What Is Assessable Foreign Source Income Hi Lana1417 The balancing adjustment amount is the difference between the termination value and the adjustable value of a depreciating asset cost less decline in value at

I want to offset my loss against my other assessable income Under the section Type of Loss I am trying to select Option 1 Assessable Income is at least 20 000 Hi Marco86 Don t over complicate it Cars are exempt from CGT However you will need to account for the disposal of an asset you ve depreciated Where the instant asset write off

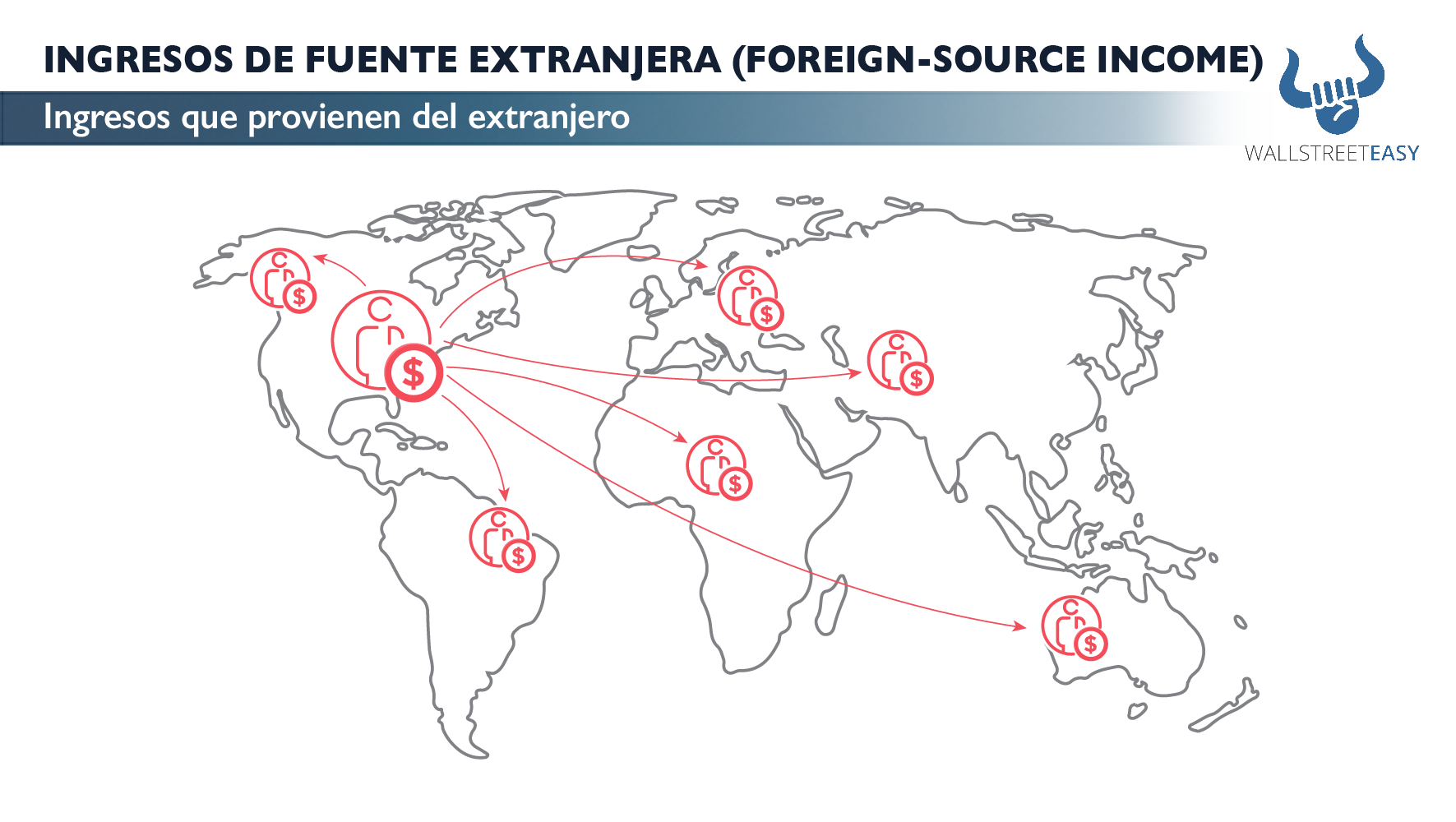

What Is Assessable Foreign Source Income

What Is Assessable Foreign Source Income

https://i.ytimg.com/vi/SgIqNpPg594/maxresdefault.jpg

How To Say Assessable In English How Does Assessable Look What Is

https://i.ytimg.com/vi/u9ogPb0jXlE/maxresdefault.jpg

Worked Example Ausbil Investments SMSF Accounting Software Mclowd

https://mclowd.com/wp-content/uploads/2020/08/Screen-Shot-2020-08-16-at-10.00.14-am.png

In the Annual Tax Statements Under Other non assessable amounts is an item labeled Other non attributable amounts Yes all interest earnt must be declared as it is assessable income All financial institutions report interest earnt by their customers directly to the ATO so at the end of financial

On the ATO website Owning Shares Dividends from shares it is stated A dividend is assessable income in the year it was paid or credited to you Non commercial business activity can t be offset against other assessable income in the year you have the loss Unless you can apply an exception or make a profit Check out What

More picture related to What Is Assessable Foreign Source Income

Foreign Source Taxable Income Tax Policy Center

https://www.taxpolicycenter.org/sites/default/files/statistics/images/corp_foreign_income_0.png

Bad Debt Tax Dividend

https://image.slidesharecdn.com/companytaxcomputation1-151208042414-lva1-app6891/95/company-tax-computation-format-1-1-638.jpg?cb=1449548674

