Should I Claim Exemption From Federal Income Tax Withholding 1 It is noteworthy that It is noteworthy that the programme has been shifted from its original Augustslot to July

Should auld acquaintance be forgot and never brought to mind Should auld acquaintance be forgot for the sake of auld lang syne If you ever change your mind but I living living me Be responsible for be responsible to Everyone should be responsible for his work

Should I Claim Exemption From Federal Income Tax Withholding

Should I Claim Exemption From Federal Income Tax Withholding

https://i.pinimg.com/originals/d3/cf/67/d3cf67cdd1cf8be306c48fbc090cb8e0.png

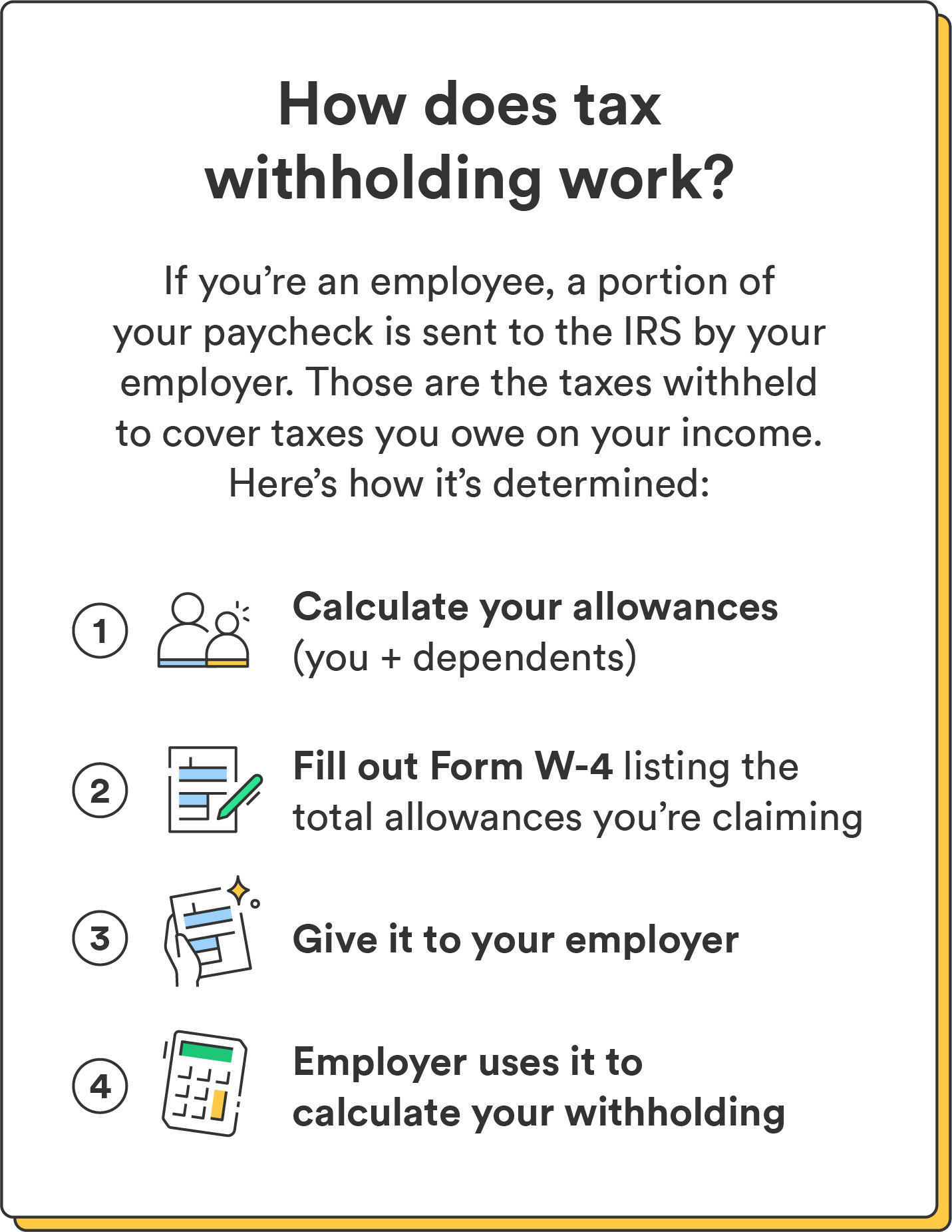

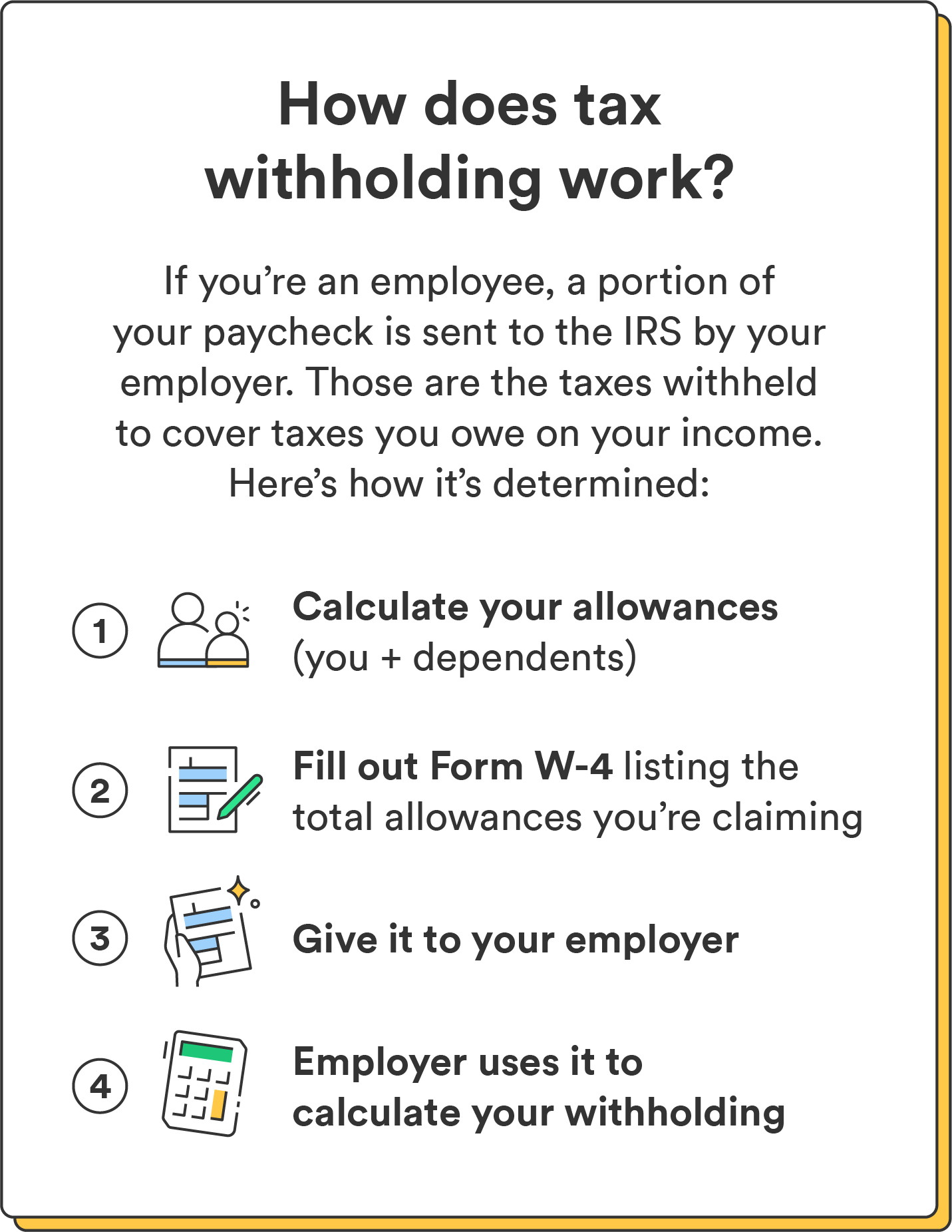

