What Percentage Is Education Tax In Jamaica What are the payroll taxes and statutory deductions PAYE Income Tax 25 Education Tax 2 employees 3 employers NHT 2 employees 3 employer NIS 2 employees

Education Tax Rate The percentage rate at which Education Tax is levied The revenue generated from Education Tax is used exclusively for educational purposes This includes funding schools providing educational materials Is there any limit to the amount that one should pay for Education Tax There is no limit Deduct NIS from gross emoluments and calculate 2 for employees and 3 for employers

What Percentage Is Education Tax In Jamaica

What Percentage Is Education Tax In Jamaica

https://i.ytimg.com/vi/6XXTjT0r_fU/maxresdefault.jpg

Jamaica Tax Navigating The Personal Income Tax System YouTube

https://i.ytimg.com/vi/UHqJ9ER2Fiw/maxresdefault.jpg

What Percentage Is The SHADED Part Of The Square Civil Service Exam

https://i.ytimg.com/vi/xQ0bSTFfzsA/maxresdefault.jpg

Education Tax All employed self employed people are liable to pay education tax 2 Indirect Taxes Types of taxes under this General Consumption Tax GCT General Employees contribute 2 25 of their gross salary after NIS and superannuation pension deductions towards the education tax This tax is used to fund public education programs in Jamaica Even though taxes are withheld

Education Tax Education Tax is charged at the rates of 3 5 for employers and 2 25 for employees after the deduction of NIS contributions and contributions to an approved Tax Administration Jamaica TAJ wishes to remind employers and self employed persons that the new rate of Education Tax which came into effect on April 1 2013 is to be applied as

