What Is 250 With Tax 24 10 10 0 24 9 25 0 49 9 50 0 99 9

250 200 PPT 1 100 1 1

What Is 250 With Tax

What Is 250 With Tax

https://images.squarespace-cdn.com/content/v1/54341a03e4b08690c01bc8de/fd6ec552-33e0-41ea-a00b-8efab7948f43/0214_BI+Understanding+your+Tax+Return+-+Why+Adjusted+Gross+Income+Matters.jpg

Buy I Bonds With Your Tax Refund What To Know About Rates Deadline

https://www.gannett-cdn.com/presto/2022/10/31/PDTF/7071bbfe-e396-4b28-a7a9-c4f8d9d18214-IBondsOctober.jpg?crop=1888,1062,x0,y75&width=1888&height=1062&format=pjpg&auto=webp

2014 Lexus IS 250 Long Term Arrival Motor Trend

https://www.motortrend.com/uploads/sites/5/2014/01/2014-Lexus-IS-250-front-end1.jpg

35 60 120 160 200 220 240 270 300 400 250 excavating machinery

100 200 250 HID

More picture related to What Is 250 With Tax

States With Low And No Capital Gains Tax Kiplinger

https://cdn.mos.cms.futurecdn.net/HxGSWnMk6pS8YYzJ9SRkUA.jpg

2014 Lexus IS 250 Specs And Photos StrongAuto

http://strongauto.net/wp-content/uploads/images/2014-Lexus-IS-250_3205.jpg

How To Calculate After Tax Cash Flow In Real Estate

https://leaddeveloper.com/wp-content/uploads/2022/12/How-to-calculate-after-tax-cash-flow-in-real-estate.png

365 104 11 250 250 4 62 5 250 12 200 250 350 500

[desc-10] [desc-11]