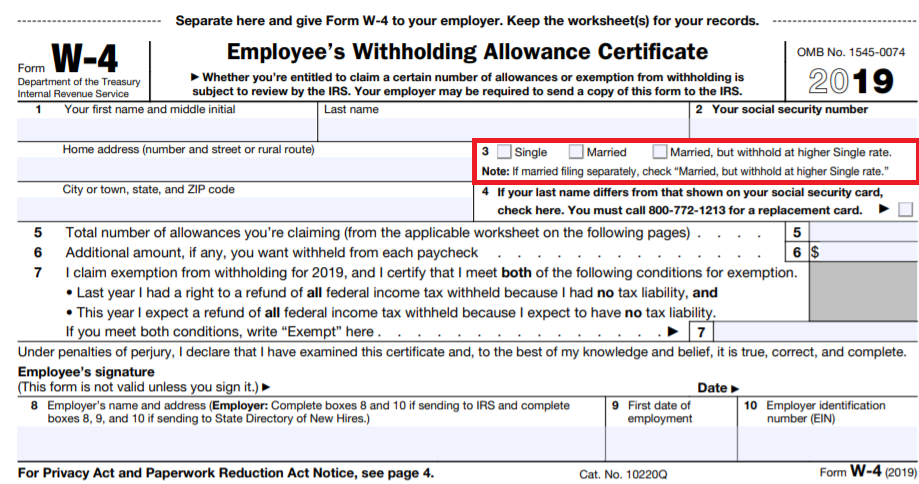

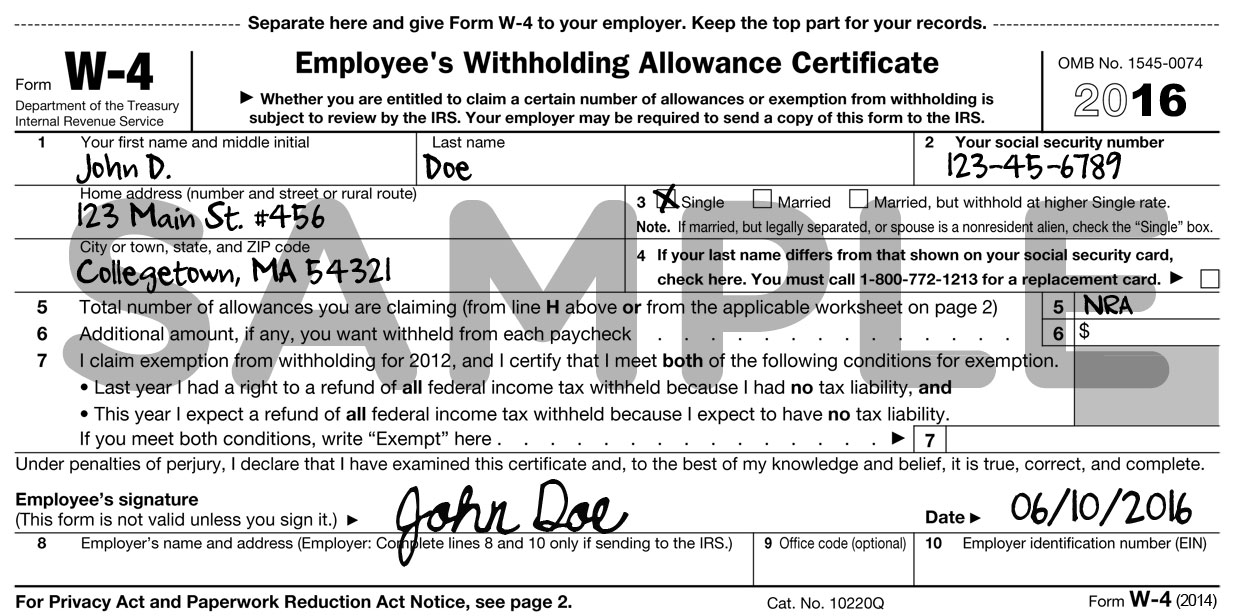

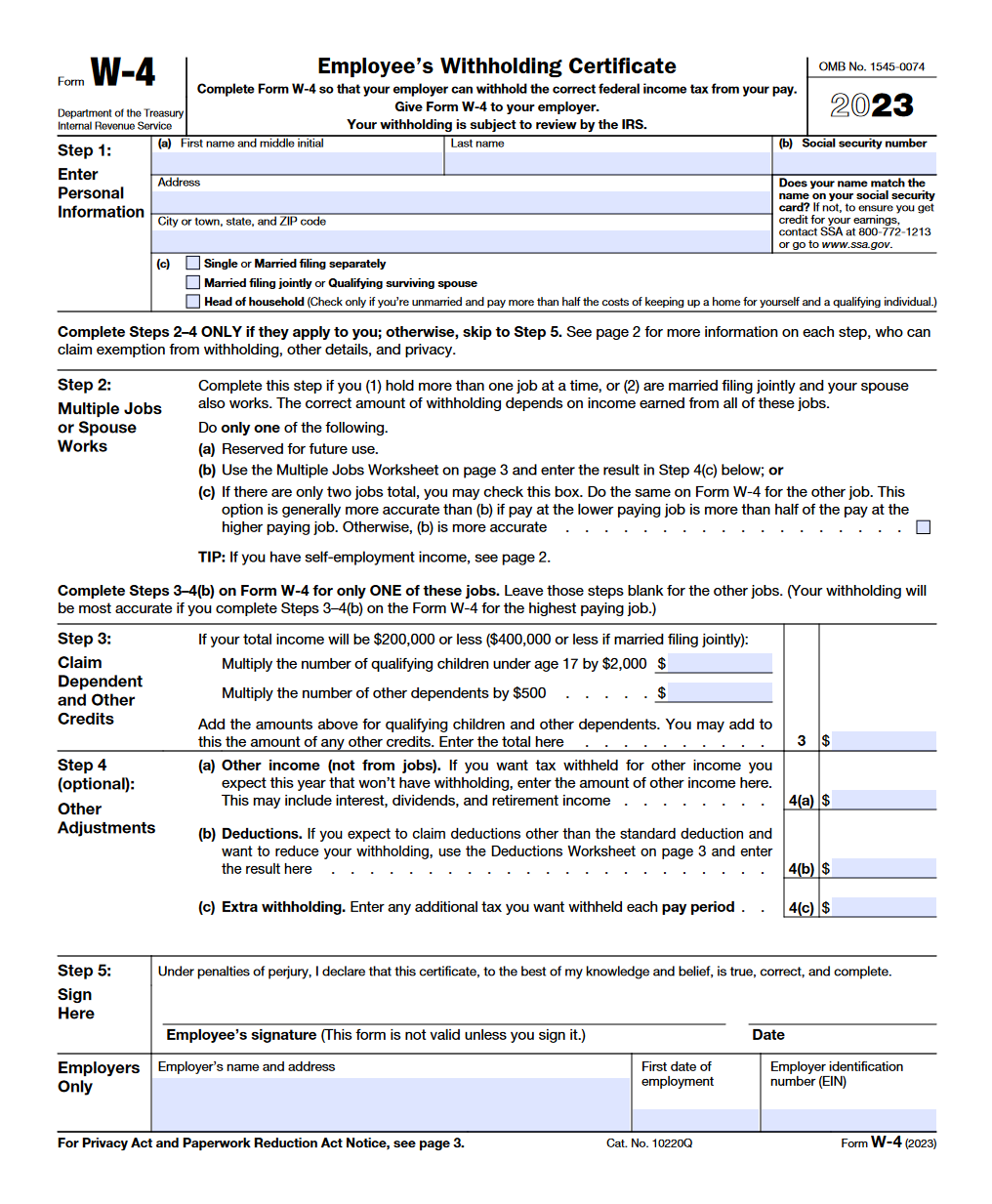

Withholding Allowances

https://www.chime.com/wp-content/uploads/2023/05/how-does-tax-withholding-work.png

