tax In Excel Using Vlookup Formula YouTube

https://i.ytimg.com/vi/m6HtEY-UDac/maxresdefault.jpg

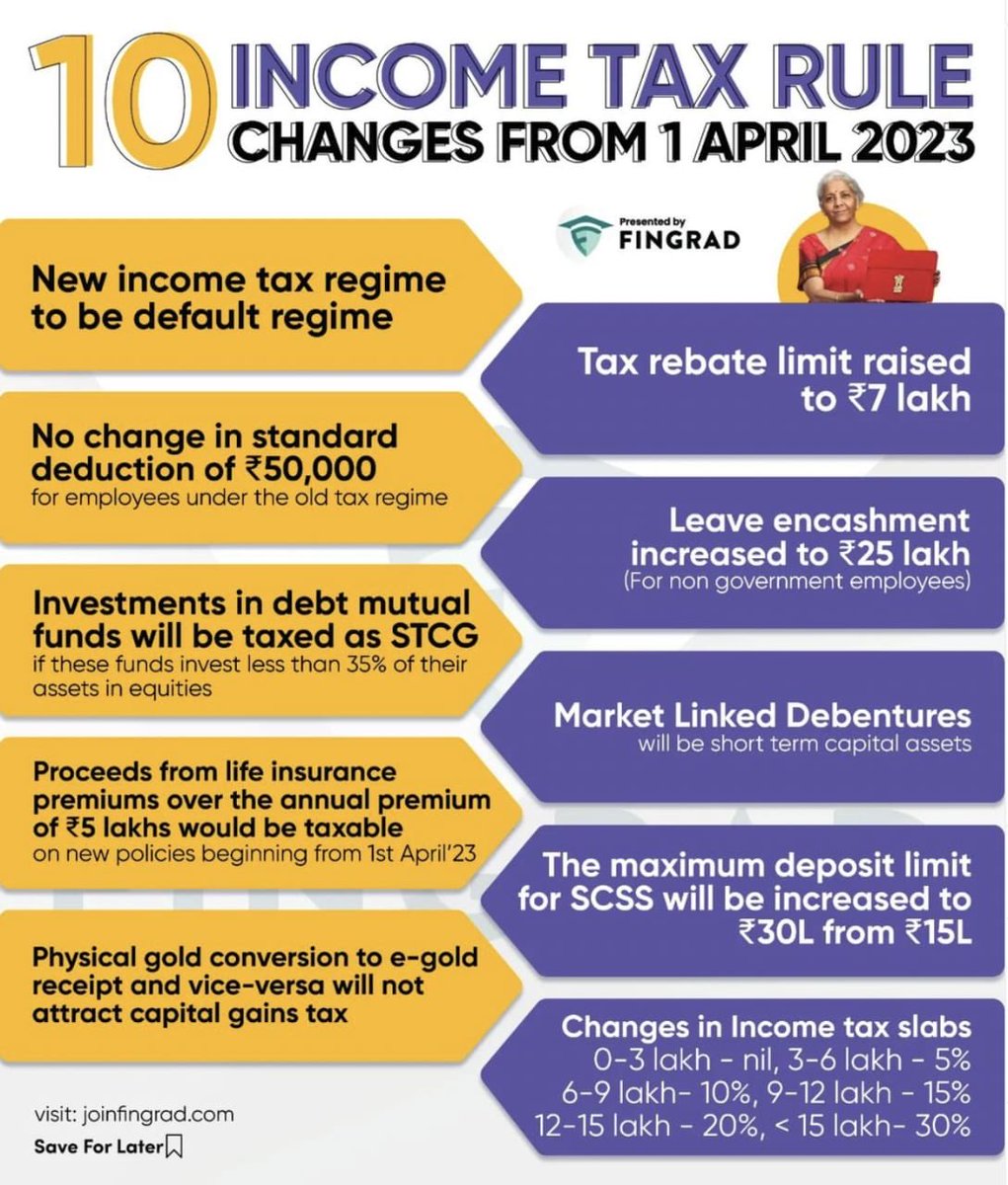

New Income Tax Rules To Come Into Effect From Today 01 04 2023 New

https://pbs.twimg.com/media/FsookcyaAAEqDqC.jpg

The Federal Board of Revenue is pleased to direct that the following further amendments shall be made in the Sales Tax Rules 2006 which shall take effect on the 1st day of July 2008 4 View Finance Act 2019 Explanation of important amendments in Sales Tax Act 1990 Federal Excise Act 2005 and Islamabad Capital Territory Tax on Services Ordinance 2001 View 06 of 2006

[desc-10] [desc-11]

Sales Tax pdf Templates At Allbusinesstemplates

https://www.allbusinesstemplates.com/thumbs/6e659190-6e21-499f-b500-e7f0a3517f93_1.png

Income Tax Rules Changes 1

https://static.india.com/wp-content/uploads/2023/03/income-tax-rules-change.jpg

https://download1.fbr.gov.pk/Docs/...

Sales Tax Rules 2006 The SALES TAX RULES 2006 Updated By a team of ST FE Policy Wing FBR Islamabad Updated up to 31 10 2023 Latest amendments are in RED Any inadvertent

https://download1.fbr.gov.pk/Docs/...

Sales Tax Rules 2006 1 The SALES TAX RULES 2006 Updated By FATE WING FEDERAL BOARD OF REVENUE ISLAMABAD Updated up to 30 10 2018 Last amendments made through S R O No 259 I 2018 S R O No 277 I 2018 S R O No 493 I 2016 S R O No 757 I 2016 S R O No 1031 I 2016 S R O No 227 I 2016 have been shown in RED

Sales Tax In The US How To Deal With My Count Solutions

Sales Tax pdf Templates At Allbusinesstemplates

Income Tax Rules No Tax Will Be Given To Those Earning 8 Lakhs A Year

Income Tax On Gifts All About Gift Tax Rules Exemptions List Of

Taxmann Master Guide To Income Tax Rules A Rule wise Commentary On

Taxmann Income Tax Rules As Amended By Finance Act 2022

Taxmann Income Tax Rules As Amended By Finance Act 2022

New Tax Rules 2023 Latest News Photos And Videos On New Tax Rules

Income Tax Rules CBDT Issues Guidelines On Deduction Of Tax At Source

Tax Rules And Due Diligence For Gambling Think Outside The Tax Box

Sales Tax Rules 2006 - This document outlines the chapters contained in The Sales Tax Rules 2006 There are 15 total chapters that cover various aspects of sales tax regulations such as registration filing of returns credit debit notes refunds audits zero rating of supplies and dispute resolution