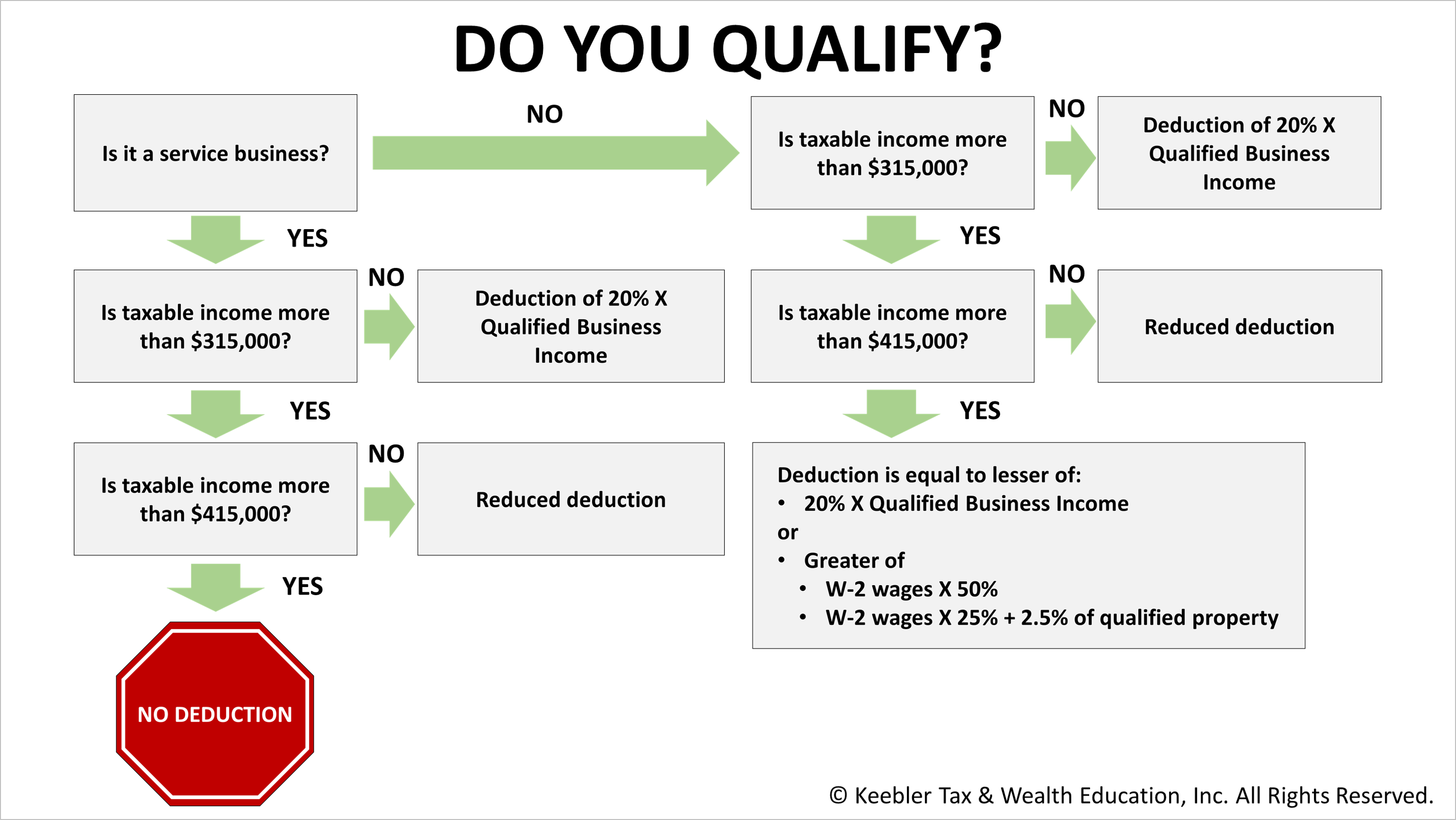

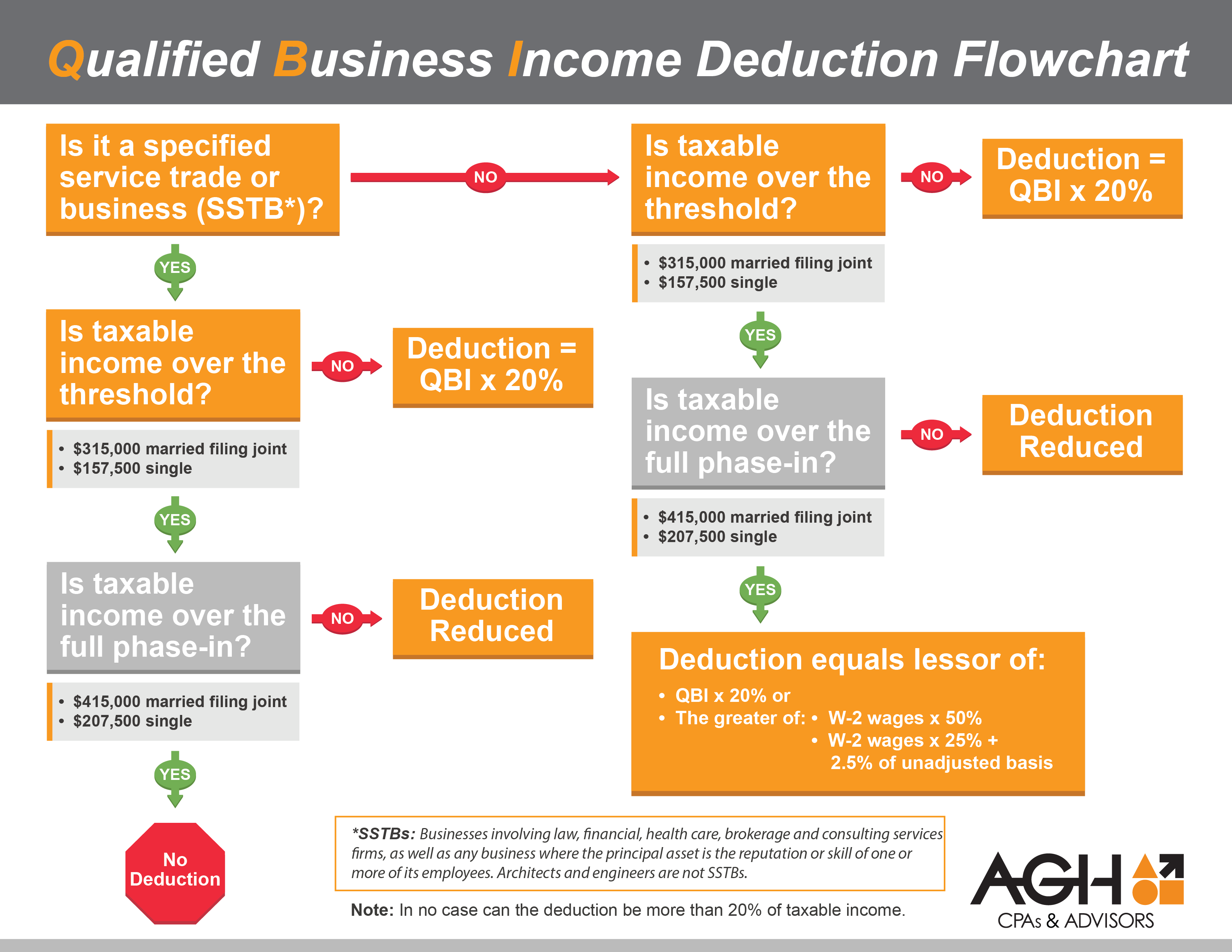

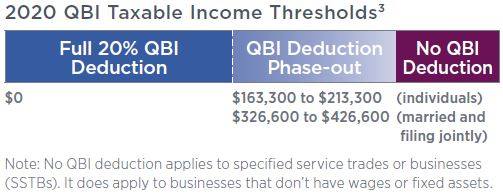

What Is Net Qualified Business Income The qualified business income deduction QBI is a tax deduction that allows eligible self employed and small business owners to deduct up to 20 of their qualified business income on their taxes

What is the qualified business income deduction The qualified business income QBI deduction also known as Section 199A allows owners of pass through businesses to claim a tax deduction worth up to 20 percent of their qualified Qualified business income QBI is the net income or loss from a trade or business This includes income generated from partnerships S corporations sole proprietorships and

What Is Net Qualified Business Income

What Is Net Qualified Business Income

https://i.ytimg.com/vi/eTPFnLjPPDE/maxresdefault.jpg

Qbi Phase Out 2024 Sellers Vintage Brunofuga adv br

https://www.nysscpa.org/cpaj-images/CPA.2022.92.5.006.t002.jpg

Financial Briefs Shepherd Financial

http://contentengine.advisorproducts.com/images/NL_Images/3828_1.png

Types of Income Covered The QBI deduction applies to income from active business activities It encompasses the net amount of income gain deduction and loss from What is Qualified Business Income QBI QBI is essentially the net amount of qualified items of income gain deduction and loss from any qualified trade or business That includes income from partnerships S