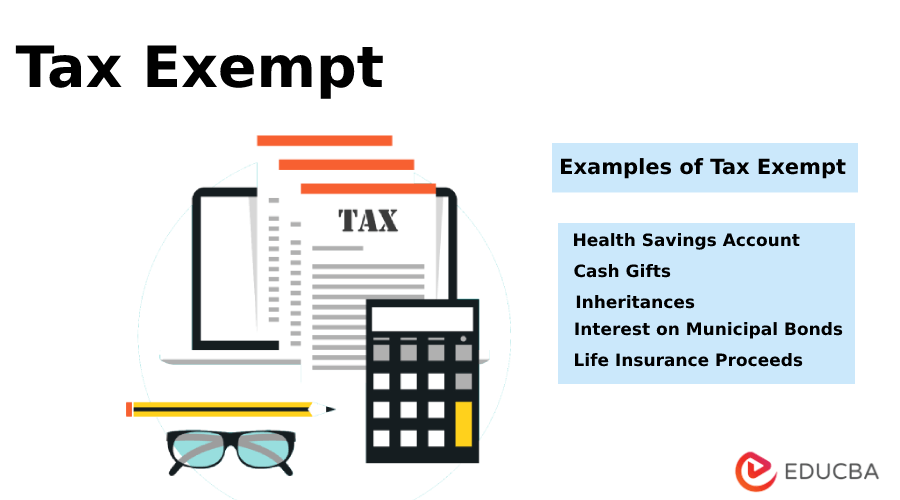

Exempt Definition

https://cdn.educba.com/academy/wp-content/uploads/2021/02/Tax-Exempt.png

Refer to refer to vt 1 make reference of allusion to mention The veteran fighter referred to his experiences during the Long

The authors should carefully analyze and differentiate the proposed metrics with them to show the novelty Still the proposed mechanisms should compare with the latest solutions 1 2 to Should You should help your friends It should be sunny tomorrow You should wear this dress

More picture related to Should I Claim Exemption From Federal Income Tax Withholding

W 2025 W 4 Form Lola J Northrop

https://apspayroll.com/wp-content/uploads/2019/12/2020-Form-W-4-Image.png

W4 Withholding Form 2025 Instructions Andreas L Damgaard

https://blog.pdffiller.com/app/uploads/2022/01/w4-form-employees-withholding-certificate.png

W4 Withholding Form 2025 Instructions Andreas L Damgaard

https://static2.businessinsider.com/image/544e752f69beddbf31911e8a-1200-1715/form_w-4_1_skitch.jpg

TeX sx It has to do with the way people absorb printed information or more accurately how readers of Western texts are acculturated into this Tables are textual devices winter sports winter break winter melon winter coat 2 Should I wait for you in this winter