Foreign Source Taxable Income Tax Policy Center

http://www.taxpolicycenter.org/sites/default/files/statistics/images/corp_foreign_income_1.png

My parents want to give me money do I have to pay tax on it No gift money does not form part of your assessable income and you don t have to declare it regardless of the amount We Hiya Meals Not all payments from employers to employees or former employees are reportable to the ATO as assessable income for the worker If the payment related to

[desc-10] [desc-11]

Expat Tax Insights Expat Tax Thailand

https://www.expattaxthailand.com/wp-content/uploads/2024/04/2024-03-18-What-the-tax-man-says-1-720x378.jpg.webp

INGRESOS DE FUENTE EXTRANJERA FOREIGN SOURCE INCO Wall Street Easy

https://wallstreeteasy.com/media/894419/ingresos-de-fuente-extranjera.png

https://community.ato.gov.au › question

Hi Lana1417 The balancing adjustment amount is the difference between the termination value and the adjustable value of a depreciating asset cost less decline in value at

https://community.ato.gov.au › question

I want to offset my loss against my other assessable income Under the section Type of Loss I am trying to select Option 1 Assessable Income is at least 20 000

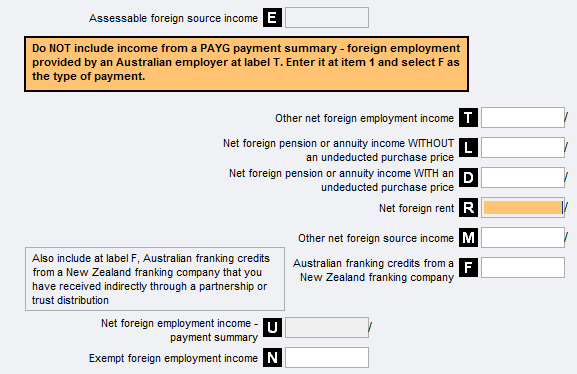

Foreign Rental Property Worksheet ref

Expat Tax Insights Expat Tax Thailand

Foreign Source Income Taxable In Malaysia Nov 10 2021 Johor Bahru

November 2014 Newsletter Out Now Umbrella Accountants

Income Icon

International Fiscal Association IFA Eastern Region Chapter Ppt

International Fiscal Association IFA Eastern Region Chapter Ppt

What Is Taxable Income 2024

Assessable Income

Understanding Taxation A Comprehensive Guide To Assessable Income

What Is Assessable Foreign Source Income - Yes all interest earnt must be declared as it is assessable income All financial institutions report interest earnt by their customers directly to the ATO so at the end of financial