What Is Wacc And Why Is It Important This guide will provide a detailed breakdown of what WACC is why it is used and how to calculate it WACC is used in financial modeling as the discount rate to calculate the net

The importance and usefulness of the weighted average cost of capital WACC as a financial tool for both investors and companies are well accepted among financial analysts WACC which stands for Weighted Average Cost of Capital is a crucial metric used by investors to evaluate the profitability and risk of an investment It serves as a

What Is Wacc And Why Is It Important

What Is Wacc And Why Is It Important

https://i.ytimg.com/vi/MUpCQyKeFgI/maxresdefault.jpg

Weighted Average Cost Of Capital WACC Formula Examples 60 OFF

https://study.com/cimages/videopreview/uixfbmk0mf.jpg

ZWCAD India Best 2D 3D CAD Software Hope Technologies 46 OFF

https://www.financestrategists.com/uploads/WACC-Formula.png

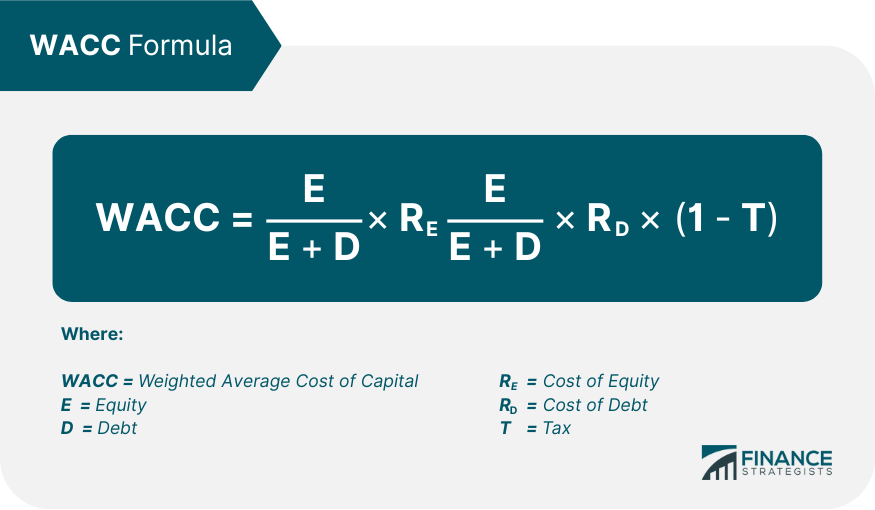

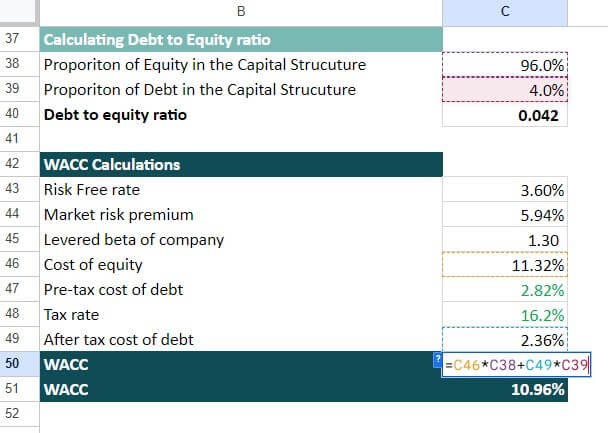

