What Is Deferred Revenue Expenditure Journal Entry Example The typical times that deferred settlement is used is a When a company undergoes a reconstruction i e XYZ XYZDA XYZ b When a partly paid security turns

I m looking at SPN and their dividends are 5 776c 0 872C FRANKED 30 3 288C TAX DEFERRED according to ASX au What implication does the tax deferred If I have pre orders and you ve accepted cash for them that is deferred revenue of 5mil and I ve already used 4mil before delivering those orders I only have 1m cash left

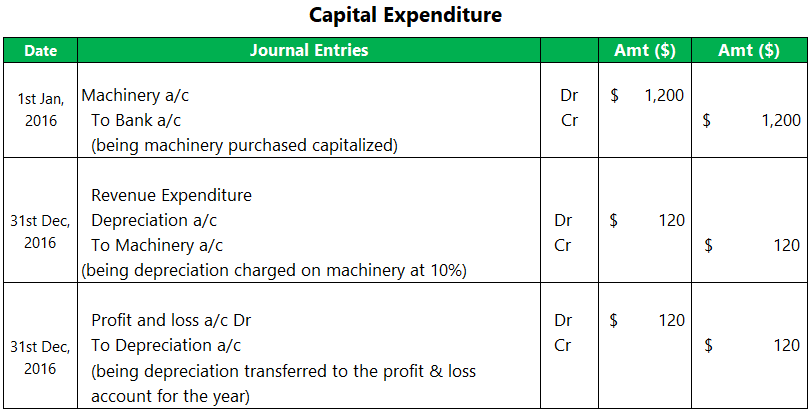

What Is Deferred Revenue Expenditure Journal Entry Example

What Is Deferred Revenue Expenditure Journal Entry Example

https://i.ytimg.com/vi/_X1NLeptcM4/maxresdefault.jpg

Deferred Revenue Expenditure EXPLAINED By Saheb Academy YouTube

https://i.ytimg.com/vi/U70b6USByeA/maxresdefault.jpg

CONFUSION UNBILLED REVENUE Vs DEFERRED REVENUE UNDERSTAND WITH CASE

https://i.ytimg.com/vi/HYYUUDNxqEU/maxresdefault.jpg

Deferred management Fees Another great business opportunity made by and for Macquarie Bank and a host of other financial leeches The short story Ghoti is that the BIG O As such any investor that is considering selling their units during the deferred settlement period and who may be concerned about the deferred settlement is encouraged to

After 12 months you sell for 7500 The 100 tax deferred amount comes off your purchase price when calculating the capital gain so your gain is 7500 5000 100 2600 1 Each entrant may choose one ASX listed stock or ETF Options warrants and deferred settlement shares are not permitted 2 Stocks with a price of less than 0 01 are

More picture related to What Is Deferred Revenue Expenditure Journal Entry Example

Deferred Revenue Expenditure Class 11 Capital And Revenue Receipts

https://i.ytimg.com/vi/amojMMU1SJ0/maxresdefault.jpg

What Is Deferred Revenue Expenditure YouTube

https://i.ytimg.com/vi/123iFDj05mo/maxresdefault.jpg

Accounting For Deferred Income Taxes IFRS And Future Income Taxes

https://i.ytimg.com/vi/gWfns0GcXXA/maxresdefault.jpg

Good morning everyone and welcome to the November 2023 stock tipping competition entry thread A quick recap of the rules for those not familiar with them 1 Each If the shares were transfered to a company in which you re GF and or yourself is a director then there is also the possibility of a Deferred Tax Asset DTA or a Deferred Tax

[desc-10] [desc-11]

:max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg)

Revenue Definition Formula Calculation And Examples 49 OFF

https://www.investopedia.com/thmb/9R0Qsq4PgzyrHOAfjdMr6jMnGi8=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg

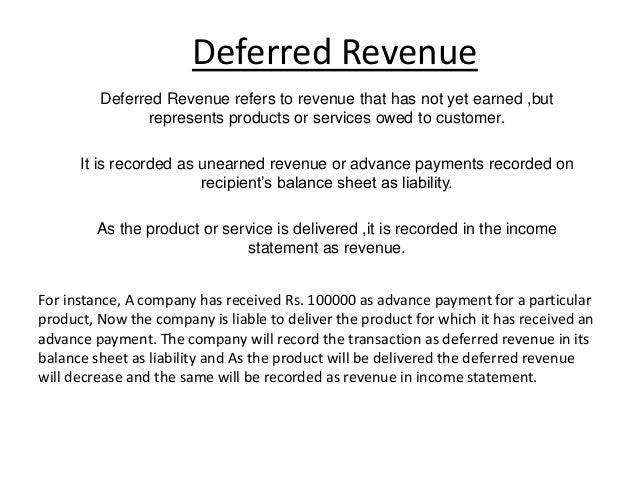

What Is Deferred Revenue Sales Encyclopedia 1up ai

https://1up.ai/wp-content/uploads/what_is_deferred_revenue.png

https://www.aussiestockforums.com › threads

The typical times that deferred settlement is used is a When a company undergoes a reconstruction i e XYZ XYZDA XYZ b When a partly paid security turns

https://www.aussiestockforums.com › threads

I m looking at SPN and their dividends are 5 776c 0 872C FRANKED 30 3 288C TAX DEFERRED according to ASX au What implication does the tax deferred

