What Is Professional Tax The Professional Tax is administered under the provisions of The Punjab Finance Act 1977 and the Punjab Professions and Trade Tax Rules 1977 This tax is levied and collected on from the persons or class of persons engaged in a profession trade calling or employment in the Province of the Punjab and it shall come into force on and from the

PROFESSIONAL TAX This tax is levied under the Sindh Finance Act 1964 The basis of this tax is to bring various categories of persons engaged in different trade callings and professions Professional tax is a form of direct taxation imposed on individuals who earn income from their professional activities or services rendered Professional tax is

What Is Professional Tax

What Is Professional Tax

https://startupsguide.co.in/blog/what-is-professional-tax.jpg

What Is Professional Tax Professional Tax Payment MoneyPiP

http://moneypip.com/wp-content/uploads/2020/11/What-is-professional-tax_-1024x576.jpg

Roots

https://roots.hdfcsec.com/storage/CkphsJ4alOPe7kcs3m5OcSM7jQhppLZs8xm0beBo.jpg

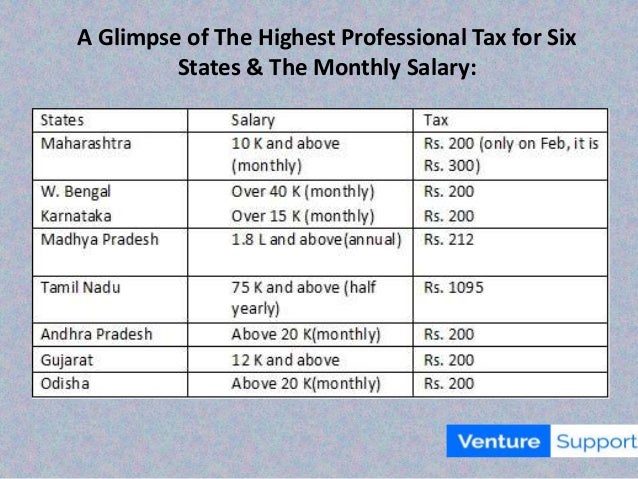

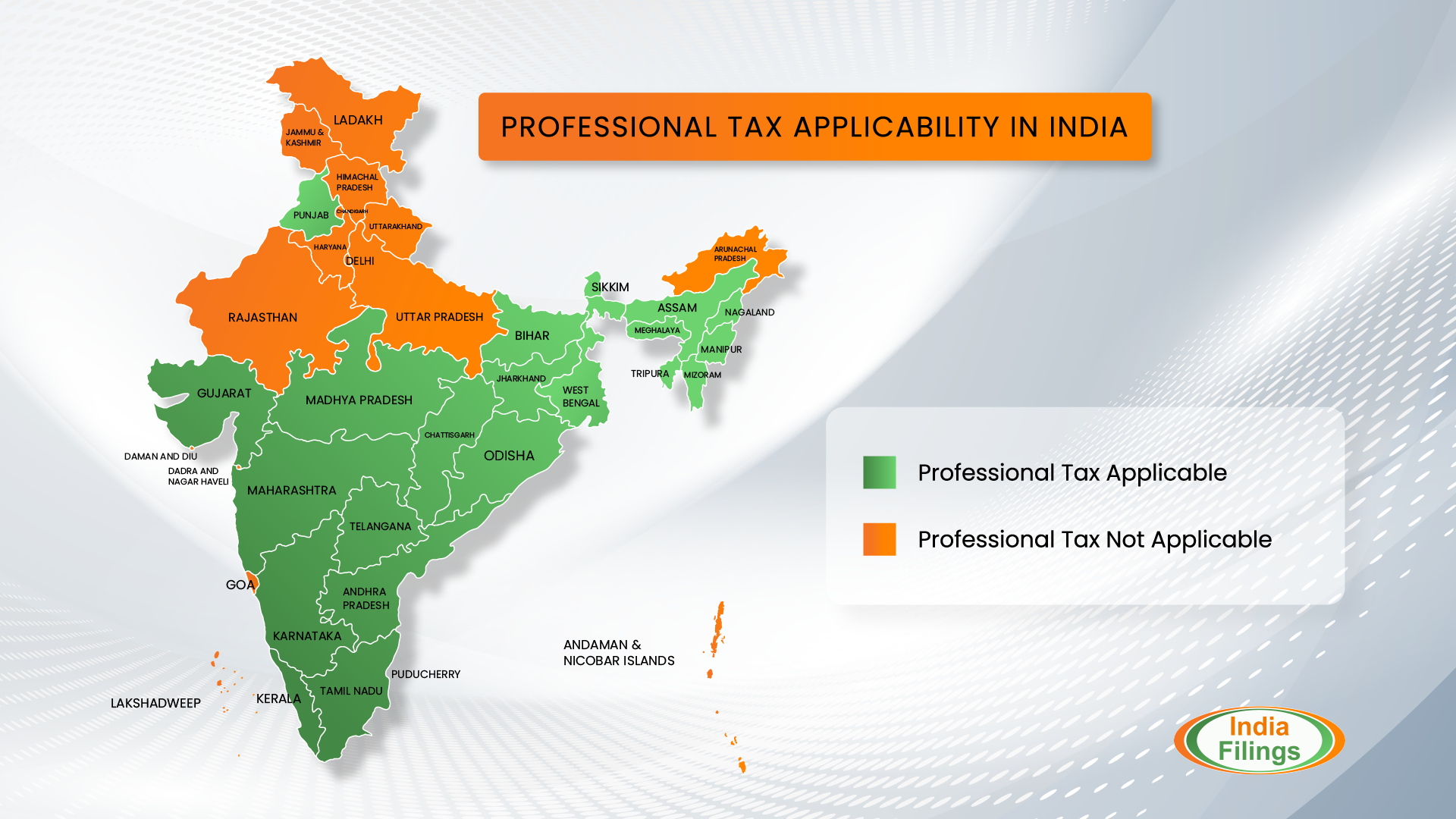

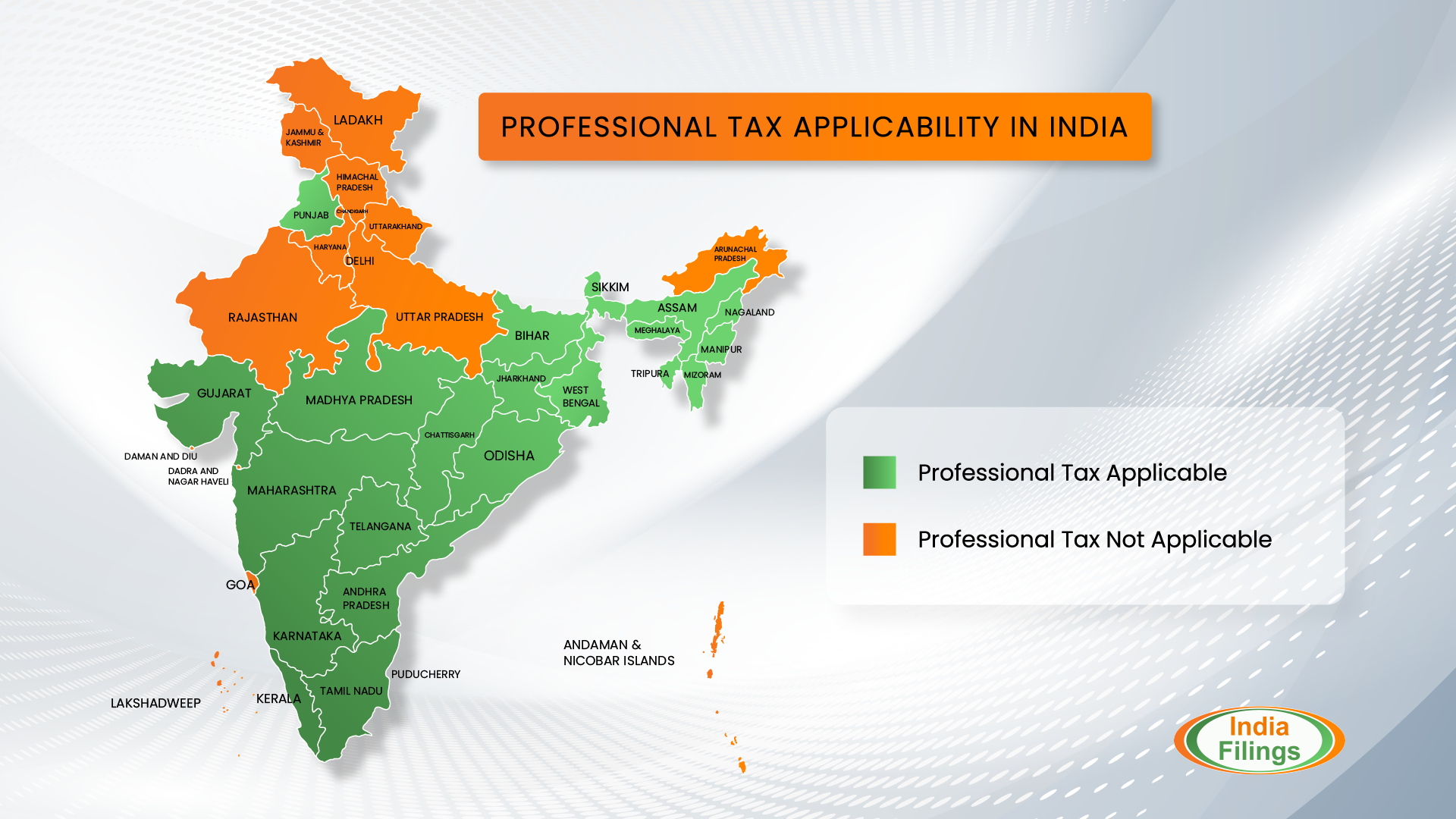

Professional Tax is implemented under the Finance Act 1977 It is a tax levied and collected with respect to earning or income from any profession trade calling or employment for each financial year in addition to any tax rate duty or What is Professional tax Professional tax is a tax on all kinds of professions trades and employment and levied based on the income of such profession trade and employment It is levied on employees a person carrying on business including freelancers professionals etc

