Who Are Liable To File Income Tax Return Hi all The following sentence was written by me A person who breaks this regulation is liable for a fixed penalty of 1 000 A native speaker corrected my sentence

You will be held liable to the loss You will hold liable to the loss I saw someone use the first sentence but if I were to write the sentence I would write the second one Just for the fun of it I looked at Ngram for AE usage and both prone to and liable to are good 100 times less frequent than likely to in modern AE I know that the Ngram graph is

Who Are Liable To File Income Tax Return

Who Are Liable To File Income Tax Return

https://static.fintoo.in/blog/wp-content/uploads/2023/06/benefits-of-ITR-1-1.png

ITR Filing AY 2023 24 Update Income Tax Filing AY 23 24 ITR Start

https://i.ytimg.com/vi/0D_l81bvzSo/maxresdefault.jpg

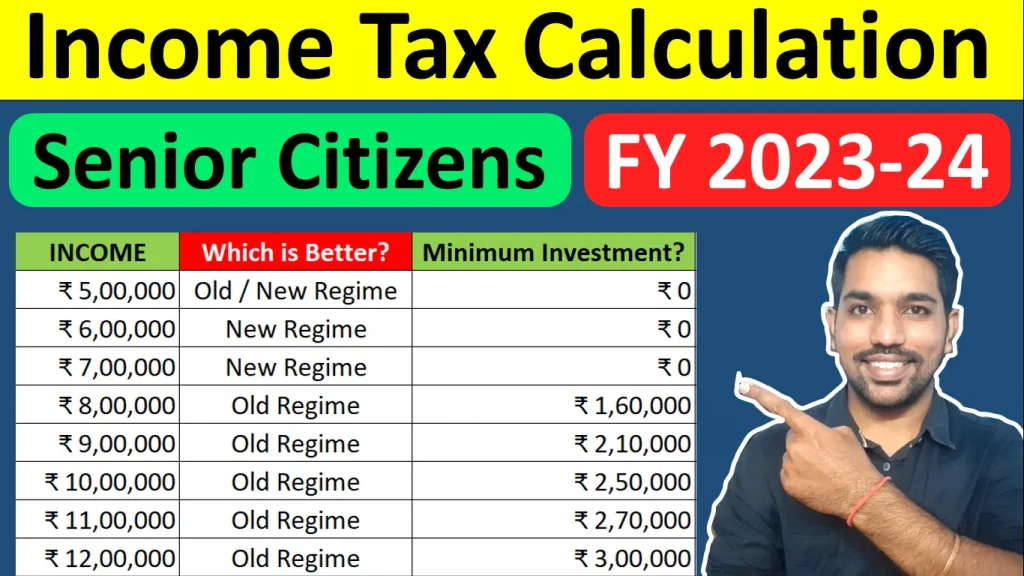

Income Tax Calculator Fy 2023 24 Slab Rates Image To U

https://fincalc-blog.in/wp-content/uploads/2023/02/senior-citizen-income-tax-calculation-2023-24-examples-tax-slabs-and-rebate-video-1024x576.webp

Liable and likely I would suggest mean a very similar thing though liable tends to imply something negative eg I am likely to win this bet He is liable to crash if he drives When problems occur that cause monetary loss injury or even death to people responsible accountable parties may be held liable legally responsible for these damages

Ah but ewie does liable in your road sign mean 3 a Exposed or subject to or likely to suffer from something prejudicial 1860 R USKIN Mod Paint V VI ix 83 At edges The company will be liable it will be the company s responsibility the company will be held liable the company will be deemed and treated as being responsible So however

