What Is Income Reporting Threshold Calfresh 10 rowsFor most households the monthly gross income before payroll deductions must be

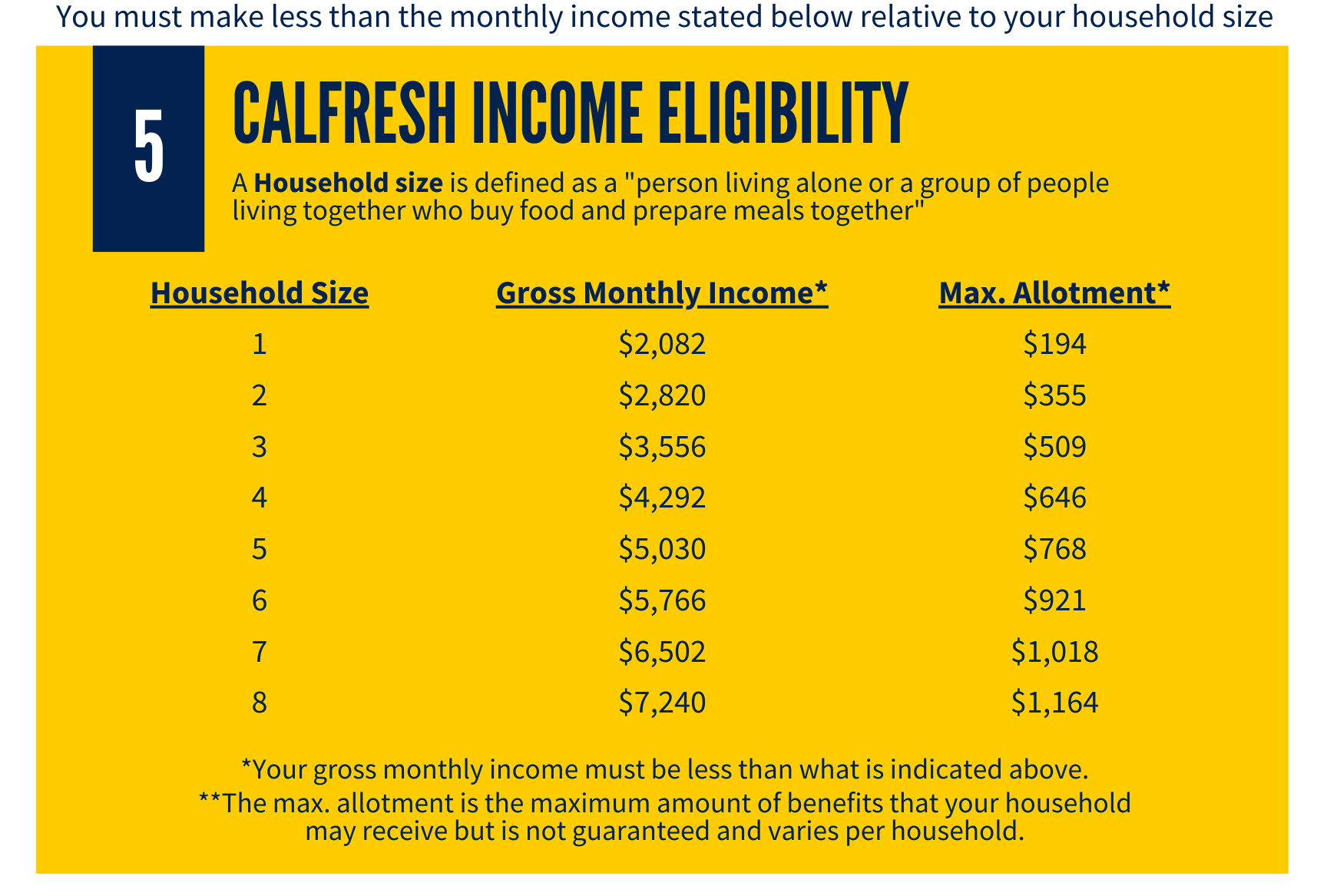

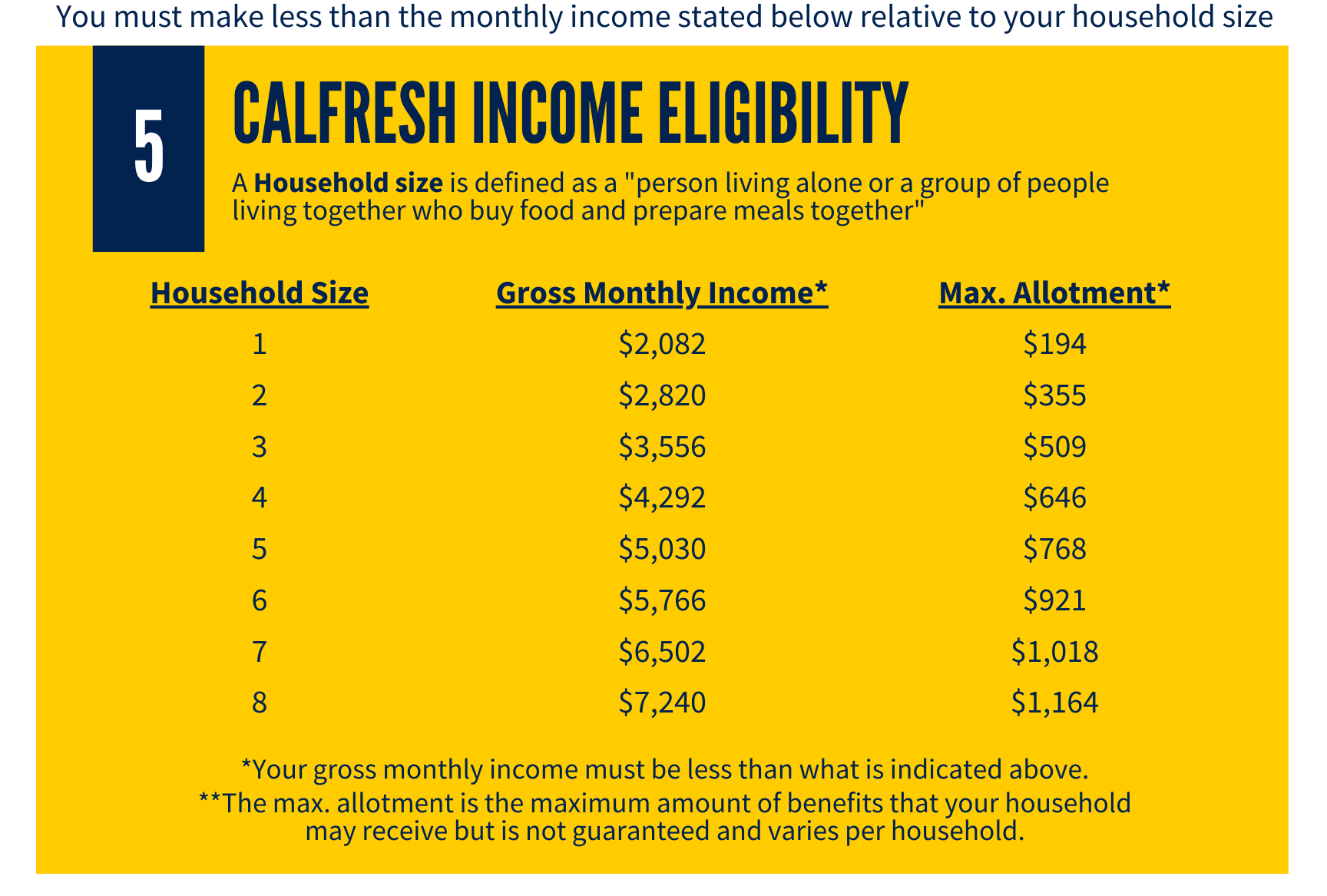

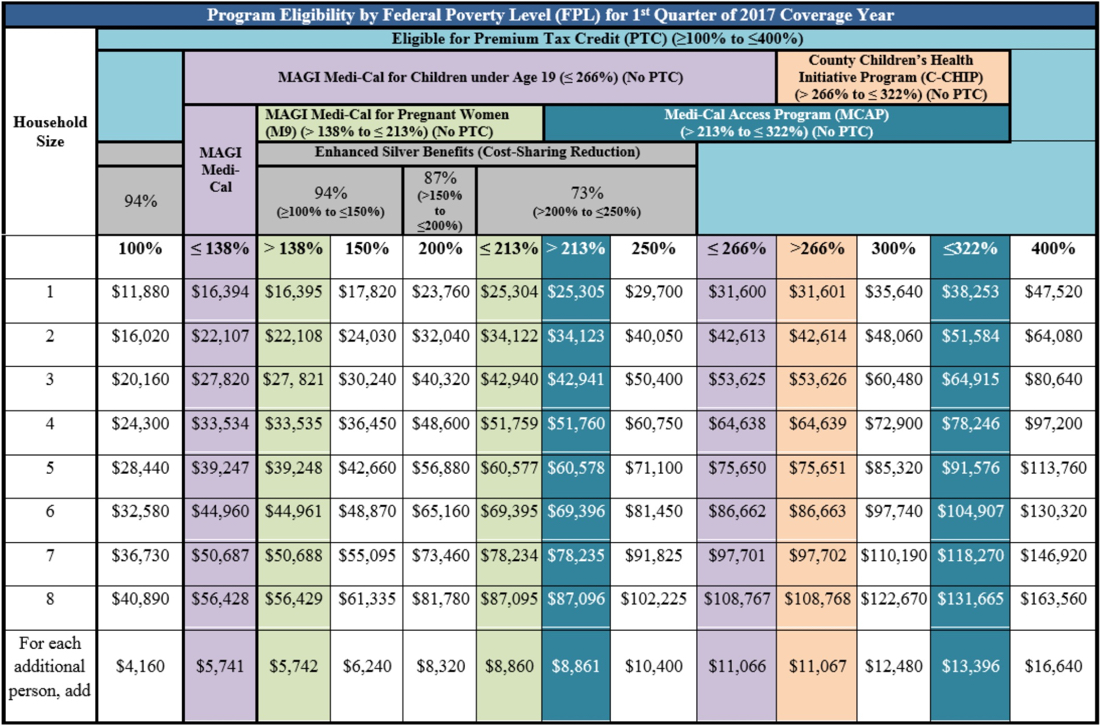

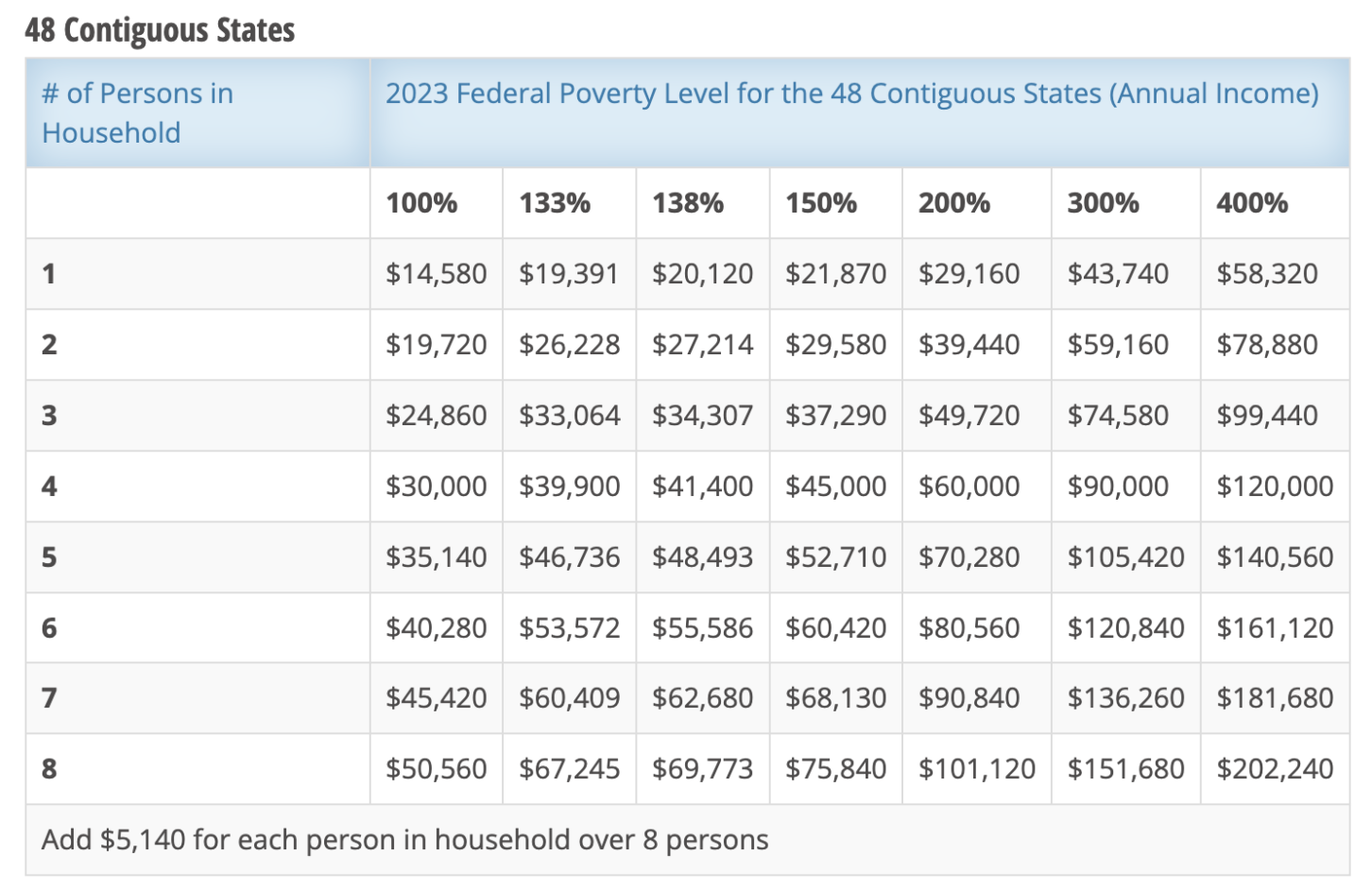

Most households must have a total gross monthly income less than or equal to 200 of the federal poverty level FPL to be potentially Exhibit A here is an admittedly helpful chart on page two