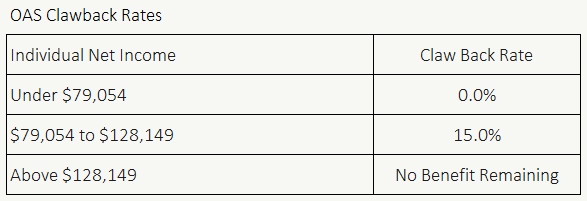

What Income Is Oas Clawback Based On The Old Age Security OAS clawback officially known as the OAS Recovery Tax is calculated based on your Net Income Before Adjustments line 23400 on your tax return not your taxable income line 26000

What is OAS clawback The government starts reducing your OAS amount once you make over 90 997 in 2024 taxable income note that this figure changes annually according to inflation This reduction is commonly If your net world income exceeds the threshold amount 86 912 for 2023 you have to repay part or your entire OAS pension Part or your entire OAS pension is reduced as a monthly recovery

What Income Is Oas Clawback Based On

What Income Is Oas Clawback Based On

https://i.ytimg.com/vi/8b91s_FwDUw/maxresdefault.jpg

Understand The OAS Clawback Rules In 2023 YouTube

https://i.ytimg.com/vi/L_VRnwYAS-c/maxresdefault.jpg

How To Avoid The OAS Clawback In Canada Strategies For High Income

https://i.ytimg.com/vi/oqifkjULA9I/maxresdefault.jpg

What income is the OAS clawback based on The OAS clawback is officially known as the OAS recovery tax and as my client suspected the clawback for any payment The OAS clawback is based entirely on individual income not household or family income If your personal net income exceeds the government set threshold you will need to

If you are aged 65 to 74 and have a net income of 154 196 or higher or individuals aged 75 and above with a net income of 154 196 or higher will not be eligible to receive any OAS For 2024 the OAS clawback threshold is expected to be approximately 90 997 meaning that any income above this limit will trigger a reduction in your OAS payments As we