More picture related to Who Are Liable To File Income Tax Return

Who Is Liable To Pay GST Smile And File

http://smileandfile.com/wp-content/uploads/2017/03/who-is-liable-to-pay.jpg

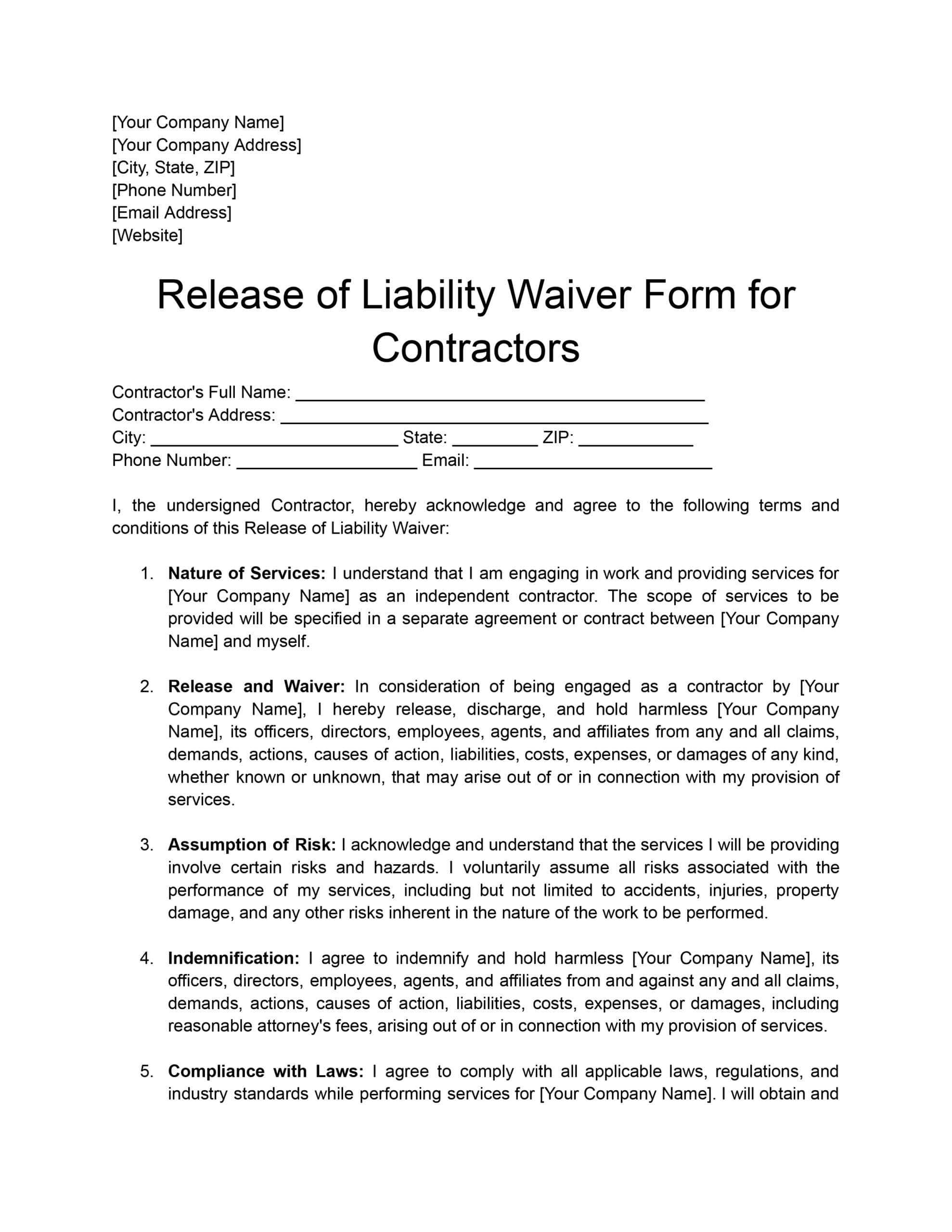

LETTER3 5 Lowes Contractor Paper Terms Of Use

https://www.workyard.com/wp-content/uploads/2023/05/Release-of-Liability-Waiver-Form-for-Contractors-scaled.jpg