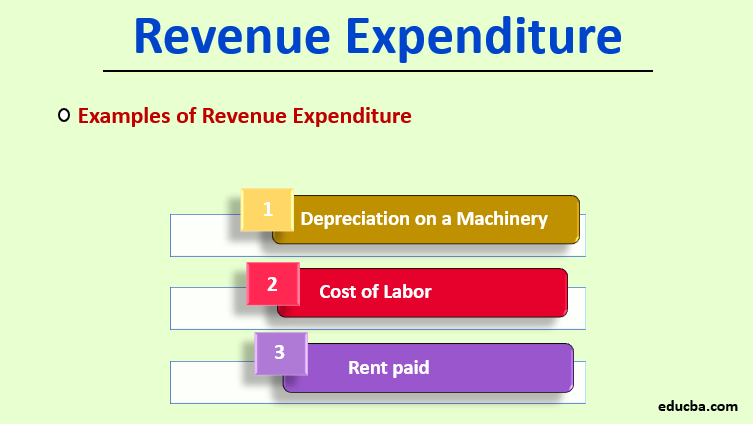

Revenue Expenditure Top 3 Examples Of Revenue Expenditure

:max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg)

Revenue Definition Formula Calculation And Examples 49 OFF

Revenue Expenditure Top 3 Examples Of Revenue Expenditure

Coachkopol Blog

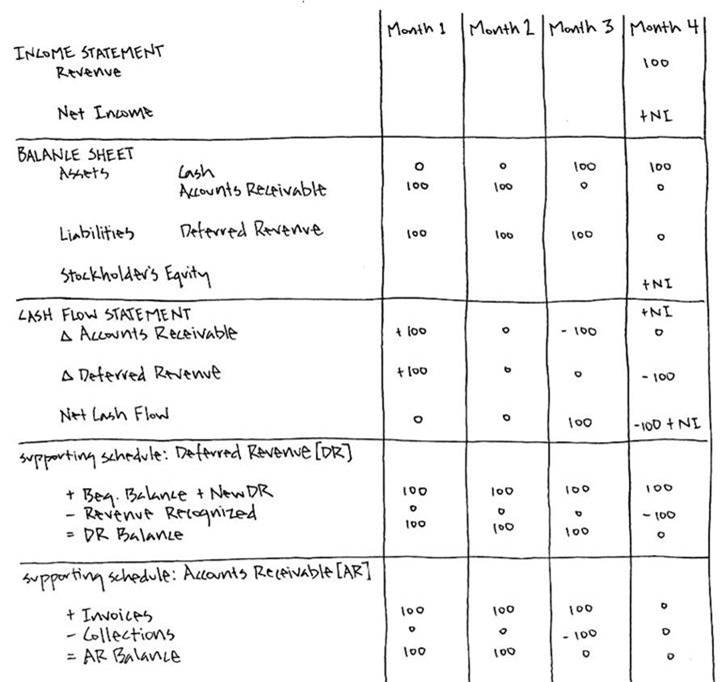

Deferred Revenue A Simple Model

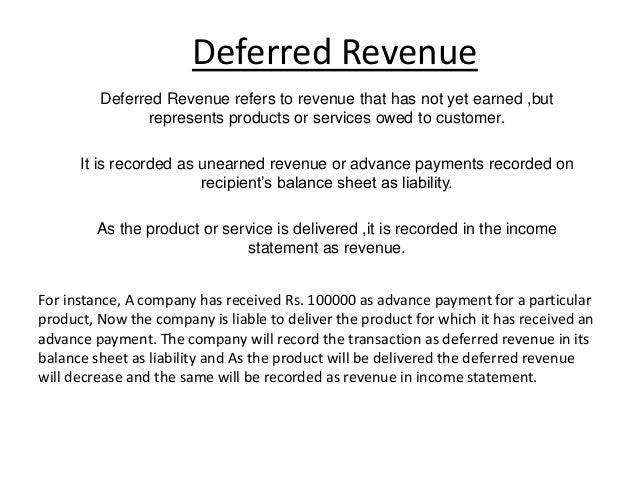

Understanding Deferred Revenue

Understanding Deferred Revenue

Deferred Expenses Wize University Introduction To Financial

Unearned Revenue Journal Entry LizethkruwSmith

Unearned Revenue Journal Entry LizethkruwSmith

What Is Deferred Revenue Expenditure Journal Entry Example - [desc-14]