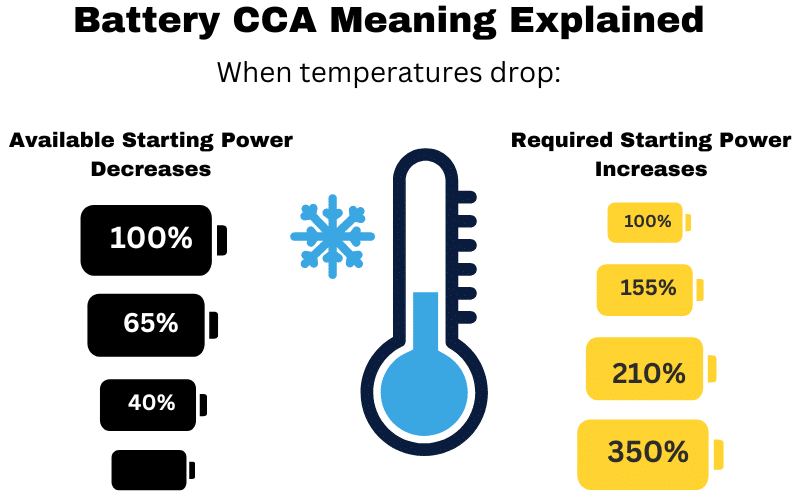

What Is Cca 3 13 Varies Leasehold interest You can claim CCA on a leasehold interest but the maximum rate depends on the type of leasehold interest and the terms of the lease 14 Varies

December 30 2024 Ottawa Ontario Department of Finance Canada Today the Department of Finance Canada announced the automobile income tax deduction limits and expense benefit Information relating to capital cost allowance Can you claim CCA Classes of depreciable properties How to calculate CCA