Fbr Income Tax Rates 2023 Image To U

https://bslearning.com/fbr-income-tax-return/images/income-tax-return.webp

The reason is likely because liable is a stronger word expression To use likely as a stronger word that has certainty the English speaker says more than likely If I go to the In certain kind of agreement Notwithstanding the foregoing Distributor as an independent contractor shall bear sole responsibility for and shall be solely liable for the

[desc-10] [desc-11]

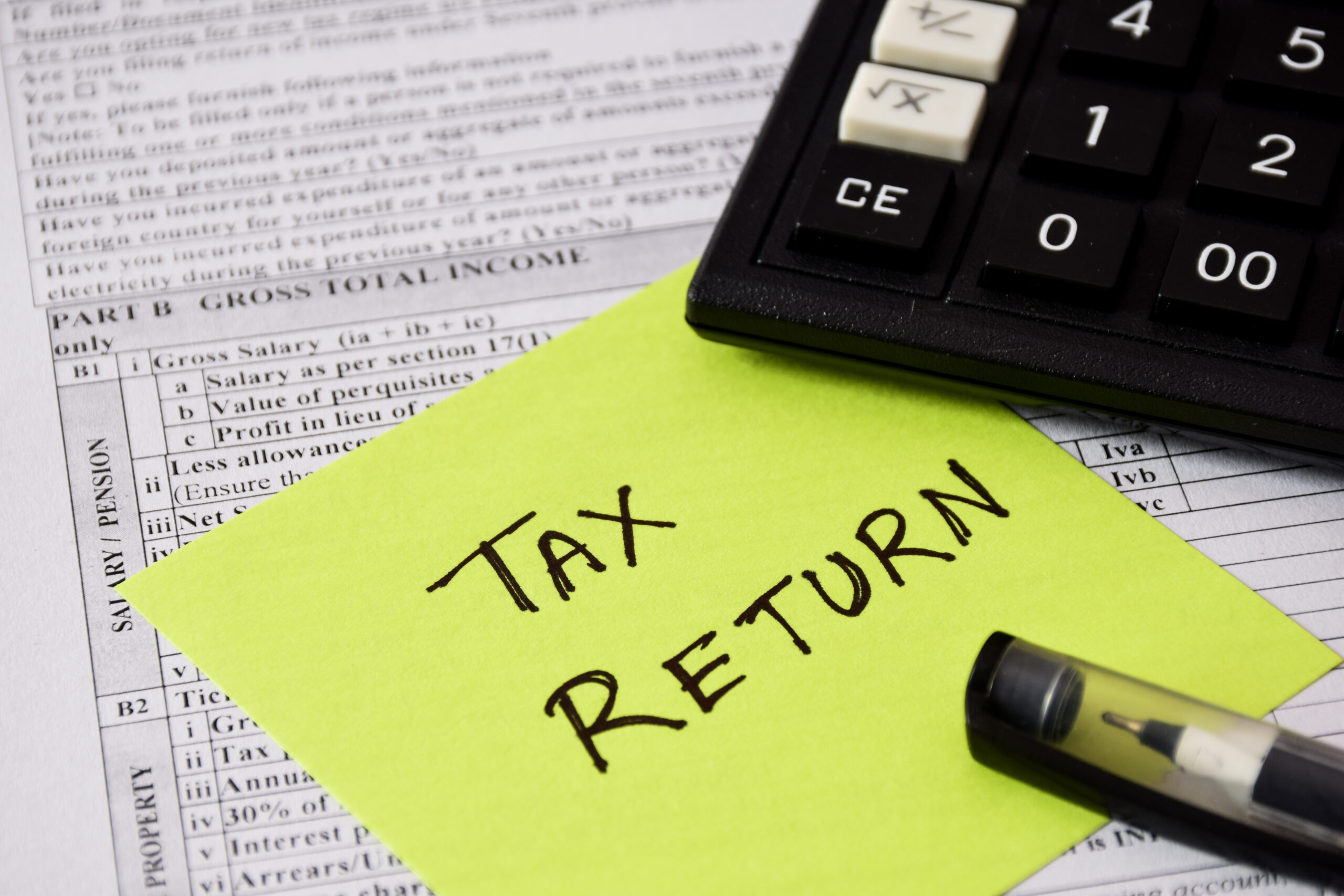

ITR Filing Checklist Documents Required To File Income Tax Returns For

https://d6xcmfyh68wv8.cloudfront.net/blog-content/uploads/2022/07/shutterstock_2020498841-scaled.jpg