that breaks down six differing types of CalFresh eligible households each with differing rules for gross income limits

What Is Income Reporting Threshold Calfresh

What Is Income Reporting Threshold Calfresh

https://i.ytimg.com/vi/T8yvyr7_IIw/maxresdefault.jpg

Student Eligibility Basic Needs Security

https://basicneeds.ucmerced.edu/sites/basicneeds.ucmerced.edu/files/page/images/am_i_eligible.png

Help Me Help You CalFresh

https://static.wixstatic.com/media/54502f_63b27437b91940f4a2e10bb24eb77e4b~mv2.png/v1/fill/w_654,h_315,al_c,q_85,usm_0.66_1.00_0.01,enc_auto/Income Guidelines Oct1 2021 to September 30 2022.png

Effective October 1 2024 a new CalWORKs Income Reporting Threshold IRT will be effective The new IRT amounts are in a chart attached to this ACL Income over the All Income IRT Tier 2 CalFresh IRT Tier 3 If existing income is IRT is Region 1 Size of household Region 1 Exempt Non Exempt Region 2 Exempt Region 2 Non CalWORKs

The following documents list the various aid amounts and standards in many of the programs involved in State Hearings Child Care Rates Table Income Reporting Threshold IRT EAS 44 316 324 CalWORKs recipients subject to SAR and AR CO must report verbally or in writing within 10 days when their income exceeds the IRT for

More picture related to What Is Income Reporting Threshold Calfresh

CalWORks FAQs LAHC

https://www.lahc.edu/sites/lahc.edu/files/styles/inline_image_1100w_/public/2022-08/CA4.png?itok=-OyQJN3k