More picture related to What Income Is Oas Clawback Based On

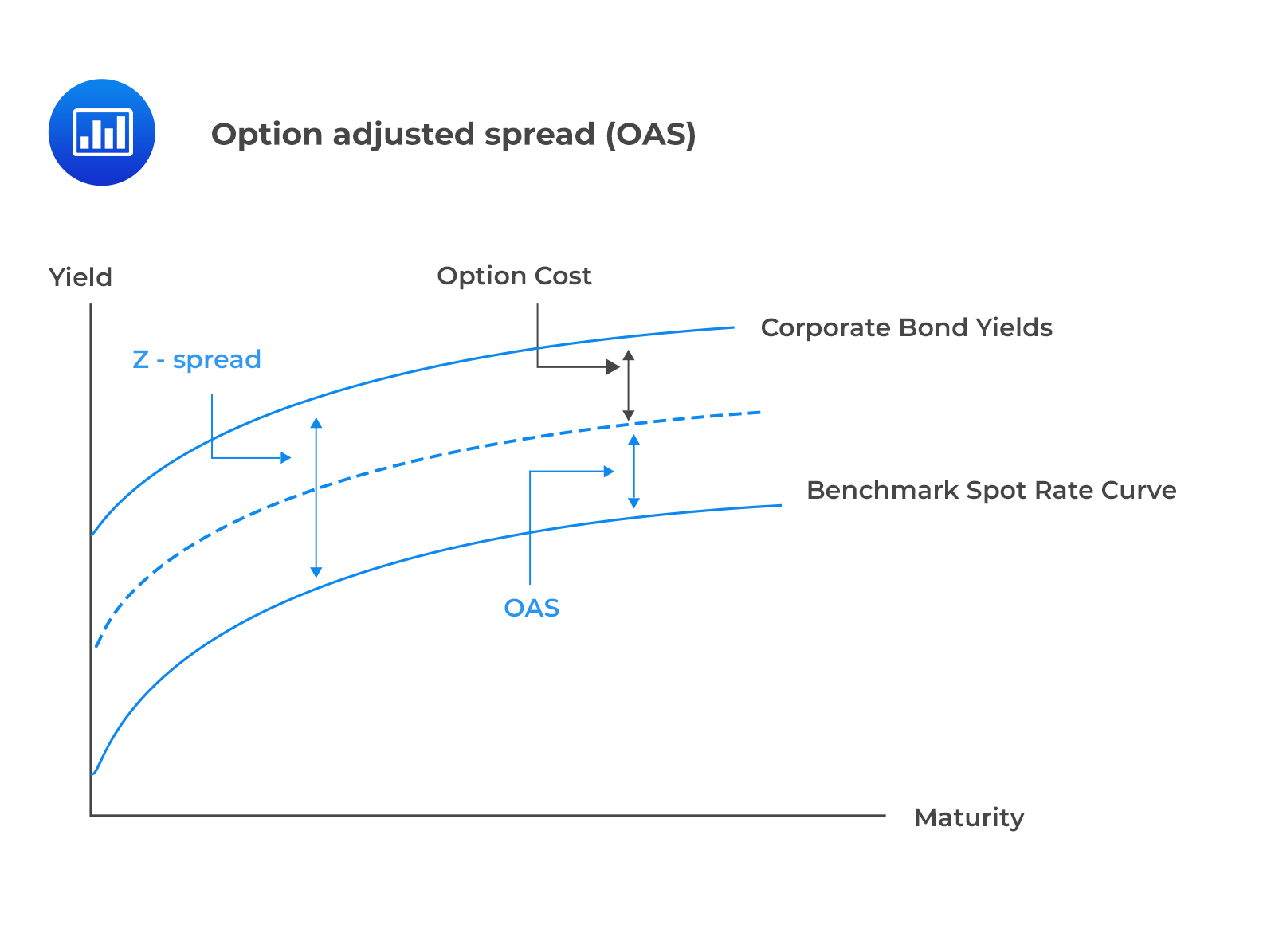

CFA Level I Fixed Income G Spread Z Spread OAS YouTube

https://i.ytimg.com/vi/RKRDVPeRUFE/maxresdefault.jpg

OAS Clawback How To Keep More Of Your Income YouTube

https://i.ytimg.com/vi/T7BmKa0NbzA/maxresdefault.jpg

When You Discover The OAS Payment Dates In 2023 You ll Be Surprised

https://i.ytimg.com/vi/rMuI3nK__z8/maxresdefault.jpg

The quarterly adjustment for all OAS benefits including the Guaranteed Income Supplement GIS is based on the difference between the average CPI for 2 periods of 3 months each the What is the OAS Clawback The OAS clawback or recovery tax requires seniors with higher incomes to repay part or all of their OAS benefits Clawback Thresholds 2025

What income is included in OAS clawback The income threshold for the OAS clawback changes annually For the 2024 tax year the threshold is 90 997 If your net What is the Maximum Income You Can Earn While Receiving OAS The OAS clawback 2025 is applied monthly based on your annual income Determine Excess Income

Organization Of American States Full Explain In Hindi What Is Oas

https://i.ytimg.com/vi/uDuZ4ST2b4g/maxresdefault.jpg

OAS Clawback Archives Cashflows And Portfolios

https://www.cashflowsandportfolios.com/wp-content/uploads/2021/06/what-is-oas-and-oas-clawback.jpg

https://artofretirement.ca › retirement-planning

The Old Age Security OAS clawback officially known as the OAS Recovery Tax is calculated based on your Net Income Before Adjustments line 23400 on your tax return not your taxable income line 26000

https://www.wealthsimple.com › en-ca › learn › oas...

What is OAS clawback The government starts reducing your OAS amount once you make over 90 997 in 2024 taxable income note that this figure changes annually according to inflation This reduction is commonly

