What Tax Bracket Is 24 Percent How much tax will I pay on my retirement lump sum withdrawals From age 55 you can take up to one third of your retirement fund Retirement Annuity Company Pension Fund

Tax season has officially started Regardless of your situation it is important to file your tax return This will allow you to receive the benefits and credits to which you are Income tax calculator Updated for 2024 25 tax year how much tax will you pay on your salary in South Africa find out with the SARS income tax calculator updated for 2024 25 tax year

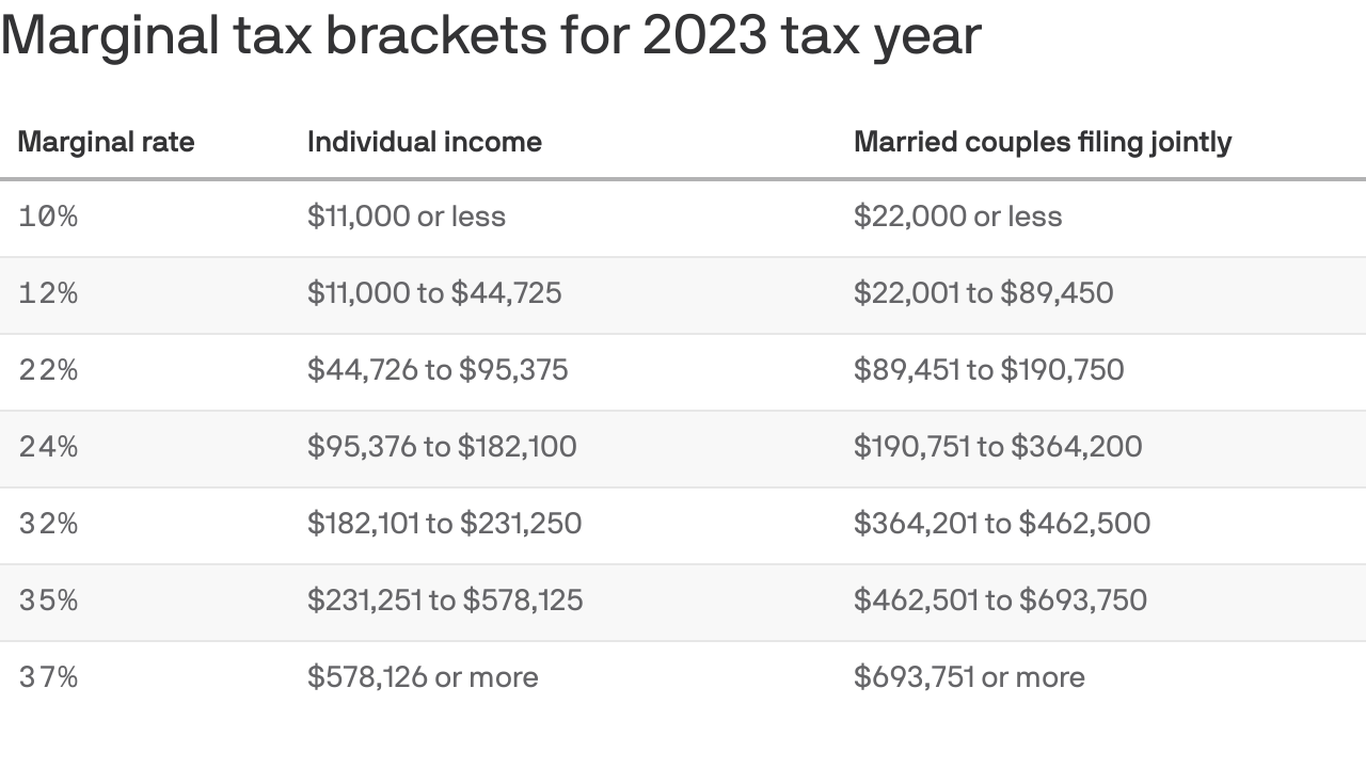

What Tax Bracket Is 24 Percent

What Tax Bracket Is 24 Percent

https://images.axios.com/FeF3kXyZuSjEVWj-265DifJa2hw=/0x0:1280x720/1366x768/2022/10/19/1666195709283.png

2025 Tax Brackets Lily Yara

https://static-ssl.businessinsider.com/image/5c33833ebd7730076d294700-2400/2019 tax brackets table 1.png

Tax Brackets 2025 Standard Deduction Jennifer Allen

https://www.wiztax.com/wp-content/uploads/2022/10/2.png

When you are on your Sign In Partner s website ensure it is your information that is entered and not that of somebody else If you register with someone else s banking credentials This tax season the Canada Revenue Agency CRA has simplified its sign in process making it easier to access the My Account My Business Account and Represent a

Income tax Personal business corporation trust international and non resident income tax Canada Disability Benefit The Canada Disability Benefit provides direct financial support to people with disabilities who are between 18 and 64 years old The program is

More picture related to What Tax Bracket Is 24 Percent

2024 Tax Table Single Filer Dolly Meredith

https://taxedright.com/wp-content/uploads/2022/10/2023-Tax-Brackets.jpg

Monthly Tax Tables 2024 2025 Netti Sarene

https://thecollegeinvestor.com/wp-content/uploads/2022/10/TCI_-_2023_Federal_Tax_Brackets_1600x974.png

California Tax Brackets 2025 Married Jointly Wahkan Skye

https://hkglcpa.com/wp-content/uploads/2022/10/2022-Tax-Brackets-for-Single-Filers-and-Married-Couples-Filing-Jointly.png

Social insurance number SIN full name and date of birth complete address assessed tax return notice of assessment or reassessment other tax document or be signed in to CRA My The CRA is offering tax relief to businesses in response to tariffs including deferred GST HST and corporate tax payments with interest relief from April 2 to June 30 2025

[desc-10] [desc-11]

2025 Us Income Tax Brackets Calculator Maria S Acker

https://image.cnbcfm.com/api/v1/image/107136825-1666125851699-6clBX-marginal-tax-brackets-for-tax-year-2023-single-individuals_1.png?v=1666125859

Ontario Income Tax Rates Historical

https://taxedright.com/wp-content/uploads/2022/10/2023-Tax-Brackets-768x510.jpg

https://howtaxworks.co.za › questions › tax-implications-retiring-from-ra

How much tax will I pay on my retirement lump sum withdrawals From age 55 you can take up to one third of your retirement fund Retirement Annuity Company Pension Fund

https://www.canada.ca › en › revenue-agency › news › tax-season-start…

Tax season has officially started Regardless of your situation it is important to file your tax return This will allow you to receive the benefits and credits to which you are

What Tax Bracket Am I In 2025 Canada Judith R Young

2025 Us Income Tax Brackets Calculator Maria S Acker

2025 Standard Deduction Married Joint Senior Chelsea L Clews

[img_title-11]

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

What Tax Bracket Is 24 Percent - This tax season the Canada Revenue Agency CRA has simplified its sign in process making it easier to access the My Account My Business Account and Represent a