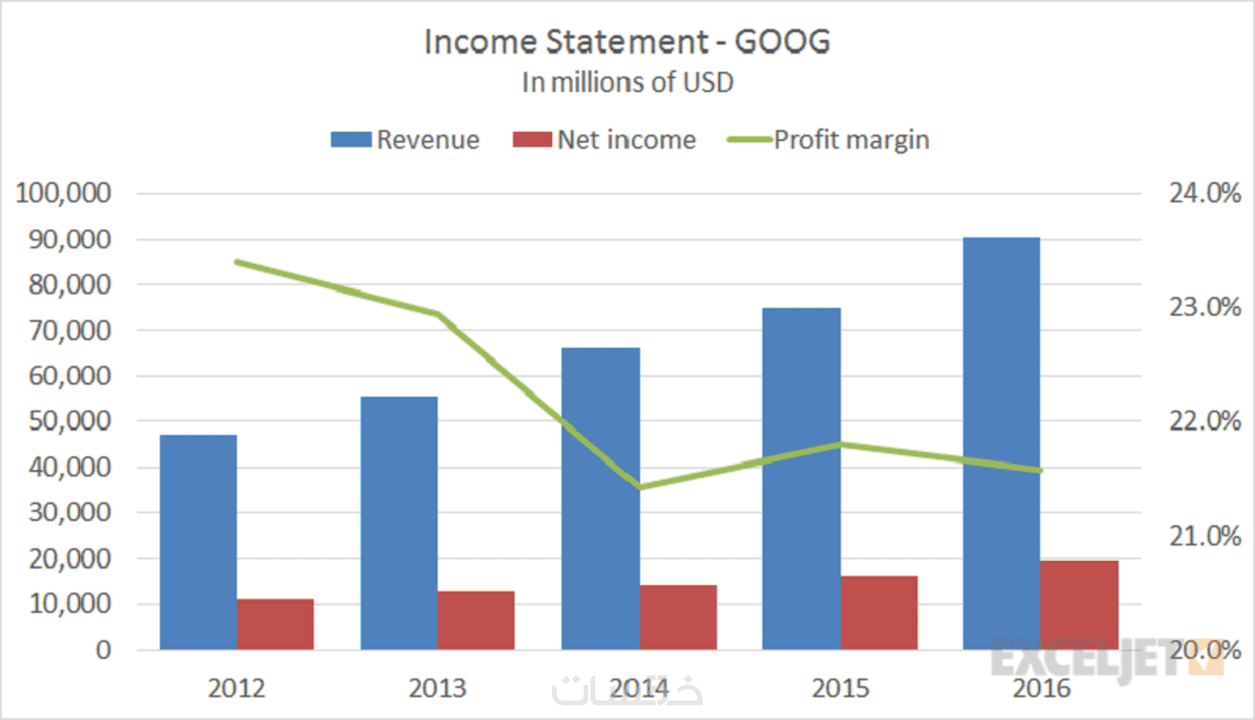

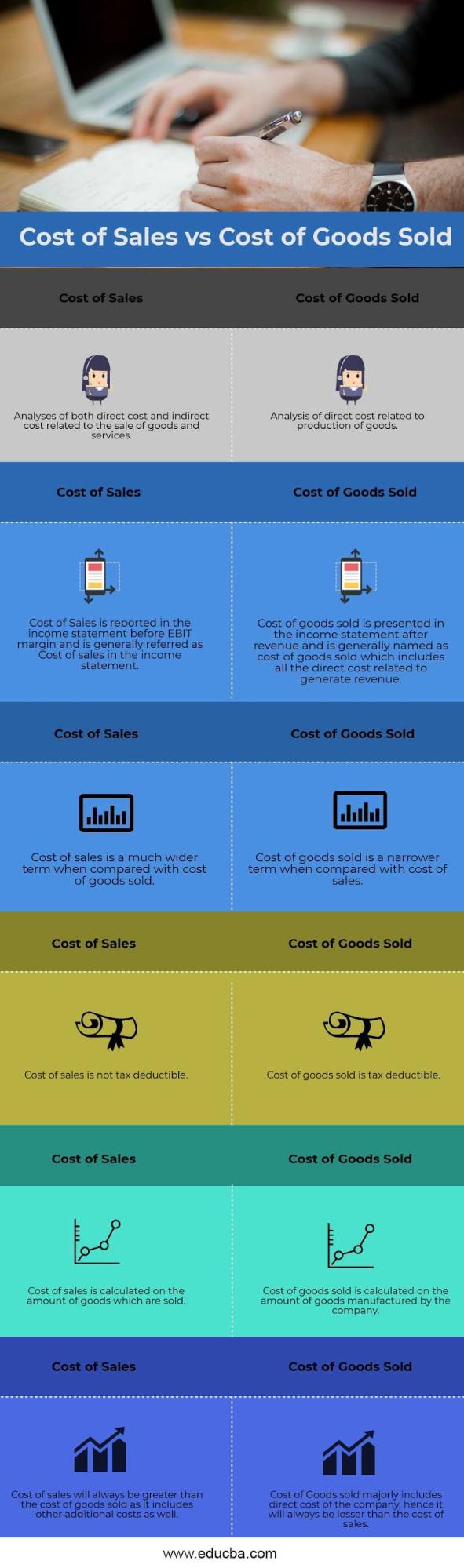

What Percent Of Revenue Should Cogs Be This measure calculates the total annual cost of goods sold COGS as a percentage of revenue COGS represents the cost of purchasing raw materials and manufacturing finished products It

Understanding the cost of goods sold and how it impacts your overall revenue is essential as is staying abreast of factors that influence your COGS Additionally research Knowing and understanding the cost of goods sold COGS is vital to a business s success Find out ways to reduce your COGS to help improve your bottom line

What Percent Of Revenue Should Cogs Be

What Percent Of Revenue Should Cogs Be

https://i.ytimg.com/vi/p9qTlOpio4c/maxresdefault.jpg

Keep Your Budget Simple With The 50 30 20 Rule

https://i.pinimg.com/originals/92/e8/40/92e840436e58c0448ec0cdc5a1133ce5.png

https://khamsat.hsoubcdn.com/images/services/3512552/a9b7f6cc6f2a6d872da3840625de6000.jpg