PPT Social Security And Railroad Retirement Equivalent 46 OFF

Organization Of American States Full Explain In Hindi What Is Oas

OAS Clawback On Vimeo

OAS Official Assessment System In Undefined By AcronymsAndSlang

OAS Clawback Rates 2021 PlanEasy

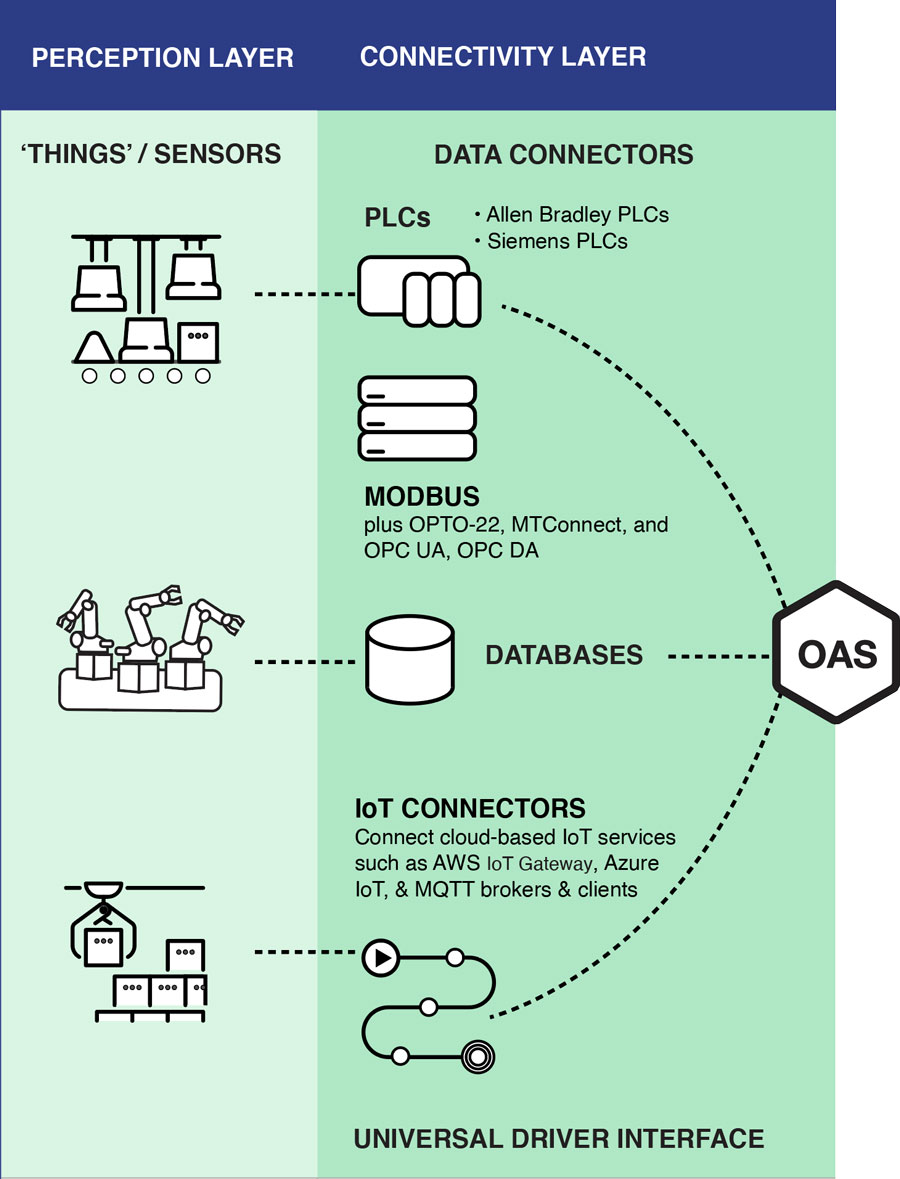