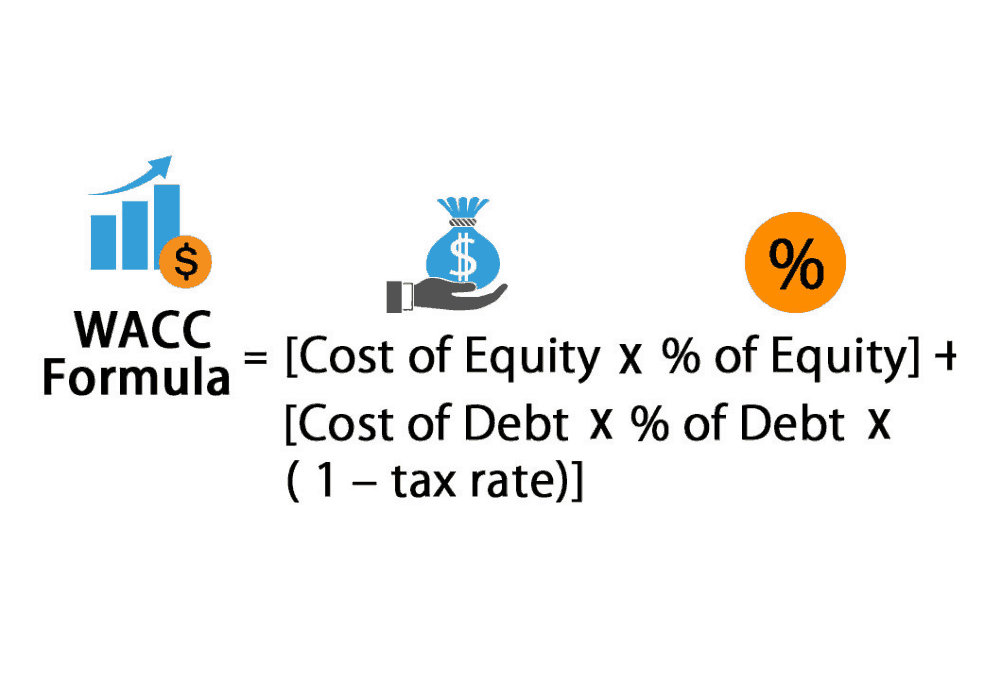

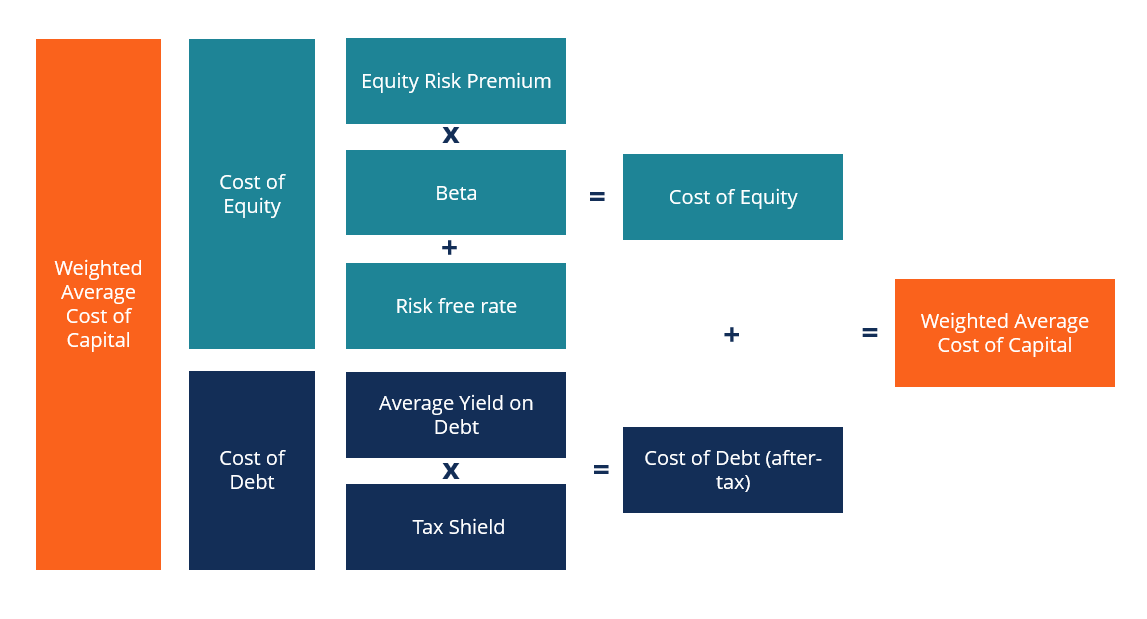

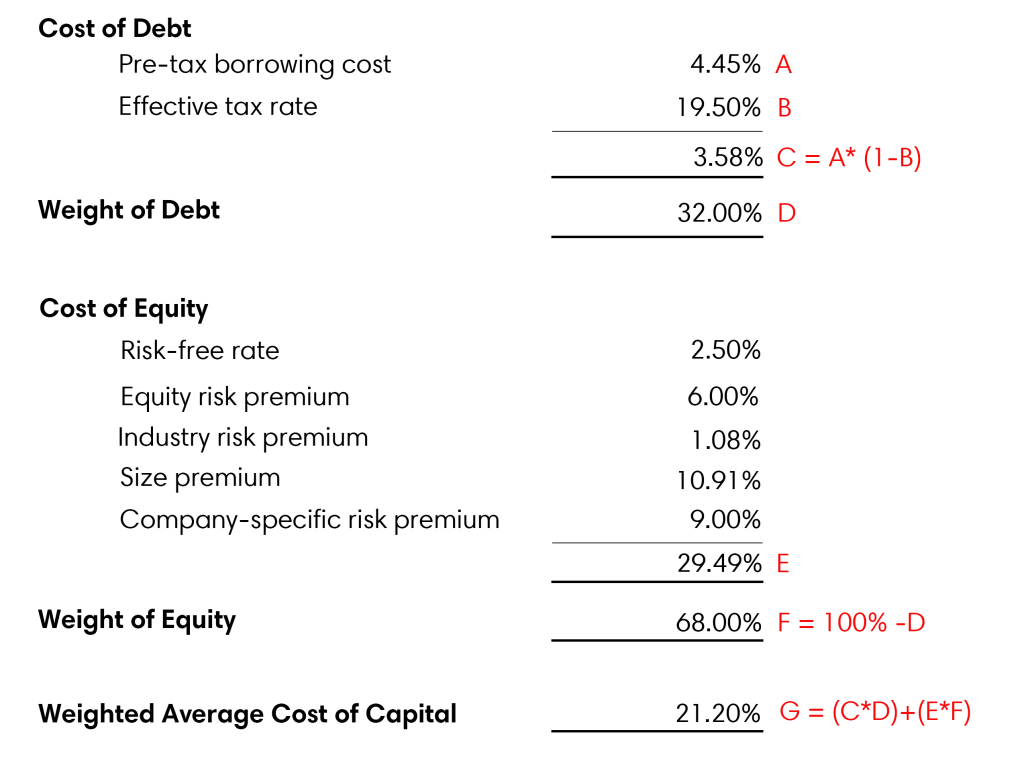

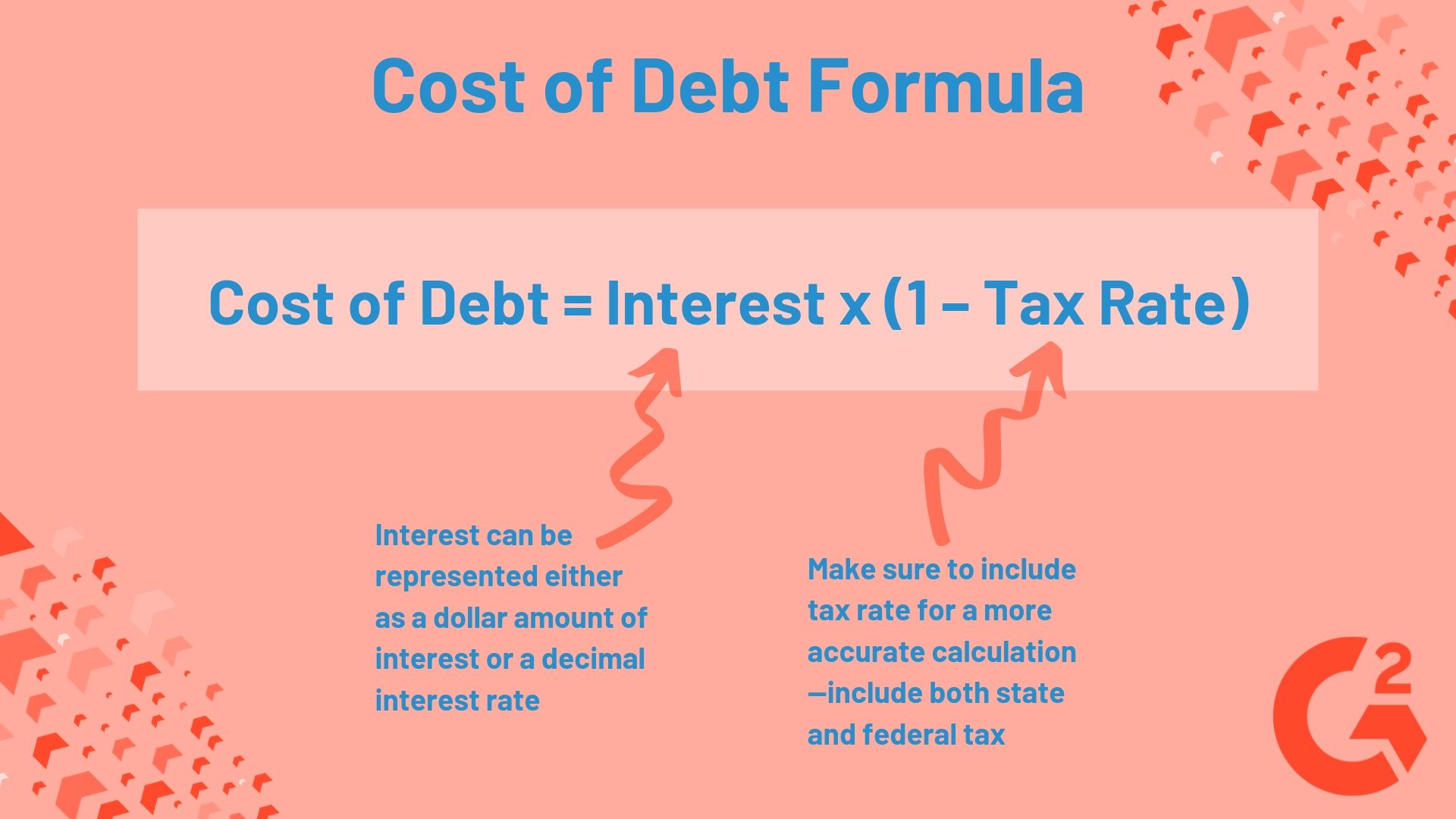

Weighted average cost of capital WACC is a key metric that shows a company s cost of capital across its debt and equity If a company s WACC is elevated the cost The weighted average cost of capital WACC is a measure of the average rate of return that a company is expected to pay to its investors to finance its assets

