What Is Income Threshold For Child Benefit The personal income levels used to calculate your Ontario tax have changed The amount of most provincial non refundable tax credits have changed The alternative minimum tax rate was

How to determine your income When applying for the Guaranteed Income Supplement and the Allowance you or in the case of a couple you and your spouse or common law partner must Filing an income tax and benefit return can help you access benefit and credit payments like the GST HST credit up to 533 for an eligible individual the Canada child

What Is Income Threshold For Child Benefit

What Is Income Threshold For Child Benefit

https://finance.gov.capital/wp-content/uploads/2023/09/what-is-income-from-royalties_318667832.jpg

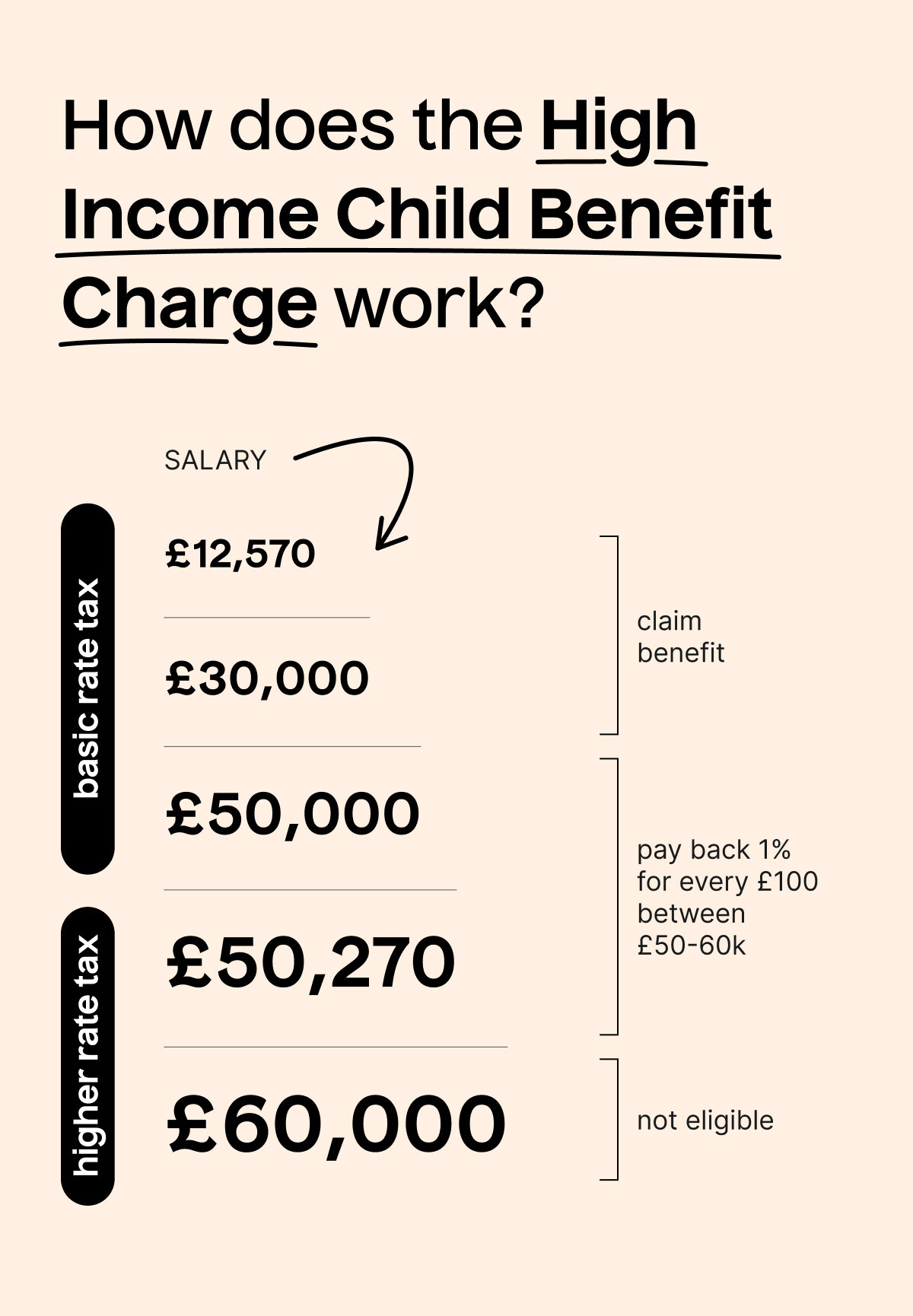

What You Need To Know About The High Income Child Benefit Charge And

https://www.ashfordpartners.co.uk/wp-content/uploads/2023/08/High-Income-Child-Benefit-shutterstock_526243096-1000x630.jpg

What Do You Need To Know About Income Tax Glazers Blog

https://blog.glazers.co.uk/accountants-london/wp-content/uploads/2023/05/What-do-you-need-to-know-about-Income-Tax-1-5000x2500.png