The Professional Tax is a Provisional Levy which is applicable on any business establishment profession or employment in Sindh Province It is a yearly tax which is paid in advance before 31 st August of every year The Professional Tax is based upon the Annual Turnover in case of individual business and partnership firms All establishments including video shops real estate shops agencies card dealers and net cafes assessed or not assessed to income tax in the preceding financial year

More picture related to What Is Professional Tax

What Is Professional Tax

https://image.slidesharecdn.com/whatisprofessionaltax-ppt-190925075812/95/what-is-professional-tax-8-638.jpg?cb=1569398567

What Is Professional Tax

https://image.slidesharecdn.com/whatisprofessionaltax-ppt-190925075812/95/what-is-professional-tax-1-638.jpg?cb=1569398567

What Is Professional Tax A Complete Guide IndiaFilings

https://www.indiafilings.com/learn/wp-content/uploads/2023/09/What-is-Professional-tax.jpg

Every salaried individual working and earning a monthly income is liable to pay a certain part of his her earnings to the respective state governments in the form of professional tax This tax often referred to as P tax is reflected in an individual s salary slip as well Professional tax is a tax paid by an individual who earns money through his her profession and is liable to pay some amount to the government

[desc-10] [desc-11]

What Is Professional Tax A Complete Guide IndiaFilings