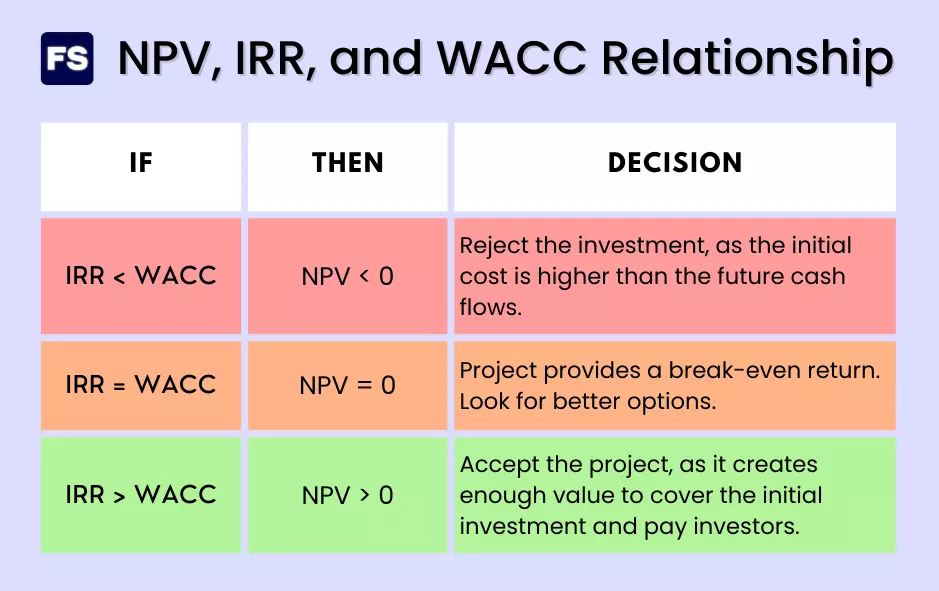

A company s weighted average cost of capital WACC is the blended cost a company expects to pay to finance its assets It s the combination of the cost to Importance of WACC in Finance WACC is a vital tool in finance for several reasons Discount Rate in Valuation WACC is frequently used as the discount rate in

More picture related to What Is Wacc And Why Is It Important

WACC Formula Excel Overview Calculation And Example 49 OFF

https://cdn.educba.com/academy/wp-content/uploads/2020/04/Eg2-Step3-3.jpg

WACC Calculator Formula Weighted Average Cost Of Capital

https://calculators.io/wp-content/uploads/2018/03/WACC-Calculator-Formula-Weighted-Average-Cost-of-Capital.png

WACC Calculator AllYouNeedToKnow

https://cdn.corporatefinanceinstitute.com/assets/wacc.png

The weighted average cost of capital WACC is the implied interest rate of all forms of the company s debt and equity financing which is weighted according to the The average rate of return a firm or organisation pay to its investors and creditors for using company capital is called The Weighted Average Cost of Capital WACC It helps

[desc-10] [desc-11]

WACC Example 1 Finding After Tax WACC YouTube

https://i.ytimg.com/vi/0GEioxGzyOY/maxresdefault.jpg

Rumus Wacc

https://i.ytimg.com/vi/yTIrRkpIzLM/maxresdefault.jpg

https://corporatefinanceinstitute.com › resources...

This guide will provide a detailed breakdown of what WACC is why it is used and how to calculate it WACC is used in financial modeling as the discount rate to calculate the net

https://efinancemanagement.com › investment-decisions...

The importance and usefulness of the weighted average cost of capital WACC as a financial tool for both investors and companies are well accepted among financial analysts

Wacc Calculator Cheap Sale Cityofclovis

WACC Example 1 Finding After Tax WACC YouTube

START HERE Return On Invested Capital ROIC Investing For

Weighted Average Cost Of Capital WACC Calculator

What Is WACC Davis Martindale Blog

What Is WACC How Companies Investors And You Can Use It

What Is WACC How Companies Investors And You Can Use It

What Is WACC How Companies Investors And You Can Use It

Images Of NPV JapaneseClass jp

IRR Greater Than WACC Do You Know What It Means

What Is Wacc And Why Is It Important - [desc-14]