Tax On 30 Lakhs Ctc Income tax Personal business corporation trust international and non resident income tax

Information on taxes including filing taxes and get tax information for individuals businesses charities and trusts Income tax How much tax will I pay on my retirement lump sum withdrawals From age 55 you can take up to one third of your retirement fund Retirement Annuity Company Pension Fund

Tax On 30 Lakhs Ctc

Tax On 30 Lakhs Ctc

https://i.ytimg.com/vi/5pyZCvsZcqo/maxresdefault.jpg

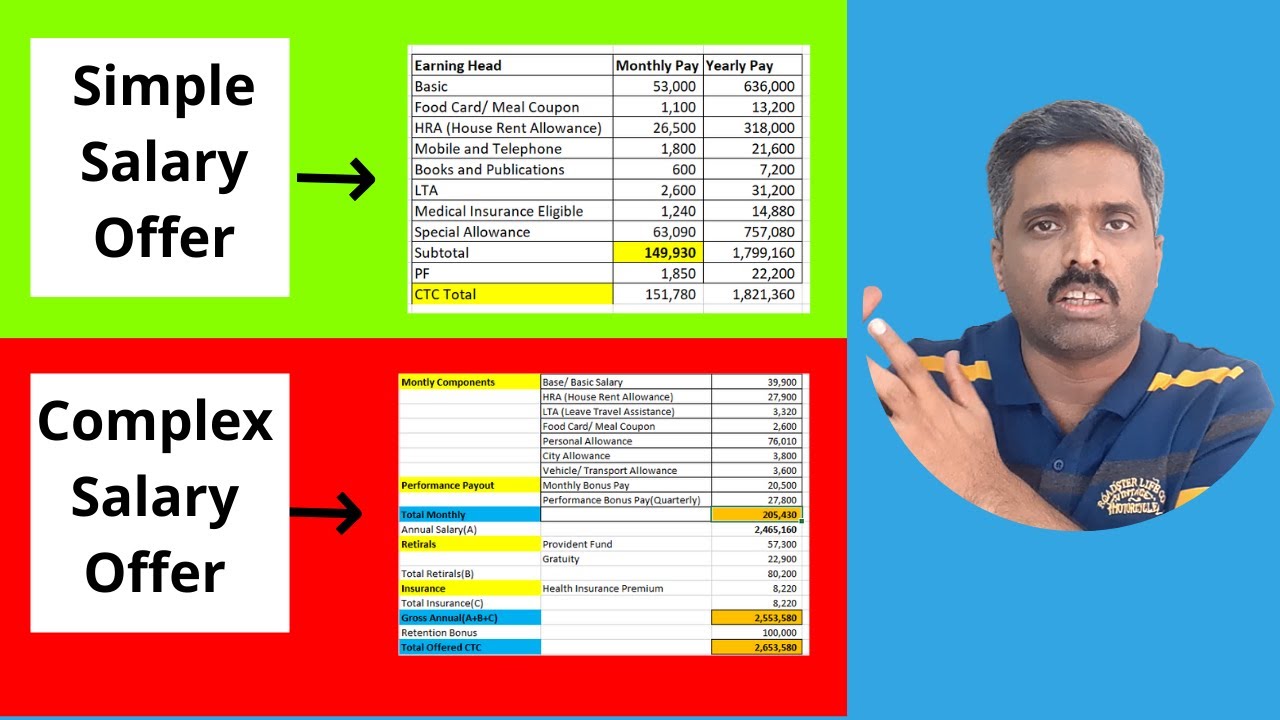

How To Compare Salary Structure Or CTC In Two Offer Letters YouTube

https://i.ytimg.com/vi/jnI3rfDltZQ/maxresdefault.jpg

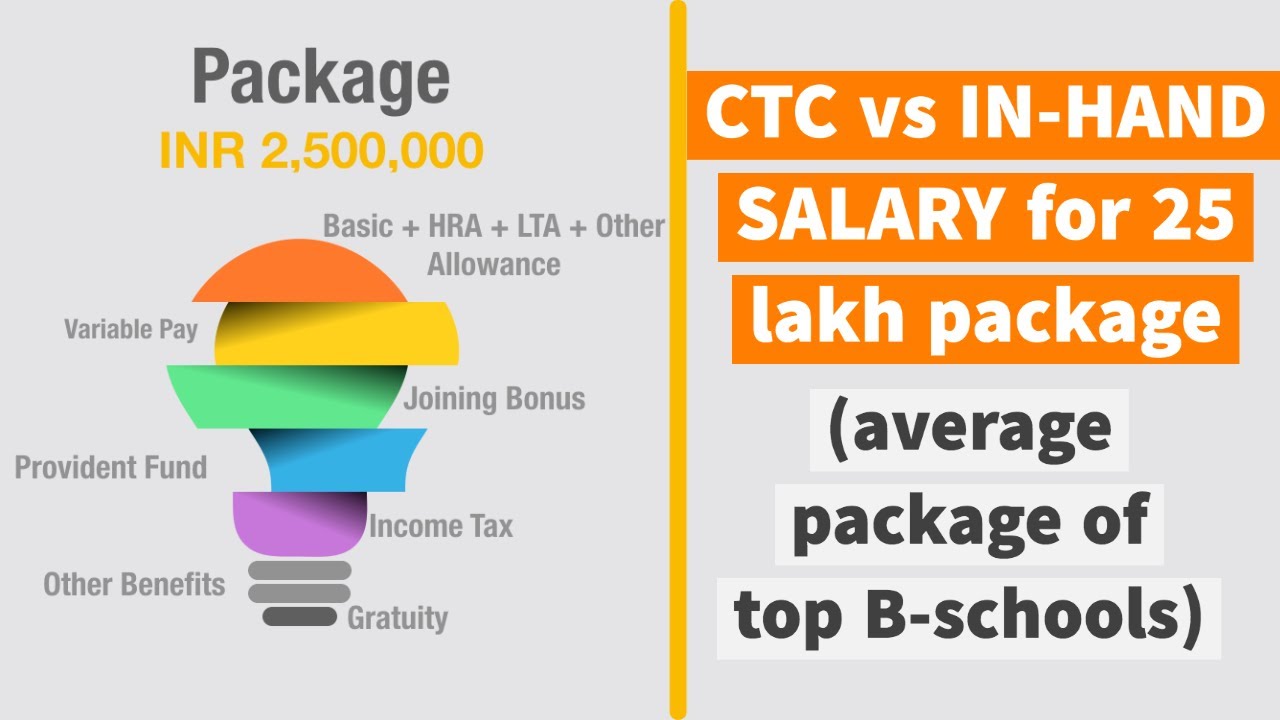

CTC Vs Actual Take home Salary I Reality Of 25 Lakh Package In India

https://i.ytimg.com/vi/fsQDQT2LA1A/maxresdefault.jpg

The middle class tax cut would reduce the tax rate that is applied to the first 57 375 in 2025 of an individual s taxable income regardless of their income level As shown Income tax calculator Updated for 2024 25 tax year how much tax will you pay on your salary in South Africa find out with the SARS income tax calculator updated for 2024 25 tax year

When using certified tax software the Auto fill my return service automatically fills in parts of your income tax and benefit return with information that the CRA has available at Personal income tax Who should file a tax return how to get ready and file taxes payment and filing due dates reporting income and claiming deductions and how to make payments or

More picture related to Tax On 30 Lakhs Ctc

40 LPA In Hand Salary Reality Of 40 LPA Tax Calculation For 40

https://i.ytimg.com/vi/CcMfZw6JQh8/maxresdefault.jpg

Sad Reality Of 30 Lakh Package In India How To Calculate Your In Hand

https://i.ytimg.com/vi/JnQHzZIZ0gk/maxresdefault.jpg

30 LPA In Hand Salary Reality Of 30 LPA Tax Calculation For 30

https://i.ytimg.com/vi/EbEOXcrNFwc/maxresdefault.jpg

This tax season the Canada Revenue Agency CRA has simplified its sign in process making it easier to access the My Account My Business Account and Represent a Understand how premiums and contributions to various insurance plans such as group life health dental and disability insurance are treated for tax purposes under CRA guidelines

