Which Allowance Is Exempted From Tax Provision for loan losses Allowance for Loan losses 1 allowance Loan 2 Provision impair

Allowance bonus Commission Incentive RDA recommended dietary allowance 1994 RDA

Which Allowance Is Exempted From Tax

Which Allowance Is Exempted From Tax

https://i.ytimg.com/vi/MVb1TG4EqDo/maxresdefault.jpg

Income Exempted

https://i.pinimg.com/originals/da/a4/11/daa41151f5a8a0c1fcf98686bc23747b.jpg

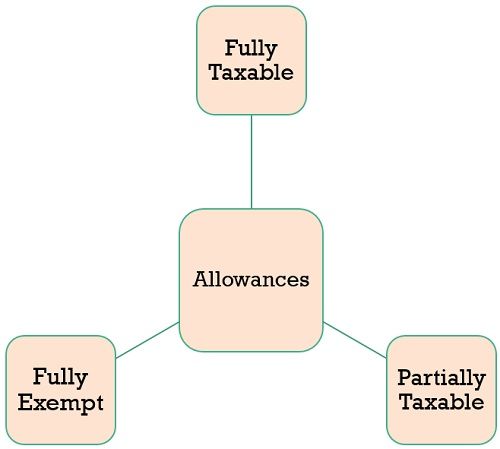

Difference Between Allowances And Perquisites with Comparison Chart

https://keydifferences.com/wp-content/uploads/2021/12/allowances.jpg

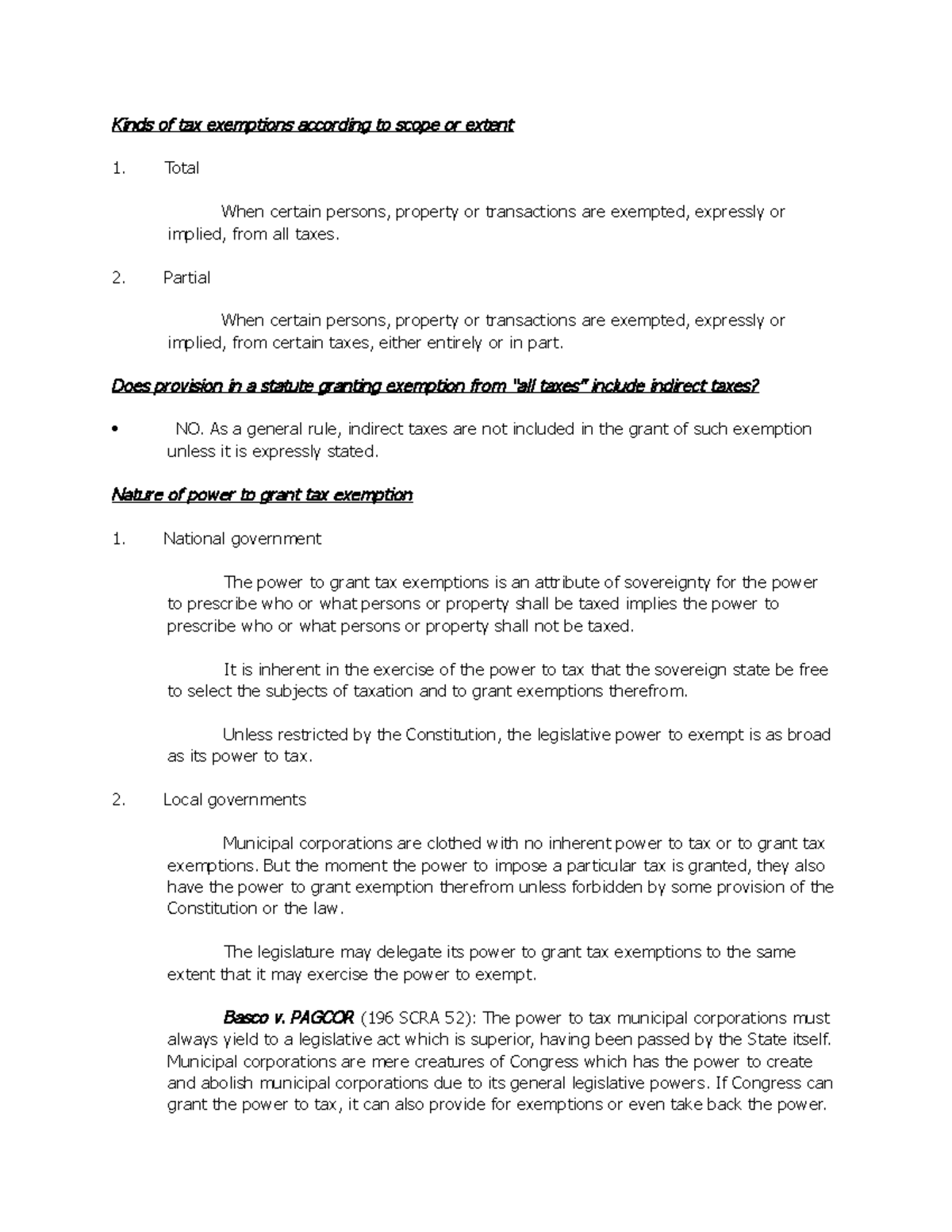

[desc-4] [desc-5]

[desc-6] [desc-7]