Snap Income Guidelines 2025 Ri Isla Hanan

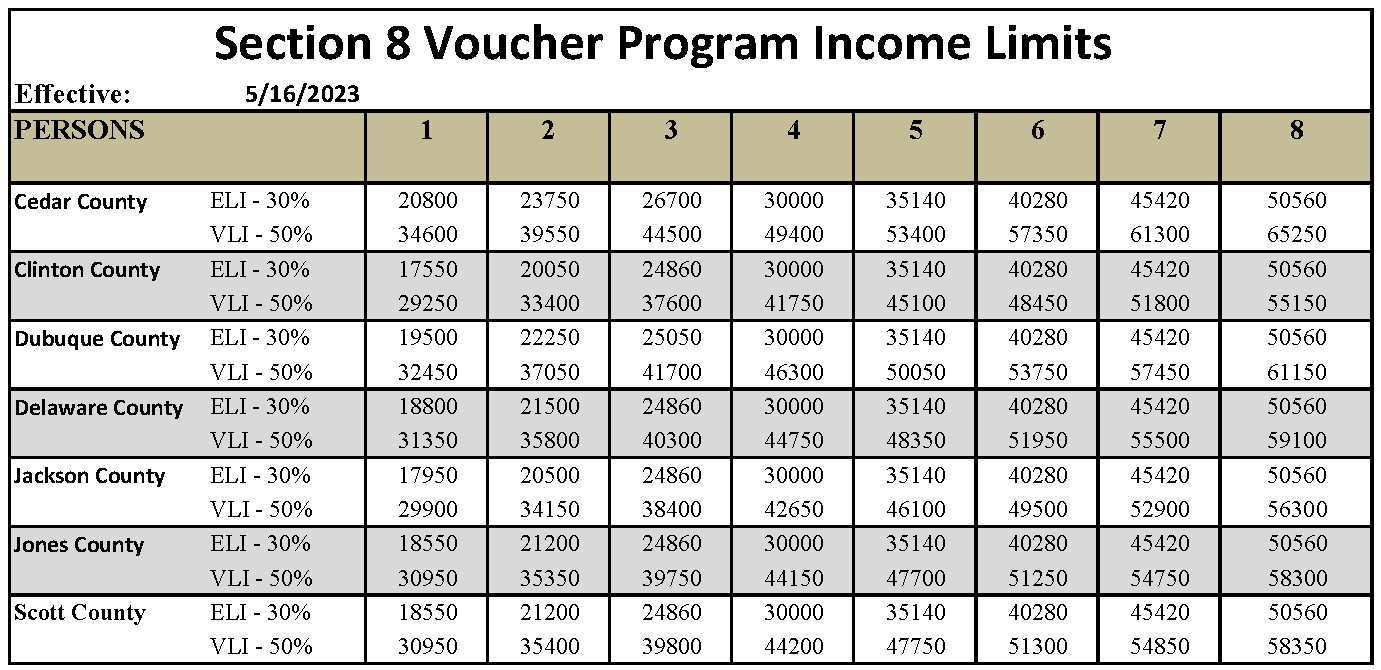

https://eirha.org/Images/2023 Section 8 Income Limits.png

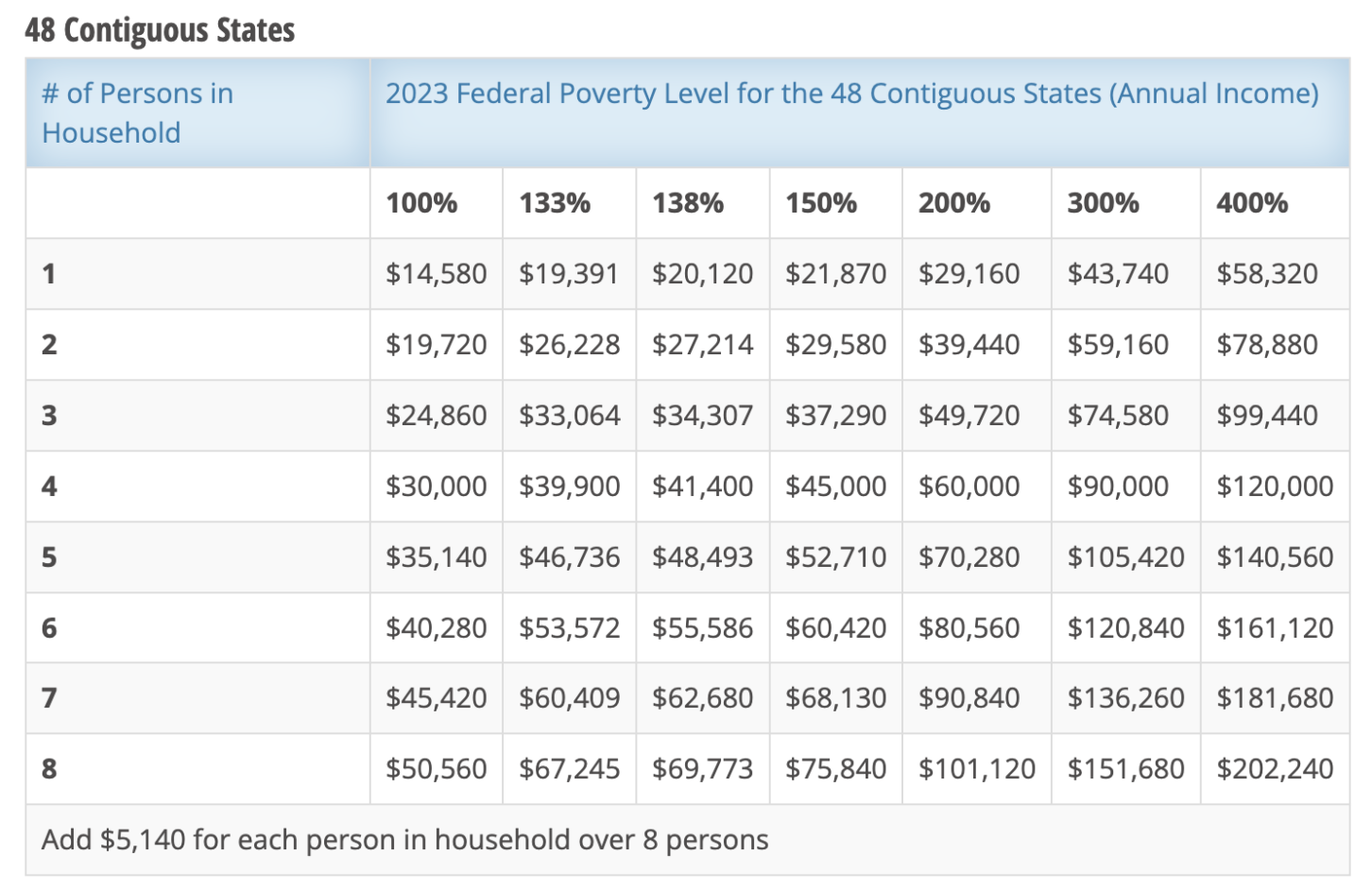

250 Poverty Level 2025 Emily R Cooper

https://www.immi-usa.com/wp-content/uploads/2023/02/Screen-Shot-2023-02-14-at-2.58.02-PM-1452x941.png

Income Reporting Threshold IRT You must report any time your household s total monthly income is more than your current IRT The report must be made within 10 days after the Over your IRT you must report your new gross income to your worker within 10 calendar days of receiving it How Do I Report That My New Income Is Over My IRT You can report your new

The California Department of Social Services CDSS revised the Income Reporting Threshold IRT that triggers the recipient income reporting requirements for the CalFresh and CalWorks Income Reporting Threshold IRT When California implemented the 200 FPL gross income threshold last year it also implemented a 200 FPL income

2024 Payroll Tax Changes Calla Magdaia

https://www.thechichesteraccountants.com/wp-content/uploads/2023/01/tax-2-2-1024x633.png