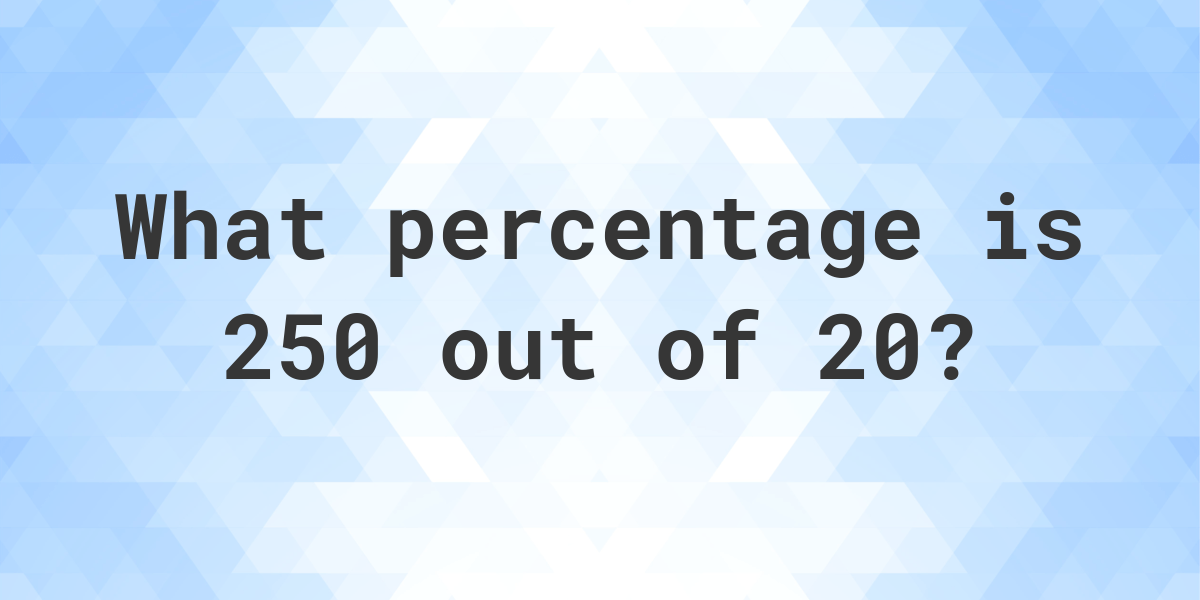

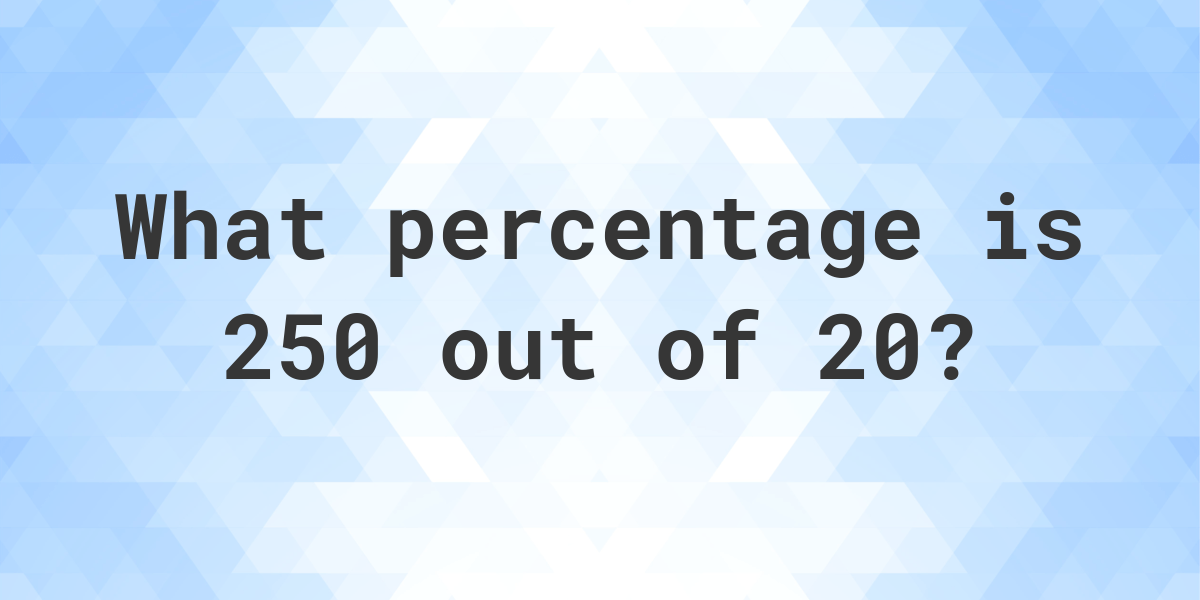

What Is 250 20 As A Percent Calculatio

https://calculat.io/en/number/percentage/250--20/generated-og.png

2024 State Corporate Income Tax Rate Changes A Comprehensive Analysis

https://taxfoundation.org/wp-content/uploads/2024/01/CIT_Rates_24.png