More picture related to What Percentage Is Education Tax In Jamaica

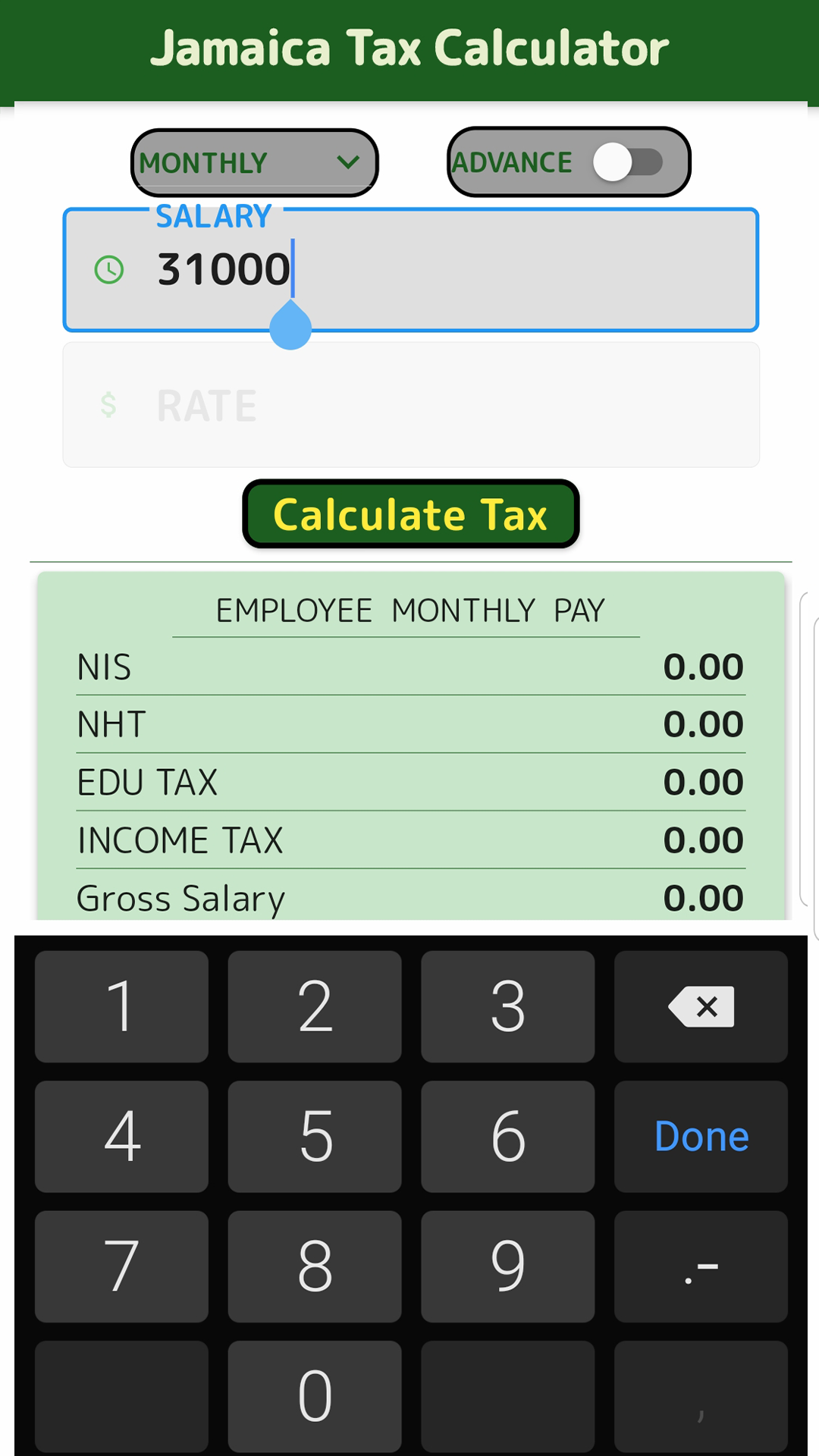

