What Wage Pays 40 Tax What is the average salary in Finland If you make 40 000 a year living in Finland you will be taxed 15 462 That means that your net pay will be 24 538 per year or 2 045 per month

For the 2024 2025 tax year this amount is set at 50 270 If your income exceeds this threshold you ll be taxed at a 40 rate on the extra earnings Knowing about this bracket helps you plan What Is the 40 Tax Bracket The 40 tax bracket is officially referred to as the higher rate of income tax in the UK For the tax year 2024 25 individuals earning between

What Wage Pays 40 Tax

What Wage Pays 40 Tax

https://pbs.twimg.com/media/FyIIhWrWYBI1dOJ.png

AM 22571 24 Art Mob Australian Aboriginal Art Gallery

https://artmob.com.au/wp-content/uploads/2024/05/22571-24-Julian-scaled.jpg

Neoregelia Domino Ecoterrazas

https://www.ecoterrazas.com/2761-thickbox_default/neoregelia-domino.jpg

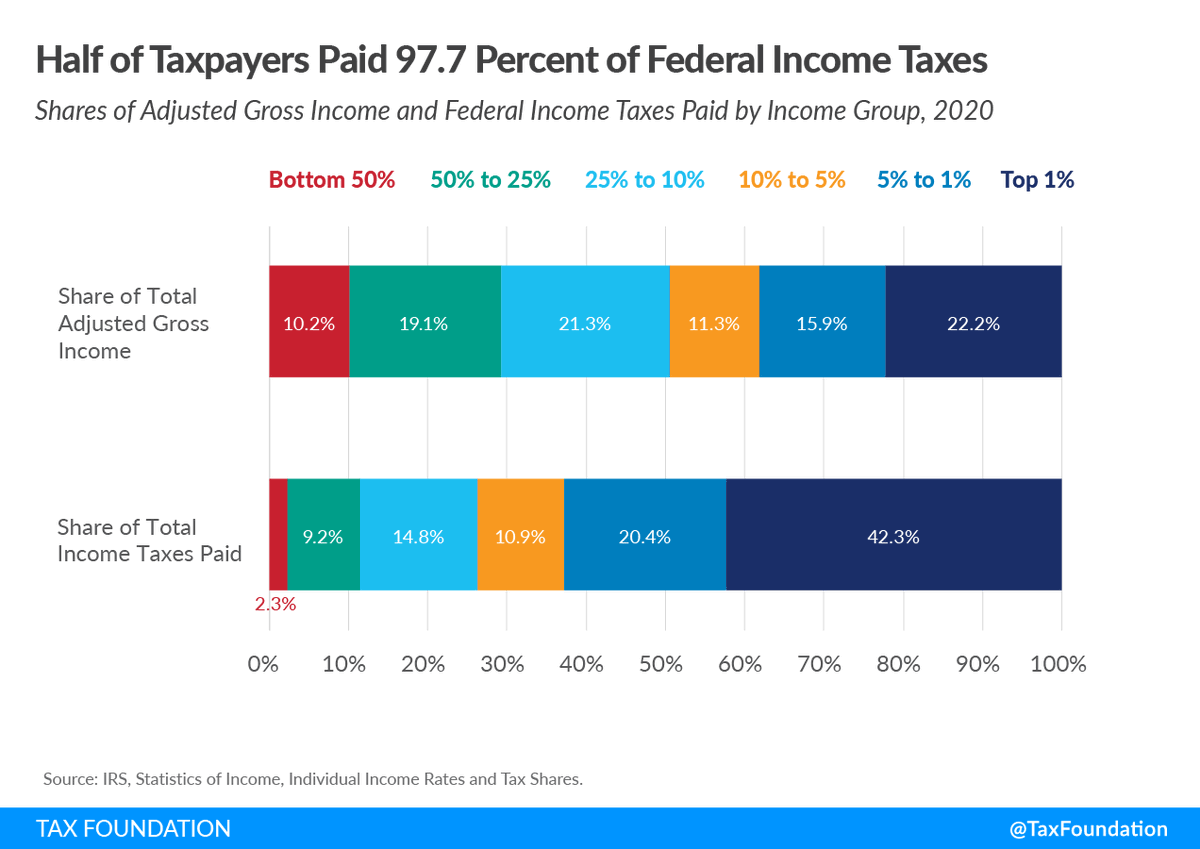

40 000 5 486 34 514 total annual salary minus Income Tax deductions Higher rate Anything you earn between 50 271 and 100 000 per year is taxed within the 40 higher rate tax bracket Say your salary is Explore the 40 tax bracket in the UK for 2025 income thresholds impacts strategies and tax saving tips explained

40 tax on earnings between 50 271 75 000 Therefore you re only paying the 40 tax rate on 24 729 of your earnings Does the 40 tax bracket ever change The The 40 tax bracket is one of the highest tax brackets in the UK with a high tax rate for individuals earning more than 50 270 as of 2023 In this blog we will analyse the fundamentals of the 40 tax bracket implications for