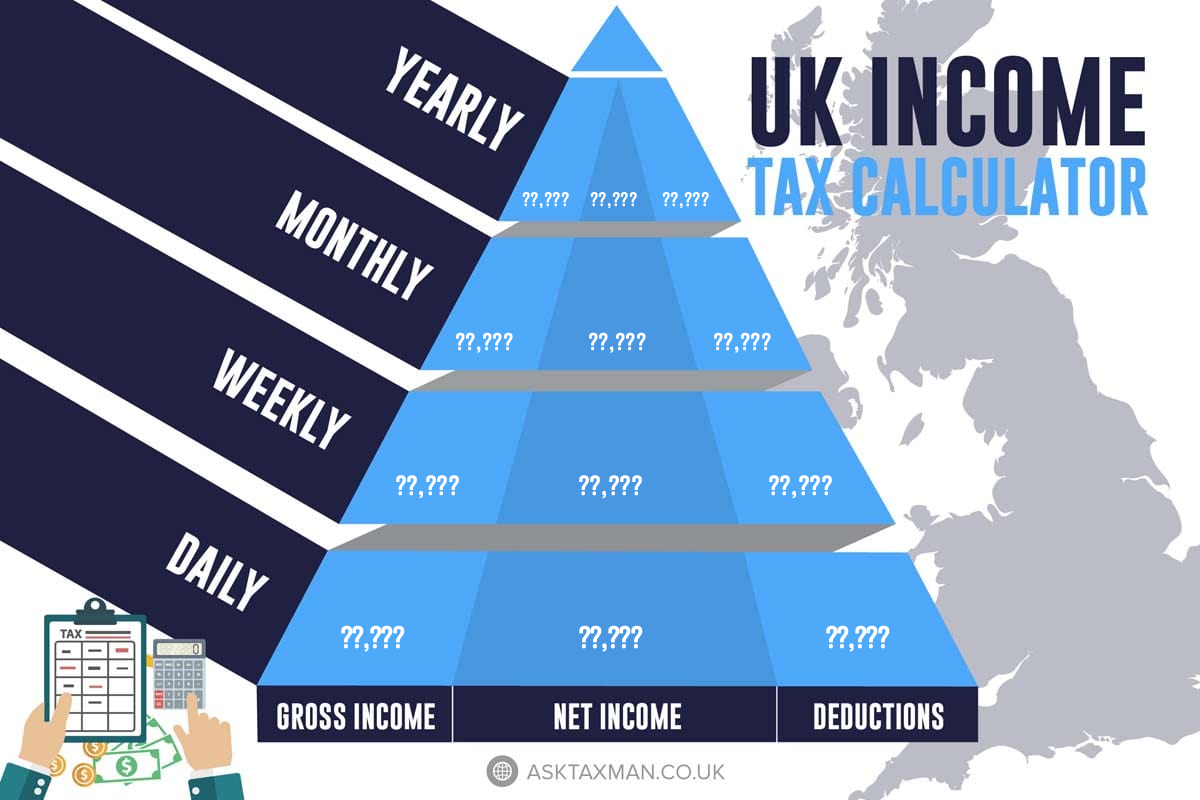

12 710 A Month After Tax Income Tax Calculator

What Is 250 20 As A Percent Calculatio

250 Number Images Stock Photos Vectors Shutterstock

Budget FY24 Use Our Calculator To Find Out How Much Tax You Will Pay

Federal Solar Tax Credits For Businesses Department Of Energy

WinWin The Feel Good Flutter