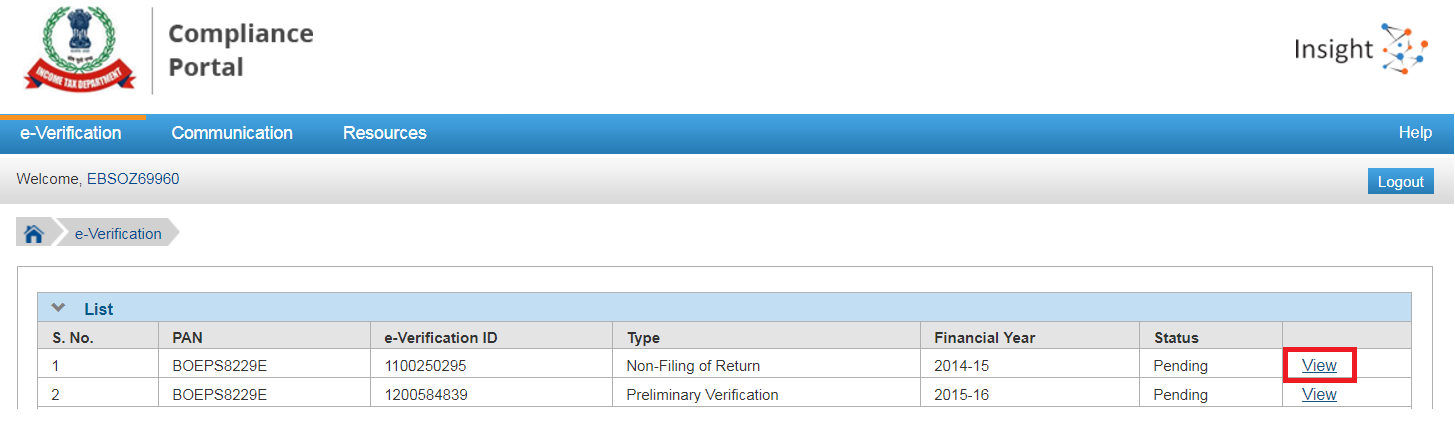

Compliance Portal Responding To ITR Learn By Quicko

https://learn.quicko.com/wp-content/uploads/2020/03/Compliance-portal-view.png

https://forum.wordreference.com › threads

Hi all The following sentence was written by me A person who breaks this regulation is liable for a fixed penalty of 1 000 A native speaker corrected my sentence

https://forum.wordreference.com › threads

You will be held liable to the loss You will hold liable to the loss I saw someone use the first sentence but if I were to write the sentence I would write the second one

Humerus Anatomy Nerves

ITR Filing Checklist Documents Required To File Income Tax Returns For

File Income Tax Return 2024 Evie Oralee

File Income Tax 2024 Nadya Mariam

Devoluci n De Impuestos Servicio De Ingresos Internos Bloque H R

Sample Release Of Liability Waiver Form Vrogue co

Sample Release Of Liability Waiver Form Vrogue co

Last Day To File Income Tax 2025 Online Megan Knox

Salary Payments That Need To Contribute To Payroll L Co

Last Day To File Taxes 2025 California F Audrey Hennessey

Who Are Liable To File Income Tax Return - Liable and likely I would suggest mean a very similar thing though liable tends to imply something negative eg I am likely to win this bet He is liable to crash if he drives