What Is Cca 3

What Is Cca 3

https://i.ytimg.com/vi/hj4pmUtiZH0/maxresdefault.jpg

Understanding Lead Acid Battery Ratings What Is CCA RC AH YouTube

https://i.ytimg.com/vi/tyzvrVkt0X4/maxresdefault.jpg

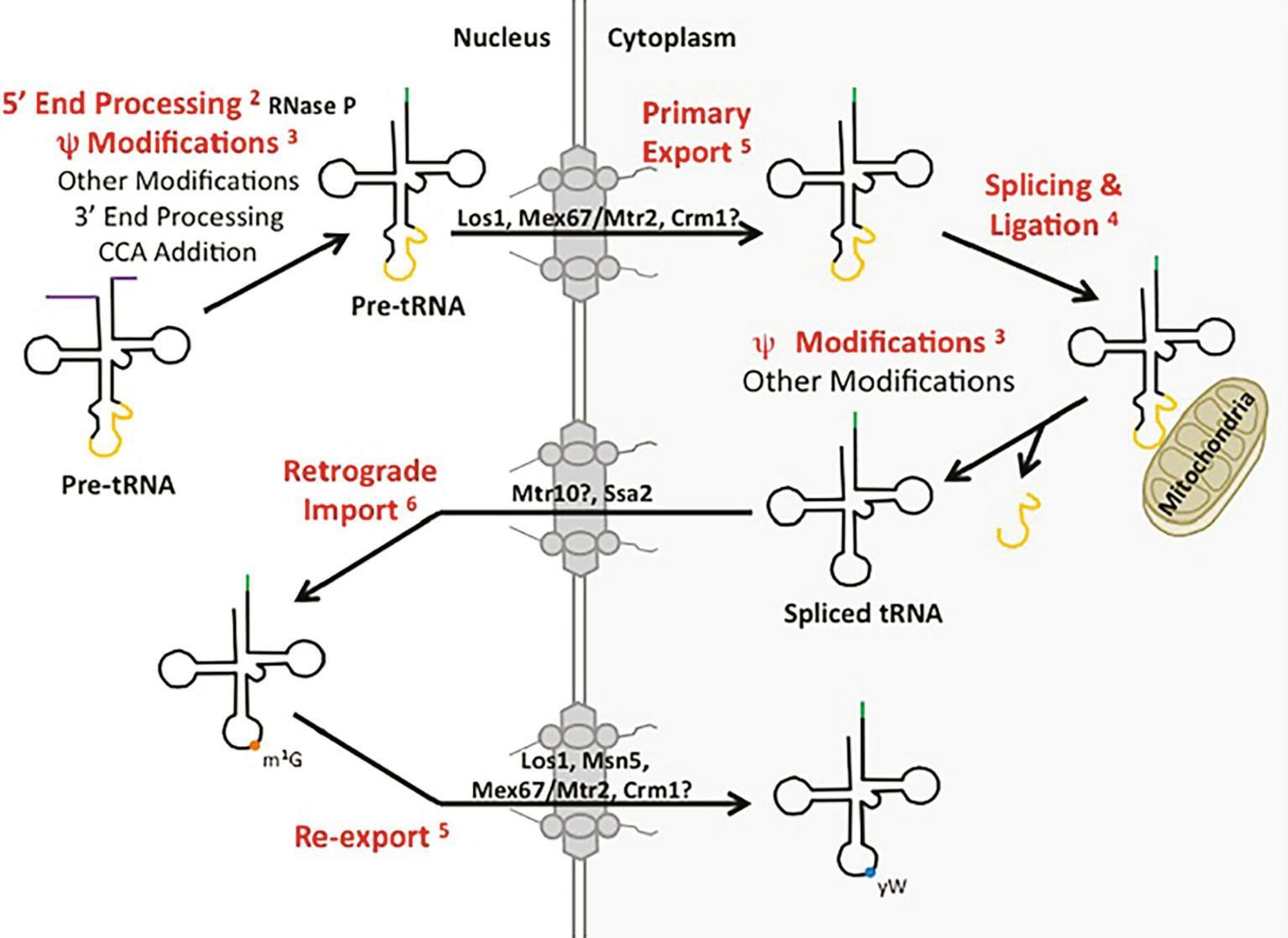

In TRNA CCA Sequence Is Found At 3 End And G At 5 End This CCA Group

https://i.ytimg.com/vi/jjXf_4wVdSk/maxresdefault.jpg

Today the Department of Finance Canada announced the automobile income tax deduction limits and expense benefit rates for 2024 The following changes to limits and rates Capital cost is generally your full cost of acquiring a property The capital cost of a property is usually the total of the following You cannot claim CCA on most land or on living things such

Learn how to file your GST HST return using the online NETFILE form and whether this method meets your needs For CCA purposes the capital cost is the part of the purchase price that relates to the building only When you dispose of a rental property that you have set up in a separate

More picture related to What Is Cca 3

CCA Battery Chart Battery Tools

https://batterytools.net/wp-content/uploads/CCA1-e1682491515633.png

CCA Treated Pine Tapered Pine Timber Products

https://www.pinetimberproducts.com.au/wp-content/uploads/2020/04/CCA-Treated-Pine-Tapered.jpg

Capital Cost Allowance Calculation 2 YouTube

https://i.ytimg.com/vi/f925lNLg3VA/maxresdefault.jpg

The CCA rate will not change but a separate CCA deduction can now be calculated for a five year period When all the property in the class is disposed of the undepreciated The Capital cost allowance CCA you can claim depends on the type of property you own and the date you acquired it Base your CCA claim on your fiscal period ending in the current tax year

[desc-10] [desc-11]