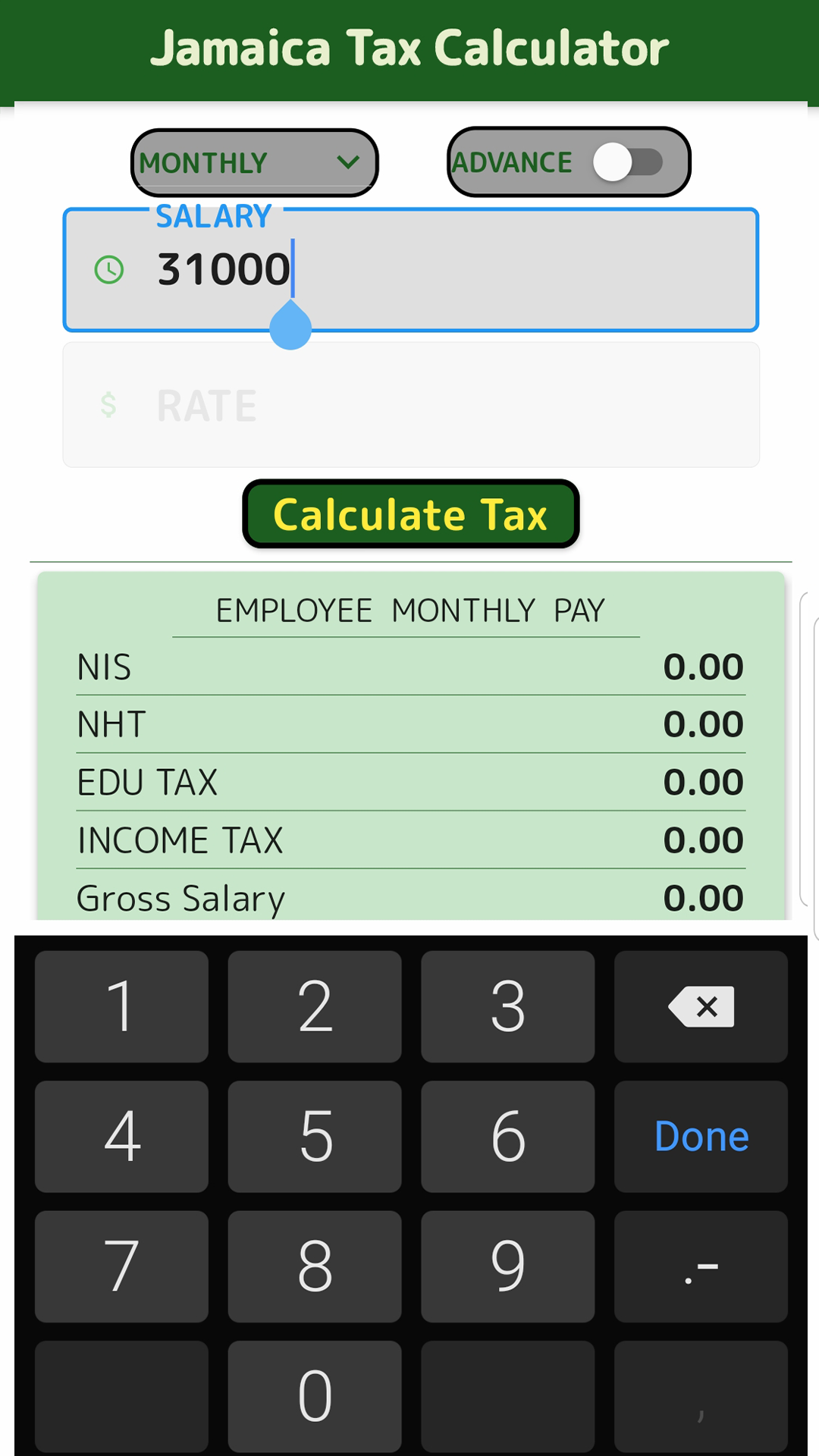

Jamaica Tax Calculator

https://itsallwidgets.com/screenshots/app-1282-2.png?updated_at=2022-01-23 01:01:06