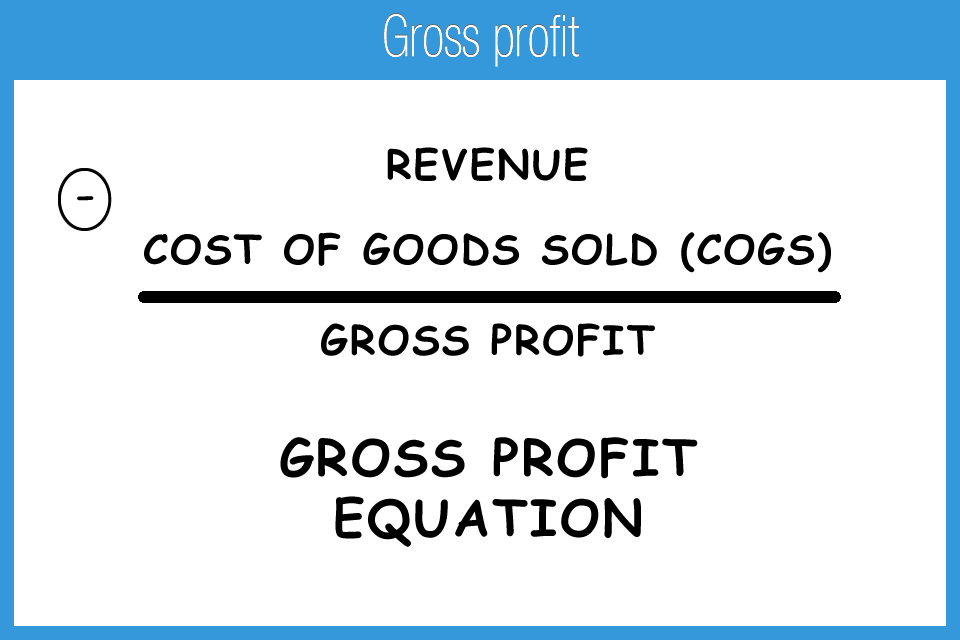

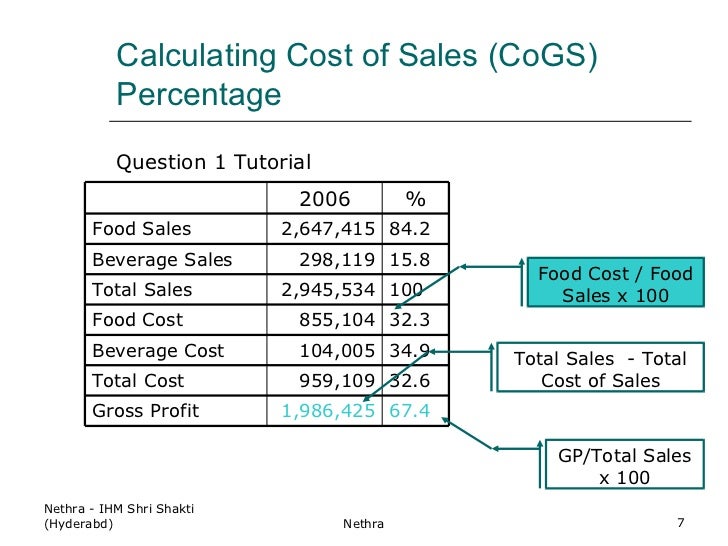

To calculate the cost of goods sold percentage just divide COGS by total revenue and then times the resultant number by 100 The formula for calculating COGS percentage COGS Total revenue X 100 COGS Percentage Example COGS percentages are determined by taking the COGS and dividing it by the revenue For example if the COGS for beer that week was 1 000 and 4 000 of beer was

The percentage of Cost of Goods Sold COGS relative to sales is calculated as follows COGS Percentage COGS Total Sales 100 Determine your total COGS Find your total sales revenue for the same The relationship between your COGS and revenue determines your gross margin Your gross margin is the amount of revenue you retain after subtracting the total cost to produce and sell your product It s essentially your gross profit

More picture related to What Percent Of Revenue Should Cogs Be

Revenue Cogs Showres

https://accountingplay.com/wp-content/uploads/2015/08/K_4F_Gross_profit.png

Revenue Cogs Assistantmoli

https://cdn.corporatefinanceinstitute.com/assets/amazon-sales-revenue.png

Percentage 15 20

https://1.bp.blogspot.com/-PzwnLzX4Z4A/VOH7nwzjCTI/AAAAAAAABiA/I4kJMsjEpBI/s1600/percentage.PNG

As the first expense deducted from revenue COGS serves as the starting point for understanding a business s gross margin which is a measure of the percentage of revenue Gross margin is the percentage of revenue that exceeds a company s Costs of Goods Sold calculated using the formula below Gross margin is an important metric that often involves operations procurement