[desc-10] [desc-11]

wipro salary Wipro Salary Slip Structure Variable Pay 9 5 Lakhs

https://i.ytimg.com/vi/Zqoxi8GlG3A/maxresdefault.jpg

35 LPA In Hand Salary Reality Of 35 LPA Tax Calculation For 35

https://i.ytimg.com/vi/oehZislUjXo/maxresdefault.jpg

https://www.canada.ca › en › services › taxes › income-tax

Income tax Personal business corporation trust international and non resident income tax

https://www.canada.ca › en › services › taxes

Information on taxes including filing taxes and get tax information for individuals businesses charities and trusts Income tax

Reality Of A 32 Lakh Salary Package At IIT NIT IIMs In Hand Salary Vs

wipro salary Wipro Salary Slip Structure Variable Pay 9 5 Lakhs

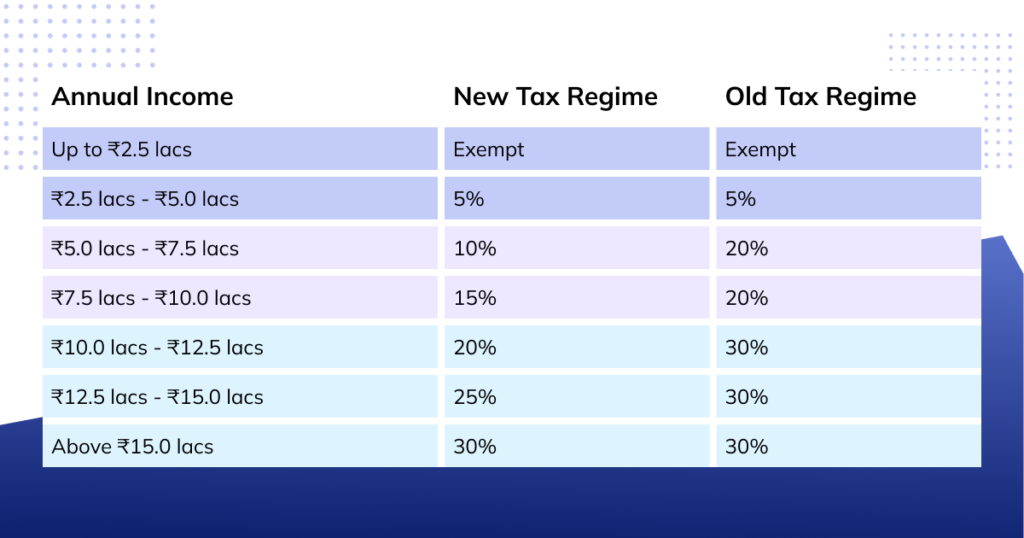

New Tax Regime Vs Old Tax Regime Which Is Better With Calculator

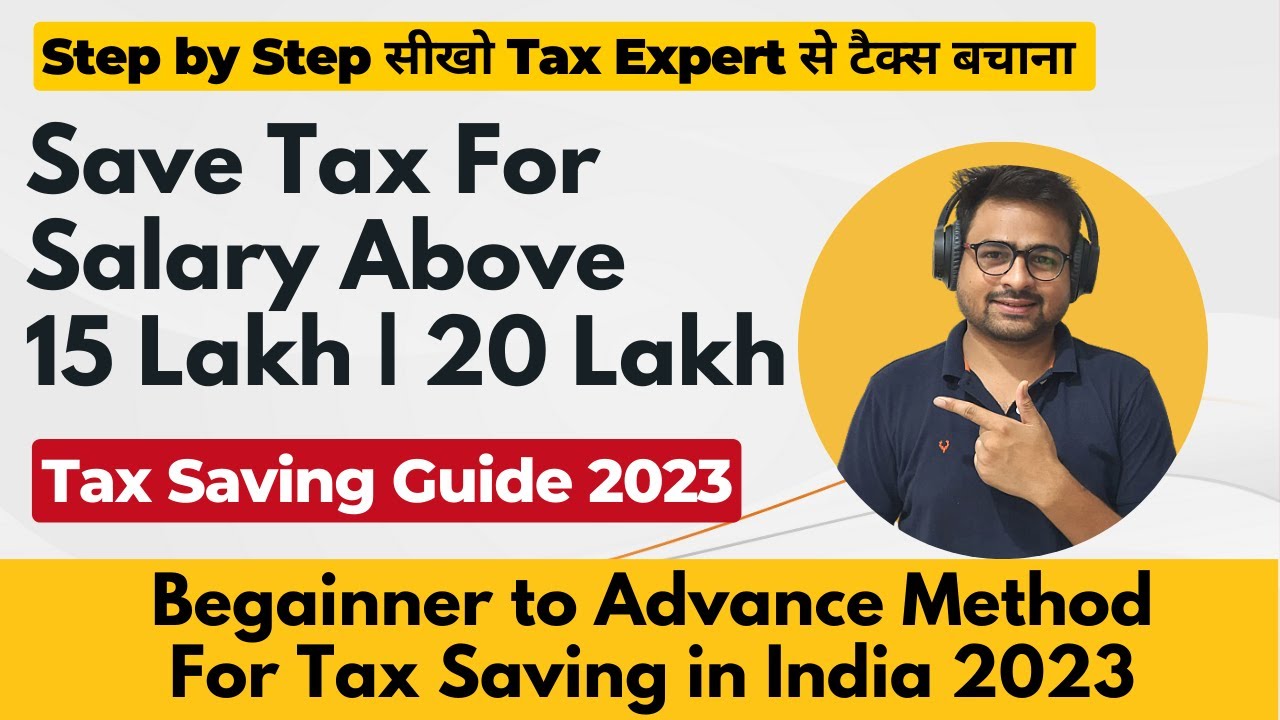

How To Save Tax For Salary Above 15 Lakhs Or 20 Lakhs Income Tax

How To Save Income Tax On Salary Above 7 Lakh Old Vs New Tax Regime

ReillyViola

ReillyViola

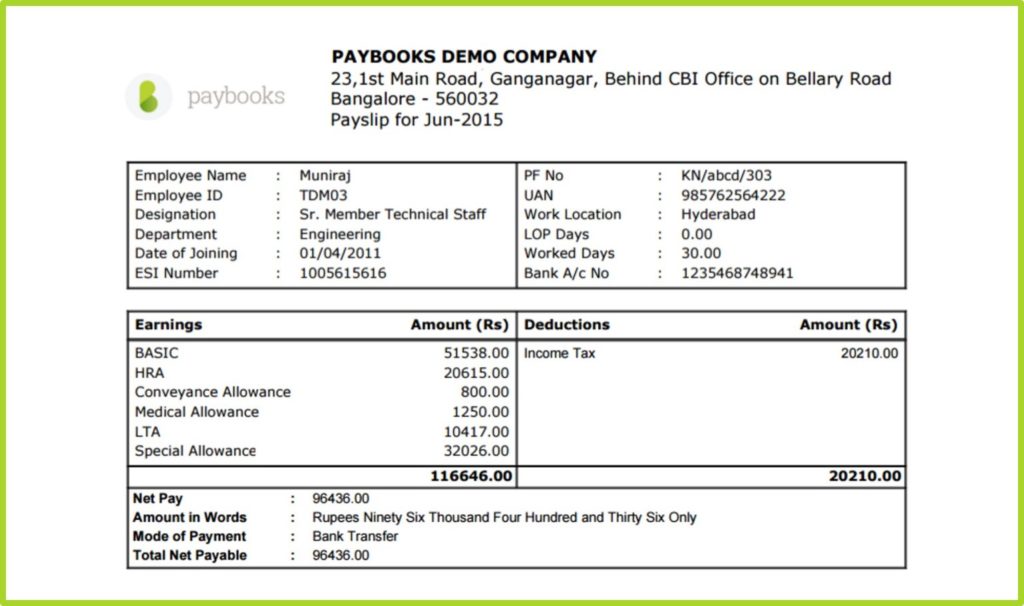

Salary Slip Format India Kidsop

Salary Tax Calculator Fy 2023 24 Image To U

Form 16 Meaning Eligibility Benefits More Razorpay Payroll

Tax On 30 Lakhs Ctc - The middle class tax cut would reduce the tax rate that is applied to the first 57 375 in 2025 of an individual s taxable income regardless of their income level As shown