What Is A Valuation Formula Explore CFI s valuation courses to find expert insights and learn about different methods and tools to make informed financial decisions and drive growth

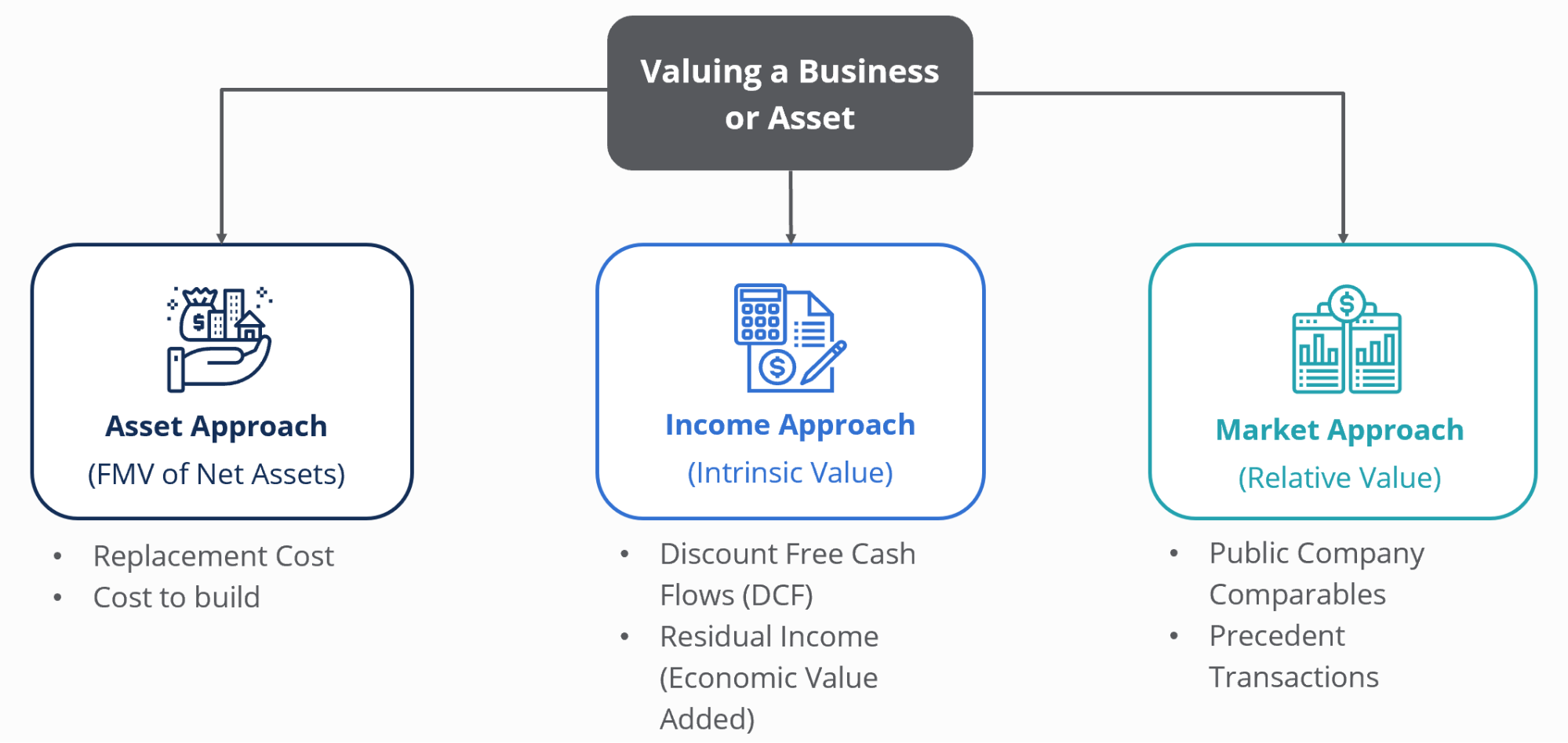

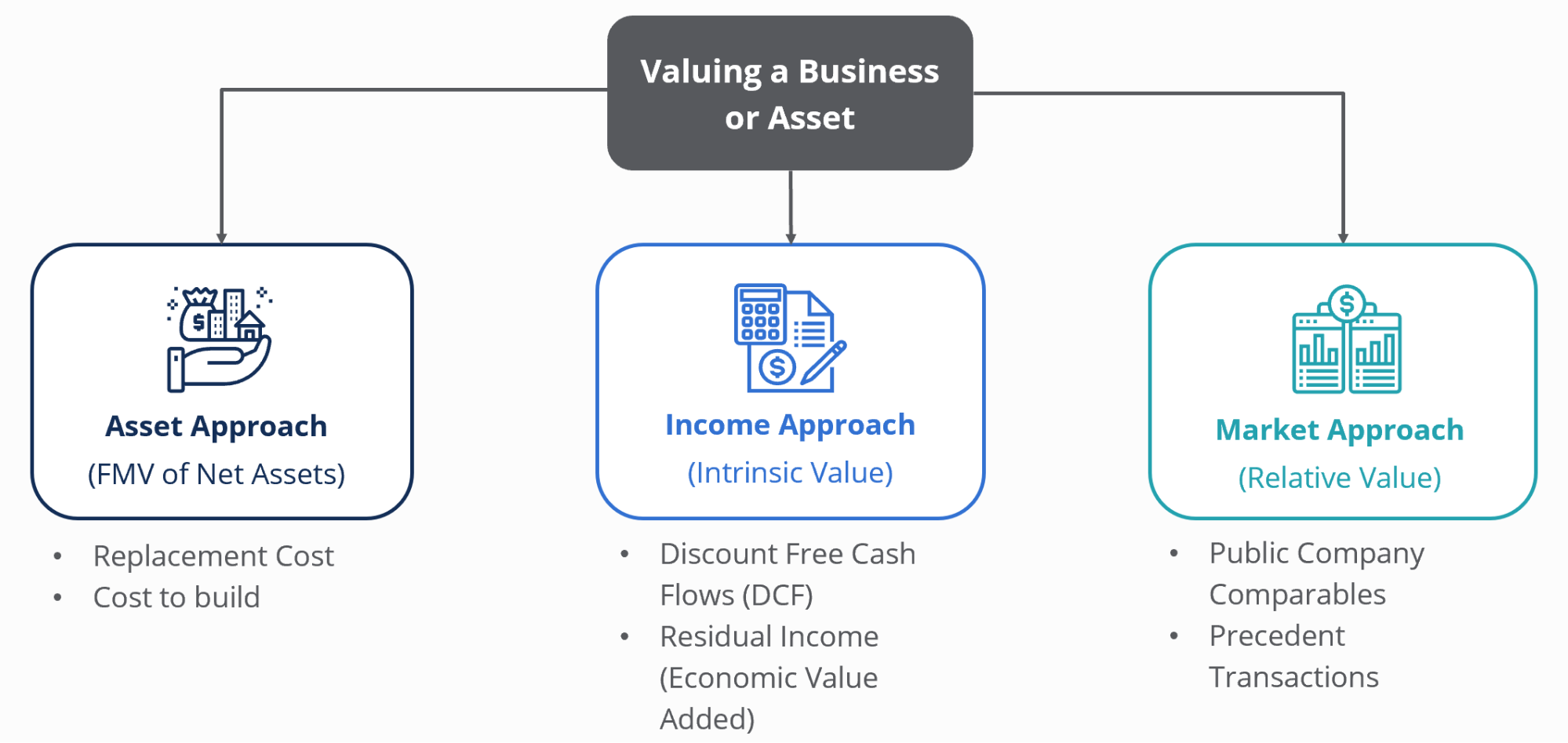

The following are the key valuation principles that business owners who want to create value in their business must know Business valuation involves the Introduction to Business Valuation Valuation is probably the most fundamental concept in finance and is a necessary skill to become a world class financial analyst In this course we will cover

What Is A Valuation Formula

What Is A Valuation Formula

https://cdn.corporatefinanceinstitute.com/assets/valuation-business-asset.png

Residual Income Model Demonstration YouTube

https://i.ytimg.com/vi/xKdFf4n_eHg/maxresdefault.jpg

Business Valuation Meaning Methods Formula Calculate

https://www.wallstreetmojo.com/wp-content/uploads/2022/09/2bad768f-4d6b-4dd0-97db-5e0642def3fe.png

FMVA Program Overview CFI s Financial Modeling Valuation Analyst FMVA Certification imparts vital financial analysis skills emphasizing constructing effective Advance your career with expert led finance courses and certifications Gain real world skills in financial modeling M A and valuation Start learning today