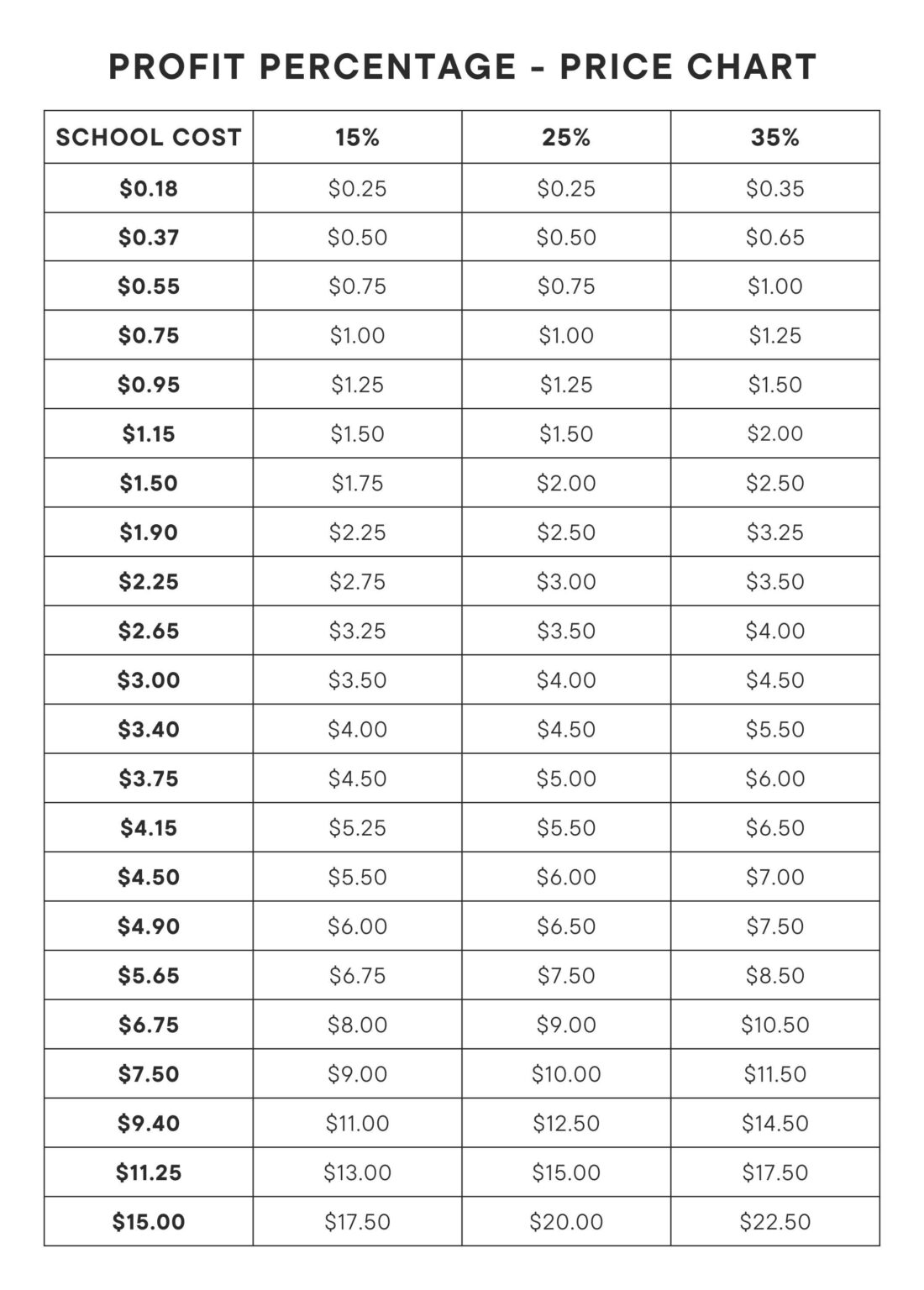

Profit Percentage Fun Services Florida

https://funsouthflorida.com/wp-content/uploads/2023/01/Profit-Percentage-Price-Chart-1920-×-4000-px-1100x1536.jpg

FORM 1 Tax Administration Jamaica

https://www.yumpu.com/en/image/facebook/40931005.jpg

Paying income tax in Jamaica can be a complicated process Get clarity on how this tax is calculated when it is to be paid and more Visit now Preamble An act to impose an education tax and to provide for matters connected therewith and incidental thereto Long Title Short Title The Education Tax Act Operational Date July 1

Finally the personal income tax PIT represents approximately 11 5 percent of the total tax revenues and social security contributions SSCs are around 4 percent Together these five Education tax is charged at a total of 5 75 per cent 3 5 per cent is paid by the employer and 2 25 per cent paid by the employee This percentage is calculated on your

Jamaica Tax Calculator It s All Widgets

https://itsallwidgets.com/screenshots/app-1282-1.png?updated_at=2020-05-03 00:05:08

Facebook

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=10160856852707996

https://www.jamaicatax.gov.jm › income-tax-faq

What are the payroll taxes and statutory deductions PAYE Income Tax 25 Education Tax 2 employees 3 employers NHT 2 employees 3 employer NIS 2 employees

https://jm.icalculator.com › guides › educati…

Education Tax Rate The percentage rate at which Education Tax is levied The revenue generated from Education Tax is used exclusively for educational purposes This includes funding schools providing educational materials

