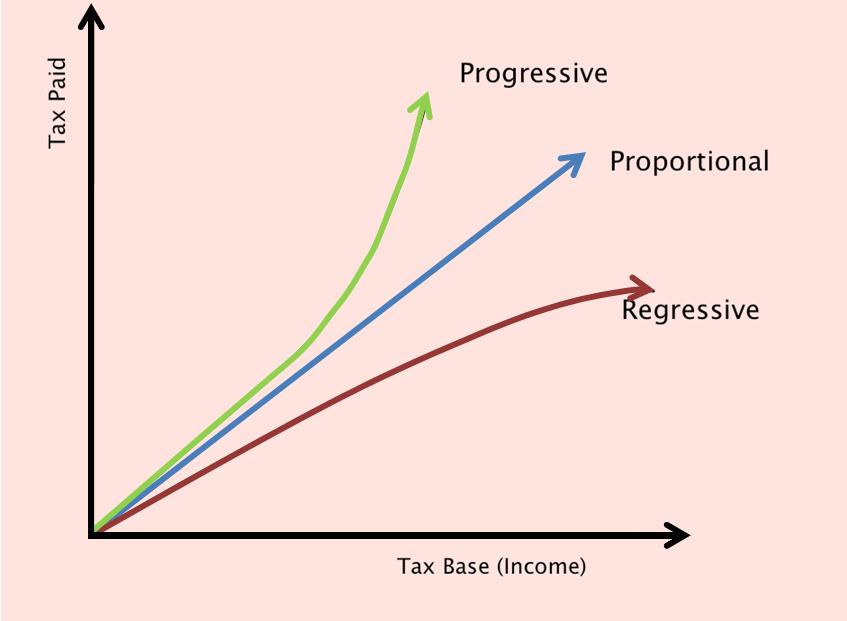

What Is Proportional Tax A proportional tax is a type of tax where the tax rate is the same for all income levels It is a flat tax where everyone pays the same percentage of their income Proportional

A proportional tax is a tax imposed so that the tax rate is fixed with no change as the taxable base amount increases or decreases The amount of the tax is in proportion to the amount What is Proportional Tax A proportional tax is a single rated tax wherein all the incomes without considering the slabs or other criteria tax is levied at a flat fixed rate

What Is Proportional Tax

What Is Proportional Tax

https://i.ytimg.com/vi/WKxNV6p_nmo/maxresdefault.jpg

Proportional Tax Intelligent Economist

https://www.intelligenteconomist.com/wp-content/uploads/2019/09/Proportional-Tax.png

Mlhaak Blog

https://pbs.twimg.com/media/COCljPyVAAAzM33.jpg

A proportional tax is a type of tax in which the tax rate remains constant and does not change with the increase in income of the taxpayer In a proportional tax system all What is a Proportional Tax A proportional tax system often referred to as a flat tax levies taxes at the same rate on every income earner irrespective of their income level Proportional taxes

In a proportional tax system every individual and entity pays taxes at the same rate regardless of their annual income or financial status This uniform tax rate is a defining A proportional tax often referred to as a flat tax is a tax system that applies the same tax rate to all income levels This article delves into the intricacies of proportional

More picture related to What Is Proportional Tax

What Is Proportional Tax

https://marketbusinessnews.com/wp-content/uploads/2019/10/MBN_Logo.png

Tax Brackets 2024

https://districtcapitalmanagement.com/wp-content/uploads/Tax-Bracket-scaled.jpg

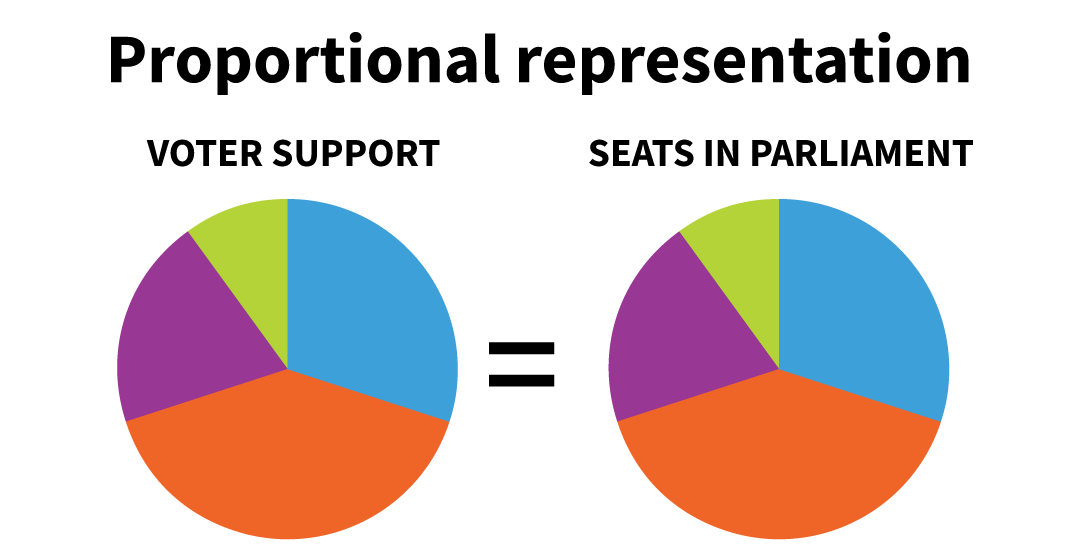

What Is Proportional Representation Fair Vote Canada

https://www.fairvote.ca/wp-content/uploads/2021/07/What-is-PR-page-pie.png

Proportional tax often referred to as a flat tax is a taxation system where the tax rate remains constant regardless of the income level This means that every taxpayer pays the A proportional tax or flat tax applies the same rate to all individuals regardless of income differing from progressive tax systems that impose higher rates on higher earners

[desc-10] [desc-11]

What Is Proportional Tax

https://marketbusinessnews.com/wp-content/uploads/2024/02/Proportional-Tax-thumbnail-image.jpg

Proportional Tax FundsNet

https://fundsnetservices.com/wp-content/uploads/what-is-proportional-tax.png

https://www.financestrategists.com › tax › proportional-tax

A proportional tax is a type of tax where the tax rate is the same for all income levels It is a flat tax where everyone pays the same percentage of their income Proportional

https://en.wikipedia.org › wiki › Proportional_tax

A proportional tax is a tax imposed so that the tax rate is fixed with no change as the taxable base amount increases or decreases The amount of the tax is in proportion to the amount

What Is Proportional Tax

What Is Proportional Tax

Proportional Tax Finance Reference

What Is Proportional Relationship Free Sample Example Format

TAXES Dead Weight Loss Consumer Surplus YouTube

What Is Proportional Integral Derivative Control PID

What Is Proportional Integral Derivative Control PID

Taxation

What Is Proportional Control Electrical Volt

What Is Microsoft Teams Pocket Tactics

What Is Proportional Tax - A proportional tax often referred to as a flat tax is a tax system that applies the same tax rate to all income levels This article delves into the intricacies of proportional