More picture related to Which Allowance Is Exempted From Tax

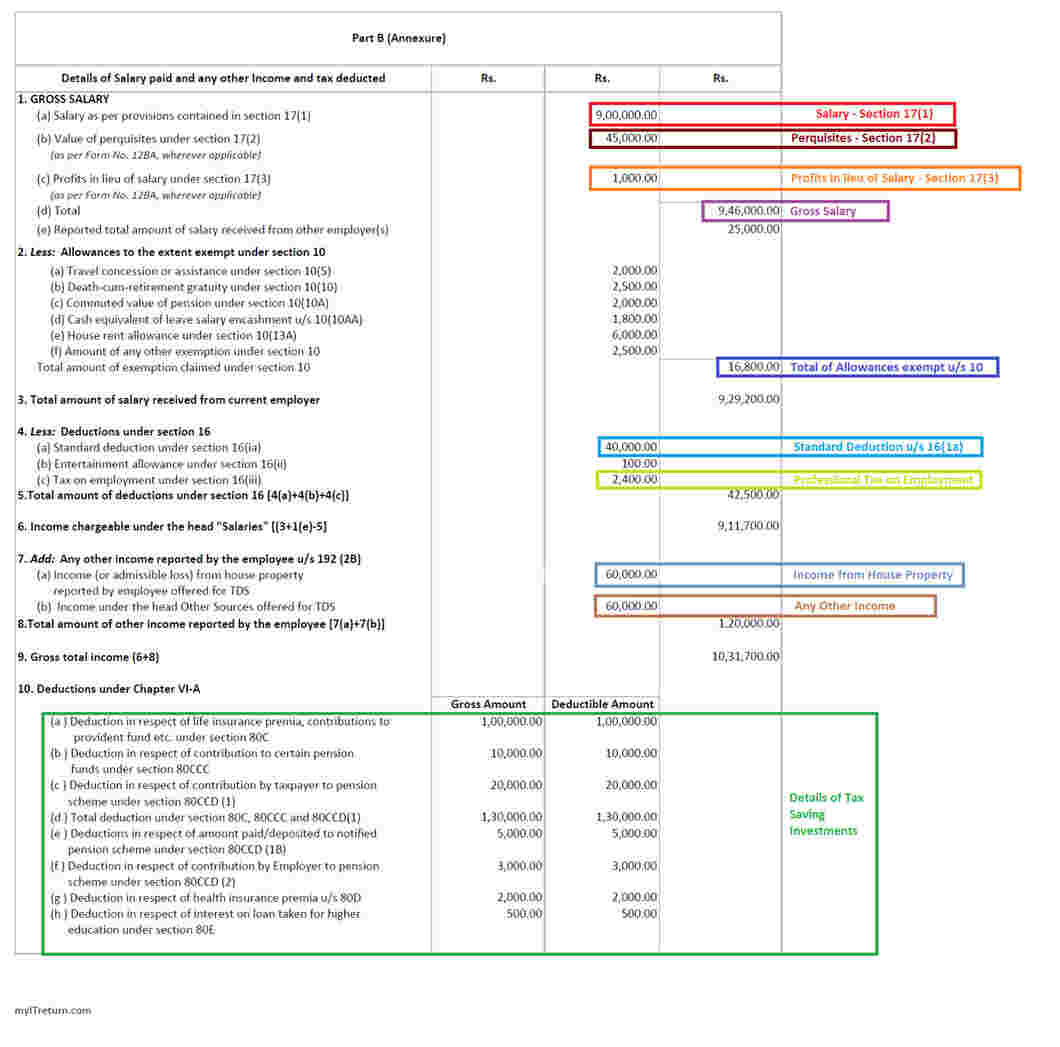

Exemptions Allowances And Deductions Under Old New Tax Regime

https://www.taxhelpdesk.in/wp-content/uploads/2023/06/EXEMPTIONS-ALLOWANCES-DEDUCTIONS-AVAILABLE-UNDER-THE-OLD-NEW-TAX-REGIME-1.jpg

List Of Exempted Incomes Tax Free Under Section 10

http://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/Exempted-Incomes/Exempted Income.jpg

Income Tax Exemptions And Deductions For Salaried Individuals

https://media.geeksforgeeks.org/wp-content/cdn-uploads/20230227151715/Income-Tax-Exemptions-and-Deductions-660x330.png

[desc-8] [desc-9]

[desc-10] [desc-11]

No Income Tax On Medical Reimbursement Up To Rs 15 000

https://www.charteredclub.com/wp-content/uploads/2014/05/Tax-Exempt-1.jpg

S Kinds Of Tax Exemptions According To Scope Or Extent Kinds Of Tax

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/7679ec83a50ea49baf860bc842eac016/thumb_1200_1553.png

https://zhidao.baidu.com › question

Provision for loan losses Allowance for Loan losses 1 allowance Loan 2 Provision impair

https://zhidao.baidu.com › question

Allowance bonus Commission Incentive

Salary Payments That Need To Contribute To Payroll L Co

No Income Tax On Medical Reimbursement Up To Rs 15 000

Who Qualifies For Tax Exemption A Comprehensive Guide

Salary Payments That Need To Contribute To Payroll L Co

All About Allowances Income Tax Exemption CA Rajput Jain

Exempted Income INCOME EXEMPTED FROM TAX IN INDIA Income Tax Ppt

Exempted Income INCOME EXEMPTED FROM TAX IN INDIA Income Tax Ppt

Section 10 Of Income Tax Act Deductions And Allowances

Income Tax Form 16 What Is Form 16 Eligibility Benefits And Exemptions

4 Steps To Calculate Income Tax Yadnya Investment Academy

Which Allowance Is Exempted From Tax - [desc-6]