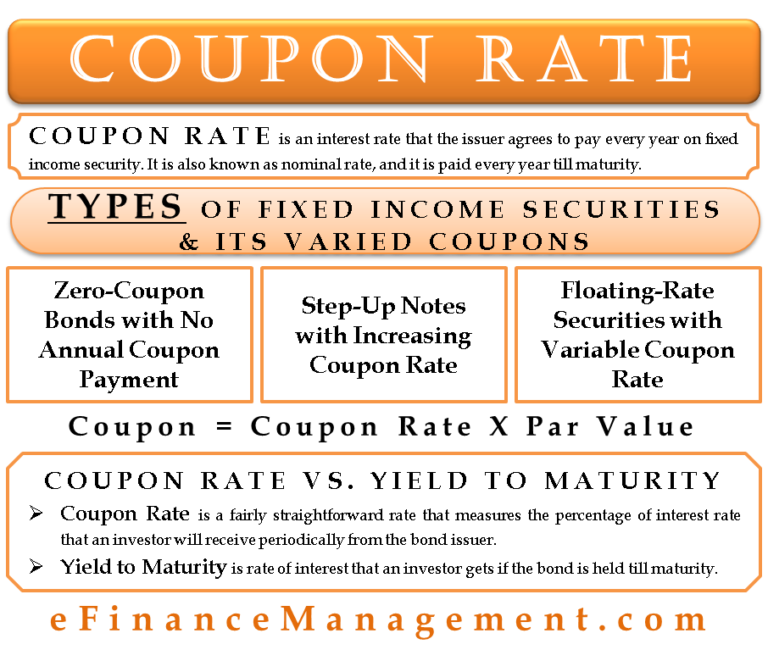

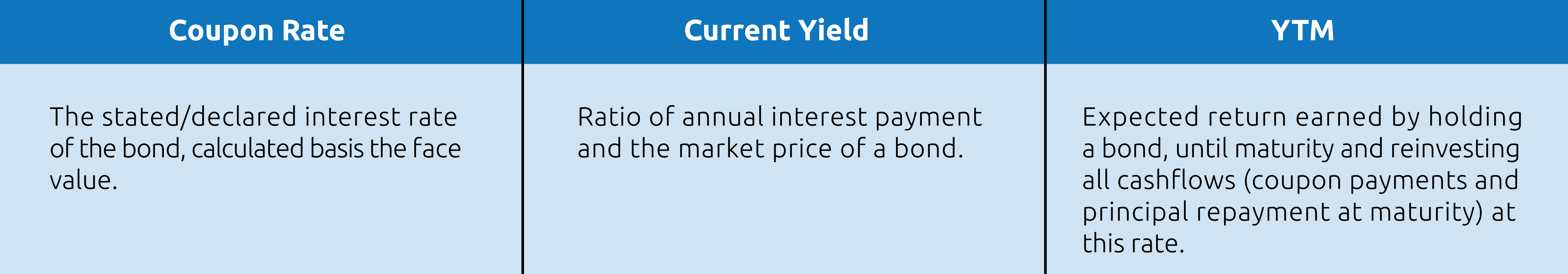

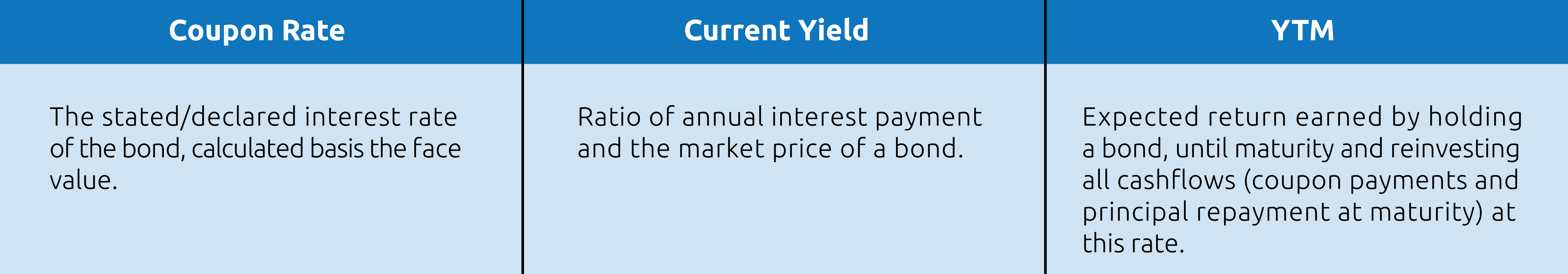

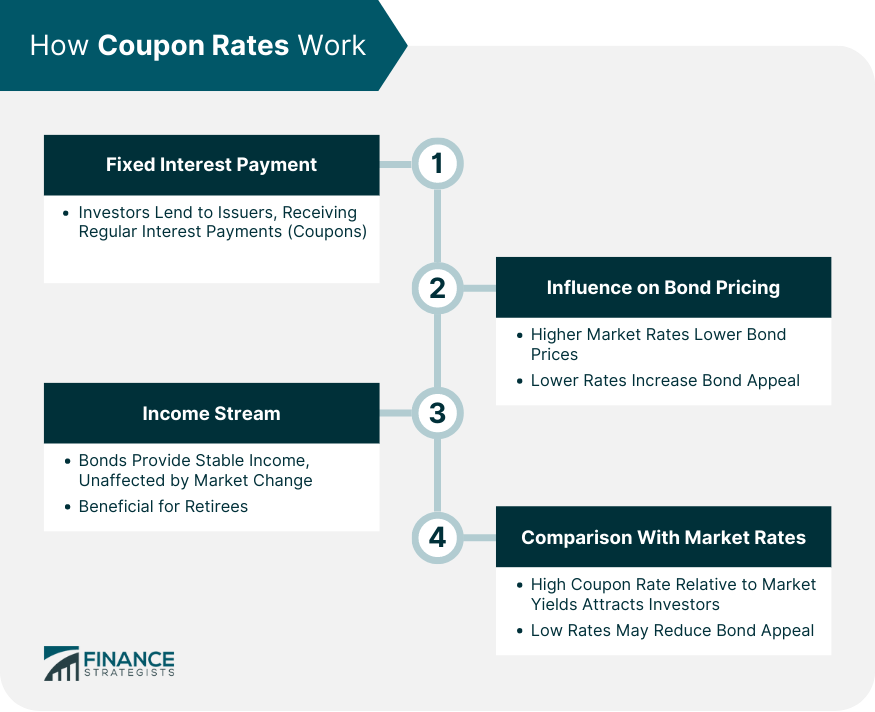

What Is Coupon Rate The coupon rate is simply the amount of interest an investor will receive Also known as nominal yield or the yield from the bond the coupon rate doesn t change Simply put it is the total value of all coupon payments or the annual interest rate of the security plus any gain loss in value as a percentage of the initial investment

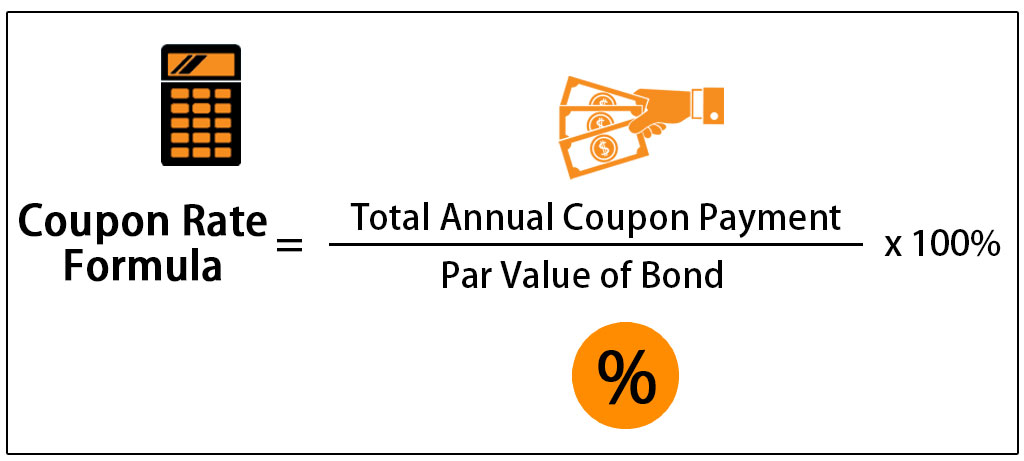

Coupon rate number of years to maturity frequency of payments and current price of the bond How to Calculate Yield to Maturity For example you buy a bond with a 1 000 face value and an 8 coupon for 900 The bond pays interest twice a year and matures in 5 years You would enter 1 000 as the face value 8 as the annual coupon rate In the 1980s some financial institutions began purchasing coupon bonds and selling the coupons as separate securities called strips Let s assume you purchase a 1 000 XYZ Company coupon bond The coupon rate on the bond is 5 which means the issuer will pay you 5 interest per year or 50 on the face value of the bond 1 000 x 0 05

What Is Coupon Rate

What Is Coupon Rate

https://www.wallstreetmojo.com/wp-content/uploads/2023/06/Coupon-Rate-Formula.png

Coupon Rate And Yield Crucial Factors In Bond Valuation

https://www.thefixedincome.com/blog/wp-content/uploads/2021/09/27-sept-What-os-the-coupon-rate-of-a-bond-01-2-2048x1284.jpg

Coupon Rate Meaning Example Types Yield To Maturity Comparision

https://efinancemanagement.com/wp-content/uploads/2019/01/Coupon-Rate-768x661.png

For example a preferred stock with a 25 par value and an 8 coupon would pay an investor dividends of 2 00 per share over the course of the year Investors should note that the coupon rate can be different from the market yield If the shares with an 8 coupon traded for 28 instead of 25 then the market yield would be a bit over 7 2 28 For example let s assume a particular bond is trading at par or 100 cents on the dollar and that it pays a coupon rate of 3 In this case the bond s current yield will also be 3 as shown below CY 3 100 3 00 However let s now assume that the same bond is trading at a discount to its par value For the sake of example let s say