WinWin The Feel Good Flutter

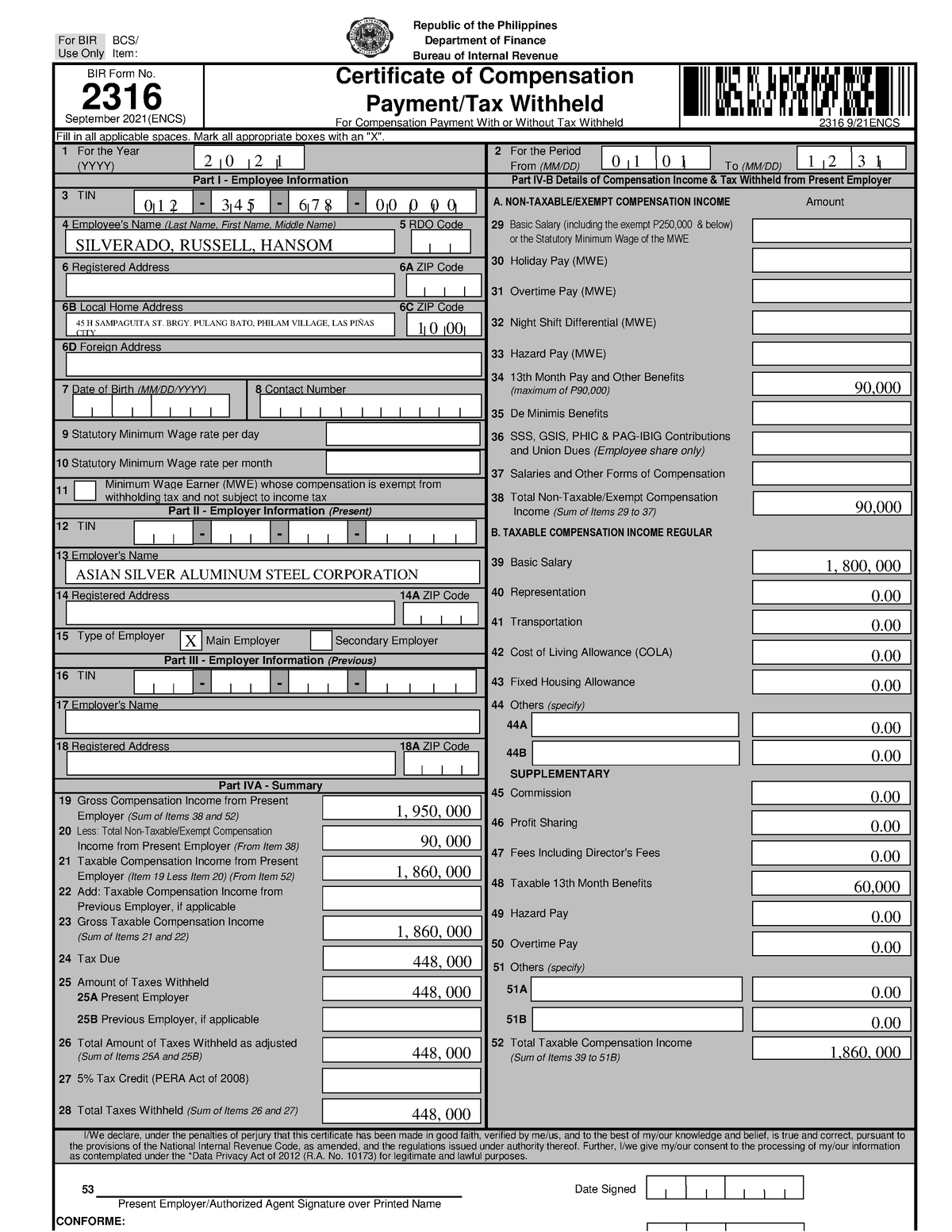

2316 23162316 For Compensation Payment With Or Without Tax Withheld

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

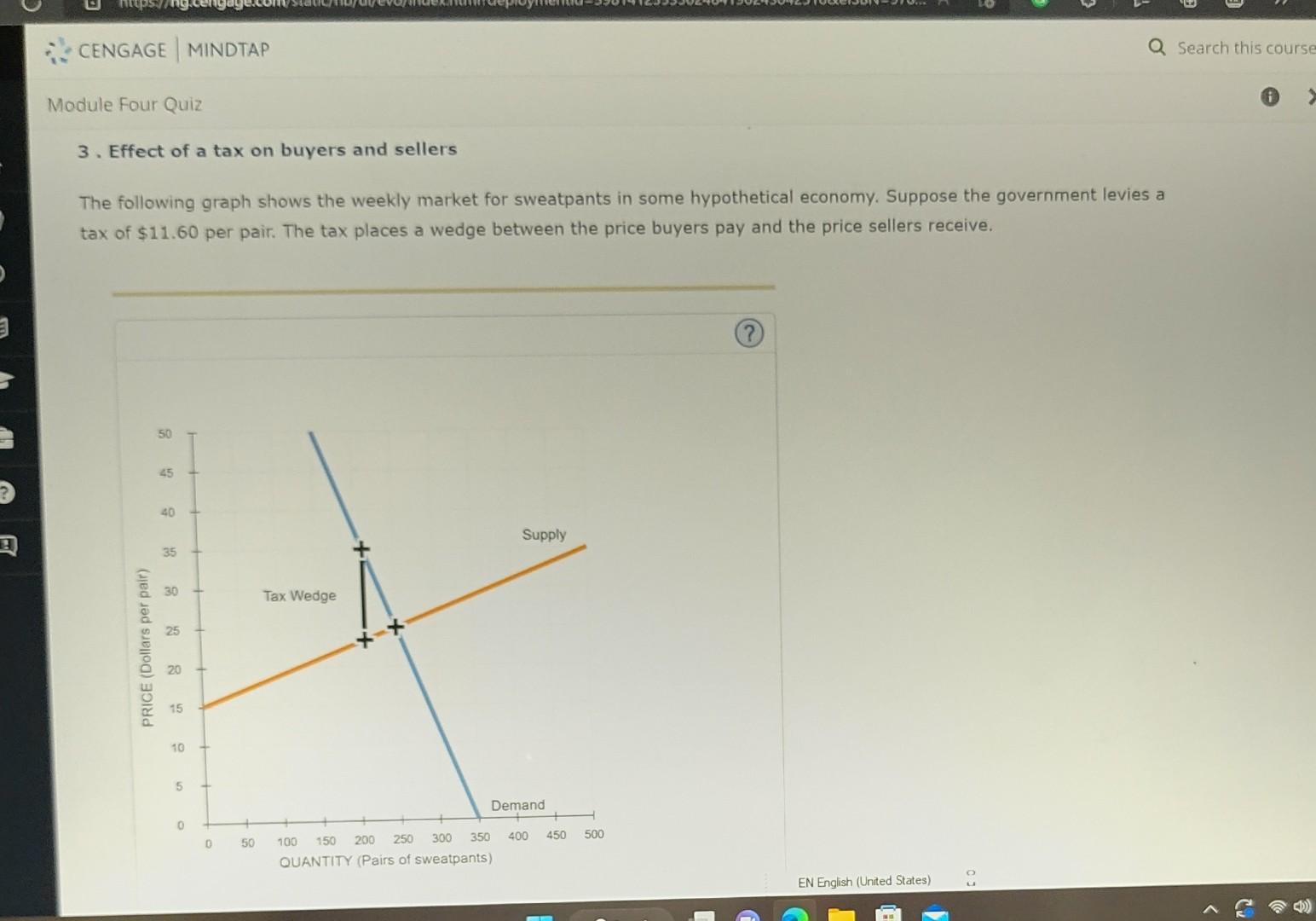

Solved 3 Effect Of A Tax On Buyers And Sellers The Chegg

What Is 250 With Tax - [desc-14]