What Are Expenses Treated As Non Taxable Fringe Benefits These include small items such as pens pencils paper clips stationery and stamps For office expenses related to your workspace see Line 8811 Office stationery and supplies below

Variable B is the taxpayer s ratio of permissible expenses for the year multiplied by the taxpayer s ATI unless the taxpayer made an election under subsection 18 21 2 The ratio of Moving expenses reasonable moving expenses that have not been claimed as moving expenses on anyone s tax return to move a person who has a severe and prolonged mobility

What Are Expenses Treated As Non Taxable Fringe Benefits

What Are Expenses Treated As Non Taxable Fringe Benefits

https://lennox-lld.com/wp-content/uploads/2022/04/what-makes-1.png

http://sport600.ru/images/what.png

What Just Happened Jimmy Sticker What Just Happened Jimmy Elvis The

https://media.tenor.com/S2LnWeldyVwAAAAC/what-just-happened-jimmy.gif

The expenses you can deduct include any GST HST you incur on these expenses minus the amount of any input tax credit claimed However since you cannot deduct personal expenses For more information on deductible expenses go to Rental expenses you can deduct Non compliant amount For tax years after 2023 if a short term rental is non compliant for any

The medical expense tax credit provides tax relief for individuals who have sustained significant medical expenses for themselves or certain of their dependants The medical expense tax However as a rule you can deduct any reasonable current expense you incur to earn income The deductible expenses include any GST HST you incur on these expenses

More picture related to What Are Expenses Treated As Non Taxable Fringe Benefits

E Commerce Distribution Channels Explained FigPii Blog

https://www.figpii.com/blog/wp-content/uploads/2022/08/Direct-and-Indirect-channels-1024x1024.png

M L Studios Comedy Podcast Podchaser

https://www.mandlstudios.com/wp-content/uploads/2024/03/What-You-Do-sq-2.jpg

Contact Us

https://whataithinksabout.com/wp-content/uploads/2023/10/WAITA.png

For more information see Income Tax Folio S1 F3 C4 Moving Expenses and the instructions on Form T1 M Moving Expenses Deduction If you are moving to be enrolled in a In this info sheet the term out of pocket expenses refers to expenses that a supplier may incur when providing a taxable other than zero rated supply of services to a client Generally the

[desc-10] [desc-11]

What Is She Doing Happily Sticker What Is She Doing Happily What Shes

https://media.tenor.com/3s-j_WEDwK8AAAAC/what-is-she-doing-happily.gif

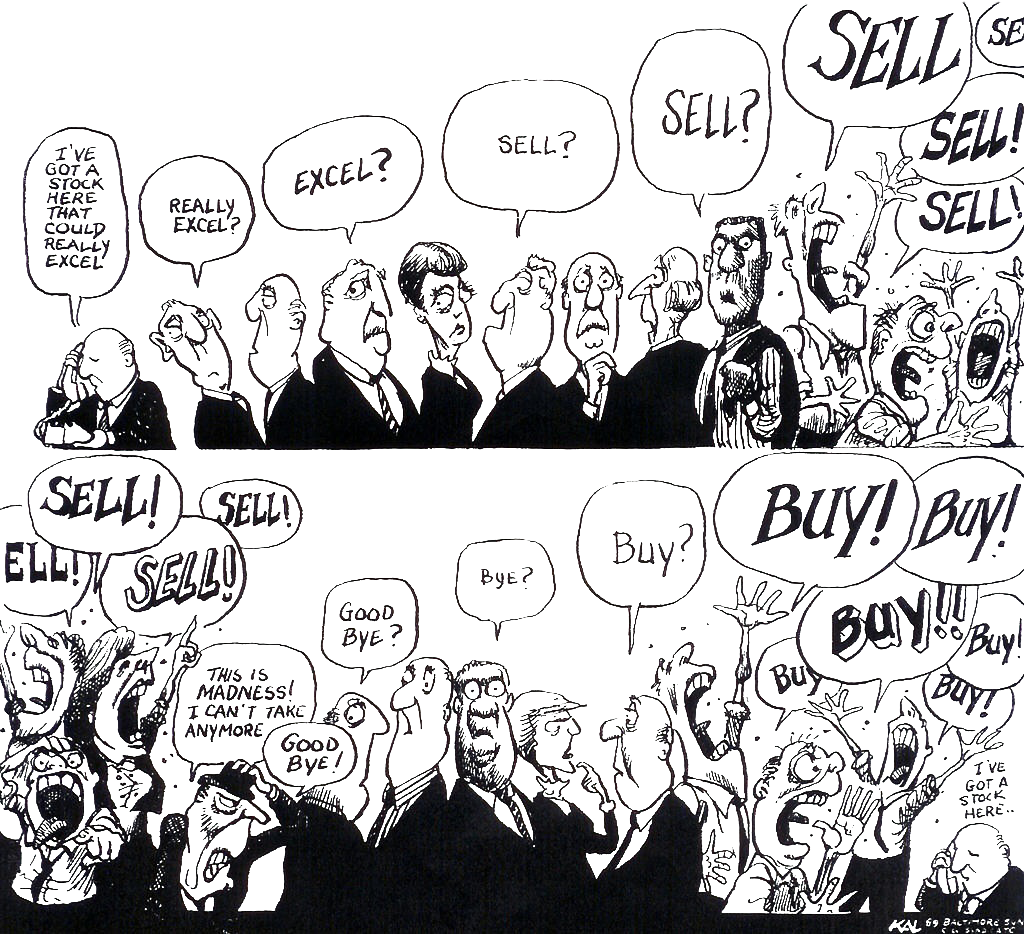

For Your Second Assignment You Will Be Investigating Chegg

https://media.cheggcdn.com/media/2e9/2e9dd536-a7b0-46bf-809c-c29f61cbd552/phpsaFig4

https://www.canada.ca › en › revenue-agency › services › forms-publicat…

These include small items such as pens pencils paper clips stationery and stamps For office expenses related to your workspace see Line 8811 Office stationery and supplies below

https://www.canada.ca › en › revenue-agency › programs › about-canad…

Variable B is the taxpayer s ratio of permissible expenses for the year multiplied by the taxpayer s ATI unless the taxpayer made an election under subsection 18 21 2 The ratio of

What Jim Lake Jr Sticker What Jim Lake Jr Trollhunters Tales Of

What Is She Doing Happily Sticker What Is She Doing Happily What Shes

Getting What You Want Vs What You Need By Arjuna Ishaya Medium

We Print What You Want

The Office Thats What She Said Sticker The Office Thats What She Said

What Causes A Market Crash and What You Can Do Minimalist Trading

Tucker Carlson GIF A Digital Snapshot Of Controversy And Humor

What Is Funneling R ClashOfClansMemes

What Are Expenses Treated As Non Taxable Fringe Benefits - The medical expense tax credit provides tax relief for individuals who have sustained significant medical expenses for themselves or certain of their dependants The medical expense tax