How Does a Coupon Equivalent Rate CER Work To calculate the coupon equivalent rate use the following formula Spread between current price and face value current price x 365 time to maturity note that some versions of the formula use a 365 day year while others use 360 day year Both methods are very common The bond has a coupon rate of 5 1 000 par value and maturity of three years The bond is currently priced at 1 012 and makes an annual coupon payment It is callable in 1 year We can use this information to calculate the bond s yield to maturity YTM

More picture related to What Is Coupon Rate

Bonds

https://d1vtbil09mxkdf.cloudfront.net/Pictures/Bond-yields.webp

Coupon Rate Formula Calculator Excel Template

https://cdn.educba.com/academy/wp-content/uploads/2019/03/Coupon-Rate-Formula.jpg

Coupon Rate And Yield To Maturity How To Calculate Coupon Rate YouTube

https://i.ytimg.com/vi/x-YAg2vm8Co/maxresdefault.jpg

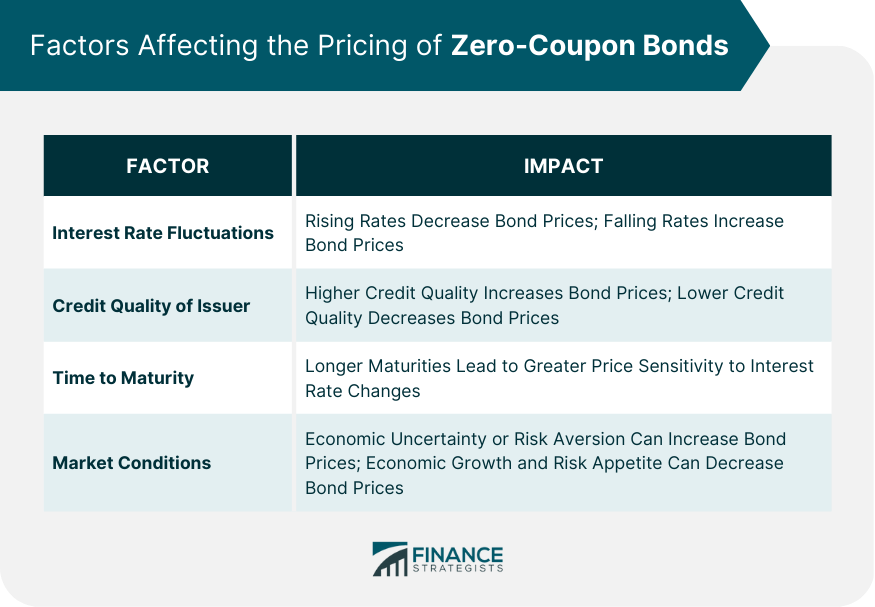

Zero coupon bonds are sensitive to interest rate fluctuations The price you can get on the open market will be determined by current interest rates If you purchased a zero coupon bond at 5 and interest rates rose and offered a 10 yield your zero coupon bond won t look as attractive because of the lower return The initial coupon rate on a step up bond is usually above market Many step up bonds are callable which gives issuers some protection against falling interest rates For example if after three years the XYZ bond is paying 8 but market rates are down to 5 Scenario A Company XYZ would be paying a relatively high interest rate on its debt

[desc-10] [desc-11]

Yield To Maturity YTM What Is YTM Calculator Formula Nippon

https://mf.nipponindiaim.com/investor-education/Style Library/images/YTM-content1.jpg

What Is A Zero Coupon Bond The Motley Fool

https://m.foolcdn.com/media/dubs/images/zero-coupon-bond-infographic.width-880.png

https://investinganswers.com › dictionary › yield-maturity-ytm

The coupon rate is simply the amount of interest an investor will receive Also known as nominal yield or the yield from the bond the coupon rate doesn t change Simply put it is the total value of all coupon payments or the annual interest rate of the security plus any gain loss in value as a percentage of the initial investment

https://investinganswers.com › calculators

Coupon rate number of years to maturity frequency of payments and current price of the bond How to Calculate Yield to Maturity For example you buy a bond with a 1 000 face value and an 8 coupon for 900 The bond pays interest twice a year and matures in 5 years You would enter 1 000 as the face value 8 as the annual coupon rate

Coupon Rate Formula Step By Step Calculation with Examples

Yield To Maturity YTM What Is YTM Calculator Formula Nippon

Coupon Rate Definition And Meaning Market Business News

What Is Coupon Rate In Bonds Coupon Rate Kya Hai Explained In Hindi

Coupon Rate Definition How It Works Significance And Types

What Is Coupon Rate Definition And Meaning Capital

What Is Coupon Rate Definition And Meaning Capital

Zero Coupon Bonds

Coupon Rate Definition Formula Calculation Video Lesson

What Is Coupon Rate Yield In Bond Market

What Is Coupon Rate - How Does a Coupon Equivalent Rate CER Work To calculate the coupon equivalent rate use the following formula Spread between current price and face value current price x 365 time to maturity note that some versions of the formula use a 365 day year while others use 360 day year Both methods are very common