February 24 2025 You can start filing your 2024 income tax and benefit return online April 30 2025 Deadline for most individuals to file their income tax and benefit return and pay any Enter net income or loss after income tax and extraordinary items at amount A page 1 of Schedule 1 Add the taxable items and the non allowable expenses listed on lines 101 to 199

If your net world income exceeds the threshold amount 86 912 for 2023 you have to repay part or your entire OAS pension Part or your entire OAS pension is reduced as a monthly recovery Do not report tax exempt employment income you paid to your employee who is registered or entitled to be registered under the Indian Act using box 14 use code 71 or for a

More picture related to What Is Income Threshold For Child Benefit

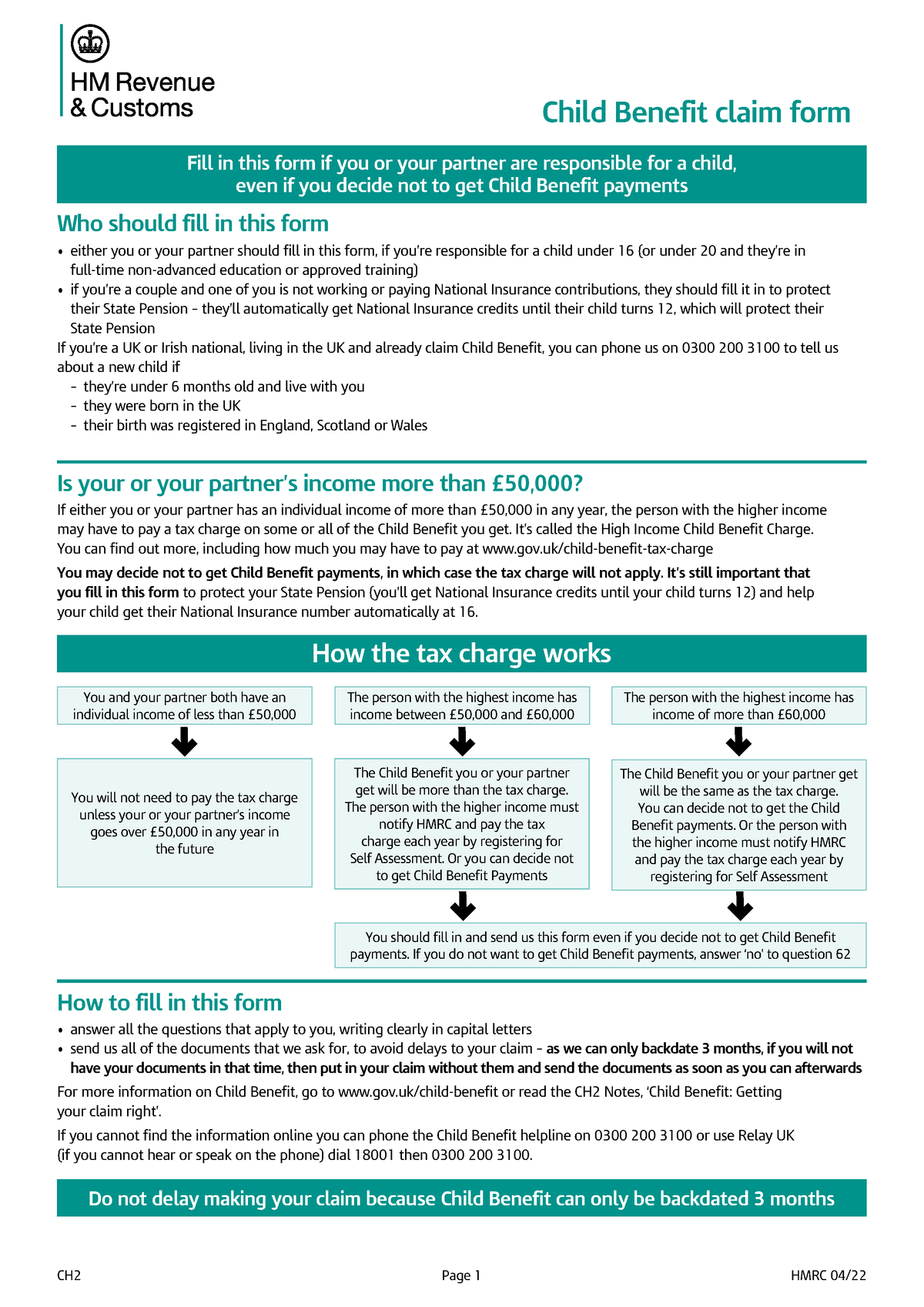

CH2 Child Benefit Claim Form English CH2 Page 1 HMRC 04 Child

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/8f97d6d1ad24b73082669709d7e98d30/thumb_1200_1697.png

What Should You Do About The High Income Child Benefit Charge TaxScouts

https://taxscouts.com/wp-content/uploads/Child_Benefit_Infographic.jpg

What Is Passive Income FAQ Growing PIGs

https://growingpigs.com/wp-content/uploads/2023/08/money-umbrella.jpg

The personal income levels used to calculate your Manitoba tax have changed The basic personal amount has changed The maximum annual amount of eligible expenses for fertility 2 49 In broad terms the enhanced dividend gross up and dividend tax credit apply to dividends distributed to an individual from corporate income taxed at the general corporate income tax