Synthesis And Processing Of Trna

https://cdn.eduncle.com/library/scoop-files/2022/5/image_1651755692162.jpg

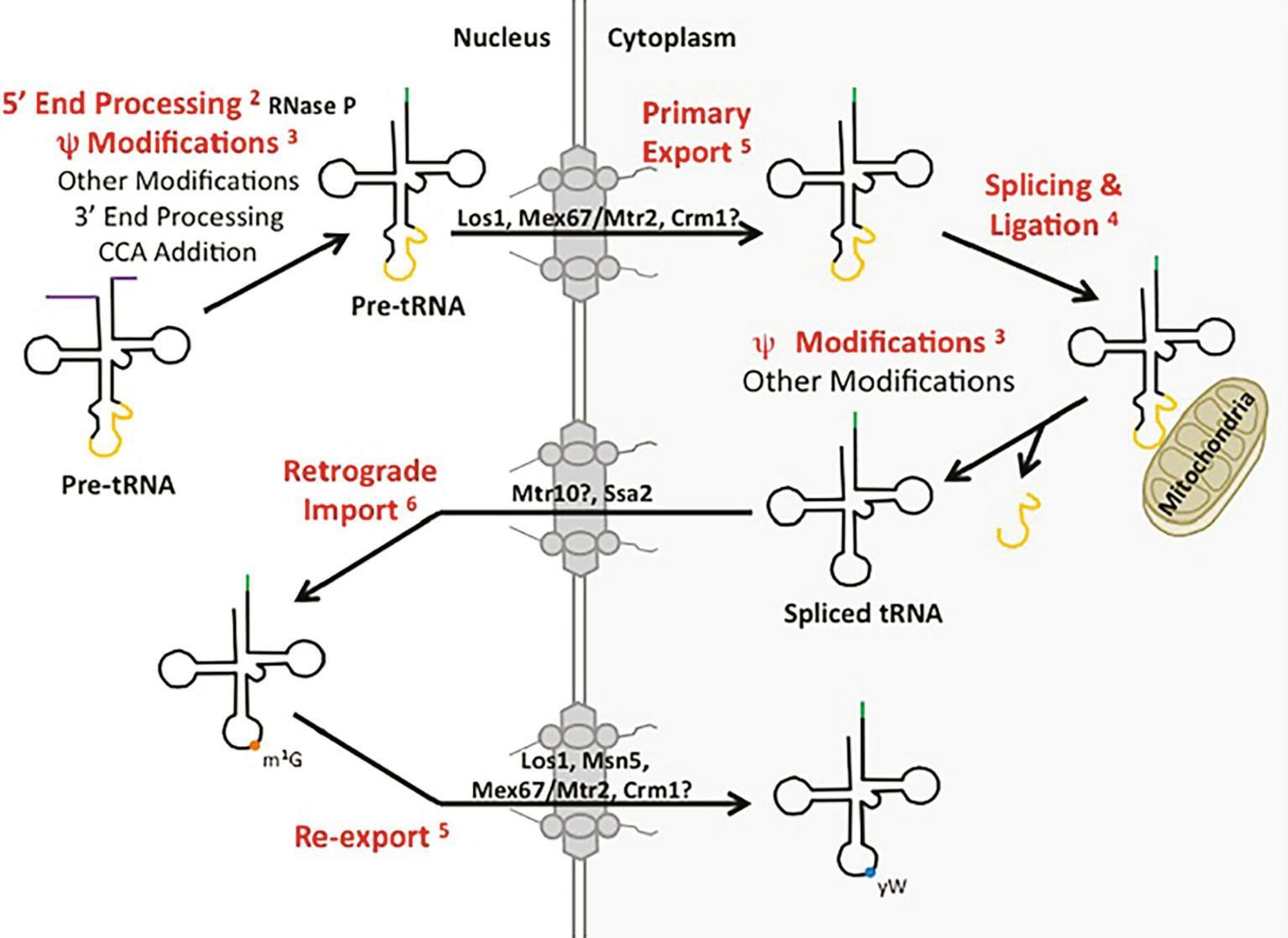

Cold Cranking Amps CCA How To Choose Your Battery Autobatteries

https://d3as1itr0z6zbr.cloudfront.net/assets/marketingContent/1663846288938.jpg

https://www.canada.ca › en › revenue-agency › services › tax › business…

13 Varies Leasehold interest You can claim CCA on a leasehold interest but the maximum rate depends on the type of leasehold interest and the terms of the lease 14 Varies

https://www.canada.ca › en › department-finance › news

December 30 2024 Ottawa Ontario Department of Finance Canada Today the Department of Finance Canada announced the automobile income tax deduction limits and expense benefit