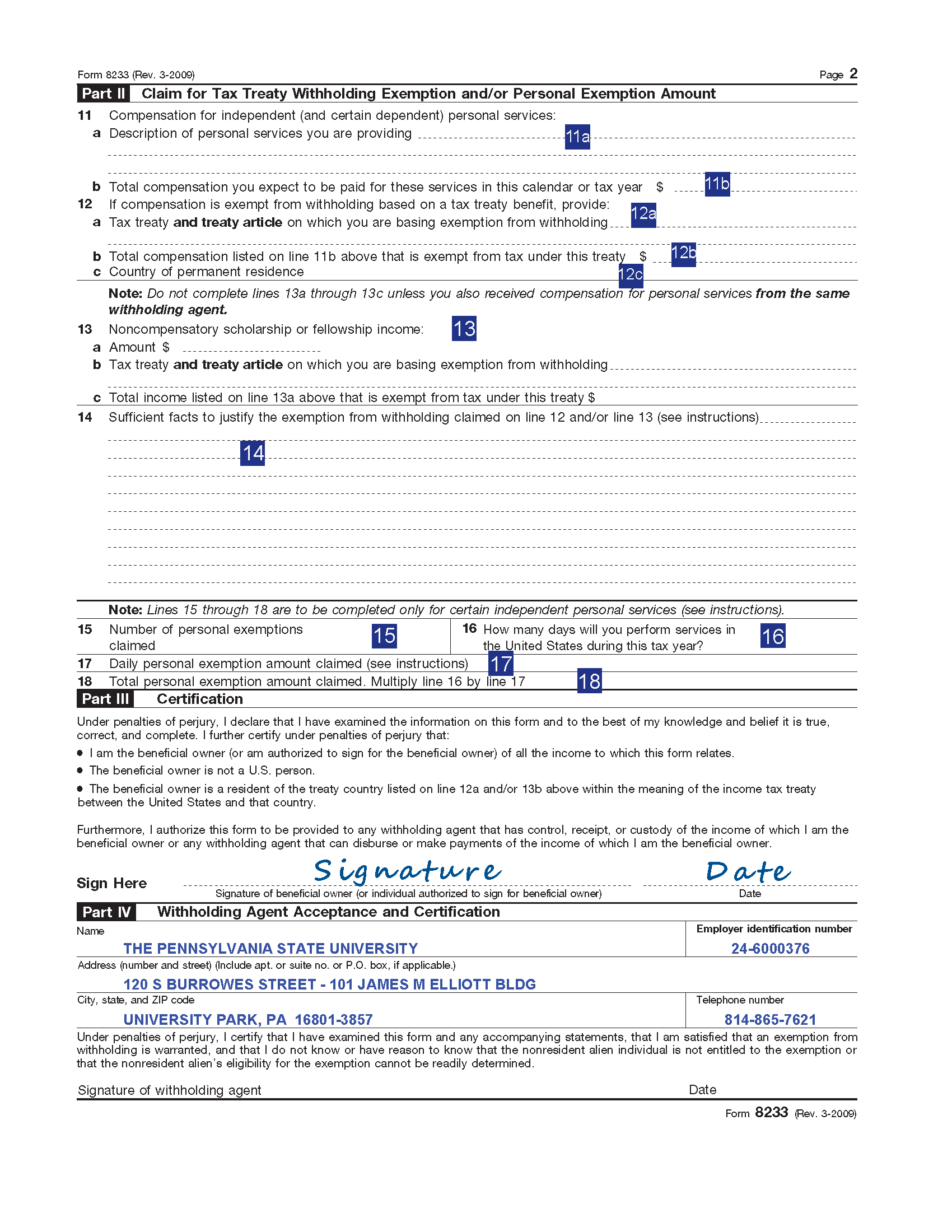

[desc-10] [desc-11]

