Annual Tax Rates 2024 Individual Income Tax is charged for each year of income on all the income of a person whether resident or non resident which accrued in or was derived from Kenya Individual Tax Bands and Rates With effect from 1st July 2023 Personal Relief of Kshs 28 800 per annum Kshs 2 400 per month Taxation for Non Resident s Employment Income

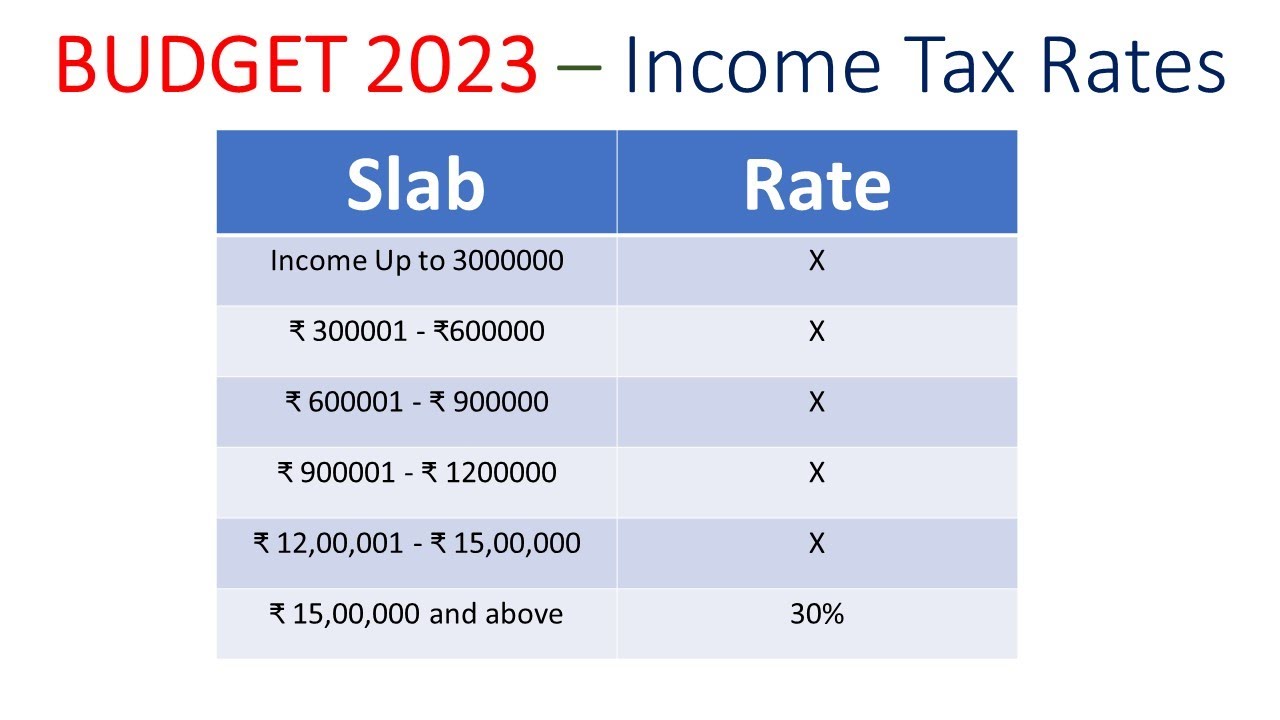

Income Tax Individual Tax Rates For purposes of computing PAYE an employer is required to apply the Individual Income Tax Rates Bands that range from 10 to 35 as per Finance Act 2023 as tabulated effective 1 st July 2023 Monthly Pay Bands Ksh Annual Pay Bands Ksh PAYE Due Date Kenya PAYE Calculator with Income Tax Rates Of January 2024 Calculate PAYE Net Pay NHIF and NSSF Pension