PercentMate Percentages Apps On Google Play

Jamaica Tax Calculator It s All Widgets

Welcome Ppt Download

The Box and whisker Plot Below Represents Some Data Set What

Tax Administration Jamaica Fitness Fee ONLINE Facebook

Salary Calculator Jamaica Tax Calculator Jamaica ICalculator

Salary Calculator Jamaica Tax Calculator Jamaica ICalculator

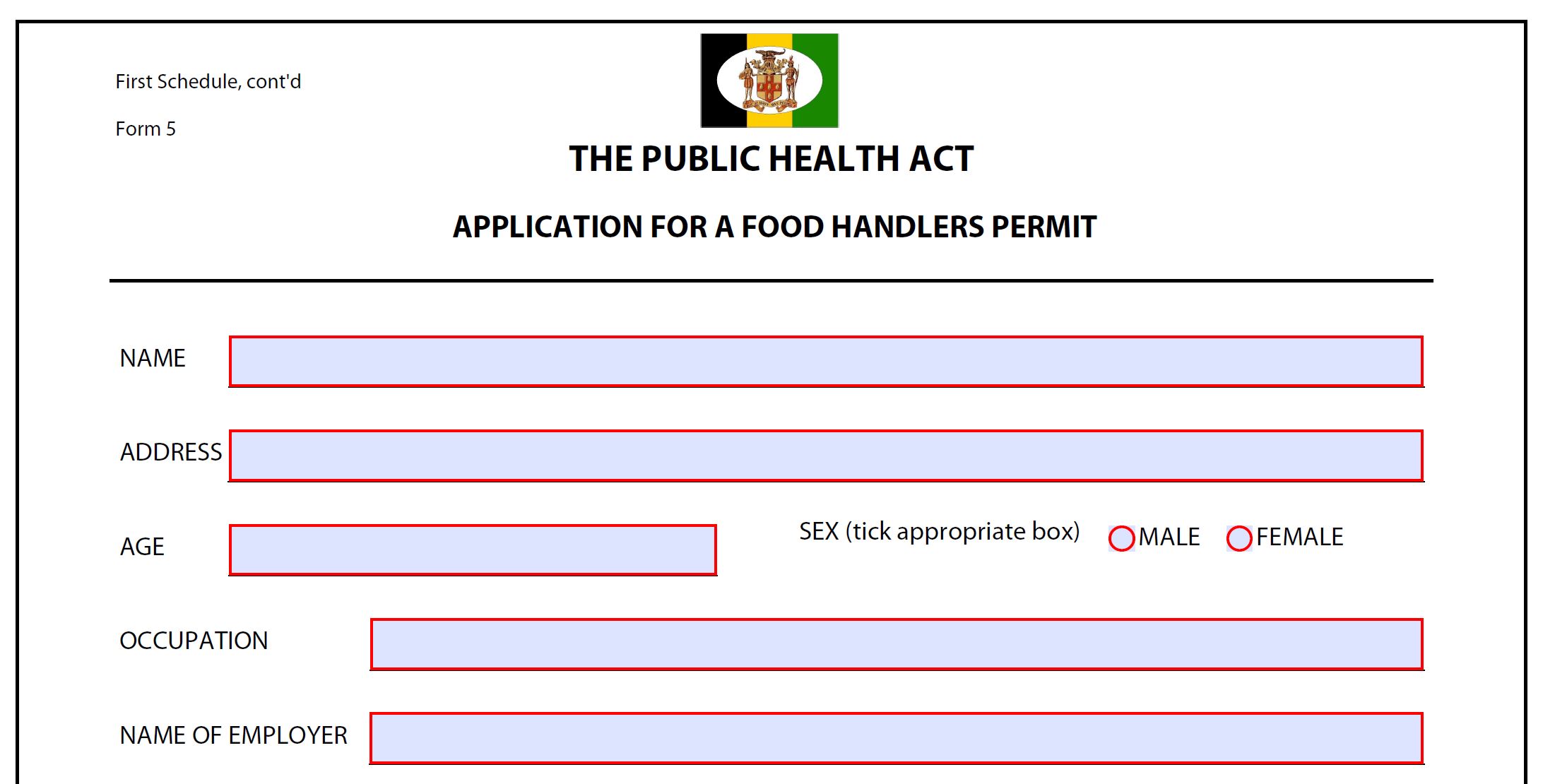

Download Application Form Food Handlers Jamaica How To Jamaica