More picture related to What Wage Pays 40 Tax

Minimum Wage Levels In The EU 2024

https://datawrapper.dwcdn.net/5UTHJ/full.png

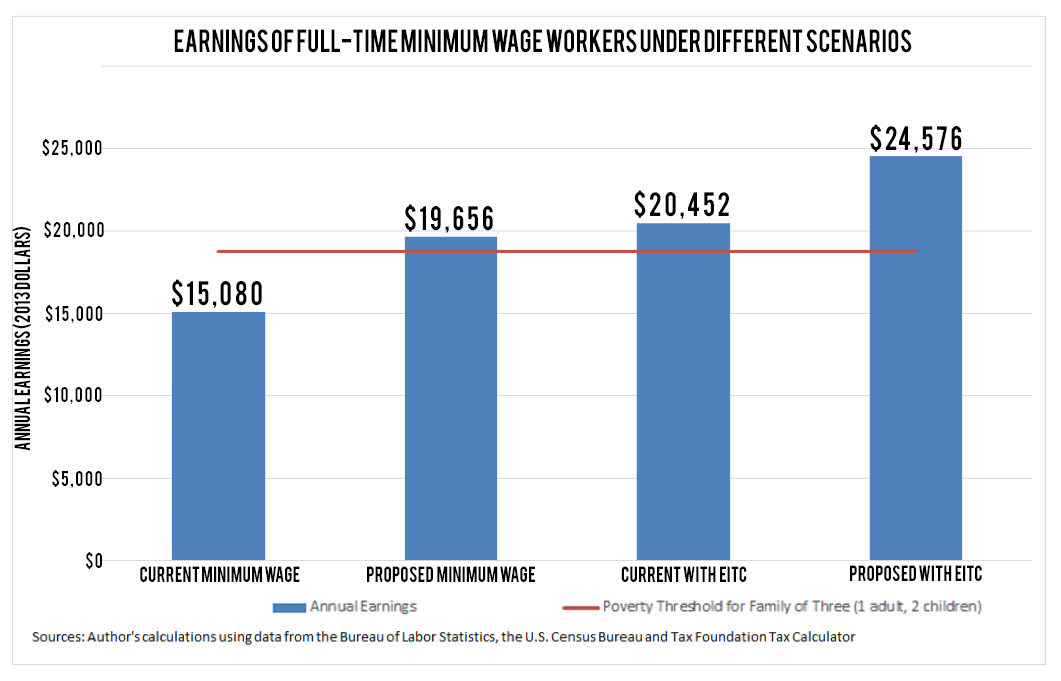

The Truth About Minimum Wage Workers Take Home Pay The Fiscal Times

https://cdn.thefiscaltimes.com/sites/default/files/03132014_Chart_Scenarios_Improved.jpg

How A 70 000 Minimum Wage Pays Off For 1 Company Minimum Wage

https://i.pinimg.com/originals/93/f2/6c/93f26c9450a05c26cf90d12f02083446.jpg

The 40 tax bracket applies a 40 tax deduction to an individual s income This tax bracket deducts a significant portion of a taxpayer s income Individuals with an annual income The 40 tax bracket is also known as the Higher Rate If your income is within those figures of that tax band you ll have to pay 40 tax on any earnings that are over the threshold How

To put it in context there are four main tax bands Personal Allowance 0 tax on income up to 12 570 Basic Rate 20 tax on income between 12 571 and 50 270 Higher Rate 40 The 40 tax bracket also referred to as the higher rate of tax applies to individuals earning above 50 270 per year However it s important to note that this rate only applies to

RADFLO 2 0 INCH REAR NISSAN XTERRA W REMOTE RESERVOIR

https://jking4x4.com/40591-thickbox_default/radflo-oe-replacement-20-inch-rear-nissan-xterra-w-remote-reservoir.jpg

Intense Kiwi Flavors Ready to Use Liquid 10ml Svapoebasta

https://www.svapoebasta.com/64059-thickbox_default/intense-kiwi-flavors-ready-to-use-liquid-10ml-red-fruits-mint.jpg

https://fi.talent.com › en › tax-calculator

What is the average salary in Finland If you make 40 000 a year living in Finland you will be taxed 15 462 That means that your net pay will be 24 538 per year or 2 045 per month

https://taxcare.org.uk

For the 2024 2025 tax year this amount is set at 50 270 If your income exceeds this threshold you ll be taxed at a 40 rate on the extra earnings Knowing about this bracket helps you plan

Harrer 2022 Riesling Doc Alto Adige Colterenzio Vinolog24

RADFLO 2 0 INCH REAR NISSAN XTERRA W REMOTE RESERVOIR

Lit Control PH Down Devicare

HOW TO OBTAIN 45 TAX RELIEF ON PENSION CONTRIBUTIONS Rutherford

Red Bottom Plate

Hot Dog Gummy Jellies Trolli

Hot Dog Gummy Jellies Trolli

Moravanti Italian Imports Has Four Employees And Pays Chegg

Yellow Bottom Plate

Tapis De Souris Optique Lamberet Shop

What Wage Pays 40 Tax - The 40 tax bracket also known as the Higher Rate tax applies to anyone earning over 50 270 per year However it s crucial to understand that only the portion of your