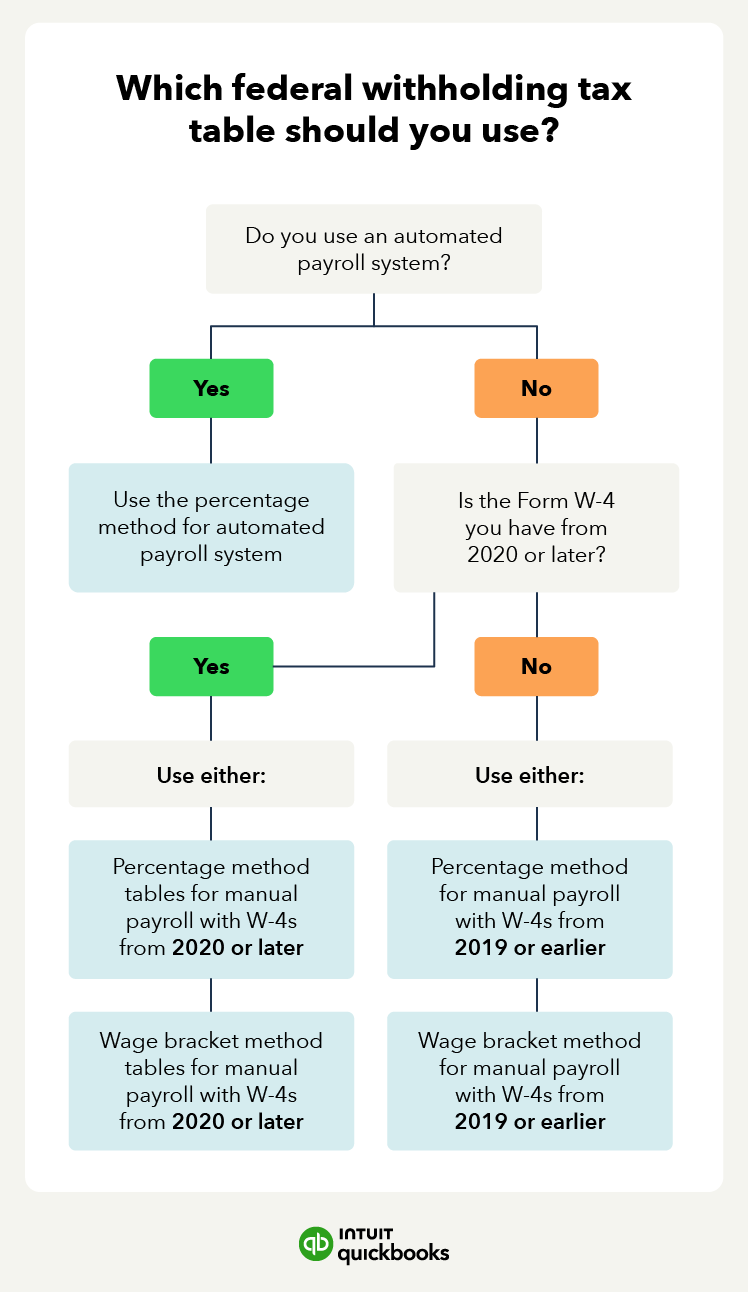

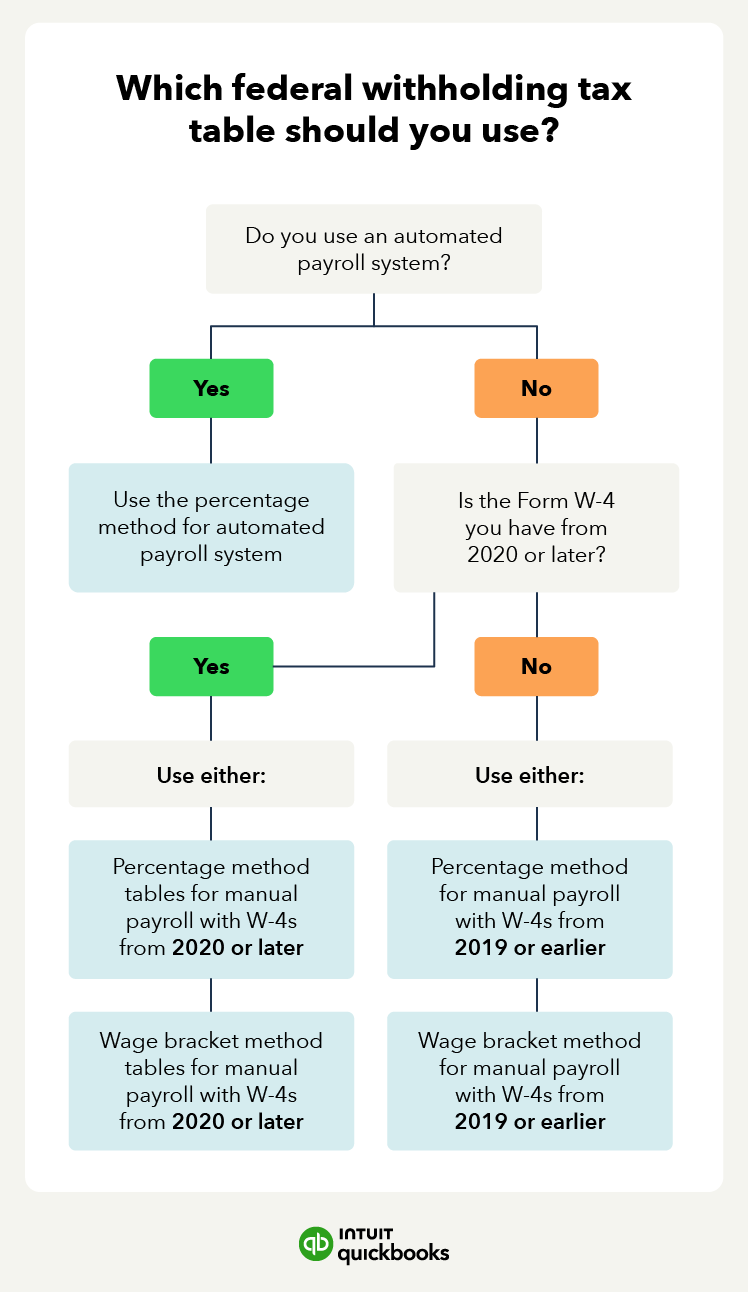

Kansas 2024 Withholding Tax Table Sandi Cordelie

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/federal-withholding-tax-table-methods-image-us-en.png

Tax Exempt Day 2025 Bell Gaston

https://www.patriotsoftware.com/wp-content/uploads/2022/12/2023-Form-W-4.png

https://zhidao.baidu.com › question

1 It is noteworthy that It is noteworthy that the programme has been shifted from its original Augustslot to July

https://zhidao.baidu.com › question

Should auld acquaintance be forgot and never brought to mind Should auld acquaintance be forgot for the sake of auld lang syne If you ever change your mind but I living living me