https://www.indiafilings.com/learn/wp-content/uploads/2023/09/Professional-tax.png

SuperCA

https://superca.in/storage/app/public/blogs/proftax.webp

https://excise.punjab.gov.pk › professional_tax

The Professional Tax is administered under the provisions of The Punjab Finance Act 1977 and the Punjab Professions and Trade Tax Rules 1977 This tax is levied and collected on from the persons or class of persons engaged in a profession trade calling or employment in the Province of the Punjab and it shall come into force on and from the

https://excise.gos.pk › taxes › professional-tax

PROFESSIONAL TAX This tax is levied under the Sindh Finance Act 1964 The basis of this tax is to bring various categories of persons engaged in different trade callings and professions

What Is Professional Tax Meaning Rates Compliance Stride Post

What Is Professional Tax A Complete Guide IndiaFilings

What Is Professional Tax Rates Due Date Compliance

What Is Professional Tax Professional Tax Cost 2023

What Is Professional Tax Definition Cost Penalties Doctor Genesis

Professional Tax Meaning Slab Rates And Applicability 2024

Professional Tax Meaning Slab Rates And Applicability 2024

Professional Tax Meaning Slab Rates And Compliance

What Is Professional Tax And How Is It Calculated Templates Sample

What Is Professional Tax How Much Is Charged As Tax

What Is Professional Tax - Professional Tax is implemented under the Finance Act 1977 It is a tax levied and collected with respect to earning or income from any profession trade calling or employment for each financial year in addition to any tax rate duty or