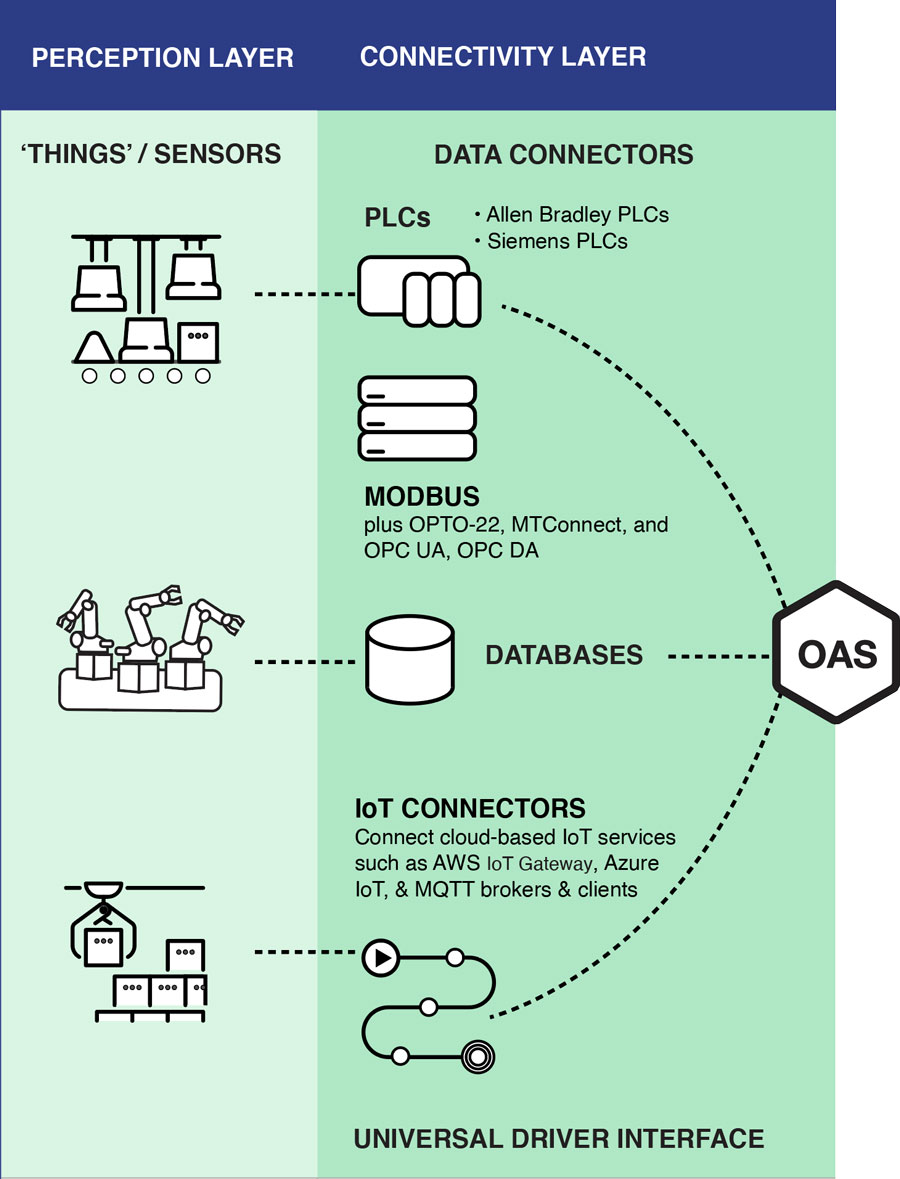

What Is OAS Industrial IoT Data Platform

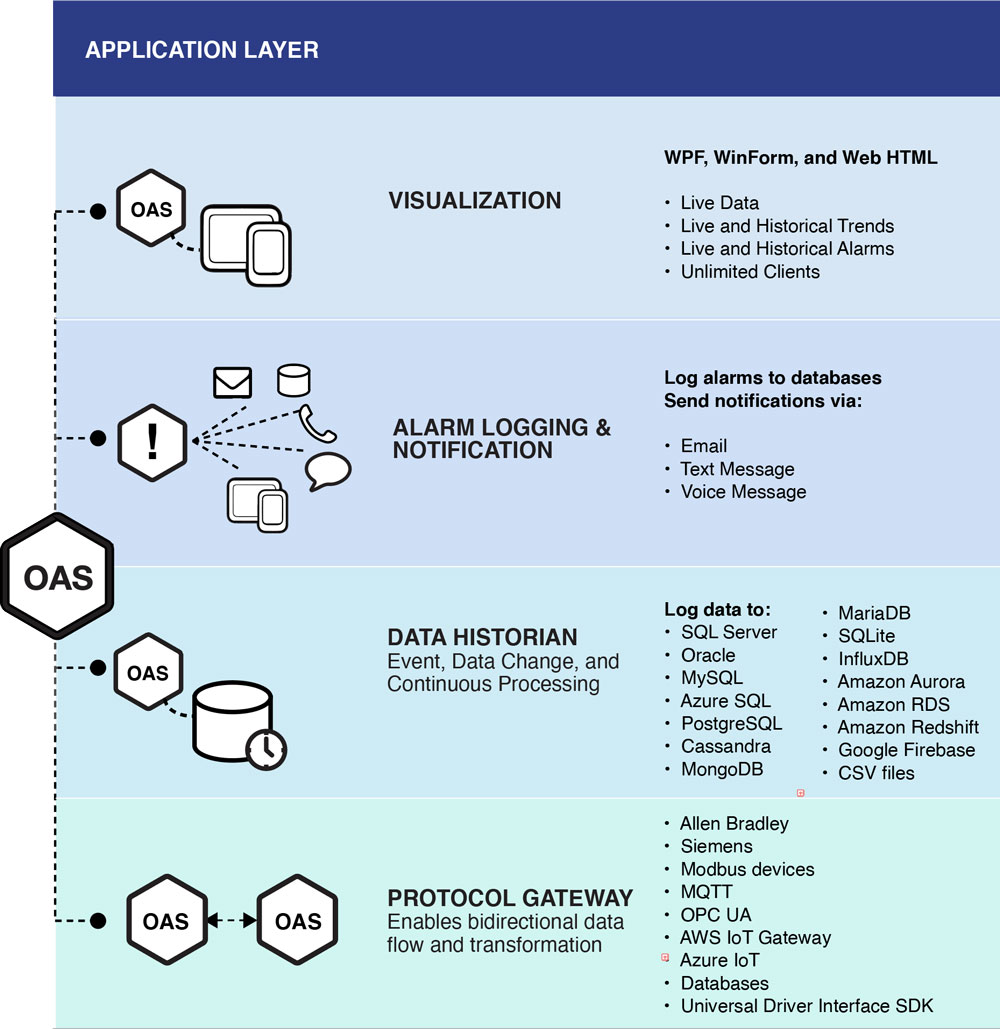

What Is OAS Industrial IoT Data Platform

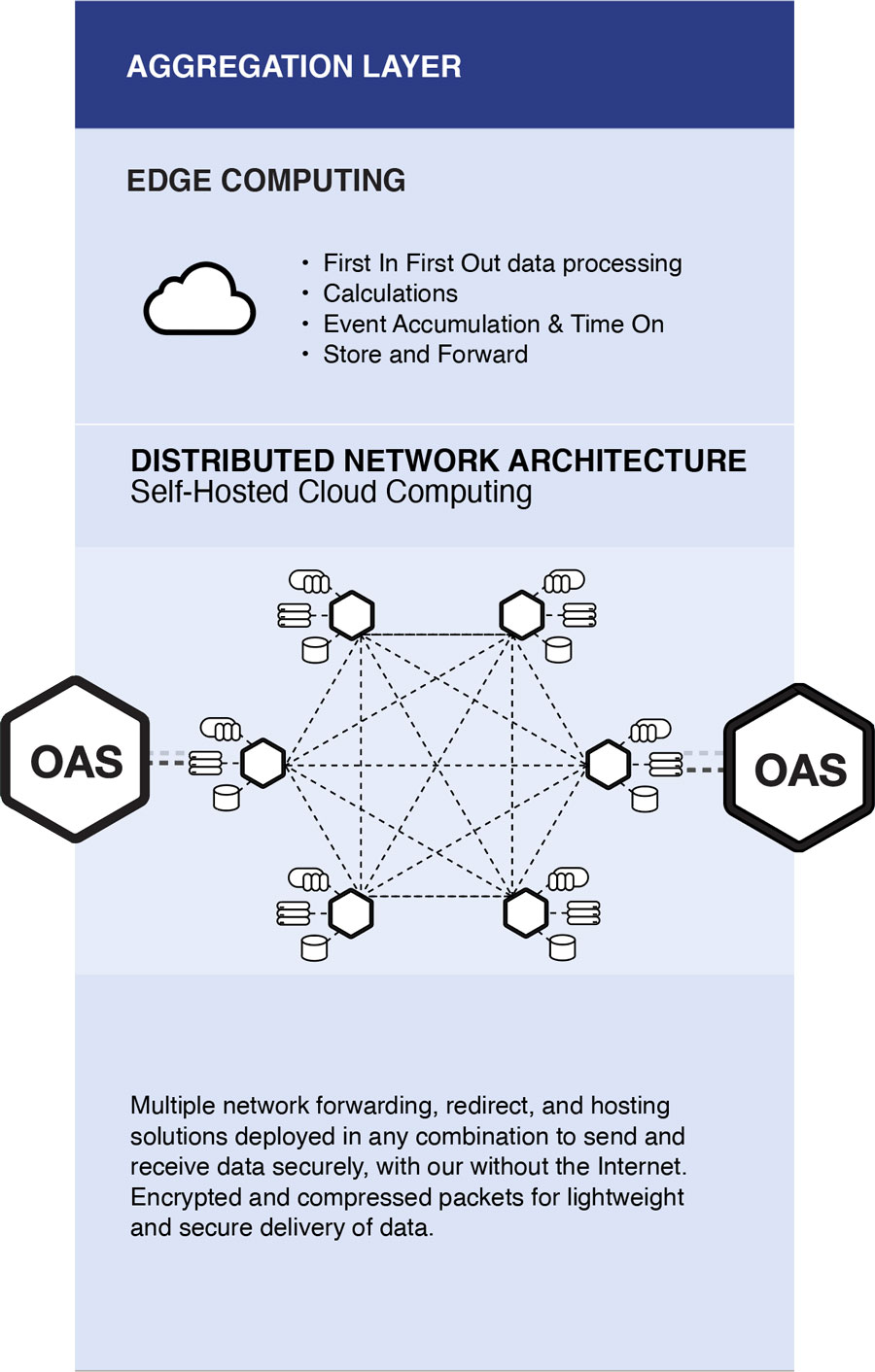

What Is OAS Industrial IoT Data Platform

What Is OAS Industrial IoT Data Platform

Mans o Apresenta o Habilitar Spread Duration Calculation Entusiasmo

What Income Is Oas Clawback Based On - The OAS clawback is calculated based on a retiree s net income reported on their tax return For 2025 the income threshold and recovery rate determine how much of the OAS benefit is