Option Pricing Models are mathematical models that use certain variables to calculate the theoretical value of an option The theoretical value of an Learn what Enterprise Value EV is how to calculate it and its importance Understand EV formulas components and financial modeling use cases

More picture related to What Is A Valuation Formula

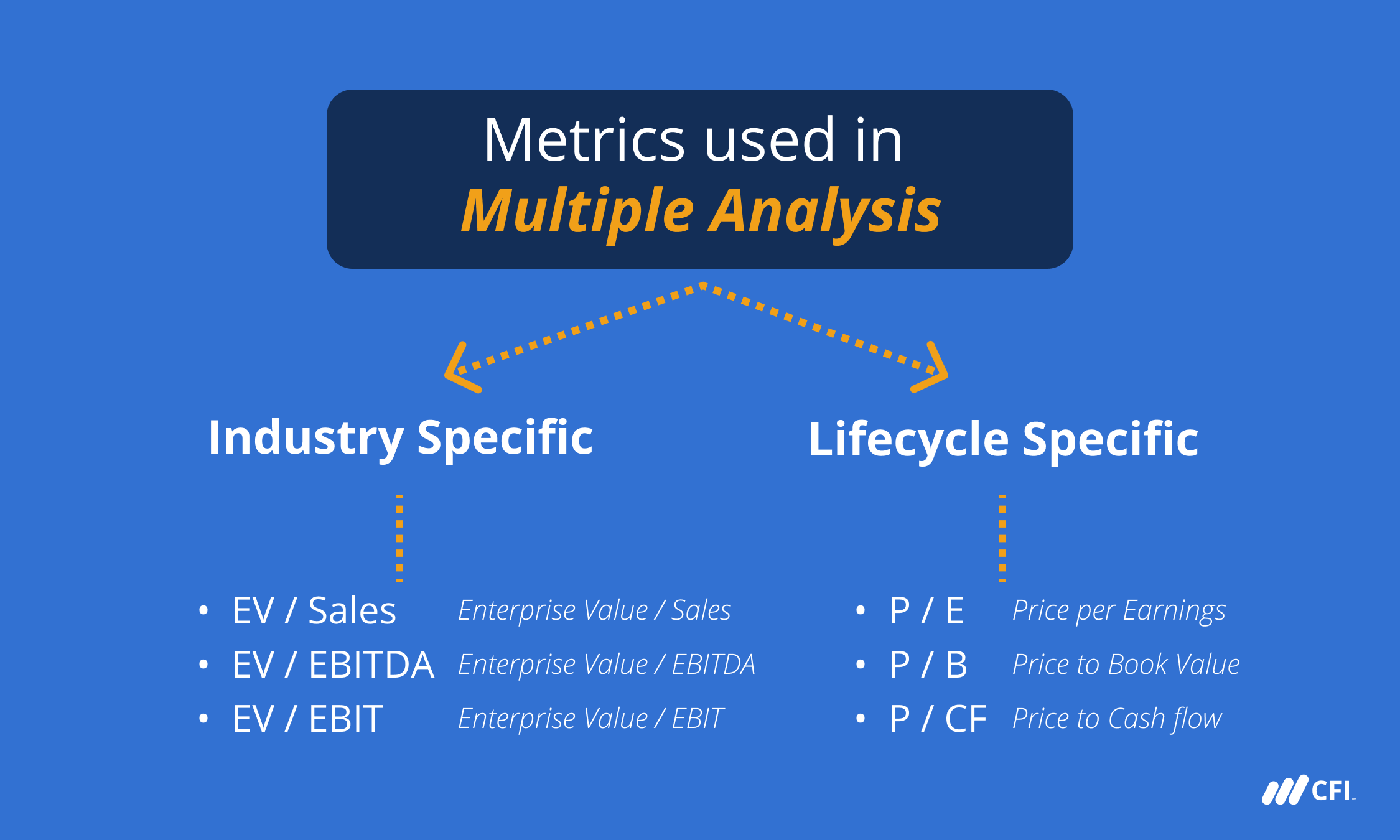

Multiples Analysis Definition And Explanation Of Valuation

https://cdn.corporatefinanceinstitute.com/assets/Multiple-Analysis-1.png

Session 07 Objective 1 Interest Rates And Bond Valuation 2023

https://i.ytimg.com/vi/9XeXgSNIAmE/maxresdefault.jpg

Pre Money Vs Post Money Valuations How To Calculate Each

https://lh4.googleusercontent.com/CzDEYlhZUX9oewFH3l0cCiUigO27Ao1YZlw5IhWQeDJgiAzchFz41QDvA5QT0wStE2u2xq4-HNgAVITUt3bTmTxLmL2tYIVEKKrEEKNVRMx44inebUZny2CTaLDouKM45Rc8EbPn

