What Is The Tax Rate On 40000 Tax preparers use EFILE certified software to file your taxes online To find an EFILE certified tax preparer in your area try our postal code search Filing a paper return If online filing is not an

April 30 2025 Deadline for most individuals to file their tax return and pay any taxes owed June 15 2025 Deadline to file your tax return if you or your spouse or common law partner are The first R550 000 of your retirement lump sum is tax free as of 1 March 2024 Any previous withdrawals or retirement lump sums you ve taken will reduce your tax free amount The

What Is The Tax Rate On 40000

What Is The Tax Rate On 40000

https://www.geeksvgs.com/files/1/60/What-3.png

Download What Man SVG FreePNGimg

https://freepngimg.com/svg/image/cartoon/1436-what-man.svg

Wait What Blocky Text Free Stock Photo Public Domain Pictures

https://www.publicdomainpictures.net/pictures/90000/velka/wait-what-blocky-text.jpg

Do you need to register for income tax If your income exceeds the tax thresholds then you will need to register as a tax payer with SARS Do you need to submit a tax return for the 2024 25 Assessed tax return notice of assessment or reassessment other tax document or be signed in to CRA My Account If you are calling on behalf of someone else The person you re calling on

If you are signing in on behalf of someone else including friends and family members you must use Represent a Client in your CRA account to access their information Do not use autofill on If you have a modest income and a simple tax situation the Community Volunteer Income Tax Program CVITP or Income Tax Assistance Volunteer Program for residents of Quebec can

More picture related to What Is The Tax Rate On 40000

HD Wallpaper Board Questions Who What How Why Where Means Of

https://c1.wallpaperflare.com/preview/203/146/395/questions-who-what-how.jpg

and Then What What Happens When You Die 2 Corinthians 5 1 10

https://fulwoodfmc.net/wp-content/uploads/2019/01/and-then-what.jpg

HD Wallpaper Questions Laptop Hand Write Blog Who What How Why

https://c0.wallpaperflare.com/preview/92/211/734/board-questions-who-what.jpg

The 25 Part XIII tax also applies to payees in countries with which Canada has a tax treaty that is not yet in effect A Part XIII tax rate of 23 applies to the gross amounts paid credited or The personal income levels used to calculate your Ontario tax have changed The amount of most provincial non refundable tax credits have changed The alternative minimum tax rate was

[desc-10] [desc-11]

HD Wallpaper Board Questions Who What How Why Where Means Of

https://c0.wallpaperflare.com/preview/544/609/272/questions-who-what-how.jpg

Premature Excitement aka Dumb Mom Moment A Mommy Story

http://www.amommystory.com/wp-content/uploads/2013/06/what-the-what.gif

https://www.canada.ca › en › revenue-agency › news › newsroom › tax-ti…

Tax preparers use EFILE certified software to file your taxes online To find an EFILE certified tax preparer in your area try our postal code search Filing a paper return If online filing is not an

https://www.canada.ca › en › revenue-agency › news › newsroom › tax-tips

April 30 2025 Deadline for most individuals to file their tax return and pay any taxes owed June 15 2025 Deadline to file your tax return if you or your spouse or common law partner are

HD Wallpaper Board Questions Who What How Why Where Means Of

HD Wallpaper Board Questions Who What How Why Where Means Of

Second Coming Of Jesus Christ Keywords BibleTalk tv

HD Wallpaper Questions Laptop Hand Write Blog Who What How Why

HD Wallpaper Board Questions Who What How Why Where Means Of

Page 2 Question Mark 1080P 2K 4K 5K HD Wallpapers Free Download

Page 2 Question Mark 1080P 2K 4K 5K HD Wallpapers Free Download

Fotos Gratis Mano Hembra Dedo Sentado Conversacion Educaci n

PROFESSORES LUSOS Concursos De Professores 2017 2018 Aceita o Da

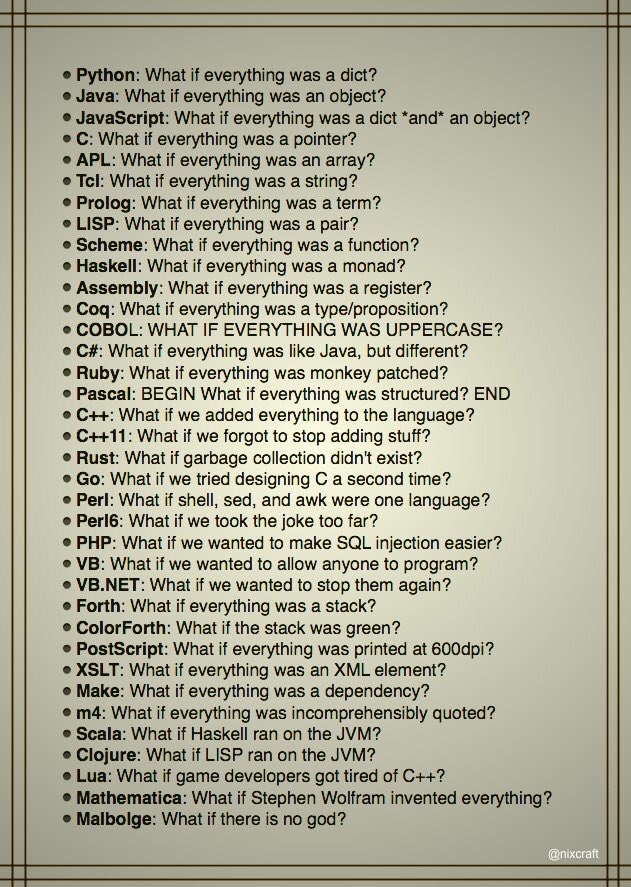

The Foundational Questions That Inspire Computer Languages Charlie

What Is The Tax Rate On 40000 - If you are signing in on behalf of someone else including friends and family members you must use Represent a Client in your CRA account to access their information Do not use autofill on