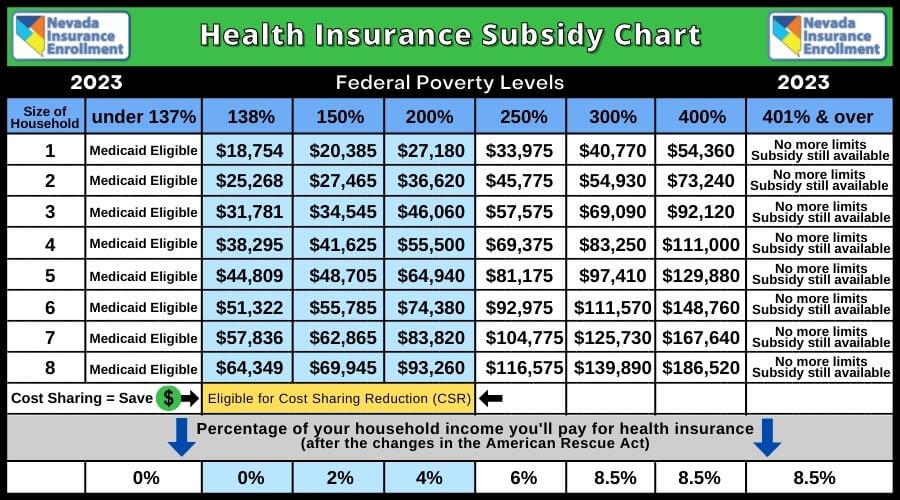

Poverty Guidelines 2025 Marketplace Income Limits Tiff Doloritas

https://www.nevadainsuranceenrollment.com/wp-content/uploads/2022/10/2023-Health-Insurance-Subsidy-Chart-Federal-Poverty-Levels.jpg

https://dpss.lacounty.gov › en › food › calfresh › gross-income.html

10 rowsFor most households the monthly gross income before payroll deductions must be

https://icaliforniafoodstamps.com › calfres…

Most households must have a total gross monthly income less than or equal to 200 of the federal poverty level FPL to be potentially