As a general rule your combined CoGS and labor costs should not exceed 65 of your gross revenue this would be a major inventory mistake However if your business is in an But how do you know what percentage of your revenue should be allocated to Cost Of Goods Sold COGS Is there an optimal number that will help ensure profitability In

Lityhealth Blog

https://www.invespcro.com/blog/images/blog-images/Basic-formula.jpg

F B Control

https://image.slidesharecdn.com/fbcontrol-120104023404-phpapp02/95/f-b-control-7-728.jpg?cb=1325644633

https://www.apqc.org › what-we-do › benchmarking › open...

This measure calculates the total annual cost of goods sold COGS as a percentage of revenue COGS represents the cost of purchasing raw materials and manufacturing finished products It

https://marketrestaurant.co.uk › running-a...

Understanding the cost of goods sold and how it impacts your overall revenue is essential as is staying abreast of factors that influence your COGS Additionally research

What Percentage Of Revenue Should SaaS Startups Spend On Payroll By

Lityhealth Blog

Total Revenue Formula

Revenue Recognition Principle Financial Management Revenue

Deferred Revenue Debit Or Credit And Its Flow Through The Financials

EXCEL Of Income And Expense Statement Chart xlsx WPS Free Templates

EXCEL Of Income And Expense Statement Chart xlsx WPS Free Templates

Unearned Revenue T Accounts In

How To Lower Your Company COGS

Cost Of Sales Definition Formula How To Calculate

What Percent Of Revenue Should Cogs Be - What is COGS Margin The COGS Margin Cost of Goods Sold Margin is a financial metric that represents the percentage of revenue consumed by the cost of producing