The Qualified business income deduction QBI allows self employed and small company owners to deduct up to 20 of their qualified business income from their taxes In The Qualified Business Income QBI deduction also known as Section 199A is a valuable tax benefit introduced by the Tax Cuts and Jobs Act of 2017 This guide explains everything business owners need to know about

More picture related to What Is Net Qualified Business Income

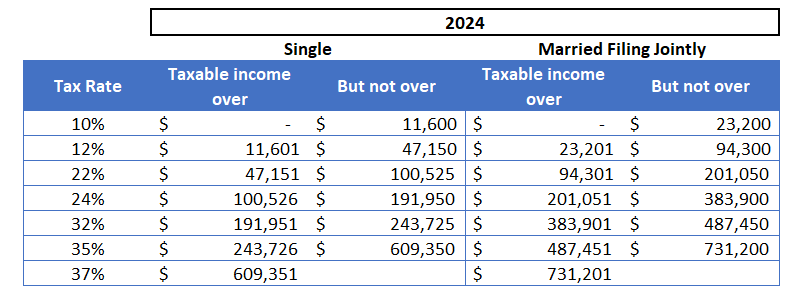

2024 Tax Brackets Darrow Wealth Management

https://darrowwealthmanagement.com/wp-content/uploads/2023/11/2024-Tax-Brackets.png

Schedule 1 Worksheet 2023

https://dontmesswithtaxes.typepad.com/.a/6a00d8345157c669e2026bdecfbbd4200c-800wi

Tax Tables For 2025 Claudia Juan

https://www.taxpolicycenter.org/sites/default/files/model-estimates/images/t23-0017.gif

Section 199A c 1 defines qualified business income as the net amount of qualified items of income gain deduction and loss with respect to any qualified trade or business of the taxpayer The Qualified Business Income Deduction QBI is a recently established tax deduction allowing businesses to deduct as much as 20 of their earnings This deduction

Qualified business income means the net amount of your business s income except for investment income like capital gains or losses or dividends income from any businesses What is the qualified business income deduction The qualified business income QBI deduction is a tax break that lets business owners with pass through income write off up

Qbi Deduction Phase Out 2025 Gary Perkins

https://media.smallbiztrends.com/2023/01/qbi-deduction-infographic-1000x525.png

Qbi Deduction 2025 Alexa Bryant

https://help.holistiplan.com/hs-fs/hubfs/image-png-Sep-06-2022-04-02-12-82-PM.png?width=688&name=image-png-Sep-06-2022-04-02-12-82-PM.png

https://www.nerdwallet.com › article › taxes › qualified...

The qualified business income deduction QBI is a tax deduction that allows eligible self employed and small business owners to deduct up to 20 of their qualified business income on their taxes

https://www.bench.co › blog › tax-tips › qbi-deduction

What is the qualified business income deduction The qualified business income QBI deduction also known as Section 199A allows owners of pass through businesses to claim a tax deduction worth up to 20 percent of their qualified

2025 Schedule Se Form 1040 Nissa Anallise

Qbi Deduction Phase Out 2025 Gary Perkins

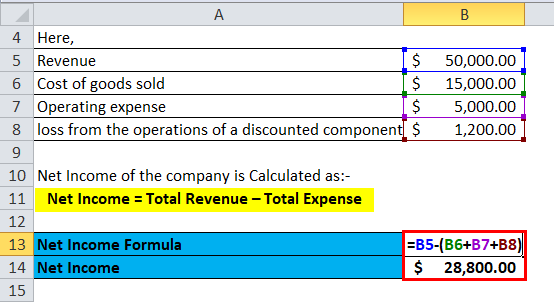

Accounting Equation To Calculate Net Income Tessshebaylo

Qbi Deduction Phase Out 2025 Bent T Carlsen

Total Revenue Formula

Economic Impact Payment 2025 Tax Return Form Todd M Anderson

Economic Impact Payment 2025 Tax Return Form Todd M Anderson

Qbi Calculation Worksheet Printable Word Searches

Qbi Calculation Worksheet Printable Word Searches

Maximizing Your Qualified Business Income Deduction

What Is Net Qualified Business Income - Qualified Business Income QBI is a tax term that you need to understand It refers to the net income generated by any qualified trade or business But what does a qualified