New Exempt Salary Threshold 2025 Dol Calvin Qasim

2024 Payroll Tax Changes Calla Magdaia

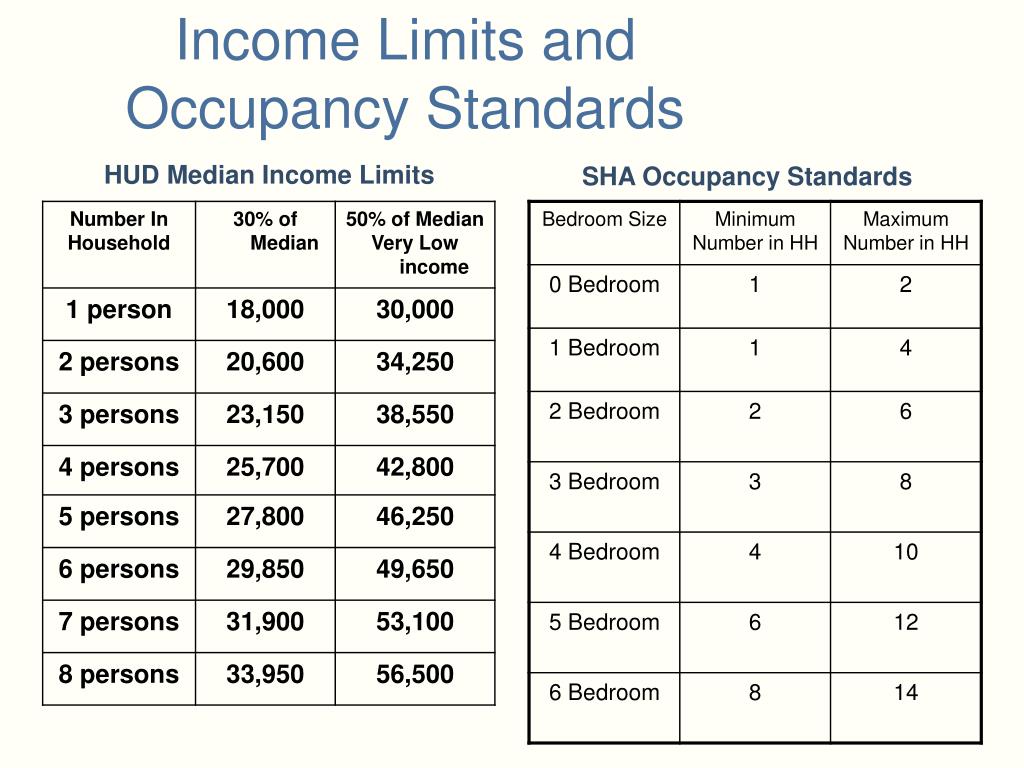

2025 Hud Income Limits 60 De Daniela M Jung

Poverty Guidelines 2025 Florida Eric I Thomas

Qmb Income Guidelines 2024

Reporting Changes Calfresh Fill Out Sign Online DocHub

Reporting Changes Calfresh Fill Out Sign Online DocHub

Policy Implementation Ppt Download

Poverty Level Income 2024 Michigan Caro Martha

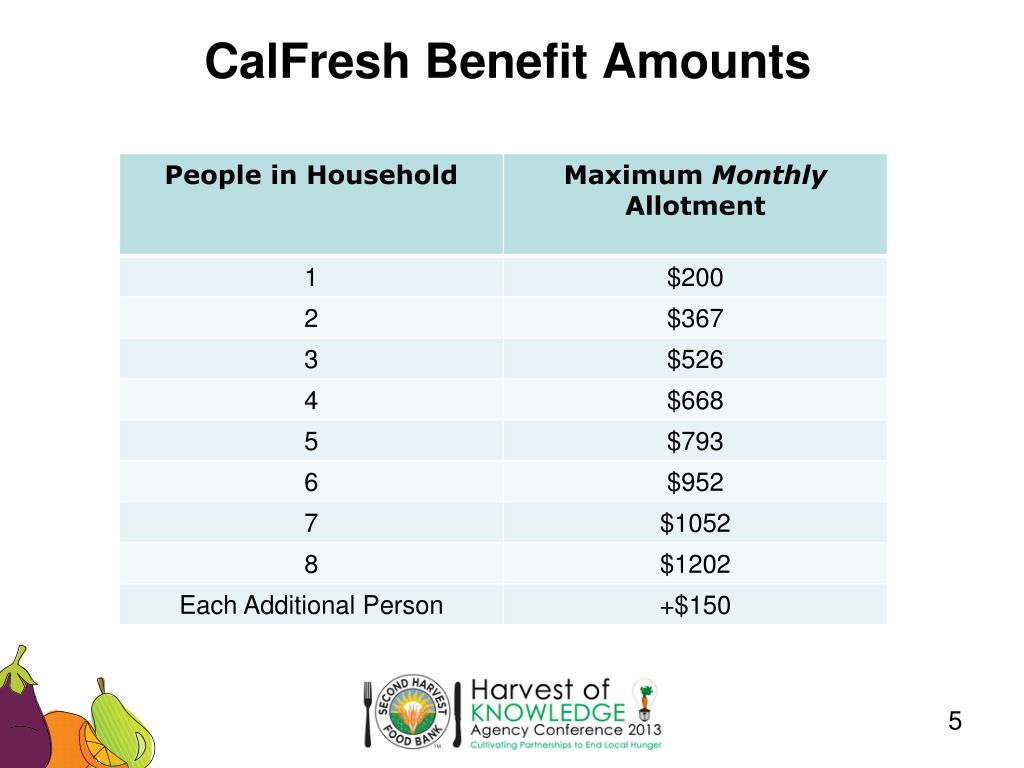

Calfresh Allotment Chart 2023 Blog Archives

What Is Income Reporting Threshold Calfresh - California families who meet income limits may receive benefits to buy food CalFresh the name of the food stamp program in California provides a monthly food allowance to eligible