S01 Tax Administration Jamaica TAJ

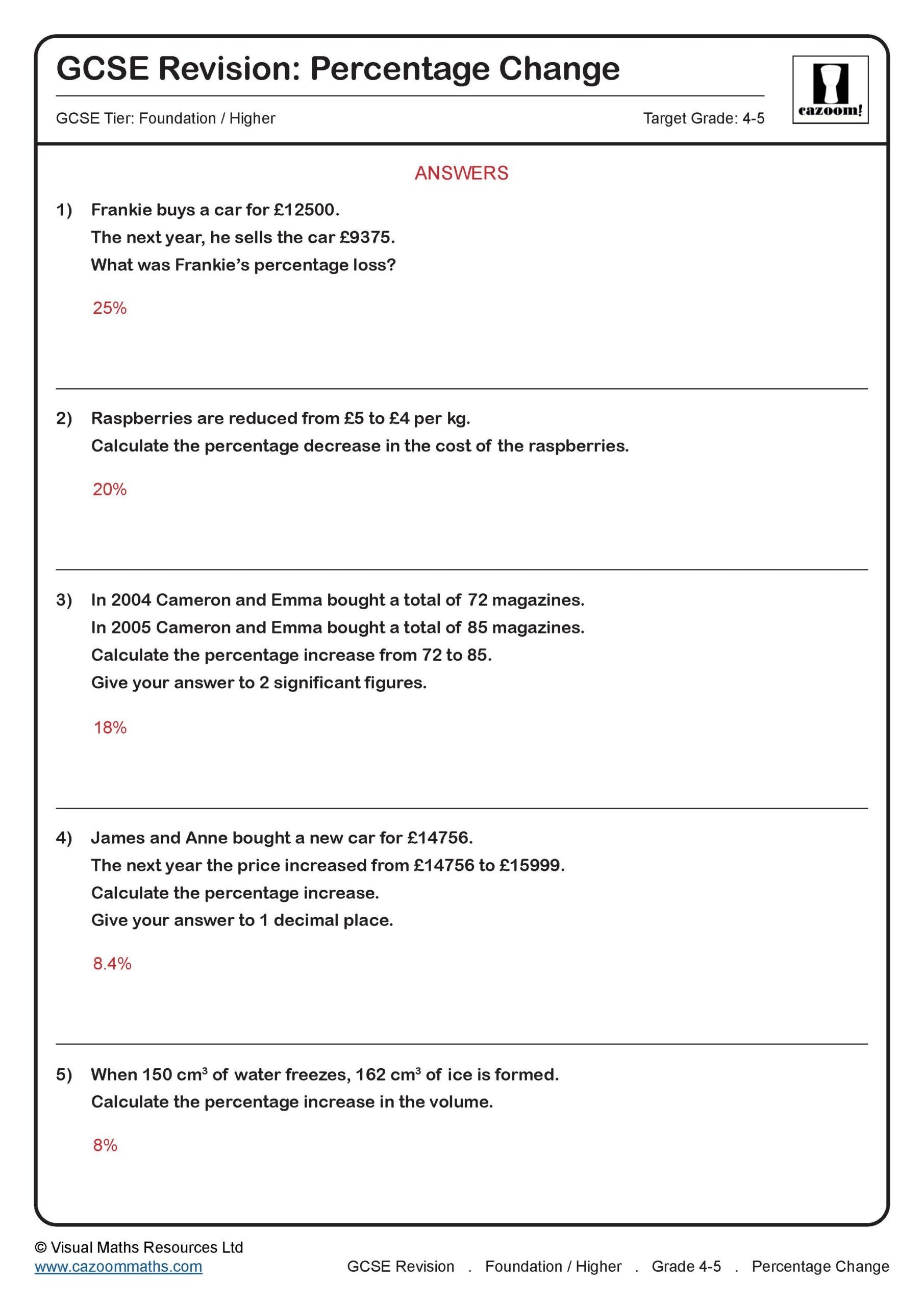

Percentage Change GCSE Questions GCSE Revision Questions

What Percentage Is Education Tax In Jamaica - Employees contribute 2 25 of their gross salary after NIS and superannuation pension deductions towards the education tax This tax is used to fund public education programs in Jamaica Even though taxes are withheld