Annual Tax Rates 2024

Annual Tax Rates 2024

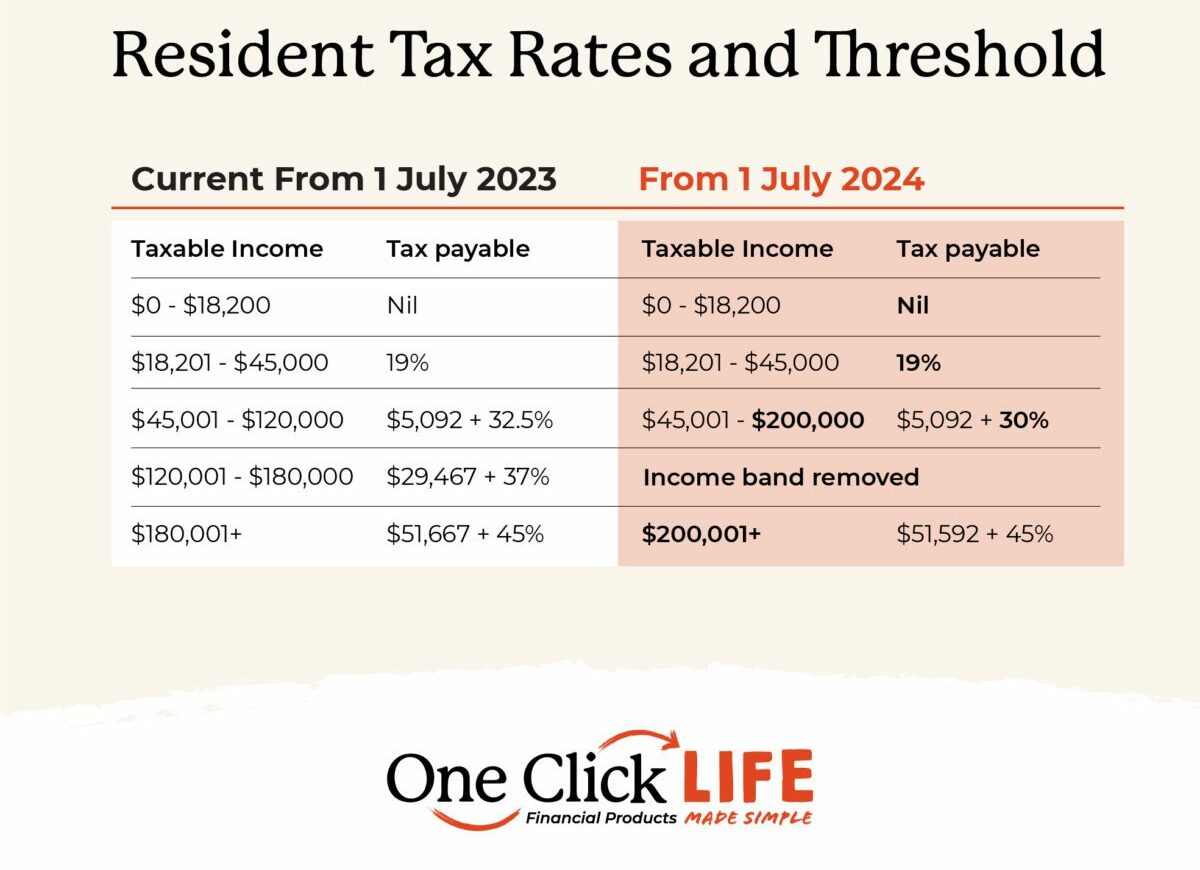

https://oneclicklife.com.au/wp-content/uploads/2023/04/Budget-Tax-Rates-Threshold-01-scaled-e1681366579595.jpg

Federal Tax Table For 2024 Becca Carmine

https://i0.wp.com/justonelap.com/wp-content/uploads/2023/06/Tax-rates-2024-1.jpg?w=1526&ssl=1

Income Tax Table 2024 Malaysia Shaun Michelina

https://www.pinoymoneytalk.com/wp-content/uploads/2020/06/income-tax-rates-bir-train-law-2023.png

Employers are required to deduct tax PAYE from their employees emoluments at the prevailing Individual Income Tax Rates and remit the amounts deducted to KRA on or before the 9th day of the following month Gains or profits from employment that are not paid in cash are chargeable to tax Such gains or benefits include PAYE Tax Brackets in Kenya 2024 simplified Learn obligations deductions info on tax free taxable benefits reimbursements

As of 2024 the personal income tax rates in Kenya are progressive which means higher income brackets are taxed at higher rates The income tax bands are as follows These rates apply to gross monthly earnings after allowable deductions have been applied Effective 1 July 2023 the tax rates applicable to taxable income are tabulated as follows Kenyan shillings As shown above the maximum rate of 35 will be charged on income in excess of KES 9 600 000

More picture related to Annual Tax Rates 2024

Individual Federal Tax Rates 2024 Image To U

https://images.axios.com/FeF3kXyZuSjEVWj-265DifJa2hw=/0x0:1280x720/1366x768/2022/10/19/1666195709283.png

Tax Rates For Assessment Year 2024 25 Image To U

https://i.ytimg.com/vi/asxjIGBC24k/maxresdefault.jpg

Individual Tax Rates 2024 Nz Neda Tandie

https://governmentph.com/wp-content/uploads/2017/12/Personal-Income-Tax-2023.png

Calculate your KRA NHIF NSSF Old and new rates and net pay Work out backwards from a given net pay With effect from 19 March 2024 the employee and employer are each required to pay 1 5 of monthly gross salary as housing levy Starting 27 December 2024 the employee s payment is fully tax deductible

[desc-10] [desc-11]

[img_title-7]

[img-7]

[img_title-8]

[img-8]

https://www.kra.go.ke › ... › individual-income-tax

Individual Income Tax is charged for each year of income on all the income of a person whether resident or non resident which accrued in or was derived from Kenya Individual Tax Bands and Rates With effect from 1st July 2023 Personal Relief of Kshs 28 800 per annum Kshs 2 400 per month Taxation for Non Resident s Employment Income

https://www.kra.go.ke › individual › filing-paying › types-of-taxes › paye

Income Tax Individual Tax Rates For purposes of computing PAYE an employer is required to apply the Individual Income Tax Rates Bands that range from 10 to 35 as per Finance Act 2023 as tabulated effective 1 st July 2023 Monthly Pay Bands Ksh Annual Pay Bands Ksh PAYE Due Date

[img_title-9]

[img_title-7]

[img_title-10]

[img_title-11]

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

Annual Tax Rates 2024 - PAYE Tax Brackets in Kenya 2024 simplified Learn obligations deductions info on tax free taxable benefits reimbursements