What is a DCF Model A DCF model is a specific type of financial modeling tool used to value a business DCF stands for D iscounted C ash F low so a DCF model is simply a forecast of a Discounted cash flow DCF is an analysis method used to value investments by discounting the estimated future cash flows

[desc-10] [desc-11]

Business Valuation Excel And Google Sheets Template Simple Sheets

https://kajabi-storefronts-production.kajabi-cdn.com/kajabi-storefronts-production/themes/3571678/settings_images/JyH5dhtRR2cb9kRSRryt_3_3.PNG

Valuing A Business 7 Company Valuation Formulas Step by Step

https://global-uploads.webflow.com/5a710020b54d350001949426/641b647719600075fe8fdbac_200.1.jpg

https://corporatefinanceinstitute.com › topic › valuation

Explore CFI s valuation courses to find expert insights and learn about different methods and tools to make informed financial decisions and drive growth

https://corporatefinanceinstitute.com › resources › valuation › valuation-…

The following are the key valuation principles that business owners who want to create value in their business must know Business valuation involves the

Cyclops Brusc Bra Multiple Number Calculator Aduce Meyella Reac ie

Business Valuation Excel And Google Sheets Template Simple Sheets

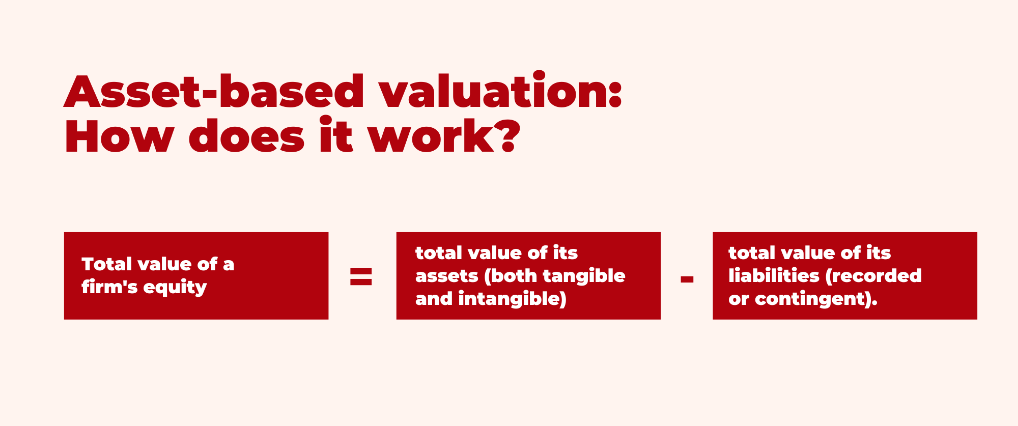

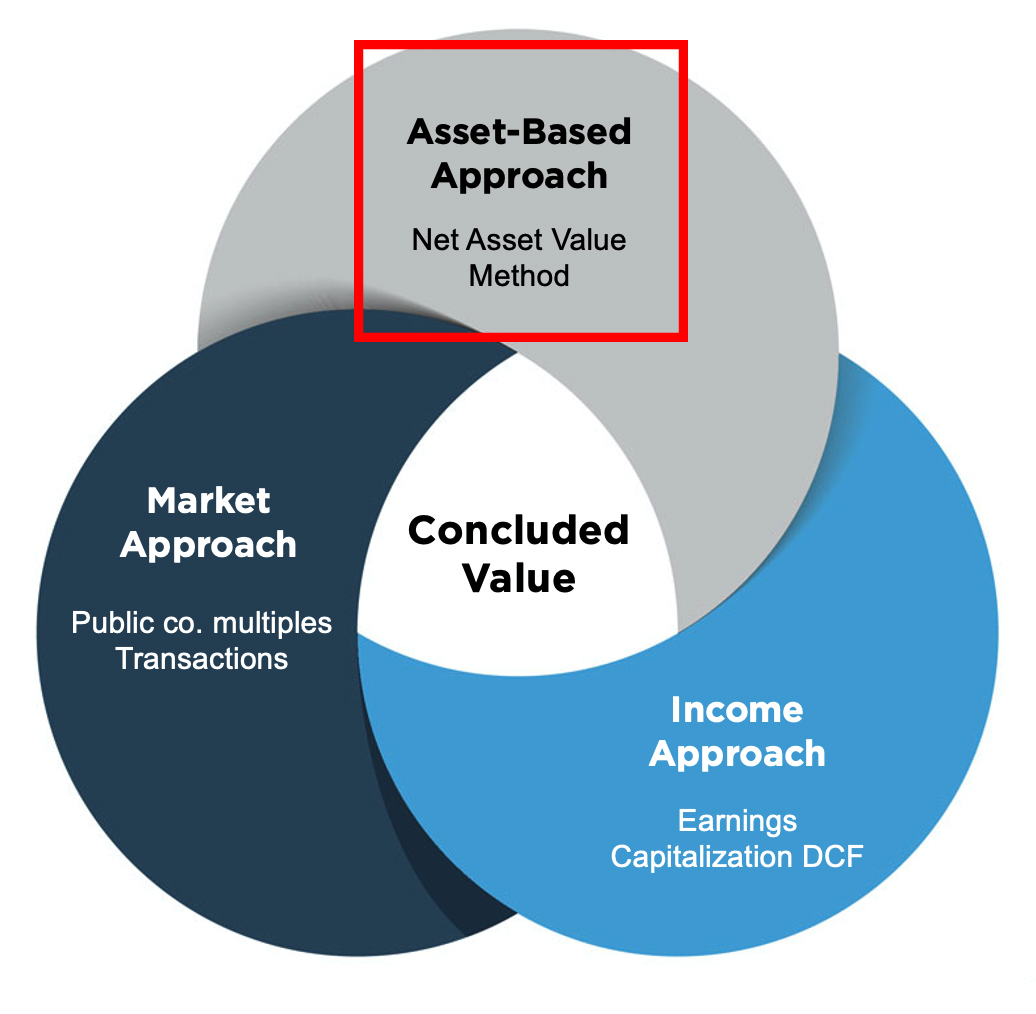

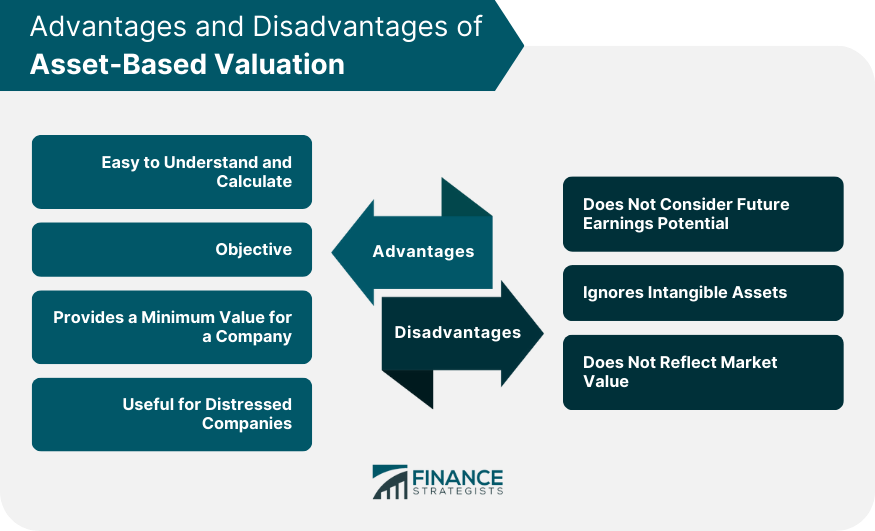

A Detailed Guide On Business Valuation Asset Based Approach

Valuation Meaning

Discounted Cash Flow DCF Formula

nh Gi V Th m nh Gi L G Nh ng Ki n Th c C n Bi t

nh Gi V Th m nh Gi L G Nh ng Ki n Th c C n Bi t

Valuing A Business 7 Company Valuation Formulas Step by Step

Understand The Asset Approach In A Business Valuation Mercer Capital

Asset Based Valuation Definition Types Steps Pros And Cons

What Is A Valuation Formula - FMVA Program Overview CFI s Financial Modeling Valuation Analyst FMVA Certification imparts vital financial analysis skills emphasizing constructing effective