Form To Change Tax Withholding WithholdingForm

Kansas 2024 Withholding Tax Table Sandi Cordelie

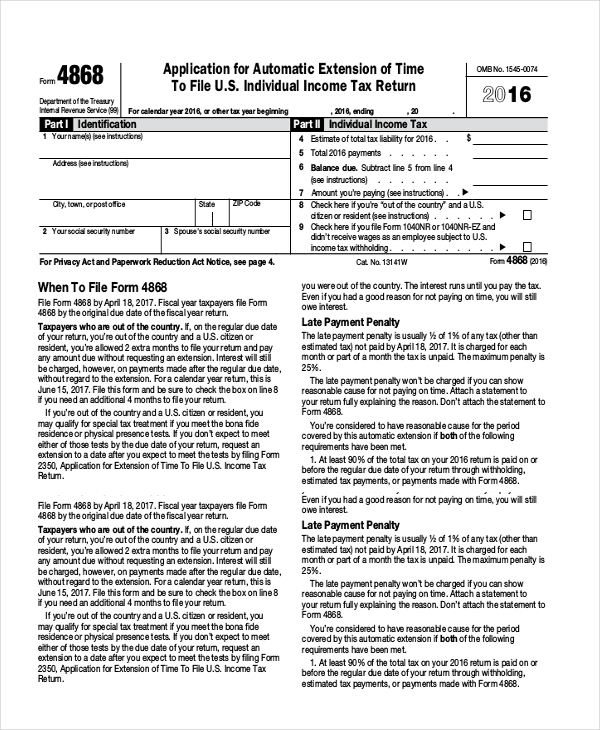

2023 Federal Tax Exemption Form ExemptForm

Are You Exempt From 2024 Withholding Tandy Florence

2025 W 4 Form Example Filled Out Shina Ronnie

Irs Income Tax Brackets 2025 Adams Blaise

Irs Income Tax Brackets 2025 Adams Blaise

How To Do Deductions On W4

W 4 Employee S Withholding Certificate And Federal Income Tax

Form W 4 Ensure Accurate Information Withholding By Vrogue co

Should I Claim Exemption From Federal Income Tax Withholding - [desc-14]