Car Battery Cca Chart Vrogue co

Synthesis And Processing Of Trna

Cranking Amps

Tax Tables Worksheets And Schedules Cabinets Matttroy

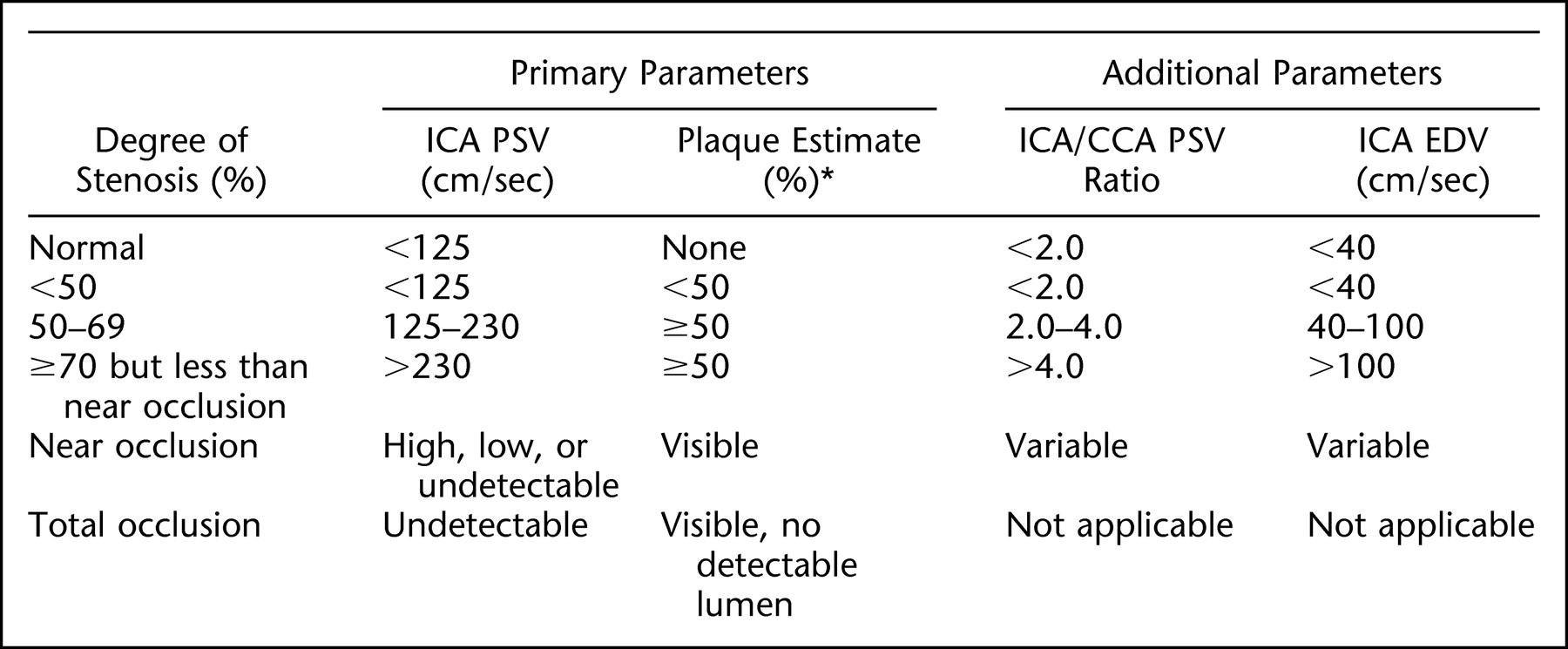

Answers To The Quiz Carotid Artery Ultrasound On Page 76

How To Choose Your CCA An Unofficial Guide

How To Choose Your CCA An Unofficial Guide

Kabel CCA 5 Najwa niejszych Rzeczy Do Rozwa enia Przy Wyborze

2025 Battery Autozone Auto Jett S Hixson

Accident On Gandy Todayoreillys Auto Parts Lawn Mower Battery

What Is Cca 3 - [desc-14]