[desc-10] [desc-11]

:max_bytes(150000):strip_icc()/deferredincometax-v3-b8dc55e780ab4f47a0987161ece97060.png)

What Is Income Tax And How Are Different Types Calculated 50 OFF

https://www.investopedia.com/thmb/5gk30VTd3T-tJlqMprcY4lsSMJk=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/deferredincometax-v3-b8dc55e780ab4f47a0987161ece97060.png

Income Protection Can An Insurer Stop Paying My Benefits Zaparas Law

https://www.zaparaslaw.com.au/wp-content/uploads/2023/02/iStock-1387074602-1550x1034.jpg

https://www.canada.ca › ... › general-income-tax-benefit-package › ontario

The personal income levels used to calculate your Ontario tax have changed The amount of most provincial non refundable tax credits have changed The alternative minimum tax rate was

https://www.canada.ca › ... › old-age-security › guaranteed-income-supp…

How to determine your income When applying for the Guaranteed Income Supplement and the Allowance you or in the case of a couple you and your spouse or common law partner must

What Is Income Unit Ppt Download

:max_bytes(150000):strip_icc()/deferredincometax-v3-b8dc55e780ab4f47a0987161ece97060.png)

What Is Income Tax And How Are Different Types Calculated 50 OFF

INCOME TAX SLAB FOR FY 2022 23 BBNC

What Is Income Protection Super Advice New Zealand

Income Tax Earning Income From House Rent Will You Have To Pay Tax

What Is Income Statement Definition Format Examples

What Is Income Statement Definition Format Examples

What Is Income Statement PDF Gross Margin Expense

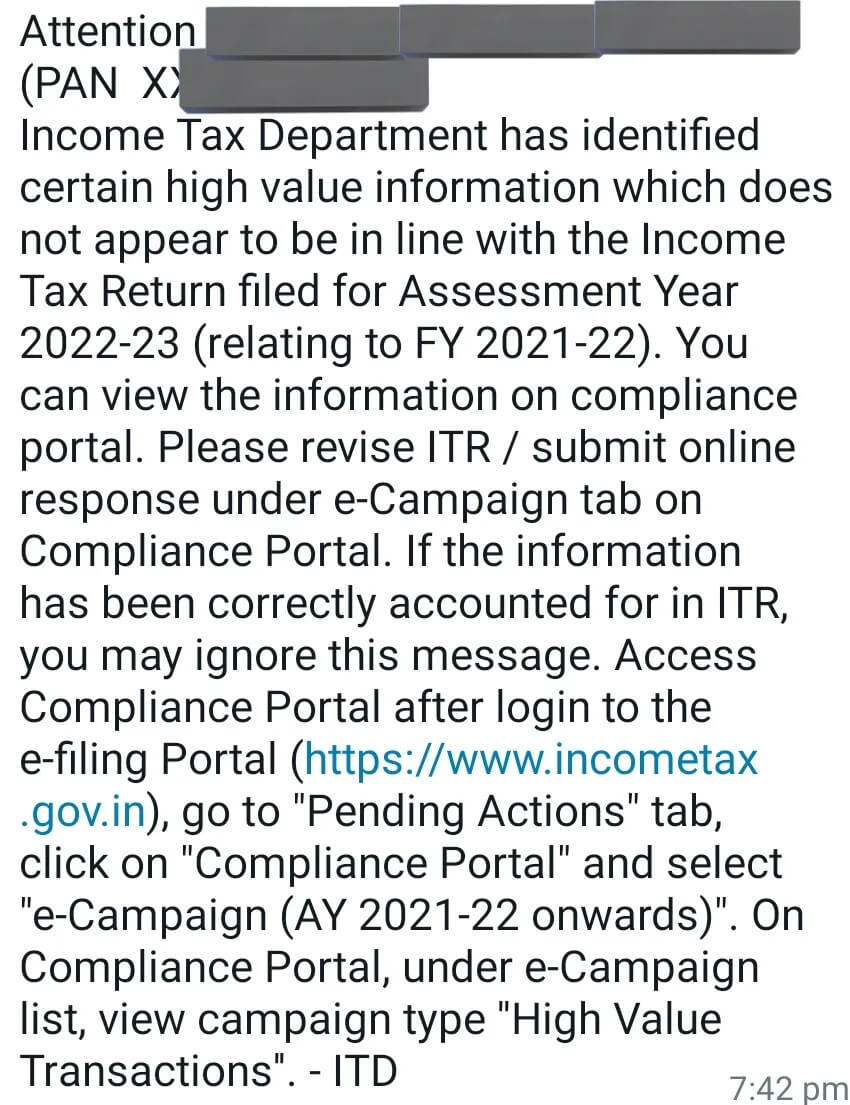

How To Reply To Income Tax Mail SMS On E Campaign For High Value

What Is Income Protection Awareness Week Dentistry

What Is Income Threshold For Child Benefit - [desc-14]